shulz/E+ via Getty Images

Investment Thesis

You are going to hear about more and more small banks partnering with fintech companies. The goal of these partnerships is for banks to reach new borrowers outside of their current geographic footprints that they wouldn’t normally be able to reach with their small marketing budgets. The fintech companies bring the technological capabilities and branch-light strategy to draw from a national consumer base, while the banks serve as the funding sources that these fintechs need for originations and in some cases the back-end infrastructure to actually originate the loans in a regulatory-compliant manner.

Arguably no bank has taken more advantage of fintech partnerships than FinWise Bancorp (FINW), which only went public less than two months ago. Once a small struggling bank, FinWise over the last five years has gone out and developed the technology and data to partner with many fintech companies and originate a massive amount of loan volume for a bank with just $338 million in total assets. While the bank’s model and balance sheet are filled with risk due to the types of loans being originated, FinWise is growing revenue and profits at lightning speed and has generated returns far beyond anything I’ve encountered in the banking sector. The potential upside from the business is substantial and makes this stock worth a nibble, in my opinion.

Business model

FinWise Bank only launched in 1999 as Utah Community Bank and quickly experienced issues with credit quality during the Great Recession. Following a cease-and-desist order from the Federal Deposit Insurance Corporation, the bank would go on to hire its current CEO Kent Landvatter, a banking veteran from Goldman Sachs and Comenity Capital Bank. Landvatter would correct issues pertaining to the consent order and eventually embark on a tech- and data-driven strategy to turn the bank around and find a niche within the industry. Landvatter also built out a team of executives, many of whom have expertise in more niche lending areas.

FinWise has two major lines of business. The first is what it calls its strategic program loans, in which it partners with fintech companies to originate unsecured and secured consumer loans across the credit spectrum from borrowers with no credit history to super-prime borrowers. While you may have never heard of FinWise Bancorp before, you’ve likely heard of many of its partners.

For instance, in one of its strategic programs, FinWise partners with the popular fintech Upstart (UPST) to originate installment loans through its platform, which uses artificial intelligence to assess credit quality and promises 75% lower default rates with the same loan approval rate. In another partnership, FinWise licenses the Rise loan product from the subprime lender Elevate (ELVT), which is a four to 26-month installment loan with an effective annual percentage rate of 110%. Other fintechs and lenders FinWise works with include OppFi (OPFI), Behalf, Edly, Empower, Great American Finance, LendingPoint, Liberty Lending, and Mulligan Funding. FinWise uses an application programming interface (API) to connect with these other platforms and organize funding for the loans as well as underwriting.

FinWise’s second major lending program is lending in tandem with the U.S. Small Business Administration (SBA), particularly in the SBA’s 7(a) program in which FinWise works with the government to provide loans to small businesses. Because of the riskier nature of these businesses, the SBA guarantees somewhere around 75% of the loan, removing a good amount of risk for the bank. Through the first nine months of 2021, FinWise was the 37th largest SBA 7(a) lender in the U.S. FinWise also participated in the Paycheck Protection Program during the pandemic, which is based on the traditional SBA lending program. The bank originated $127 million of PPP loans. FinWise gets most of its 7(a) loans through referrals from a company called Business Funding Group, which refers the bank SBA loans from all over the country. FinWise has an interesting connection to BFG. Five members of BFG own more than 37% of outstanding FinWise shares, four of which are on FinWise’s board of directors. As a result, FinWise directors and officers own a sizable 33% stake of the company, nearly 10% of which is owned by Landvatter. In 2019, FinWise also acquired a roughly 10% ownership stake in BFG, split evenly into voting and non-voting units. FinWise has the right of first refusal to acquire 100% of BFG up through Jan. 1, 2028.

