Michael Vi/iStock Editorial via Getty Images

The story

Slight adjustments to management guidance, in addition to a broader tech selloff in response to rising interest rates, have sent PayPal shares into a downward spiral in recent months. Short-term hiccups like this are inevitable and oftentimes present strategic buying opportunities for long-term investors. PayPal (NASDAQ:PYPL), the most accepted digital wallet in North America and Europe, boasts a 50% market share in the global payment processing software industry. Not only that, the company’s fundamentals remain impressive, prompting me to believe its current underperformance is merely a window of opportunity to acquire shares at a cheaper price. Whether it’s the company’s recent partnership with Amazon (NASDAQ:AMZN), or the recent acquisition of Paidy, a Japanese payments company, PayPal is involved in some exciting and innovative work. Combine that with strong financials and a shrinking valuation, and I would say today is an excellent time to purchase PayPal stock.

Fundamentals remain intact

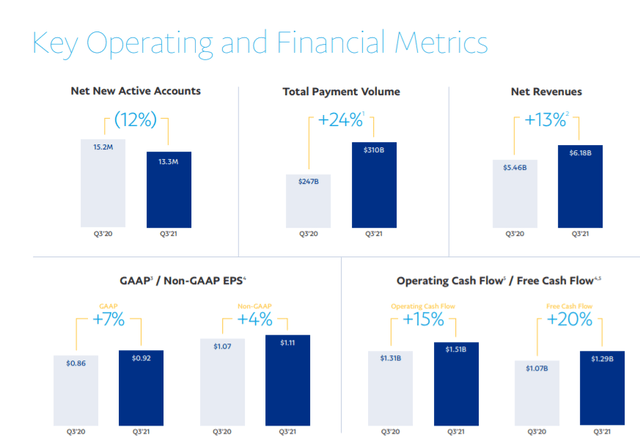

I am impressed with PayPal’s growth when looking at the magnitude of the company. In the third quarter of 2021, PayPal generated $6.2 billion in revenue, yielding 13% growth year-over-year. Total payment volume grew 24% to $310 billion, and the number of active accounts grew 15% to 416 million. Venmo – one of PayPal’s most exciting business segments – experienced total payment volume growth of 36% to $60 billion. The company’s name has been synonymous with growth in recent years. PayPal’s three-year revenue, EBITDA, and net income CAGR’s are 18%, 17%, and 33%, respectively. Looking ahead, analysts are forecasting the company’s revenue and EPS to be $52.4 billion and $10.22 in the fiscal year 2025, representing an average annualized growth of 16% for revenue and 17% for earnings over the next five years. The company also blusters an impressive balance sheet. As of the third quarter, PayPal has $7.8 billion in cash, $9.7 billion in debt, and $22.1 billion in total equity. The company’s strong cash position and lack of debt in relation to equity serves as a great signal for investors. Speaking more in regards to cash, PayPal generated $5.0 billion in levered free cash flow in the fiscal year 2020, translating to a robust 48.1% increase year-over-year. This cash-generating pattern has continued into 2021. In its most recent quarter, the company experienced free cash flow and cash from operations growth of 20% and 15%, respectively. Given its five-year levered free cash flow CAGR of 22%, PayPal has historically been successful in generating cash from its business operations.

PayPal 3Q21 Investor Presentation

Valuation nearing pre-pandemic levels

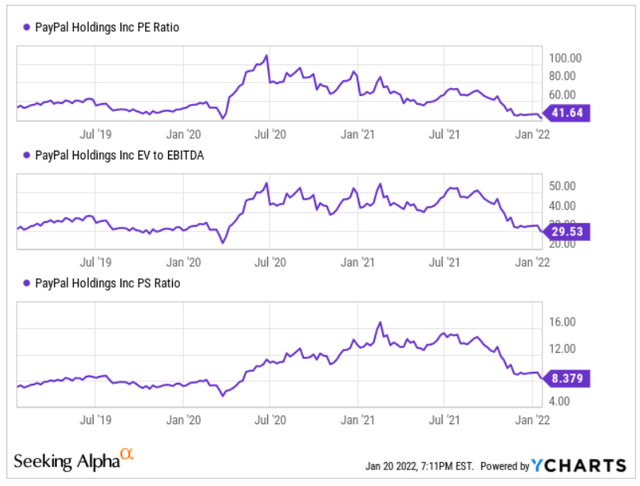

PayPal’s valuation hit all-time highs back in June 2020 when the company’s P/E multiple soared above 100x. Since then – and especially as of recent – the company’s P/E has been on a downfall. PayPal’s P/E has contracted ~62% from its June 2020 highs down to 42x. PayPal’s current P/E is much lower than the company’s five-year average of 55x, with its valuation skidding down toward pre-pandemic levels. The chart below tells the story of PayPal’s recent decline in widely used valuation multiples.

YCharts

In plain language, PayPal is trading near the same P/E levels as it was five years ago even though the company is forecasted to generate both higher EPS and earnings growth in the upcoming fiscal year than it was back then. In January 2017 when PayPal was getting ready to announce full-year results for 2016, Wall Street forecasted that the company would experience ~14%-15% growth in earnings year-over-year. PayPal ended up slightly beating Wall Street expectations, generating an EPS of $1.15, or 15% growth. At the time, PayPal was trading at a P/E around 35x. Fast forward five years, and the fintech giant is projected to generate an EPS of $4.62 in 2021 (4x more than FY16), representing 19% growth year-over-year. Again, the stock is trading at 42x earnings today, similar to that of five years ago despite increased earnings and more robust growth.

Looking ahead

PayPal has a bright future ahead. The company recently announced its partnership with Amazon, which will enable U.S. customers to pay with Venmo at checkout starting in 2022. Venmo’s 80+ million users in the United States makes this an enormous revenue-driving opportunity for PayPal. In October 2021, PayPal officially acquired Paidy, a Japanese payments platform and provider of buy now, pay later solutions. Japan is the world’s third largest ecommerce market with online shopping having more than tripled over the past ten years to ~$200 billion. Additionally, the company recently rolled out its new digital wallet, an all-encompassing app with personalized dashboard, new wallet, finances, and payment tabs. The purpose of the app is to enable PayPal customers to do more with their money by providing them an all-in-one experience.

Bottom line

Plenty of exciting innovation is happening at PayPal. Recent market turbulence matched with short-term noise has caused an unwarranted decline in the company’s share price. Prudent investors can take advantage of the situation by purchasing PayPal shares at a bargain price. The company’s strong financials and alluring valuation make it a great long-term play in today’s market.

Credit: Source link