Robotic Surgery

Ankabala/iStock via Getty Images

This underfollowed robotic medical device play, with a significant and growing install base, has made substantial progress over the past few years under the direction of a new management team and board. Stereotaxis’ unique robotic “pull” mechanism of action utilizing magnetism to precisely steer devices throughout the entire vascular system separates it from all manual & other robotic approaches that use a “push” mechanism of action. Their technology has treated over 130,000 patients to date and led to over 400 peer-reviewed publications detailing its superior clinical efficacy, safety, and speed, over manual-based approaches.

This will be the third article I am writing on Stereotaxis (STXS) in the past two years. The first was a comprehensive dive into the company, its history, and a look at the implications of the first real upgrade to its robotic-magnetic-navigation or RMN platform in over a decade. The second focused on the 2019 acquisition of Stereotaxis’ peer for $1.1 billion (at >100x trailing-twelve-month sales and >60X forward-twelve-month sales) validating the significant potential for robotics in cardiac, peripheral & neurovascular markets, smart institutional investors buying stock, and detailed the company’s clinical trifecta (superiority, safety & speed) versus manual procedures. Here are links to the two previous articles for reference:

Stereotaxis Robotic Suite (Stereotaxis Website)

Fast forward to today and the outlook is the brightest it’s ever been on the heels of the company’s Innovation Day held in December. This is both from a fundamental business perspective, as well as its increasing potential as a takeover candidate. The details of Innovation Day and other data points will be covered throughout this update.

The Fundamental Growth Story for this Robotic Medical Device Company is Firmly Underway and Its Future Prospects Are Bright

Notwithstanding the COVID pandemic that has impacted so many medical device names in 2020 & 2021, Stereotaxis has begun to show meaningful growth in FY2021. Through the first three quarters sales have grown 35% y-o-y and sell-side estimates have FY2021 ending with 30% growth y-o-y and 20% growth compared to pre-COVID FY2019. That growth is expected to continue with consensus estimates showing 27% growth in FY2022 to ~$44 million in revenues & accelerating to 41% growth in FY2023 reaching $62 million in revenues, according to Bloomberg:

Sell-side Consensus Estimates (Bloomberg)

Here is a brief overview of some key drivers powering the company’s strong growth outlook:

- Continued Growth in System Sales – Since the delivery & installation of its first Genesis system announced on its Q3’2020 call, Stereotaxis has announced new orders for ten hardware systems on its earnings calls between Feb 2021 and Nov 2021, comprised of 8 Genesis systems and 2 Niobe systems in China where approval for Genesis is pending. That level exceeds any similar timeframe over at least the last five years. This achievement was accomplished despite (1) no significant increase in sales personnel and (2) COVID impacting hospitals and their budgets globally. For FY2022, the company has guided to system sales approximately doubling to ~$22 million. In FY2023, consensus has system sales increasing >50% and there may be upside driven by the commercial launch of the company’s recently unveiled mobile RMN system in 1H’23. More on this later.

- Upcoming Proprietary Catheter Launch (with Portfolio of Catheters to Follow) – Stereotaxis’ first proprietary in-house MAGiC catheter, part of a pleasantly surprising portfolio of catheters disclosed during the Innovation Day, is a game-changer that continues to be underappreciated. From a revenue perspective, initial sales are expected in Europe in 2022 followed by potential US approval in 2023. Overall, the management team has stated the catheter will add ~$20 million in sales based on its existing base of business. Note that estimate was prior to the 10 new system orders over the past ~12 months and any future system sales. In addition to the material sales potential these catheters have, this portfolio makes Stereotaxis a much more attractive acquisition candidate and opens the door to multiple sales strategies that the company has never had at its disposal. More on this later.

- New Applications & Products Driving New System Sales & Recurring Revenues – Stereotaxis unveiled five new clinical applications beyond cardiac ablation at its Innovation Day for its differentiated “pull” robotic platform that elegantly uses magnetism to steer & guide catheters & guidewires throughout the entire vascular system, namely (1) neurovascular (ischemic/hemorrhagic stroke), (2) coronary angioplasty, (3) tumor embolization, (4) peripheral artery disease, and (5) abdominal aortic aneurysm. These materially increase the total addressable market for Stereotaxis to over $10 billion annually (not including >$20BB TAM from system sales), and dramatically increases the likelihood of future system sales as the return on investment expands substantially for hospitals and specialized practices. To support these new areas of focus Stereotaxis is building a portfolio of RMN-compatible guidance devices, such as guidewires and guide catheters, the first of which is expected to launch commercially in 2022.

- China & New Partnership Underappreciated – In 2021 Stereotaxis received two system orders in China, which were the first orders from that country in nearly 10 years. As management noted on its Q3 call, “This is a reflection of the renewed interest and acceptance that we are experiencing globally and a specific high level of customer and strategic interest we are seeing in China”. After the call we learned of a new strategic partnership on August 30th with MicroPort EP, a 39% owned associated corporation of MicroPort Scientific Corporation, one of the largest and most successful medical device companies in China. This deal announced in August 2021 has curiously generated very little attention, however when you look at the collaboration there is reason to be excited in 2022 and more so in 2023 & beyond. With respect to 2022, the CEO stated on the Q3 call he anticipates China will exceed 2021 system sales…that implies 3 or more systems sales this year. That is certainly a positive, yet 2023 is really when the China opportunity comes into focus. As per the company, plans are in place to develop a robust ecosystem of products surrounding Stereotaxis’ robotic technology, including the integration with MicroPort’s mapping system, the development of robotically navigable catheters (ablation & diagnostic), and regulatory approvals for Stereotaxis’ products. The attributions from the press release showed enthusiasm for the large opportunity in China: (1) “I am very excited by the promise of this collaboration. Having completed nearly 2,000 robotic ablations, I deeply understand the value of robotic technology and appreciate how this partnership will expand broad access to these benefits for hospitals, physicians and their patients across China.” – Prof. Jin Qi of Ruijin Hospital in Shanghai, and (2) “We look forward to providing China’s electrophysiology community with highly innovative and differentiated products that leverage Robotic Magnetic Navigation technology. This will both strengthen the importance of robotics and reinforce the key role of MicroPort EP in this rapidly growing and underserved market.” – David Fischel, CEO of Stereotaxis & Dr. Sun Yiyong, President of MicroPort EP. Stereotaxis management stated on its Q3 earnings call that the partnership may generate “tens of systems a year” in China. “Tens of systems” is open to interpretation yet 20, 30, 40 or more, all could all fit the definition…and no matter which one you choose, at a selling price >$1 million for each system plus disposables, China represents a sizable driver of future revenues.