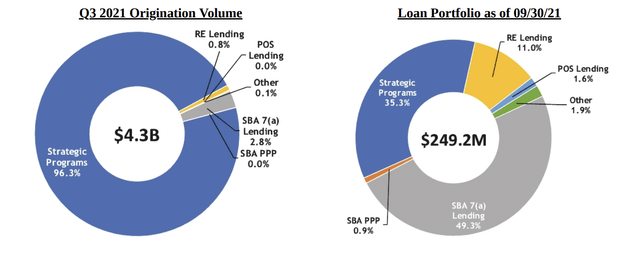

Overall, FinWise has managed to originates billions of loan volume every year, most of which is through its strategic partners. Strategic loans made up more than 96% of total origination volume through the third quarter of this year.

While the heavy majority of originations at FinWise are from strategic program loans, most of those are sold and very few (in terms of percentage of total originations) are currently retained on the balance sheet. Nearly 50% of the loans the bank retains are SBA 7(a), roughly half of which are guaranteed by the government and pose no risk and the other half of which are unguarenteed. SBA loans are generally safer than strategic program loans because the borrowers have FICO scores over 650, a debt service coverage ratio of at least 1.15%, down payments of roughly 10%, and in some cases borrowers must put up collateral.

FinWise also does residential and commercial lending, and a little bit of point-of-sale lending, which management has big ambitions to grow. Ultimately, management intends to focus on SBA 7(a), strategic loans, and point-of-sale. Here’s what the company estimates for total addressable market in each business line:

- Strategic loans – $100 billion

- SBA 7(a) – $150 billion

- POS – $160 billion

There’s probably some debate among investors over how tech-oriented FinWise actually is. But an area they focus on is with the strategic programs, in which the bank uses an API to connect its proprietary FinView Analytics Platform to evaluate borrowers from strategic programs and identify good loans to put on the balance sheet. Loans put on the balance sheet can be much more profitable than those sold to investors, as long as they don’t go into default. But it seems like FinView still needs more development, as the bank notes in their amended registration statement that they expect to develop machine learning and artificial intelligence into FinView. Many fintech loan originators already have these capabilities.

Still, Finview says it has millions of data points from loan originating and servicing that it has used to better facilitate credit decision making. For instance, between 2014 and the third quarter of 2021, FinWise has a charge-off rate (debt unlikely to be collected) of 0.2% among its SBA loans, compared to 0.9% for the whole SBA lending industry. And so far its credit quality has stayed strong since 2018. The net charge-off rate since 2018 has topped out at 2.3%, which would certainly be high for a more traditional bank but not so high for bank that has 35% of its total loan portfolio on the balance sheet in higher-risk consumer loans, many of which are unsecured or to subprime borrowers. The bank also maintains high capital ratios, which is essentially capital intended to be used for unexpected loan losses.

On the deposit side of the business, roughly 43% of FinWise’s deposits are non-interest-bearing, the best kind of deposits a bank can have because they pay no interest on them. This looks to be all or mostly from strategic program providers. As part of the relationship with companies like Upstart, Elevate and OppFi, FinWise sets up a reserve deposit account in case FinWise is unable to offload the loans it originates to investors. “The reserve deposit account balance is typically a formula that may be at least equal to the total outstanding balance of loans held-for-sale by the Bank related to the Strategic Program,” according to the S-1. Also, the bank has been able to create other types of depository relationships with strategic program companies.

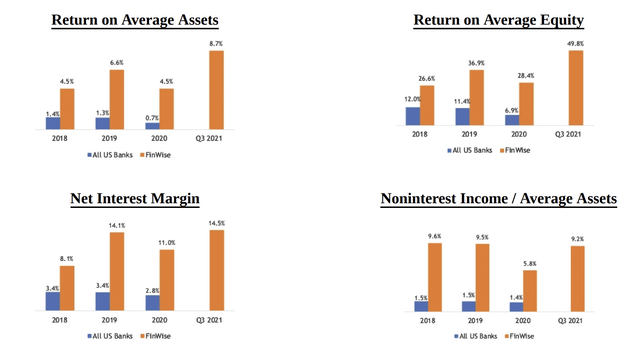

The remainder of the deposit base is not great, however, with much of the rest coming from higher-cost brokered and institutional deposits, which bank investors hate. But with FinWise’s specific model, deposit costs are less important because the bank’s loans and other interest-earning assets on the balance sheet are generating 18% yield. FinWise’s net interest margin was an incredible 14.5% for the first nine months of 2021. Still, the deposit composition leaves the bank more exposed to tougher market conditions that could impact FinWise’s ability to get the funding it needs to fund balance sheet growth, which the bank would like to do.

