MJ_Prototype/iStock via Getty Images

Robotics investments in December 2021 reach USD1.2bn

December 2021 saw 58 investments in robotics which totaled roughly USD1.2bn. In addition, there were five M&As, two of which were via SPACs. The lion’s share of the funding in December went to autonomous driving companies with a USD228mn Series A round going to Robotic Research, an American based in MD that has developed autonomous technology for the US DoD for nearly twenty years. The company used the first outside capital for a division to develop autonomous tech for commercial vehicles such as buses and trucks. Just behind Robotic Research was Haomo, a Chinese autonomous driving company which raised a Series A of USD150mn. The company was previously the intelligent driving division of Great Wall Motor (OTCPK:GWLLY) and will use the funds for R&D and expanding its workforce.

RR.AI, Haomo, Ouster, Luminar

While autonomous driving companies led in terms of total founding and number of funding rounds with nearly USD580mn, surgical robotics companies, while accounting for only a couple of funding rounds made up the second highest group in terms of funding amount with around USD120mn. Other areas which saw considerable investment activity included logistics robotics companies and mobile robot companies. Of note, Serve Robotics announced on Jan 13 the successful commercial launch of the world’s first L4 self-driving robot, which used Ouster (NYSE:OUST) lidar. Service received USD13mn in its seed round in Dec.

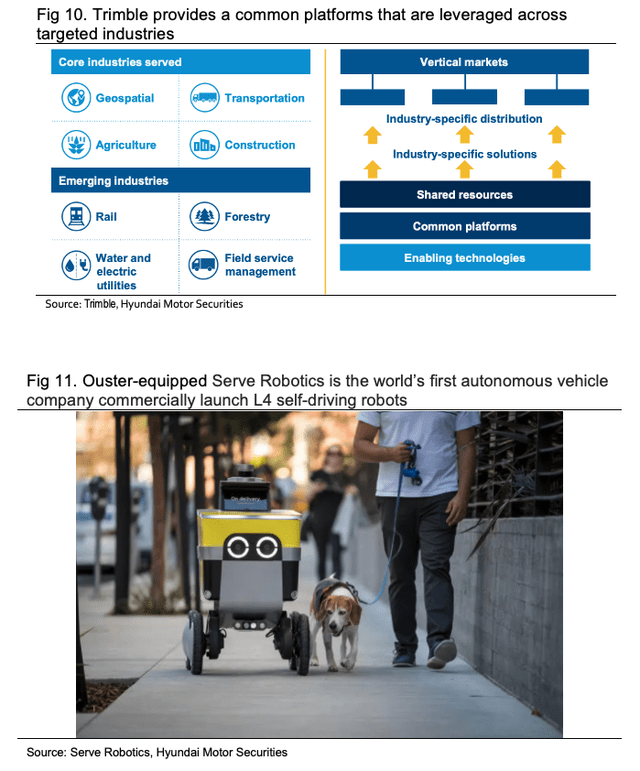

Trimble, Ouster

There were five robotics M&As in December, two of which were in logistics robots, one in healthcare robotics, one in drones, and one for a maritime robotics company. Most of the deals did not disclose financial details but transportation and logistics company Ryder (NYSE:R) paid USD480mn in cash for Whiplash.

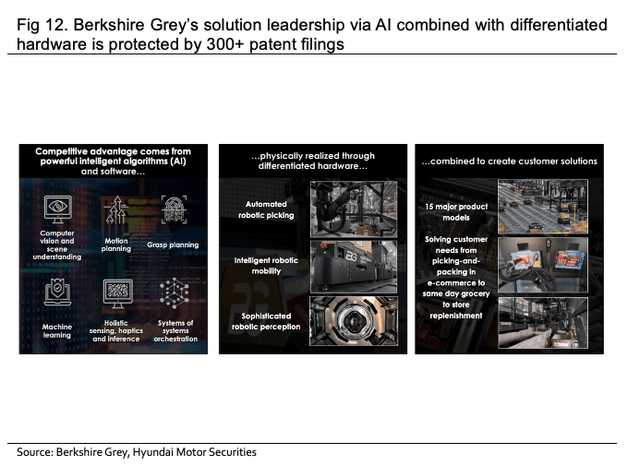

Berkshire Grey

The US and China lead in terms of robotics investment amount and activity. Breakthrough technologies and business likely to emerge from continued aggressive investments in robotics companies. Companies that provide key building blocks are the shovel and pick makers in this new gold rush. Sensor makers such as Ouster, Luminar (NASDAQ:LAZR), and Velodyne (NASDAQ:VLDR) as most indoor and outdoor robots require precise lidar to safely navigate their environments. Trimble (NASDAQ:TRMB) as it provides what many robotics companies need for autonomous navigation.