Stereotaxis New China Collaboration (Stereotaxis & MicroPort EP)

Quasi-Start-Up with an Established Foundation to Grow From

The Stereotaxis story at this juncture can be seen as a quasi-start-up with a tremendous established foundation to drive the robotic revolution in endovascular markets that the company is looking to lead. That foundation includes:

- Over 130,000 patients treated

- Over 100+ leading hospitals utilizing the system

- Over 400 scientific peer-reviewed publications detailing the clinical trifecta (superiority, safety & speed) of Stereotaxis’ robotic navigation over manual procedures

The clinical data is overwhelmingly in favor of Stereotaxis’ platform showing: (1) a decline in major adverse events, (2) a reduction in minor complications, (3) higher acute success, (4) lower cardiac perforations, (5) superior freedom from recurrence, and (6) significantly lower fluoroscopy exposure. Stereotaxis’ RMN system benefits both patients & clinicians…a solution desired by both hospitals and specialized centers alike. Lower radiation is one of many advantages highlighted by the many physicians advocating for the company’s platform.

Stereotaxis Investor Presentation (Stereotaxis)

Notably, a significant portion of the clinical data in the >400 peer-reviewed publications covering the many advantages of Stereotaxis’ robotic magnetic navigation are derived from catheters at least 15 years old and RMN systems based off the original Niobe design from 2003, which are inferior to the newer Genesis system. With respect to the catheters, Stereotaxis has had a long-standing relationship with Biosense Webster, a division of Johnson & Johnson (JNJ), that dates to 2004 and has been extended several times since. Between 2004-2009 Biosense secured FDA or CE Mark approvals for the NaviStar RMT, Celsius RMT and finally Navistar RMT Thermocool catheters, which was an irrigated catheter that provided cooling during RF ablation that ended up becoming the workhorse for Stereotaxis after its FDA approval in February 2009. So, when you observe the mountain of clinical evidence that supports the many advantages of Stereotaxis’ RMN system, it’s even more impressive given it’s built off systems and catheters that are 15-20 years old.

The fact there has not been a new catheter design in well over a decade is about to change meaningfully with the upcoming launch of Stereotaxis’ proprietary in-house MAGiC catheter, which will be covered in more detail below in the section on the company’s December 2021 Innovation Day. By having a proprietary catheter designed from the ground up to capture & enhance the well-detailed superiority of its RMN versus manual/robotic ‘push’ procedures, Stereotaxis’ revenue & earnings power should expand exponentially, making it a more valuable company and an attractive acquisition candidate in the robotic medical device arena.

Despite over 130,000 patients being treated with its RMN system by hundreds of physicians at over 100 leading hospitals worldwide, from the perspective of (1) a new EP catheter in MAGiC, (2) a new version of the RMN system in Genesis, (3) a new mobile RMN system, (4) a new broad portfolio of additional endovascular catheters, guidewires, micro-catheters, guide-catheters for neurovascular, peripheral, cardiac, and additional clinical applications, (5) a re-engineering of its leading video connectivity platform, and (6) a strong balance sheet with a business model that is almost self-funded, Stereotaxis is a quasi-start-up in the sense that it is in the initial stages of its business plan to revolutionize the broad field of endovascular surgery, much like Intuitive Surgical has done in laparoscopic surgery over the past 20 years.

Stereotaxis Investor Presentation (Stereotaxis)

Stereotaxis’ Vision to Become the Intuitive Surgical of Endovascular Surgery is Much Clearer After its Innovation Day in December 2021. Intuitive Surgical’s EVP & CMO Joining Stereotaxis’ Board Just Over Six Months Ago & Her Attribution When She Did Bodes Well.

The emergence of robotics in the medical devices industry has firmly been underway for the past two decades. This trend has led to many successful investments over that timeframe. Here are a few notable mentions: MAKO in hip and knee arthroplasty acquired by Stryker (SYK) for $1.65 billion, MAZOR in spine and orthopedic acquired by Medtronic (MDT) for $1.7 billion, Corindus in percutaneous coronary and vascular acquired by Siemens Healthineers (OTCPK:SMMNY) for $1.1 billion, and Auris in bronchoscopy & lung cancer acquired by Johnson & Johnson (JNJ) for over $3 billion.

Yet no robotic company over the past 20 years has been more successful than Intuitive Surgical (ISRG) as it has transformed laparoscopic surgery, and at its current market cap of >$100 billion has also had quite an impact on the lives of many shareholders as well. Anyone who acquired 10,000 shares (adjusted for splits) during mid-February and mid-March 2003 around the time of its merger with Computer Motion spent somewhere between $8,000 and $12,000, which is now worth $2.9 million.

Turning to Stereotaxis, the recently unveiled strategic and product roadmap at its Innovation Day positions it well to achieve its vision to become the Intuitive Surgical of endovascular surgery, positively transforming it with robotics like Intuitive has done with laparoscopic surgery.

Could Stereotaxis be the next Intuitive Surgical? From my perspective, it certainly has that potential as the total addressable market is massive and as per the hundreds of peer-reviewed publications covering its superior efficacy, safety and speed, its magnetic pull approach is arguably the best to navigate the endovascular surgery landscape – both for the patient and the physician.