A big part of FinWise’s strategy to get better is to increase core deposits and reduce its reliance on institutional and brokered deposits. It’s taken advantage of the excess deposits flooding the banking system since the start of covid to grow non-interest-bearing deposits from $71 million at the end of the third quarter of 2020 to $100 million at the end of the third quarter of this year. Management also believes there is an opportunity to expand its relationship with SBA customers. The company began piloting a new deposit program specifically for SBA 7(a) customers in 2020 and expects to promote this product further going forward. FinWise also sees its SBA relationships as ripe for growing POS lending capabilities. FinWise plans to keep growing strategic partners, start retaining more loans on the balance sheet, grow POS lending, and keep investing in its Finview platform to enhance its AI and machine learning capabilities.

Financials

Looking at the financials is fun here because FinWise is putting up the best returns in the industry and pretty much across all asset classes. I literally couldn’t believe some of the returns were real when I saw them, which is also why this bank deserves a healthy dose of skepticism when being evaluated.

FinWise’s efficiency ratio, a measure of a bank’s total expenses expressed as a percentage of revenue (so lower is better), ranged from around 46% to around 60% between 2018 and 2020. For a bank this small, anything below 60% is very good. Across the industry, anything in the low 50s percentile or below is stellar. Through the first nine months of 2021, FinWise lowered its efficiency ratio down to 38%, which is remarkable. This is largely because of FinWise’s strong revenue generation, but very impressive nonetheless.

The profits have come as FinWise has significantly increased its loan origination volume. In 2020, FinWise did $2.6 billion of total originations. Through the first nine months of 2021, FinWise has already done $4.3 billion of volume.

Valuation

We can look at FinWise’s valuation a few different ways, but in each scenario it looks extremely undervalued considering profit and revenue growth. Most banks trade relative to their tangible book value (TBV), which is what a bank would be worth if it were liquidated. Based on TBV per share of $7.91 at the end of the third quarter, FinWise trades at roughly 1.96x tangible book value. Normally, a bank this small trading at this high of a valuation in the current low-rate environment would be very impressive. But as I mentioned above, FinWise is generating returns that are literally better than any bank in the world.

And it’s growing TBV incredibly fast, which, again banks trade relative to, so a growing TBV usually results in a growing stock price. In 2019, FinWise grew TBV 39%; then nearly 40% in 2020 and 67% through the first nine months of 2021. So, let’s just say FinWise managed to grow TBV by 40% over the next year from the end of Q3. Assuming it maintains its nearly 2x TBV valuation, that would imply a stock price of roughly $22 by next September. But most banks with this kind of unheard of TBV growth would trade at much higher multiples to TBV.

Now, if you look at FinWise and see more of a fintech company, you can value it based more on earnings and revenue. In this scenario, the company also looks cheap. FinWise gas generated $56.4 million of revenue through the first three quarters of 2021. That run rate assumes the company will generate roughly $75 million in 2021, which means FinWise currently trades at about 2.5x current revenue. Net income of $21.5 million through the first three quarters of 2021 assumes the bank will make close to $29 million in profit for 2021. That would mean FinWise is trading at roughly 6.8 times current earnings, which isn’t just cheap for a fast growing fintech, but also for most traditional banks.

One last comparison I’ll make is comparing FinWise’s results to that of LendingClub (LC), another stock I am very bullish on. I see LendingClub as an interesting comparison because the company also operates a bank-fintech model that is heavily reliant on origination volume. To be sure, the company’s are very different. I believe LendingClub is far ahead of FinWise in terms of technology and automation and is also serving a much higher-quality borrower.

