whyframestudio/iStock via Getty Images

Investment Thesis

Intuitive Surgical (NASDAQ:ISRG) develops the da Vinci surgical system for robotic-assisted surgery. This system enables minimally invasive surgery and potentially improves surgical outcomes. ISRG has been a dominant leader in the robotic surgery field and has shown remarkable growth over the past several decades. Their recent earnings call is consistent with their historically strong performance, showing impressive final quarter and fiscal 2021 growth. This company belongs on the watch list because:

- Robotic surgery is a rapidly growing field. Around 15% of surgeries are performed using robots, leaving substantial room for growth as the systems gain traction with medical professionals and patients.

- ISRG is extremely profitable, with profit margins around 70%, and a cash balance that has increased $1.7 B over fiscal 2021.

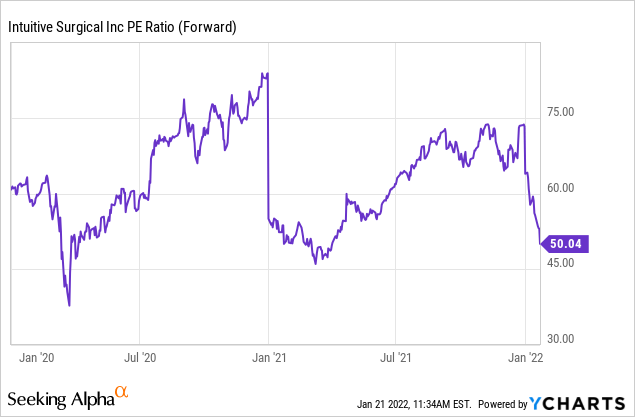

- Although the valuation remains high, the recent drop in stock price has brought it down to one of its lowest points in the past 3 years.

Robotic Assistants are the Future of Surgery

Robotic surgery allows doctors to perform procedures with more precision, flexibility and control. This often leads to fewer complications and faster recovery. Two recent studies highlight this potential.

First, a review paper evaluated the short-term outcomes of colon surgery for patients with cancer across 13,000 patients. The robotic-assisted surgeries demonstrated a 46% lower risk of anastomotic leakage, a 69% lower risk of conversion to open, and a 15% reduction in the overall complication rate compared to laparoscopic procedures.

A second analysis compared robotic-assisted and thoracoscopic anatomic lung resection in obese patients across over 8,000 patients. The robotic-assisted group showed a 5x lower risk of conversion to open, a shorter mean length of stay by 0.7 days, and a 1% lower risk of respiratory failure.

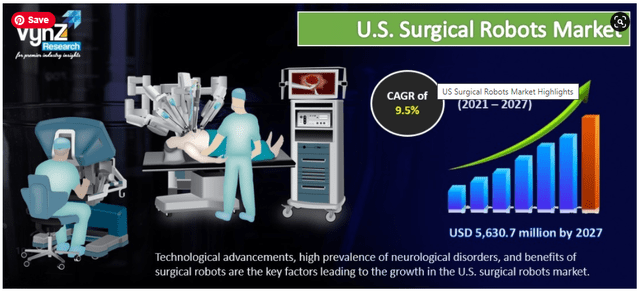

While there is certainly ongoing debate about which applications are best-suited and most cost-effective for surgical robots, overall, the market outlook is highly promising. Currently, roughly 15% of surgeries are performed with robotic assistance. Robotic assistants are becoming more mainstream, but there is still plenty of room in the market to grow. Overall, the market is expected to expand at a rate anywhere from 9.5% to 19.3% through this decade, reaching at least $5.63 B by 2027.

Surgical Robots Market Size vynzresearch.com

Strong Fiscal 2021 Results

ISRG reported strong quarterly and fiscal 2021 results on their January 20 earnings call. YoY growth was outstanding in part due to the low demand during the first pandemic wave of 2020, but 2 year growth from pre-pandemic levels was also very strong. The number of procedures grew 14% annually and new system installations grew 10% annually over a 2 year period. This resulted in an annualized increase in revenue of 13% over the same period. While strong, management believes these numbers are still negatively affected by the ongoing high COVID-hospitalizations and staffing shortages.

Given the high profitability and revenue growth protected by their economic moat, ISRG has tremendous ability to generate cash and maintains a strong balance sheet. The company has maintained profit margins of 70-71%, despite supply chain challenges and COVID-related slowdowns. Their cash & equivalent position has grown from $6.9 B to $8.6 B over fiscal 2021.

