The first lithium-ion battery cells have been produced at Northvolt’s new gigafactory in Sweden and a UK sodium-ion battery startup has been acquired by the solar subsidiary of India’s Reliance Industries.

The two items of news are a snapshot of the emerging upstream battery sectors in Europe and India: Northvolt hailed its start of production as the first homegrown European gigafactory-made battery cells, while Reliance New Energy Solar has proposed using startup Faradion’s technology at a gigafactory of its own in western India.

Northvolt anticipates that it will be just one of many operators of European gigafactories — albeit a fairly major one with a targeted 110GWh annual cell production by 2030 — as the continent’s demand for electrification grows.

Although the focus of that electrification is largely on transport at present, the company has said that a significant fraction of its production is expected to service demand in the stationary energy storage sector.

Alongside automotive sector off-take deals with the likes of Volkswagen, Northvolt also has in place a partnership with energy storage technology provider Fluence which includes co-development of energy storage system (ESS) technology as well as off-take.

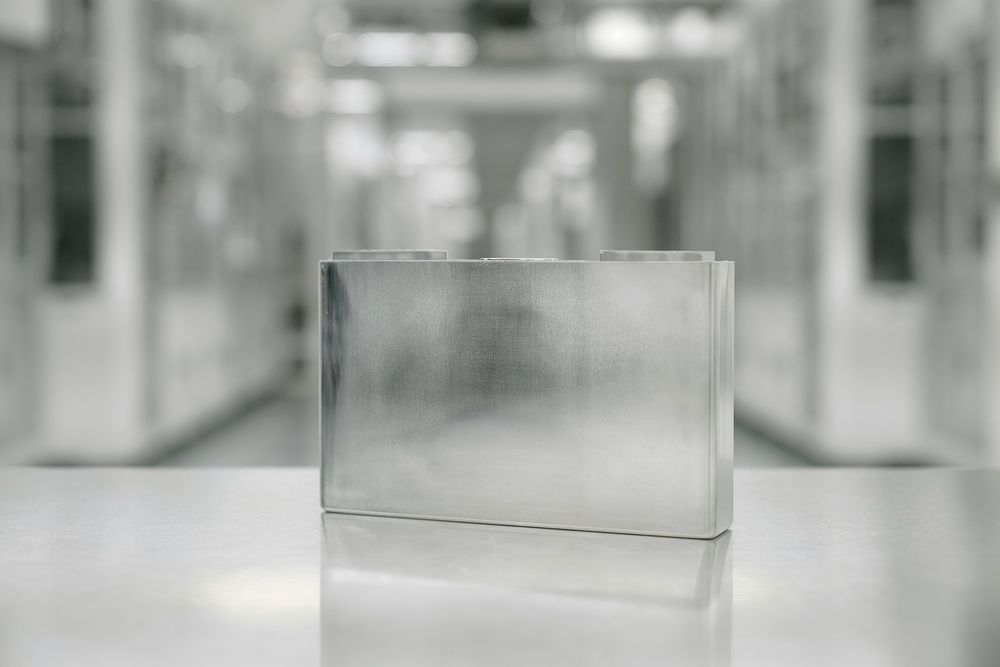

Northvolt said just before the end of last year that the first cell fully designed, developed and assembled at its Northvolt Ett plant in Skellefteå, Sweden had been manufactured as the company celebrated the gigafactory’s commissioning.

The prismatic format cell came off the assembly line on 28 December. The company is commissioning and upscaling the factory and will begin to make its first commercial customer deliveries during this year.

Northvolt Ett’s targeted capacity will be 60GWh of annual production. In total, the company already has customer contracts in place worth more than US$30 billion.

“Of course, this first cell is only the beginning,” Northvolt CEO and co-founder Peter Carlsson said.

“Over the course of the coming years, we look forward to Northvolt Ett expanding its production capacity greatly to enable the European transition to clean energy.”

The cell was developed at Northvolt’s own Northvolt Labs facility in Västerås, Sweden. The labs opened in early 2020. In a 2020 interview with Energy-Storage.news, Emad Zand, Northvolt’s president of its stationary storage division, which will serve the grid-scale and industrial market segments, said that the cells will not only be economically competitive, but also among the most sustainable devices in the market, with Northvolt’s facility powered by cheap renewable energy.

Another of Scandinavia’s battery startups, FREYR Battery, said in December that it had signed a US$3 billion, 31GWh off-take agreement with an unnamed stationary energy storage industry player.

India sodium-ion gigafactory

Meanwhile, on 31 December, UK-based battery tech company Faradion said it had signed definitive agreements to be acquired by Reliance New Energy Solar Ltd (RNESL), for an enterprise value of £100 million (US$135.2 million).

Faradion said it has an IP portfolio which covers several aspects of sodium-ion (Na-ion) cell technology — the same chemistry China’s CATL, one of the world’s biggest battery makers, is working to commercialise.

After acquiring a 100% interest, the new owner will invest £25 million into scaling up Faradion, and has proposed using its technology at a fully-integrated energy storage gigafactory at Dhirubhai Ambani Green Energy Giga Complex, Jamnagar, India.

Parent company Reliance Industries is one of India’s biggest companies, working across areas from petroleum and hydrocarbons to retail and digital services.

Our sister site PV Tech reported yesterday that RNESL has just agreed to acquire a 15.46% stake in Sterling & Wilson, bringing its shareholding in one of India’s largest solar PV engineering, procurement and construction (EPC) and operations and maintenance (O&M) companies to 40%.

The non-aqueous sodium-ion cell technology is suitable for stationary energy storage as well as electric vehicle (EV) applications, Faradion said. The company claimed it can be comparable in performance to lithium iron phosphate (LFP) technology while competitive for cost of ownership with lead-acid batteries.

It is also more sustainable than lithium-ion, Faradion has claimed, made without using lithium, cobalt or copper. Sodium used in the ion is highly abundant, the electrolytes are inexpensive and anode materials are readily available — aluminium current collectors are used in both electrodes.

The cells can be transported and stored while fully discharged to zero volts, reducing the potential for short-circuiting which can cause thermal runaway. Faradion claims the battery chemistry is also more stable than lithium-ion when charged and the sodium-ion batteries have a round trip efficiency of 92% at a discharge time of five hours.

“The sodium-ion technology developed by Faradion provides a globally leading energy storage and battery solution which is safe, sustainable, provides high energy density and is significantly cost competitive. In addition, it has wide use applications from mobility to grid scale storage and back-up power,” Reliance Industries chairman Mukesh Ambani said.

“Most importantly, it utilises sodium, which will secure India’s energy storage requirements for its large renewable energy and fast-growing EV charging market. We will work with Faradion management and accelerate its plans to commercialise the technology through building integrated and end-to-end giga scale manufacturing in India.”

While India’s government has been making supportive statements and pledges to foster a domestic battery manufacturing value chain for some time, the first announcements have begun to emerge around making those aims come true.

In September 2021, automotive parts and equipment manufacturer Lucas TVS said it wanted to open a battery gigafactory in the country by the second half of 2023 and had signed an agreement with US advanced lithium-ion battery tech company 24M. The factory, near Chennai, would serve the stationary energy storage sector as well as transport and its products would also be designed as a drop-in replacement for lead-acid batteries in various applications.

Credit: Source link