Over the last two quarters, the bank subsidiary of LendingClub has put up ROAs ranging from 3.7% to 4.7% and ROEs ranging from 26.5% to 34.7%, great results but still far behind FinWise. LendingClub, which I think is undervalued right now for the record, trades at about 3.2x TBV and four times current revenue. It has really only been profitable for the last two quarters under its new bank-fintech model but I am expecting profitability to really start to accelerate this year.

By all metrics, FinWise looks cheap, but there is of course a reason for this, which I will touch on in the next section.

Risks

FinWise tried to price its IPO at $13 to $15 per share and had to downsize to $10.50 per share, although it’s now up above $15 per share. The reason for the downsize and the skepticism from investors is, in my opinion, fourfold: FinWise has a very risky balance sheet that is engaged in a good deal of subprime lending, it’s deposit base is not great, the company’s strategic partners could run into regulatory issues, and the macro environment is changing quickly.

The strategic loan programs originate loans to a variety of credit profiles, ranging from those without any credit history to super prime and everything in between. Based on the fact that some of these companies like OppFi and Elevate are public, you can see that some of the loans have very high APR’s, with Elevate’s RISE program having an average APR of 110% and OppFi’s Opploans ranging from 30% to 160%. Believe it or not the rates can actually get a lot worse than this once you get into the subprime arena, but investors worry about these lending businesses and have shied away from them over the past few months.

OppFi in its most recent quarter had a charge-off rate of 36% (charge-offs are debt unlikely to be collected and a good indicator of losses), which isn’t exactly unexpected in the subprime business — hence the very high APRs. But it is still concerning and subprime lenders like OppFi and Elevate were heavily sold off in the last few months of 2021. At the end of the third quarter of this year, the average yield on loans that FinWise intends to sell to investors was about 40%, which again could be worse given some of the borrower profiles in the strategic programs.

But the profile of FinWise’s business and its partners bring many regulatory concerns into play. The Consumer Financial Protection Bureau (CFPB) is watching very close for predatory lending practices or other violations with lending laws. Already, the CFPB has investigated OppFi for violating the Military Lending Act, although it eventually dropped the investigation. Elevate has been sued multiple times now.

Lawmakers have also extensively discussed and proposed the idea of capping APRs at 36%, which would obviously be deadly to businesses like Elevate and OppFi. While proposals like this may seem obvious, they are not as easy to pass as one might think. Millions of Americans need access to immediate funds whether it’s for a family emergency, a car break down, or medical emergency. And if you are too risky of a borrower for a traditional lender, subprime lenders are one of the few place to turn to. Because companies like OppFi are often charging off more than one-third of their loan books or more, it has to charge extremely high interest rates to make the business work.

Lastly, investors are likely very worried right now about how consumer debt will fare as the Federal Reserve speeds up the tapering of its bond-buying program and looks to raise rates potentially multiple times in 2022. Higher interest rates for borrowers typically results in higher loss rates and potentially less loan demand. And it’s not all about loans on the balance sheet. If loans that FinWise originates and sells to investors go bad at high rates, the investors that FinWise sells those loans to may be less likely to buy such loans going forward.

Additionally, if some of FinWise’s partners get into trouble, that could potentially be detrimental to the deposit side of FinWise’s business because it’s the strategic loan partners that give the bank their non-interest-bearing deposits. To keep up with its growth, FinWise had to significantly increase its reliance on brokered and institutional deposits, which made up a whopping 37% of deposits in 2021. FinWise can afford to pay higher interest rates with the yield its getting on its interest-earning assets, but if loan demand dries up, charge-offs pile up, and funding costs dramatically rise, that would pose a significant blow to the bank’s net interest margin.

Conclusion

There is undoubtedly substantial risk in this model, given all the issues mentioned above. But the bank has produced absolutely stellar results since 2018 on almost every profitability measure, and management is invested in the business. I am sure some investors may wait to see how some of FinWise’s partners progress or how credit quality holds up in a rising-rate environment and when the consumer is less flush with cash. But given the high growth of the business and low valuation, I do think FinWise Bancorp is worth a nibble because the reward could be huge.

Credit: Source link