- Digital ID is a key enabler of a faster and more inclusive economic recovery.

- COVID-19 has had a devastating impact on small business, but digital tools can offer a path to recovery by enabling SMEs to access capital and broader customer bases.

- The startup of digital wealth management in China highlights the exponential outcome of financial product innovation and advanced development of financial infrastructure.

The COVID-19 pandemic has accelerated digital finance platforms as the primary tool for executing transactions. As such, ensuring all consumers and small businesses have access to vital technology has become ever more important.

A new white paper published by the World Economic Forum’s Global Future Council on Responsive Financial Systems shows three ways that we can harness innovation and shape public policy to enable financial inclusion.

Financial technologies present new ways for banks and start-ups to deliver a greater variety of services that are tailored to their customers’ needs. Whilst we have seen examples of dramatic advances in financial inclusion in some markets, it is uneven and there is plenty to learn across the globe.

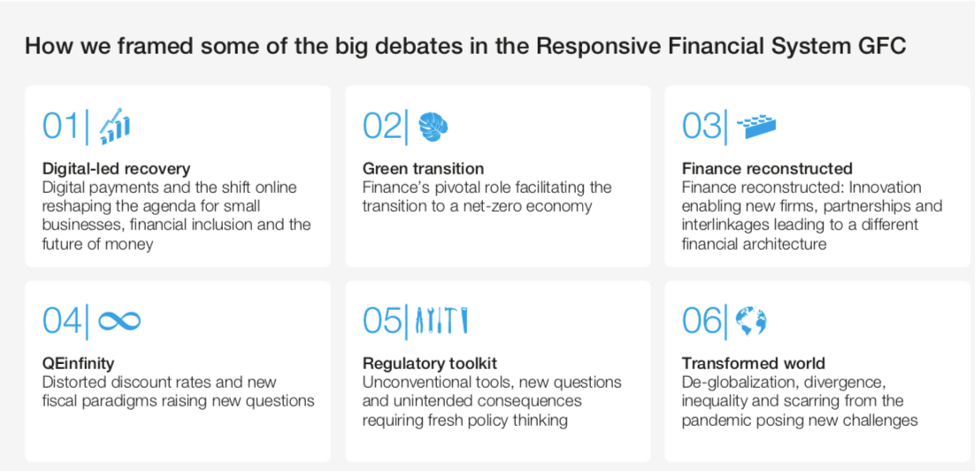

Our conversations in the Council centred on 6 focal areas and we have been struck by how much digitally enabled financial inclusion alongside digital assets and net zero have dominated our discussions. This digital shift presents stakeholders across the financial system with numerous opportunities, of which we focus on three below.

Image: GFC on Responsive Financial Systems

Accelerator 1: Digital ID as the catalyst of our digital future

Financial technology, or fintech, is rapidly filling a gap in the financial services market within the traditional banking system. Digital identification systems for individual and enterprises unlock vast opportunities to digitally deliver financial services that hitherto are not accessible by about 1.7 billion of the world’s adults. Furthermore, effective digital infrastructure and innovative new payment processes will not only benefit the unbanked and poor communities, but also ensure e-commerce and trade finance continues to innovate and become more accessible.

The emergence of new business models in a digital economy calls for innovative frameworks to establish trust in data sharing and management. Further progress will require close collaboration between private and public institutions in the development and local implementation of digitally smart regulation. Within the fintech ecosystem, a fit-for-purpose regulatory approach on digital financial services and cross-border money payments could boost growth and generate continued improvements across digital banking and digital payments.

Accelerator 2: Supporting the recovery of SMEs

Small and medium-sized enterprises (SMEs) are the foundation of the global economy and the backbone of local communities. They are job creators, community builders, enablers of opportunity, and drivers of innovation, competition and diversity. While the COVID-19 pandemic has had a devastating impact on small businesses, digital tools can offer a path to recovery.

Digital business tools enable SMEs to access broader local and foreign customer bases, and to stay competitive in the face of larger e-commerce platforms. Alternative credit assessments by financial institutions offer new means to SMEs for getting much-needed capital. Financial institutions could support SMEs by providing access to digital platforms for an omni-channel reach-out to customers, a seamless cross-border payment system and data-driven services that could deliver targeted offers and specialised incentives to customers.

Accelerator 3: Enhancing access to digital investment services

A case study conducted by Tsinghua University’s PBC School of Finance shows that digital services have meaningfully transformed consumer habits and delivered tangible benefits to individuals during the height of the pandemic in China.

Chinese asset managers embraced internet technology to reach new customers that would previously have bought their products in a bank branch. They also strengthened their digital services to interact with their customers after they had purchased wealth management solutions.

The growth in the rate of change in the adoption of digital products by consumers.

Image: GFC on Responsive Financial Systems

Chinese individual investors’ interaction with digital wealth management services has significantly increased during the pandemic (Figure 1 shows the growth in the rate of change in the adoption of digital products by consumers). The COVID-19 pandemic is serving as a game-changer in China to drive investors behaviour to change for good once they have experienced the ease and efficiency of digital financial services. One reason for this ‘stickiness’ may be that compared with traditional wealth management offerings, the digital wealth management model offers consumers added advantages, such as more efficient service provision, low transaction fees, and a more personalized customer experience through big data and more.

Yet despite the rapid increase in adoption, there remain challenges with this new model, one of them being investor education. Digital service providers must find more innovative ways to educate their customers about the products they are offering and provide them with continued education as individuals become more sophisticated in their use of investment products.

In an era of unprecedented data and ubiquitous intelligence, it is essential that organizations reimagine how they manage personal data and digital identities. By empowering individuals and offering them ways to control their own data, user-centric digital identities enable trusted physical and digital interactions – from government services or e-payments to health credentials, safe mobility or employment.

The World Economic Forum curates the Platform for Good Digital Identity to advance global digital identity activities that are collaborative and put the user interest at the center.

The Forum convenes public-private digital identity collaborations from travel, health, financial services in a global action and learning network – to understand common challenges and capture solutions useful to support current and future coalitions. Additionally, industry-specific models such as Known Traveller Digital Identity or decentralized identity models show that digital identity solutions respecting the individual are possible.

To conclude, the path to recovery and financial inclusion will be largely driven by digital tools, and collaborative efforts of financial institutions, governments and technology sectors to ensure a fair and equitable access to all.

See here for a full list of members of the Global Future Council on Responsive Financial Systems.

Credit: Source link