ipopba/iStock via Getty Images

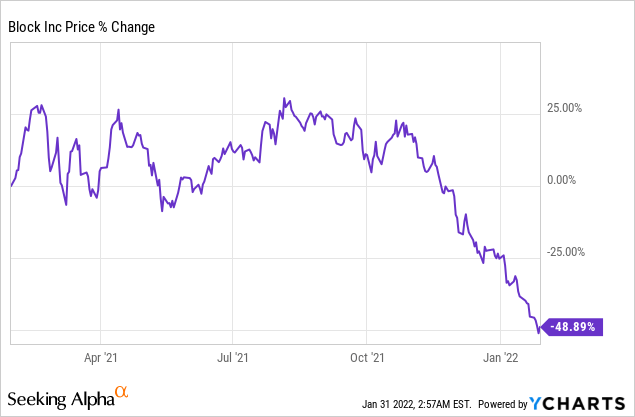

Shares of digital payments company Block (SQ) are on sale after their price dropped to a new 1-year low last week. The correction in the Fintech industry has gone too far and leading financial service providers like Block and PayPal (PYPL) are set for a major rebound. Because shares have become so cheap, the risk profile for Block is skewed to the upside!

Massive, undeserved correction creates an opportunity to engage

Shares of Block went through an almost 60% drop in pricing since October although the company submitted a strong earnings card in November. Shares now trade just around $110 and offer investors an attractive risk-reward.

Cash App ecosystem is set to drive revenue and gross profit growth for Block

Fintechs play an important role in the cash-free economy. They process payments, oftentimes much faster than regular banks, create easy-to-use apps for transactions and make online purchases more convenient than ever before. The development of the Cash App — a mobile payments service that allows users to transfer money to other users — has driven Block to the top of the Fintech food chain. Besides Cash App, Block offers payments services for merchants like payment processing and point-of-sale products. Block also offers saving and loan products to small companies.

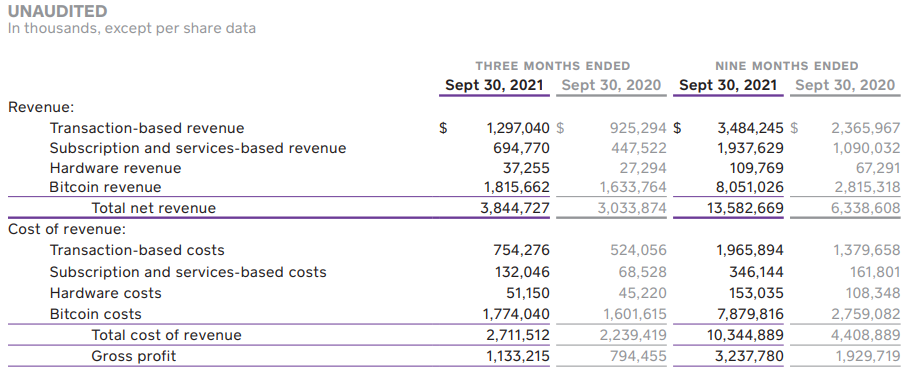

In the third-quarter, the Fintech generated 27% year over year revenue growth from all products in its ecosystem. Total revenues were $3.84 billion in the third-quarter of 2021, $1.30B of which came from transaction-based revenues. Subscription and services-based revenues were $694.8M, showing 55% growth year over year. Bitcoin revenues in the third-quarter were $1.82B, showing an increase of 11% year over year. Block purchases Bitcoin to give users access to the digital currency in the Cash App and the company charges users a small fee to buy or sell the cryptocurrency. Because Bitcoin revenues are heavily influenced by fluctuations in the market price of the cryptocurrency, Block shows related revenues separately and they can fluctuate wildly from quarter to quarter. While Bitcoin revenues were $1.82B in Q3’21, the gross profit from providing Bitcoin access in the Cash App was just $42M.

Block’s total gross profit in the third-quarter was $1.13B, showing an increase of 43% compared to the year-earlier period.