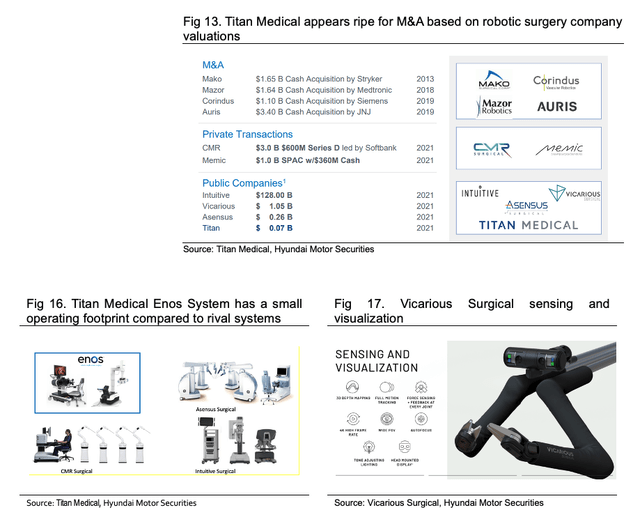

Funding level for surgical robots second highest group for December 2021 indicative of the huge market opportunity. The surgical robotics market while still dominated by Intuitive Surgical (NASDAQ:ISRG) remains in its nascency and still offers a blue ocean of opportunity for companies and their investors. Undervalued companies and potentially disruptive companies are attractive investments. Telemedicine companies related to the robotization of healthcare promising. Titan Medical (NASDAQ:TMDI) for its portfolio of patents and potential as an M&A target. Vicarious Surgical (NYSE:RBOT) for its potentially disruptive surgical robot under development.

Titan Medical, Vicarious Surgical

Logistics and mobile robot companies saw significant investments. Companies around the world look to implement or expand. logistics robotics solutions in warehouses and mobile robotics for a wide array of other use cases such as agriculture, etc. Berkshire Grey (NASDAQ:BGRY) as its stock has been beaten down. It offers proven logistics robotics systems and continues to add customers. Trimble (TRMB) as robotics companies depend on their technology to realize outdoor autonomous solutions and the number of use cases continues to grow.

What to look out for with robotics investments

For robotics components companies such as Ouster, investors should monitor the number of uses cases and clients the company wins on a quarterly basis vs rivals such as Velodyne or Luminar. For Trimble, investors should also not only the number of autonomous technology companies that their products are being deployed but also the quarter on quarter sales performance in the company’s other business segments.

For the medical/surgical robotics companies, investors should monitor the state of the approval process and use cases for their solutions. In addition, it is important to monitor industry leaders such as Intuitive Surgical (ISRG) to see if they can deploy a viable competing product or if there

Risks

Many robotics and robotics technology stocks are either pre-revenue or unprofitable and as such carry the risks that accompany such investment. For TMDI, the company is not meeting the Nasdaq listing requirements and faces potential de-listing but will continue to trade on the TSX. RBOT is unlikely to have a commercial product ready for several years due to the nature of the regulations surrounding the surgical robotics business. For autonomous vehicles and mobile robots, there are also regulatory risks which may slow the deployment of such technologies en masse.

Conclusion

While the market is in a state of flux and investors are generally avoiding growth stocks in search of investments that can weather the inflationary environment, robotics is an inevitable growth industry. For strategic investors looking out the potential of massively outsized gains over the long term, one need only to follow the money and see that funding for robotics and robotics technology companies are on the rise and this includes for startups as well as for conglomerates (e.g. Zebra’s (NASDAQ:ZBRA) acquisition of Fetch Robotics or Hyundai Motor’s (OTCPK:HYMLF) appearance at this year’s CES as well who are building their in-house capabilities and need the requisite technologies to realize their goals–e.g. components such as those from Ouster or navigation from companies like Trimble. For investors who can tolerate a higher level of risk and volatility, there are likely tremendous opportunities with investments in promising robotics companies and we see the correction as an opportunity to accumulate shares.

Credit: Source link