With that said, let’s get to someone’s view that matters much more than mine…Dr. Myriam J. Curet. Dr. Curet is the Executive Vice President and Chief Medical Officer for Intuitive Surgical. She joined Intuitive in 2005 and has since led the development of clinical evidence, physician education, and reimbursement and regulatory activities that have been instrumental to its growth across multiple clinical specialties. For more than 20 years, Dr. Curet has also served as a Clinical Professor of Surgery at Stanford University School of Medicine.

Dr. Curet joined Stereotaxis’ Board of Directors in July 2021, and had this to say about Stereotaxis:

“Stereotaxis reminds me in many ways of Intuitive Surgical in our early years. I’m impressed by Stereotaxis’ technology, clinical value and strategy to positively transform endovascular medicine with robotics. I look forward to providing strategic guidance and contributing to the effort to build a highly successful and impactful company.”

This attribution should carry significant weight given her expertise and extensive experience in the robotic medical device landscape, and in particular as she has helped drive Intuitive’s success over the past 17 years forever changing the laparoscopic surgery space through its robotic systems.

So what could Stereotaxis be worth if it positively transforms endovascular medicine with robotics? It is safe to say that the company’s valuation would expand dramatically from current levels as the size of the endovascular landscape is massive. As you will read in the next section covering Stereotaxis’ Innovation Day, its total addressable market now exceeds $10 billion annually and that does not include the >$20 billion TAM that the company sees in potential upfront robotic system sales as endovascular labs transition to robotics.

Stereotaxis Investor Presentation (Stereotaxis)

Innovation Day Highlights (Robotics, Catheters, Vascular Devices, Connectivity) and Stereotaxis’ Vision

This section will focus on Stereotaxis’ Innovation Day held in December, which was ~2 hours long (1 hour presentation & 1 hour Q&A). My apologies in advance for the length of this section, while a full recording of the event is available on Bloomberg that I utilized there are no transcripts of the event, so I tried to capture as much detail as possible.

While recognizing endovascular surgery is a modern-day miracle of science, the current approach is archaic in several ways: (1) Navigation is backwards in that operators have limited control at the end of the device that matters and is like an operator writing with a pencil by holding the eraser…it may work but it is not ideal. Precision, stability, control, and ultimately patient outcomes suffer. (2) Safety for both the patient and physician is lacking. Current endovascular surgery requires the navigation of rigid devices throughout delicate vascular anatomy, and unfortunately that can lead to tragic complications. Additionally, physicians are at risk as they’re exposed to thousands of hours of radiation over the course of their careers. (3) The operating room environment in endovascular surgery is antiquated considering how data, connectivity, automation, machine/human collaboration, and a transition from physical-to-cognitive effort are transforming so many other aspects of life. Physicians stand for hours, hold body & hands in peculiar positions while being exposed to radiation, shout instructions to others who can control what they can see and do, and operating rooms are silos largely cut-off from any external support or data.

Stereotaxis’ vision is to pioneer robotics across a broad range of endovascular surgeries to modernize the field, address shortcomings of current approaches, and meaningfully improve care. Its RMN system is the only robotic technology in endovascular today that allows for direct, distal control of an interventional device, and by doing so overcomes the navigation & safety issues highlighted above. Beyond the system’s mechanistic advantages, the company is very much focused on true digital surgery, where the benefits of data integration, automation, connectivity, and artificial intelligence can be introduced to the endovascular operating room to improve care.

With that big picture overview in place, the presentation then shifted to cover several innovations that Stereotaxis is advancing on four fronts: robotics, catheters, vascular devices, and connectivity. The CEO made it a point to note that all of what would follow could be characterized as “advanced, de-risked, and impactful in the short-to-medium term in both its beach-head market of electrophysiology (EP) and more broadly across endovascular intervention”.

A. Robotics – Stereotaxis’ Senior Director of Product Development, Brian Kidd, briefly covered the leap forward in technology with the 2020 launch of the Genesis system, which was the first substantial redesign to the robotic magnetic system since Niobe launched in 2003. Combining Genesis with the company’s Model S X-Ray made the system more affordable and accessible, yet as a fixed-install the system it still has challenging logistics for some hospitals, including significant floor loading, architectural planning with structural analysis, available space, magnetic shielding along walls, special electrical work, and an extensive planning process with an extended sales cycle. With well over 100 systems installed, these challenges can & have been overcome, but the accessibility issues to RMN technology are real and it’s had an impact on the adoption of this cutting-edge technology.

The Genesis build & launch set the stage for the next major leap in the platform, which will make accessibility to the system increase exponentially…the new ground-breaking mobile RMN system. This mobile robot combines the long-established benefits of RMN and the speed and responsiveness of Genesis, into a form factor that can be easily, rapidly, and broadly adopted. It requires no complex planning, no cable conduits, no complicated electrical work, and no lab construction or shielding of walls. As per Mr. Kidd, “a robot like this that overcomes the recognized logistics challenges has been a dream of the company since its establishment…it is now a very tangible reality”.

How did this “very tangible reality” come about now? The combination of the company’s proprietary next-gen ablation catheters allowing for use within a magnetic field strength half of what was previously required, the advancements with Genesis, and meaningful innovations across every aspect of the system’s design has led to this mobile robot. Its design also allows for high volume manufacturing and for shipments of completely assembled robots. Mr. Kidd said they expect to file for regulatory approval in last 2022 in the US & abroad and launch the system in the first half of 2023.

CEO Fischel summed up the new robot as “strategically transformative” for Stereotaxis, and for the “broad adoption of robotic magnetic navigation in electrophysiology and across endovascular interventions. This accessibility also facilitates and plays into two broader themes: the move of procedural medicine to outpatient surgical centers and the use of alternate pricing models to facilitate and accelerate adoption.” While both are clearly important, I will focus here on the alternate pricing models given the significant implications this has to the business model and the step-change in the future potential of Stereotaxis. To put this in perspective, the king of robotic medical devices Intuitive Surgical (ISRG) reported its fourth quarter on January 20th, 2022. With respect to ISRG’s newer Ion systems, leases represented 54% of the 93 systems that were placed in FY’21. Of the 385 da Vinci Surgical Systems shipped during Q4, 143 systems or 37% were lease and/or usage-based arrangements versus 41% in Q3. On its earnings call Intuitive’s CFO noted that “while leasing will fluctuate from quarter to quarter, we continue to expect that the proportion of placements under operating leases will continue to increase over time”.