Block

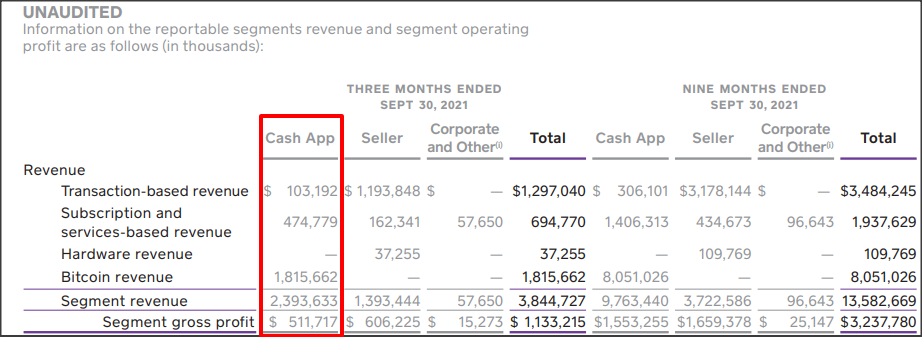

Block is solidly profitable, in large part because the Cash App has started to become a real money-maker for the Fintech. The app benefits from huge popularity with users in the U.S. and is one of the most downloaded peer-to-peer payment apps on the App store.

The Cash App ecosystem is now responsible for 62% of all company revenues and 45% of segment profits. In the first nine month of 2021, the Cash App generated $9.76B in revenues and $1.55B in gross profits. The growth rates for Cash App segment revenues and gross profits in the first nine months of 2021 were 157% and 83% year over year due to accelerating customer uptake of the Cash App and growing customer acquisition.

Block

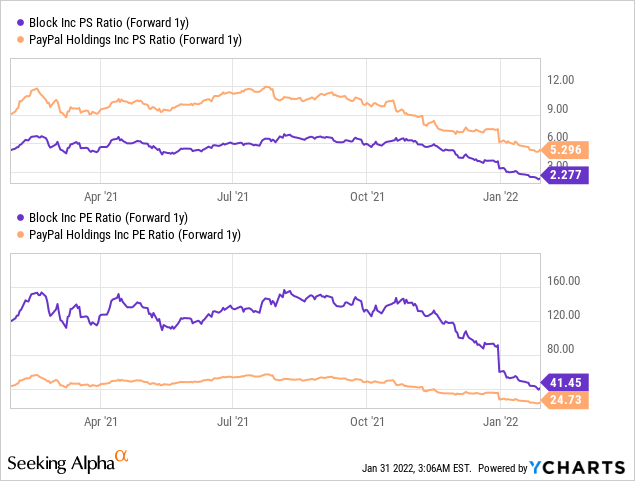

Discounted sales growth

The large drawdown in the price of Block’s shares creates an opportunity to engage. Because of the material price drop in the last three months, Block’s growth in the Fintech industry has been discounted heavily. I believe that the current market price undervalues Block’s potential in the commercial market for online payment solutions.

Block is projected to generate revenues of $18.65B in FY 2022 and $22.36B in FY 2023, implying year over year revenue growth rates of approximately 6% and 20%. Based off of revenues for FY 2023, shares of Block trade at a P-S ratio of 2.3 X. Because Block is already profitable, a P-E ratio can also be applied, which in this case is 41.5 X (FY 2023). PayPal is one of Block’s biggest rivals in the digital payments industry and the sales growth of PayPal is significantly more expensive than Block’s top line growth…

Risks with Block

Block may face a slowdown in revenue and gross profit growth in the future as more Fintechs bring new financial products to consumers and move in the small business segment of the digital payments market. The digital payments market is going to grow together with the broader e-Commerce market which could prompt new disruptive Fintechs with potentially better technology to step in and try to undercut large financial services providers like Block. Slowing revenue and gross profit growth is possibly the biggest risk for Block and its stock.

Final thoughts

After a near-60% drop in pricing, shares of Block look very attractive again. The digital payments company will continue to grow in the commercial market (online payment solutions) and expand its Cash App ecosystem which is already booming and benefiting from accelerating customer adoption. While there are risks for Block, namely slowing revenue and gross profit growth, I believe the risk profile is massively skewed to the upside here!

Credit: Source link