The S&P 500 is down more than 10% since the beginning of the year, putting it into “correction” territory. The NASDAQ is down almost 15%, but the carnage among growth technology stocks is concealed by the relative outperformance of the trillion-dollar “Big Tech” behemoths.

Recently, high-flying tech stocks like CloudFlare, DocuSign, Shopify, Twilio and Zoom are all down over 50% from their highs last year. The seamier end of the investment playground — including meme stocks, speculative cryptos and SPACs — has been crushed.

Growth stocks — which emphasize revenue now, profits TBD — are very sensitive to interest rates. Days when tech stocks are all in the red tend to be days when rates are going up.

With the Federal Reserve moving to combat inflation at 40-year highs and unwind over a decade of exceptionally stimulative monetary policy spanning the global financial crisis through the pandemic, rates are likely to continue climbing.

The result is a systematic repricing of capital and risk. Startup valuations are not immune, as all financial markets are interlaced.

The expansive monetary policy of the last decade has been spectacular for investment in startups. The Fed’s policy goal has been to get people to take more financial risk (which in turn hopefully stimulates the economy).

Mission accomplished!

But if the monetary tide starts to recede after rising for a decade — even if just at the margin — it has major implications for startup capital.

While startups at the earliest stage are appraised on their dreams and a dozen slides, as they mature the analytical arena moves into Excel. And when analysts hit F9 to recalculate their discounted cash flow models, higher interest rates yield lower valuations (profit dollars from further in the future are worth less when discounted at a higher rate).

These repricings in the spreadsheet-beholden public markets are trickling down through later growth stage startups and ultimately will reach the two people and a dog just starting up in a garage.

An inflection point for venture capital

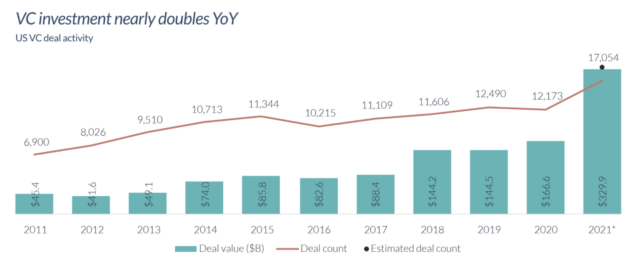

We have seen an immense flood of money into venture capital in recent years.

Beyond record amounts of money (and people) flowing into traditional venture capital, seemingly everyone else and their brother (and dog?) have become venture investors in recent years.

Hedge funds, mutual funds, sovereign wealth funds, corporations, and governments have all rushed to inscribe their names on startup capitalization tables (while being disparaged by competing investors as “tourists”).

This has led to skyrocketing valuations and, admittedly, a few excesses (e.g. SoftBank, drunken weaving across the fine line between a tech company and an IT department, “due diligence, shmoo diligence…”).

Right now those venture capitalists are all warily eyeing each other, hoping (and praying) someone else will be first to take the hit to their “founder-friendly” rating by pointing out market conditions dictate lower valuations.

While they don’t get traded and priced every day, startup valuations cannot remain unmoored from the rest of the financial system for long. The hedge funds doing venture investing, not surprisingly, aren’t waiting (or erring on the side of being polite).

A reset in valuations will be particularly acute for the legion of recently minted VCs. Many are “non-economic” in the sense they don’t have big enough funds to put food on the table from their management fees, so were counting on ever-rising valuations to help raise bigger follow-on funds. They also tend to have a portfolio entirely invested at elevated valuations, so may provide an instructive illustration of the last-in-first-out algorithm.

Another likely reset phenomenon is a proliferation of “ghost VCs” who stop coming to board meetings or even returning calls from portfolio companies. Zoom board meetings may make it harder to see who has really checked out (an abrupt unwillingness to travel to Seattle used to be a clear tell).

The “ghost VCs” will be busy triaging their portfolios, doing after-the-fact due diligence (aka “board governance” in more polite circles), and/or slinking out the back door to return to their previous careers. Many “tourist” investors are likely to revert to their traditional forms of capital allocation, while lamenting the temporary FOMO insanity that led to that dalliance with startups.

The prime startup directive: Don’t run out of money

A reset in capital flows and valuations obviously has huge implications for startups.

Some beneficiaries of the free money era amassed giant bankrolls and are well positioned to ride out any future turmoil.

I’ve seen companies who have not spent a penny from multiple financing rounds and have years of runway. But they still must generate a return on those piles of cash, which gets harder in a less go-go market.

Beyond those lucky few, most startups need to recognize that we’re probably past the peak of cheap and plentiful capital.

Close available financing rounds if you can. Venture capitalists will keep investing from their current funds.

It is hard to be certain the world has in fact hit an inflection point, much less fully internalize a paradigm change, so the default path for VCs is to keep investing like they have in recent years. In the aftermath of the dot-com bubble, the party didn’t really end until the VCs had to raise their next fund. In the meantime, many funds (unfortunately) continued to invest like it was 1999.

You are not your financing

Unappealing as it may be, founders must accept that valuation metrics are changing and comps from even a couple months ago are no longer valid.

You’re no doubt special, but probably not so special you’re invulnerable to global financial forces. This will force deep self-reflection for some entrepreneurs.

11/ behind the scenes, VCs are prob already dropping valuations by 1/3 to 1/2 for Q1 deals (or waiting until Q2 for dust to settle), except for a few hot crypto + fintech deals, or fast growing co’s that can still set their own terms.

but expect the avg startup price to go DOWN

— Dave McClure (@davemcclure) January 27, 2022

Are you really in it to build something or just wanted to ride a unicorn? Can you sustain that purpose through a flat or even down round in the near future?

Just remember the only valuation that really matters is the one at the final liquidity event.

Obviously, you will want to scrutinize your expenses. History suggests economic growth will slow (or go into outright recession) as the Fed tightens, which will probably clip your revenue. And consider how much of your revenue is venture money recirculating through other startups.

Yahoo, at the end of the dot com bubble, was unpleasantly surprised to learn just how much of its ad revenue was actually venture money that subsequently dried up. And balance sheet companies using cheap money to acquire assets are especially vulnerable to a regime change in interest rates.

People have been dismissing recent startup valuations as a bubble for years.

Maybe this is just a brief moment of turbulence, and we’ll shortly return to a permanently high plateau of startup valuations. But that isn’t the way to bet.

Things look like they’re going to get retro.

Ancient wisdom may again prove relevant: Lean startups, ramen profitable, great companies get built in hard times, etc.

Startups aren’t just about driving change — they must also respond to change.

Credit: Source link