Stereotaxis’ mobile RMN system will enable leasing of systems & placements of systems with disposable purchase commitments, which should enable customers much more rapid access to the benefits of robotics without sacrificing any economics. Obviously, this ability to lease systems or sell systems under usage-based arrangements would be important for Stereotaxis to have, and the other missing link to opening the door to leases & usage-based models is a proprietary in-house catheter to support these models. That brings us to the area of innovation covered by management, Stereotaxis’ work with Osypka and others on a portfolio of new catheters.

B. Catheters – Before I get into the presentation highlights, it bears repeating that the upcoming launch of in-house catheters is a game-changer. For almost two decades they have relied on JNJ’s Biosense Webster division to supply them with catheters, for which they received a 15% royalty. That will not continue for much longer as its proprietary MAGiC catheter for use in EP ablation (atrial fibrillation, ventricular tachycardia, etc.) will launch commercially in 2022 in Europe followed by a US launch in 2023. Stereotaxis’ CEO has said the MAGiC catheter alone will add ~$20 million in sales based on its existing base of business. Note that estimate was given prior to the 10 new system sales disclosed in 2021 and does not include any future system sales. Additionally, as covered above, this portfolio of catheters opens the door to multiple sales strategies that Stereotaxis has never had at its disposal such as leases and usage-based models, which along with the mobile RMN launch in 2023 can help drive an exponential change in demand & sales.

Back to the Innovation Day presentation…this portion of the presentation was led by Nathan Kastelein, Senior Director of R&D & Advanced Concepts, and covered a robust portfolio of robotic EP catheters that Stereotaxis will launch in the coming years including MAGiC (RF ablation), MAGiC-PFA (pulsed-field ablation), Coolloop (cryoablation), and ablation & high-density mapping catheters.

Starting with their flagship Magnetic-Interventional-Ablation-Catheter (MAGiC) catheter, it was clearly designed from the ground up to enhance the well-detailed superiority of RMN’s ‘pull’ approach versus manual/robotic ‘push’ procedures. Here are a few of the key design considerations:

- Gold / Rounded Tip – The is due to gold’s excellent conduction of RF energy, thereby maintaining a more stable temperature profile resulting in less risk of char or thrombus formation. The rounded tip design is superior to a blunt tip, especially in a magnetic catheter, as it creates a constant contact with the tissue from any angle.

- Low-flow Irrigation Design – The Biosense Webster Thermocool RMT catheter currently in the field has 6 irrigation ports and can require up to 30mL/minute of saline. While this was state-of-the-art 15 years ago, more modern catheter designs require only 15 mL/minute of saline. Given too much fluid can have a negative impact on patients, particularly those with renal issues common in arrythmia patients, this impacts physician choice in using Thermocool RMT or catheters with less saline. That will no longer be a factor moving forward with the MAGiC catheter, and it’s noteworthy that Stereotaxis’ flagship catheter is not meeting the competition here but rather taking a leadership position. Its unique low-flow irrigation design has 25 ports with a helical structure inside the tip to distribute saline equally and combined with the gold tip’s thermal characteristics, Stereotaxis will pursue a label with only 10mL of saline/minute flow rate or 50% below other irrigation catheter offerings.

- Contact Force Measurement & Contact Quality Assessment – RMN has an advantage over manual when it comes to contact force as by design it has very stable & constant force with the tissue wall even as the heart is beating. As part of its leading efforts in digital surgery, the new MAGiC catheter is designed to provide physicians with data on the quality of contact between the catheter and the tissue based on electrical data from the tip. This info is expected to improve the learning curve, procedure efficiency, physician confidence, all the while making the catheter easier to navigate.

- Improved Catheter Navigation – As detailed above, almost all the large peer-reviewed clinical data for Stereotaxis’ platform has been driven by catheters designed over 15 years ago. Their extensive experience to date with this ‘first-generation’ catheter has led to an optimal design that truly brings the amazing ability of utilizing magnetic fields to steer catheters to an entirely new level. The company has been “very pleased” with physician’s positive comments who have navigated the catheter in phantom models & animal studies, describing it as “what power steering was to cars”. For those of you old enough to have driven cars without power steering, this simple statement says quite a bit.

Mr. Kastelein noted that manufacturing is “currently ramping up” as part of verification & validation testing and will be submitting MAGiC for “CE Mark and IDE clinical trial soon”. While MAGiC is expected to positively transform the commercial opportunities and clinical performance in electrophysiology, its development also allows serves a broader clinical strategy in EP and beyond that Stereotaxis has set in motion. With respect to EP specifically, Mr. Kastelein then covered a robust portfolio of catheters that will follow MAGiC:

- MAGiC-PFA (pulsed-field ablation) being developed in conjunction with Acutus Medical (AFIB) and their pulsed-field generator and other open access PFA generators. This is an area to watch as conversations I’ve had with physicians suggest RMN & PFA could be ideal combination. The street is starting to comment on this as well, with Cowen recently noting, “Importantly, electrophysiology KOLs have recently relayed to us their optimism that RMN will play an important role in the era of PFA because stabilization of the catheter is of utmost importance when delivering pulsed field energy.” Tangible work to date includes bench & animal testing and the company is pleased with the results. Expect to be in human studies potentially by December 2022.

