zoom-zoom/iStock via Getty Images

After PayPal Holdings (PYPL -26.1%) stock dives on weak 2022 guidance and a pivot in customer acquisition strategy, against an overall weak backdrop for fintech stocks.

Fintech, online lending, and payment stocks turn down, extending a months-long slump in the sector as investors grow risk averse.

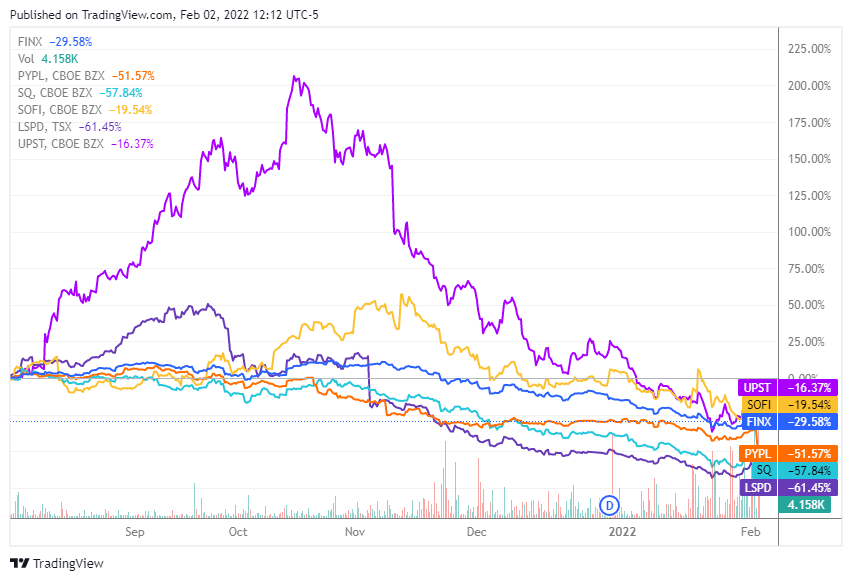

Note that Global X FinTech Thematic ETF (FINX -4.0%) has dropped 30% in the past six months. PayPal (NASDAQ:PYPL) fell 52%, Square (NYSE:SQ) 58%, Lightspeed Commerce (NYSE:LSPD) -61%, SoFi Technologies (NASDAQ:SOFI) -20%, and Upstart Holdings (NASDAQ:UPST) -16% over the same timeframe.

In Wednesday trading, Block (SQ -10.5%) drops after completing its acquisition of Afterpay. Other payment names dip as well: Paysafe (PSFE -5.0%), Lightspeed Commerce (LSPD -6.1%), Fiserv (FISV -0.9%), and Global Payments (GPN -0.6%).

Online lending names also suffer: Upstart Holdings (UPST -8.9%), LendingClub (LC -6.6%), Blend Labs (BLND -1.1%), Rocket Companies (RKT -2.2%), and SoFi Technologies (SOFI -7.3%). LendingTree (TREE +2.4%) rises after its preliminary Q4 results topped consensus.

And while investors shy away from PayPal (PYPL) in a big way after the disappointing guidance, Mizuho analyst Dan Dolev sees some notable positives in its Q4 results — incremental total payment volume growth ex-eBay/P2P accelerated in Q4 to $55B from $53B in Q3 and the take rate (also ex-eBay) increased by 5 basis points, “marking a potential change in trend.” He explains PayPal’s recent weakness as a “return to earth” after a “COVID sugar rush” in 2020 and 2021.

“On balance, despite the understandable knee-jerk negative reaction, we see signs of the COVID hangover coming to an end, opening a new opportunity in PYPL,” Dolev wrote in a note to clients.

Oppenheimer analyst Dominick Gabriele also sees PayPal’s (PYPL) swoon as a buying opportunity. “After our post 3Q21 cautious stance we see significant upside on the kitchen-sink outlook/soured sentiment and we’re going bottom fishing.”

Raymond James analyst John Davis, though, isn’t convinced. “PYPL is a ‘show-me’ story, and we believe the stock is unlikely to re-rate meaningfully higher before growth reaccelerates and investors gain confidence the 2022 outlook is overly conservative, which isn’t likely to happen before 2H22,” he wrote.

SA contributor Kirk Spano presents an option selling strategy for PayPal and Block

Credit: Source link