- Seyna, an insurance-tech company for brokers, just raised 33 million euros ($37 million).

- The startup provides insurance for pets, rent, and extended warranties, and it plans to expand.

- Check out the eight-slide pitch deck Seyna used to raise the fresh cash.

Seyna, an insurance-tech startup that offers white-label insurance products that companies can then sell to consumers, just raised 33 million euros ($37 million) in fresh funds.

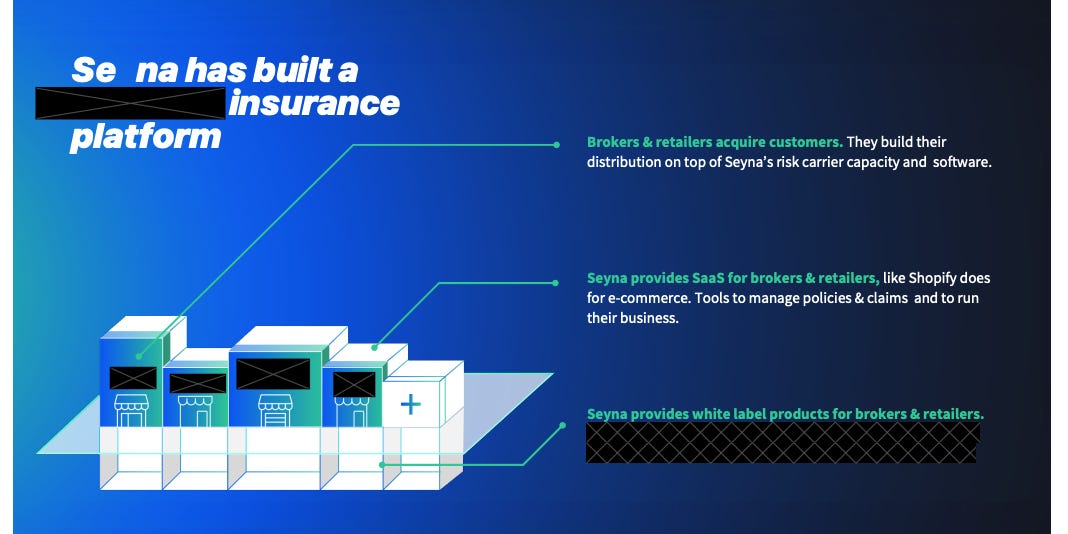

The Paris company, which has been operating since 2019, has built a “one-stop shop” for brokers that allows them to sell policies, manage clients, and combine insurance products on a single platform. The platform also allows sellers to facilitate claim management, speed up compliance, and automate payments.

The startup provides insurance for pets, rent, and extended warranties, and it plans to expand this to all property and casualty lines, starting with health insurance.

Seyna makes money like a traditional insurance company, as it’s a licensed carrier and carries the premiums offered by brokers. The startup plans to open up to other insurance providers this year, at which point it would look to introduce new revenue models.

“The original role of insurance, if we really go back to it —it’s a way to help people take risks,” chief executive Stephen Leguillon told Insider.

“It’s quite exciting, right? Without it, many products would never have happened. If you take a step back and you think of the last time you bought insurance, I don’t think you were thinking of it that way, right? It was more of a mandatory purchase,” he continued.

Leguillon said the condition of the modern insurance market wasn’t a result of anyone’s “evil intentions,” but because it was “incredibly hard to do well.”

“Legacy technology means that brokers and insurance companies are spending their time on admin, compliance, and manual inputs,” he said. “If we can bring insurance back to its original principles, that would be cool.”

The latest round was coled by digital and deep-tech investors Elaia Partners and New York firm White Star Capital, with participation from Global Founders Capital, Allianz, and Financière Saint James. The cash injection brings Seyna’s total funding to 47 million euros ($53 million).

The startup intends to use the capital to scale its head count to 100, with hires across its tech, insurance, and sales and marketing teams. New features, including tools for brokers to make more sales on and offline, are in the pipeline. A big focus is expected to be on its claims-management software to ensure that end users and brokers are happy with the automated system.

Check out Seyna’s redacted pitch deck below.

Credit: Source link