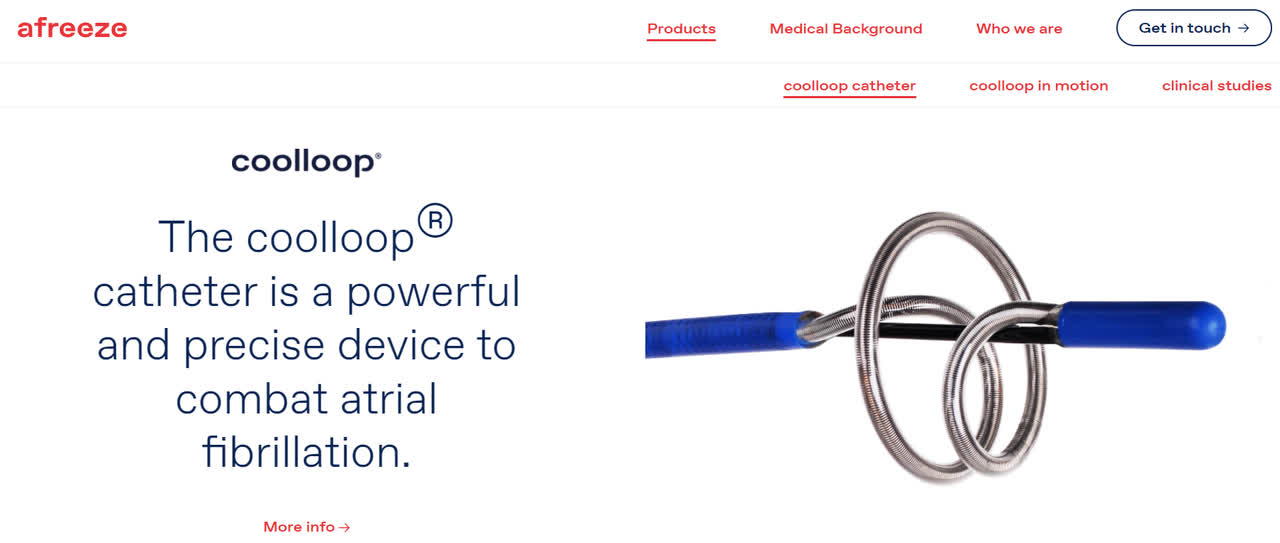

- Magnetic Coolloop (cryo-catheter) being developed in partnership with private company afreeze, which has already achieved CE Mark for its non-magnetic coolloop. Cryoablation has become a primary approach to treating paroxysmal atrial fibrillation, and many physicians that use RMN suggested to Stereotaxis that robotic magnetic control could improve a cryo-catheter’s navigation & orientation in the veins. Mr. Kastelein stated the magnetic version of coolloop may available in the European market by end of 2023.

- Broad Family of EP Catheters for China Market via Collaboration with MicroPort – Since announcing the collaboration in August 2021 have worked on multiple fronts, and fruits of collaboration are expected to lead to range of ablation & diagnostic catheters that can be used in China and potentially more broadly.

- Ablation & high-density mapping catheters were also mentioned

afreeze non-magnetic coolloop catheter (afreeze website )

C. Vascular Devices – The company is methodically advancing a series of vascular devices that will move Stereotaxis’ RMN technology into multiple new indications beyond cardiovascular broadly across the entire endovascular system. The company sees a series of unmet clinical needs that can be addressed by a family of magnetically navigated devices. They’re focused on large, existing endovascular markets where they can drive clinical benefit in indications, i.e., complex vasculature that is difficult to navigate where improving navigation can lead to: better outcomes, improved safety, expanded access to therapy, more efficient procedures, and reduced radiation exposure.

They are being prudent & have centered their attention on a small number of robotic magnetically navigated devices that are versatile and multi-purpose. These are designed to enable and interoperate with a broad range of therapeutic devices across a variety of clinical applications including:

- Neurovascular (ischemic / hemorrhagic stroke) – In neuro-intervention, particularly in improving aspiration and mechanical thrombectomy for ischemic stroke patients & in the coiling of aneurisms to prevent hemorrhagic stroke, navigation through the brain’s vasculature can be challenging. Therapies reaching the required spaces quickly, safely, and efficiently can mean all the difference between recovery or tragedy. Physicians have described proximal challenges in accessing the arteries going up to the brain, and distal challenges navigating the tortuous vasculature higher up in the head. Later in Mr. Kastelein’s presentation he notes that the company “has been fortunate to work with several leading neurosurgeons, who have supported this work and guided the company in its efforts.”

- Coronary angioplasty – In complex cardiac stenting or balloon procedures, RMN can improve the speed, ease of access, and navigation in the coronary vasculature. Stereotaxis has experience of a few thousand procedures performed over a decade ago, which gives management confidence in its plans and benefit today from that knowledge.

- Tumor embolization – The delivery of embolic agents to starve tumors of blood supply is an established therapy for hepatic cancer & others solid tumors, uterine fibroids, and BPH. With RMN, Stereotaxis believes it can overcome the existing challenges of off-target effects and damage to healthy organs by more rapidly navigating to and precisely targeting the distal vessels leading to directly to the tumor. The ability of the system to return to the same spot robotically and automatically would allow for a more efficient and precise therapy.

- Peripheral artery disease – Enabling angioplasty, stenting, atherectomy of clots in the lower limb below the knee where navigation can be very difficult, the ability of RMN to navigate these small tortuous vessels safely and intuitively is a great benefit for these types of procedures. This too is an area where Stereotaxis has experience, with the first crossing of a chronic total occlusion over a decade ago.

- Abdominal aortic aneurysm – The repair of aortic aneurysms and guiding a wire over the iliac arch can be very challenging, particularly in older patients where the vessels become very tortuous. Also accessing renal arteries can require significant time and effort. Stereotaxis’ guidewires can make these maneuvers more efficient & effective and can even enable endovascular surgeries for some patients that today require open surgery.

Addressing these multiple clinical applications with a family of guidance devices (guidewires and guide catheters) will enable Stereotaxis to work and interoperate with a broad range of catheters/products developed by other companies, leveraging its core experience in navigation to help those therapeutic catheters reach desired locations. The first of these is the Pegasus magnetic micro-guidewire that can easily bend & twist through multiple turns in a way that no other wire can, and management intends to file for CE mark and 510K approval in Q2’2022 with a commercial launch by year end.