The company plans significant infrastructure investments to build capacity and in source some high-volume accessories to make the supply chain more robust. These include growing its customer digital efforts, which include analytic tools to evaluate and improve customer outcomes and reduce costs. They have also been investing in automation, to improve manufacturing quality while lowering costs. Furthermore, they plan to expand operation, R&D, and manufacturing facilities. These investments will take several years to show their full effect, but should improve operational efficiency over the long-term.

Valuation Near its Lowest in Recent History, but Still High

As a leader in a rapidly growing market, ISRG has long commanded a premium stock price. However, recently the stock price has recently fallen off significantly to reach its lowest level in the past 6 months. Forward PE now stands at 53. This is close to its lowest point over the past 3 years. This has drawn attention, and analysts may be upgrading their positions to buy.

Intrinsic Value

Stock price has declined significantly and EBITDA has increased since my previous article. I ran a new DCF calculation to estimate the intrinsic value. For the estimation, I utilized EBITDA ($2,127 M) as a cash flow proxy and current WACC of 7.0% as the discount rate. For the base case, I assumed EBITDA growth of 25% for the next 5 years (Seeking Alpha consensus estimate) and zero growth afterwards (zero terminal growth). For the bullish and very bullish case, I assumed EBITDA growth of 35% and 45%, respectively, for the next 5 years and zero growth afterwards.

To put this in perspective, the overall robotic surgery market is expected to grow 10-20% over the next 5 years. Analysts expect ISRG to grow by 12-14% over the next several years, while ISRG guidance indicates 11-15% growth in 2022. Some premium is certainly justified, given the company’s high profitability, dominance within a high growth market, historical track record of growth, and recent launch of a new Ion system to complement the wide-selling da Vinci system. However, the calculation still suggests a rich valuation, and growth of 35-45% is well above expectations.

|

Price Target |

Upside |

|

|

Base Case |

$191.12 |

-31% |

|

Bullish Case |

$271.91 |

-1% |

|

Very Bullish Case |

$379.43 |

38% |

The assumptions and data used for the price target estimation are summarized below:

- WACC: 7.0%

- EBITDA Growth Rate: 25% (Base Case), 35% (Bullish Case), 45% (Very Bullish Case)

- Current EBITDA: $2,127 M

- Current Stock Price: $275.36 (01/21/2022)

- Tax rate: 20%

Risks

Competition within the robotic surgery field is increasing. Although ISRG’s da Vinci system if the dominant platform for general surgery, other major companies have introduced specialized robots. This includes Medtronic (NYSE:MDT) (spine and brain), Stryker (NYSE:SYK) (knee and hip replacement), Zimmer Biomet (NYSE:ZBH) (spine and knee procedures), and J&J (NYSE:JNJ) (lung biopsy). Asensus Surgical (NYSE:ASXC) offers a sophisticated digital laparoscopic platform. ISRG will benefit from the large switching cost (due to installation and training) and its first mover advantage. However, the high competition will prevent ISRG from capturing the full share of market growth and the company’s growth is likely to taper going forward.

The highly sophisticated nature of the robotic systems means that the company must maintain its vendor relationships and retain its specialized workforce. Supply chain disruptions and rising labor costs therefore will put pressure on margins. The company has grown its workforce by 21% in fiscal 2021. They will likely see rising costs due to inflationary pressures on salaries in the near future. Also, management mentioned the challenging supply environment and that they experienced minor constraints in their ability to meet demand. The supply chain should improve over time, and the company is also investing in infrastructure which will enable them to manufacture some high-volume accessories in-house.

Conclusions

ISRG is an extremely profitable company with a dominant market position. High installation and training costs provide a resilient economic moat around their technology. But the company faces increasing competition from other powerhouses. I expect their market share to erode over time, and the rapid growth in the overall market for robotic surgeries will not be enough for them to maintain the +35% levels of growth necessary to justify their current valuation. If you’ve been looking at this company for a while, now might be a good time to jump. The recent drop in stock price puts the valuation at one of its lowest points in several years. However, I will continue to hold and expect market performance from ISRG. Given the recent drop across the overall market and particularly of growth stocks, market performance could actually present quite a decent return.

Credit: Source link