The second family of devices is a family of microcatheters and guide-catheters that leverage the learnings in the design of the MAGiC catheter. They can cannulize vessels rapidly & efficiently and enable sheaths, microcatheters, and other devices to travel along the path that they have blazed. Stereotaxis expects to commercialize these devices in late 2023.

Mr. Kastelein’s presentation ended briefly covering Stereotaxis’ software modules for vascular navigation embedded in Genesis and the next-gen system that allow for efficient pathway planning and automatic navigation. They believe that automation in complex vasculature will provide substantial benefits in reducing the procedure time, complexity, and radiation.

D. Connectivity – John Platt, Senior Director of Project Management & System Software, discussed digital surgery that Stereotaxis is driving, followed by an introduction to the company’s new operating room connectivity platform called Synchrony.

Synchrony is a next-generation integrated display that builds upon the success of Stereotaxis’ Odyssey but is a more scalable solution that is more manageable in size, has faster and clearer procedural view, and improved user interface & interoperability. Connectivity can improve clinical and technical support, peer-to-peer collaboration, education & training, and enabling remote procedures. The company believes interconnected operating rooms, while maintaining patient privacy & IT security, would be a major advance for procedural medicine and thanks to their experience & history with their Odyssey system believe they are best positioned to make connected ORs (robotic & other) a reality. To that end they also introduced Synx, a mobile & browser-based app for lab connectivity. A limited rollout for Synchrony & Synx is expected later in 2022 with a full commercial launch in 2023.

CEO Fischel then came on to close this discussion around the highly synergistic Synchrony & Synx initiatives with its RMN platform, that also offer an opportunity beyond robotics. If the growth trajectory is right, then this may warrant be a potential spin-off in the future. This was an interesting comment that shows the upside potential that management thinks this may have.

With the 4 topics (robotics, catheters, vascular devices & connectivity) covered, CEO Fischel had some final comments. He noted that despite its long history, the company is at the beginning stages of its pioneering endovascular robotics. With its prior sole focus on EP without their own in-house catheter the company’s TAM was $2 billion.

With what was introduced and covered during the Innovation Day, the TAM expands to a steady-state over $10 billion annually. Notably, that does not include the greater than $20 billion TAM that the company sees in potential upfront robotic system sales as endovascular labs transition to robotics.

Stereotaxis Investor Presentation (Stereotaxis)

Excellent Financial Stewardship, Expanding Institutional Ownership, and Improving Wall Street Coverage

As mentioned earlier in the quasi-start-up section, Stereotaxis has been practically self-funded over the past two years despite COV19’s impact to hospitals, and this should get more attention than it does from the investment community. This is from the perspective that Stereotaxis as an investment offers a “free look” (strong balance sheet & solid fundamental business allowing them to reach profitability without need for additional financings) at significant upside potential as an investment; even if the company achieves 10% of what they’re setting out to do, the stock will be multiples higher than its recent price of $5/share.

Additionally, all the robotic acquisitions previously highlighted (Mazor, Mako, Corindus, and Auris) were burning significant amounts of cash prior to their $1.1 billion to $3.2 billion acquisitions. On the other hand, Stereotaxis has been an excellent steward of capital. Even with (1) meaningful progress on multiple waves of innovations including catheters, guidewires, the mobile RMN system, etc., that expand its steady-state annual TAM five-fold to >$10 billion <not including TAM from upfront robotic sales>, (2) growing the team via 14 net hires though Q3’21, (3) incurring substantial costs to build its new headquarters in 2021 that expands manufacturing capacity 3-fold, and (4) the ongoing COV19 impact to its business, Stereotaxis expects to end FY2021 with greater than $40 million in cash…impressive given they started FY2021 with $44.2 million.

Moving on to institutional ownership, and there too has been a meaningful change for the better. In the past two-and-a-half years, Stereotaxis has seen its institutional ownership rise dramatically from almost none owning shares on June 30th, 2019, to an impressive list of institutional holders including Opaleye, Arbiter, Redmile Group, Pura Vida, Iron Triangle, etc., as of September/December 2021. The overall ownership from insiders & institutions has increased to over 74% of the float.

From the perspective of Wall Street coverage, Stereotaxis has expanded from zero covering analysts two years ago, to six sell-side analysts today all of which have Buy ratings on the company with targets ranging from $9.50 to $13/share. This includes coverage from Piper, Cowen, and more recently Buy-rated initiations from Craig-Hallum and Loop Capital. Notably all six of these initiations were not banking related, so the company is attracting this coverage solely on its positive fundamental picture.

Stereotaxis Analyst Coverage (Bloomberg)

Stereotaxis is an Increasingly Attractive Acquisition Candidate; Philips and Intuitive Surgical at the Top of the List of the Multiple Potential Acquirers that Make Sense

The likelihood of Stereotaxis being acquired has moved up materially over the past 60 days, as the Innovation Day laid out a concrete path to the company becoming the leader in endovascular robotics, with a TAM that would grab the attention of almost all medical device companies. The expansion into 5 new clinical indications, the upcoming launch of the first of several in-house catheters, and the introduction of a mobile RMN robot that makes selling hundreds of robotic systems a year possible are all material catalysts from a potential acquisition standpoint. These advancements in their platform (1) open doors to leasing & usage-based models, (2) make their existing install base of over 100 hospitals that much more valuable, and (3) exponentially expand accessibility to RMN.

Expansion of clinical applications has been a key catalyst for robotic acquisitions historically, most recently with Corindus. Less than 5 months after Corindus received CE Mark in neurovascular and had pending US approval, Siemens Healthineers announced its $1.1 billion acquisition in August 2019. As per Siemens Healthineers comments, including the following excerpt from its PR announcing the deal, Corindus’ expansion into neurovascular clearly played a major role in its acquisition:

- “Corindus is currently one of the leading companies offering a robotic treatment platform for major vascular therapeutic markets, meaning coronary, peripheral vascular and neurovascular interventions”.

From a potential acquisition perspective, Stereotaxis has many favorable characteristics including…

|

Stereotaxis (STXS) Profile |

|

|

Competition |

Market leader in robotic magnetic navigation w/ no real competition |

|

Rapid Sales Growth |

Revenues growing 30% in FY21 to $35MM, 35% in FY22 to $44MM, & 45% in FY23 to $70MM |

|

High Margins |

Consistent margins above 70% (systems >30% and disposables >80%) |

|

Superiority |

Well-established clinical advantages of RMN platform over manual/robotic “push” methods with hundreds of peer-reviewed publications |

|

Clinical Safety |

Well-established safety advantages for patients & physicians via significantly lower radiation and many other benefits of RMN platform |

|

Clinical Speed |

Recent publications show increased speed that matches & exceeds manual, particularly in complex cases |

|

Cash Burn |

~$40MM cash w/ limited cash burn over past 2 years despite COVID; management expects to reach profitability with no additional capital raises |

|

Immediately Accretive? |

Most robotic acquisitions have taken years to be accretive; STXS may be accretive much faster given near break-even with opex of $31.2MM from R&D ($8.7MM), S&M ($10.8MM), and G&A ($11.7MM) over last 12 months |

|

Upcoming Regulatory and/or Commercial Launches |

(1) Mobile RMN system: CE Mark & FDA approval in late 2022 w/ launch in 1H’2023; (2) MAGiC RF ablation catheter: Europe launch in 2H’22 & FDA approval in 2H’23, (3) Pegasus micro-guidewire: launch late ‘22, (4) RMN cryo-catheter: Europe launch in ‘23, (5) RMN pulsed-field ablation catheter: in human testing by end of ’22, (6) rollout of Synchrony & Synx connectivity platform in late ’22 w/ full launch in ’23, and (7) additional catheters, guidewires, guide catheters |

|

Shortening Sales Cycle |

Upcoming launches of in-house catheter & mobile RMN robots shift elongated fixed-install sales cycle to much shorter sales cycle w/ lease & usage-based models |

|

TAM |

>$30BB (>$20BB in robot sales & >$10BB annually via catheters, guidewires, etc.) |

Source: Company presentations, conference calls, Innovation Day

With this favorable profile and the company’s goal to become the Intuitive Surgical of endovascular surgery, there are a number of companies that could look to acquire Stereotaxis, but at the top of my list are Philips (PHG), Intuitive Surgical (ISRG) and Johnson & Johnson (JNJ). Philips makes the most sense from my perspective for multiple reasons in addition to those listed in the profile above.

First and foremost, Philips’ transformation to a health-technology company is complete following the sales of its domestic-appliances unit in 2021. As per a Bloomberg research report in August 2021:

“Philips’ transition from a sprawling consumer conglomerate appears complete following the sale of its domestic-appliances unit. The company is now more stable and profitable, and the divestiture should support M&A, with Philips targeting health-related sales of more than 20 billion euros by 2025. Philips’ transformation to a health-technology company brings a more reliable and recurring revenue stream. Over 40% of company sales come from software and services, such as sleep and respiratory monitoring. This, along with savings, innovation, and M&A, may help the company narrow the margin gap with peers such as Siemens Healthineers and that company’s Ebit margin history of 15-16%. Philips targets similar margins by 2025. Diagnosis & Treatment, where the company holds market leadership for image-guided therapy systems, accounts for almost 50% of company sales.”

Second, Philips has recently expressed interest in vascular, peripheral, and neurovascular robotics as evidenced by its ownership stake in Corindus. Prior to the Siemens acquisition, Philips acquired a 12.7% stake in Corindus and in a filing in March 2019 said it may make a proposal to Corindus to provide additional capital and/or strategic commercial collaboration, and it had held periodic talks with them.

Third, Philips has an extensive presence in X-ray as well as image-guided therapy suites and are very familiar with the ‘fixed-install’ sales approach required for Genesis systems. That is positive for obvious reasons, and for one not so obvious reason. The latter is Philips knows very well the logistical challenges with fixed-install sales & the elongated sales cycle that results in, so they should have a keen appreciation of the strategic move by Stereotaxis to create a mobile RMN system.

Fourth, while Stereotaxis’ Model-S imaging system is sold with all Genesis systems and will be sold with all mobile RMN systems, it can also be sold on its own and could fill in well with Philips’ line-up of electrophysiology imaging systems. Additionally, Philips is quite aware of the replacement cycle ahead of Stereotaxis’ >100 system install base given all of them have either a Philips or Siemens imaging system in the room. Therefore, they know that the future replacement revenue opportunity exceeds $100 million, and that does not include any new system sales (as a reminder over 50% of the recent Genesis sales have been to greenfield customers establishing new robotic programs). Importantly, the Model-S Imaging system will also be sold in conjunction with every mobile RMN system and as per Stereotaxis’ management, the launch of the mobile RMN robot opens the door to “hundreds of system sales” annually. Those system sales alone represent a greater than a $100 million revenue opportunity each year, with a significant revenue tailwind from the sale of disposables, including catheters, guidewires, guide catheters, VCAS systems, and more.

Fifth, Philips through its comments and website has taken a leading role in helping clinicians and staff to manage X-ray exposure for their patients, and for themselves. There are very few potential acquisitions as well-suited to drive safety for clinicians, staff, and patients through management of X-ray exposure than Stereotaxis.

With respect to Intuitive Surgical, the continued success and growth at Stereotaxis has a front row seat to capture their attention as Intuitive Surgical’s Executive Vice President and Chief Medical Officer, Dr. Myriam Curet, joined the board of Stereotaxis in July 2021. As mentioned earlier, Dr. Curet stated at the time she joined the board:

“Stereotaxis reminds me in many ways of Intuitive Surgical in our early years. I’m impressed by Stereotaxis’ technology, clinical value and strategy to positively transform endovascular medicine with robotics…”

For obvious reasons, Intuitive can see the value in a robotic platform transforming endovascular surgery in much the same way that they’ve transformed laparoscopic surgery. They too likely have a keen appreciation for the strategic steps Stereotaxis has taken in the past few years. Given their sales model, they may be best positioned to know what having a mobile RMN system along with a portfolio of catheters/guidewires can do in terms of leasing and usage-based system sales, making Stereotaxis much more attractive to them along with most medical device companies.

With respect to Johnson & Johnson, the upcoming launch of Stereotaxis’ proprietary portfolio of catheters makes for an interesting situation from an M&A perspective. Given J&J’s Biosense Webster division has been supplying magnetic catheters to Stereotaxis in exchange for a royalty for quite some time, they know all too well that Stereotaxis has never had complete control over arguably the most important, profitable part of its business…catheters & other disposable devices. That is about to change in the very near future.

The move to design/develop/own a superior magnetic solution is a game-changer that will show the true earnings power of Stereotaxis’ business model. It also makes their current installed base that much more valuable, and the improved performance of the catheter should fuel increased utilization and market share gains. Post the Innovation Day, the disclosure that the upcoming launches of its portfolio of catheters and guidewires along with their announced clinical expansion to 5 new indications increases the total addressable market to greater than $10 billion annually, may have been enough to catch the attention of J&J, especially as J&J is currently supplying catheters to Stereotaxis. Notably that $10 billion does not include the >$20 billion TAM from upfront robot sales via their adoption in endovascular surgery.

Given J&J’s meaningful step further into the world of robotics in February 2019 with its +$3 billion acquisition of Auris Health, they are clearly bullish on the long-term opportunity of robotics. They also know how different Auris’ “push” robotics platform is from Stereotaxis’ “pull” robotics platform, so there is likely room for both within J&J’s robotics portfolio. Whether they look to acquire Stereotaxis outright remains to be seen, but they’ve likely been thinking of that possibility for some time given its Biosense Webster division’s deal with Stereotaxis has a long-standing ‘tell us if you’re in serious talks to sell’ clause.

With respect to other potential acquirers beyond these three, I think it’s important to note that Stereotaxis’ CEO stated everything discussed during its Innovation Day could be characterized as:

- “…advanced, de-risked, and impactful in the short-to-medium term in both its beach-head market of electrophysiology and more broadly across endovascular intervention…”

So, with respect to Stereotaxis’ beach-head market of electrophysiology and cardiac ablation, it’s worth noting Medtronic just acquired Affera on January 10, 2022, for ~$925 million for a company working on cardiac ablation catheters and mapping systems, but with no approved products on the market yet. The deal will be dilutive for the next three years and neutral to Medtronic’s earnings in year four. Medtronic called EP cardiac ablation an “exciting and fast-moving segment of cardiology”. Here is an excerpt from their release:

- “Within the $8 billion worldwide EP ablation market, the prevalence of cardiac arrhythmias is growing rapidly, and the need to provide treatment to the increasing patient population, which encompasses AF, supraventricular tachycardia (NYSE:SVT), and ventricular tachycardia (NYSEARCA:VT), is increasing. AF represents the largest disease segment, with nearly 60 million people affected worldwide. AF is a progressive disease, meaning over time patients can experience more frequent, and longer episodes, and medication as well as catheter ablation can become less effective. Additionally, AF is associated with serious complications including heart failure, stroke, and increased risk of death.”

With respect to Stereotaxis’ beach-head market of electrophysiology and now more broadly endovascular surgery, any well-financed buyer of Stereotaxis could in one step buy:

- A robotic magnetic navigation platform with a significant install base that has shown superior clinical efficacy, safety, and speed, over manual platforms in cardiac ablation, that is now on a path to becoming immensely more valuable with the Genesis system, the mobile RMN system, the portfolio of in-house catheters & guidewires, and the expansion of clinical indications beyond electrophysiology including neurovascular, coronary angioplasty, tumor embolization, peripheral artery disease, and abdominal aortic aneurysm;

- A robotic magnetic navigation platform that has broad regulatory clearance across the vascular system, with unprecedented precision and stability to target the vascular system from head to toe utilizing the safer “pull” approach of magnetism versus the “push” approach of manual and other robotic catheters;

- A robotic medical device company that may be accretive almost immediately as opposed to most robotic acquisitions that have taken years to be accretive. This is because it’s near break-even today with opex of $31.2MM from R&D ($8.7MM), S&M ($10.8MM), and G&A ($11.7MM) over last 12 months. Additionally with a larger balance sheet & sales force, any acquirer could more quickly capitalize on the massive opportunities ahead in endovascular surgery for Stereotaxis; and

- A robotic medical device company that is well positioned to become the Intuitive Surgical of endovascular surgery.

Summary

As stated in the previous SA articles, Stereotaxis’ unique robotic “pull” mechanism of action and the ability of magnetism to precisely steer devices throughout the entire vascular system separates it from all other robotic medical device companies and manual approaches that use a “push” mechanism of action. As such, the company can be worth significantly more from a valuation perspective, especially when taking into consideration the opportunity at hand covered in detail here in this article and the two prior articles.

Looking into the future to see what technology platforms will become standards is not an easy proposition, yet the facts show that Stereotaxis’ robotic magnetic navigation increases patient safety, increases physician safety, is more efficacious than manual platforms, and has improved materially from a procedure time perspective with the most upside on that front ahead of it…those factors certainly increase the odds. As does the leading role it has taken in telerobotics with its platform.

Notwithstanding the fact that investing in micro-caps & small caps carries higher risk, Stereotaxis looks undervalued based on its unique positioning and should continue its move higher as it exhibits high revenue growth & high margins with profitability in sight, leading to greater recognition and appreciation by the street, and potentially larger medical device industry players.

Credit: Source link