Li Auto

Li Auto

LI

$0.96

3%

25%

IBD Stock Analysis

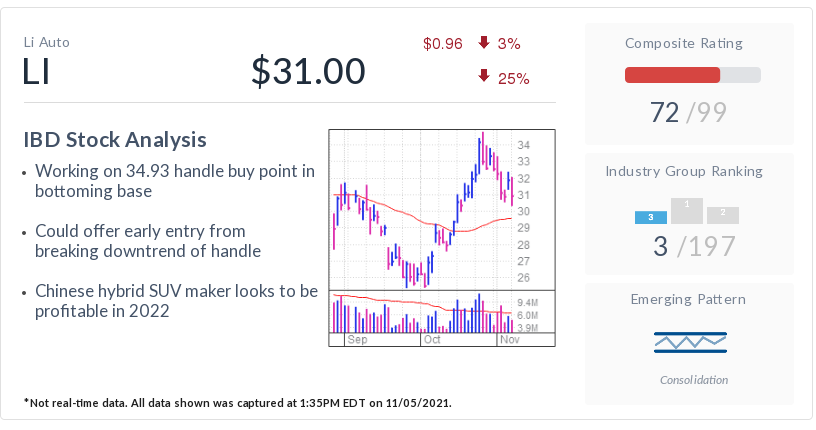

- Working on 34.93 handle buy point in bottoming base

- Could offer early entry from breaking downtrend of handle

- Chinese hybrid SUV maker looks to be profitable in 2022

Industry Group Ranking

Emerging Pattern

Consolidation

* Not real-time data. All data shown was captured at

1:35PM EDT on

11/05/2021.

China-based Li Auto (LI) is the IBD Stock Of The Day, as the EV startup gears up to offer more models. LI stock is closing in on a buy point.

X

Li Auto delivered 7,649 vehicles in October, more than double a year earlier and up slightly from 7,094 in September. Li Auto, like other automakers, has been hampered by chip shortages. Industry watchers, however, say supplies appear to be improving.

China-based rivals Xpeng (XPEV) had strong October deliveries, while Nio (NIO) stumbled. Xpeng delivered 10,138 vehicles in October, notching its second straight month of at least 10,000 deliveries. But Nio reported 3,667 deliveries in October, down 27.5% year over year, as a key production line was shut down for much of the month.

U.S.-based Tesla (TSLA) reported record deliveries in Q3. Tesla deliveries totaled 241,300 electric vehicles for the third quarter, up from 201,250 in Q2 and 184,800 in Q1.

Unlike its peers, Li Auto sells just one vehicle, the hybrid-electric Li One SUV. But more models are on the way.

“Given the proven success of our Li ONE catering to the need of families, we are working to diversify our product portfolio to appeal to an even broader family user base,” co-founder and President Yanan Shen said in an Aug. 30 call with investors. “We have three platforms under development: the X platform for our next-generation EREV with the first model to be released in 2022, and the Whale and the Shark platform for our BEV models to be launched in 2023.”

Li Earnings

Li Auto is not yet profitable. Management reported gross margin reached 18.9% last quarter, up 5.6% year over year. The company beat expectations with a 1-cent-a-share loss in Q2, as sales surged 183% to $780.4 million vs. the year-ago quarter.

Li Auto is expected to report third-quarter earnings in mid-November. FactSet analysts expect Li Auto to narrow its losses to 2 cents a share vs. an 8-cents-a-share loss in the same period last year. Sales are seen swelling nearly 207% to $1.134 billion.

However, investors are betting that Li Auto will be profitable in 2022.

Five Best Chinese Stocks To Watch Now

Li Stock

Shares fell 3% to 31 on the stock market today. LI stock is in a long consolidation with a 34.93 handle buy point, according to MarketSmith. An early entry would be breaking the trend line in the handle. But right now Li Auto stock is heading toward its 50-day line.

Li stock’s relative strength line is trending down. Its RS Rating is 77 out of a possible 99, while its EPS Rating is 32.

Xpeng stock lost 3% to 46.39. It is also near a buy point of 48.08. A better entry might be 49.65, as XPEV shares have hit resistance around 49 several times.

Nio shares sank 1.9% to 42.29. Nio stock moved above its 200-day line on Thursday but pulled back Friday. A move above Thursday’s high of 44 would offer an aggressive entry. If the stock moves higher, it will show a bottoming base with a 55.23 buy point.

And BYD (BYDDF) was down 1.5% to 39.55, still near a record high of 40.79.

Tesla dipped 0.6%, after racing up nearly 10% for the week. And recent SPAC play Lucid (LCID) jumped nearly 13% on Friday.

How To Handle The Market Rally Now; 9 Stocks In Focus

Expansion Plans

Li Auto management said in the last earnings call that the company is accelerating the expansion of its direct sales and servicing network. As of July 31, Li Auto had 109 retail stores. Shen said the company is on track to reach its year-end target of 200 retail stores.

Li Auto is also reportedly considering building an offshore production site in Europe to serve as a steppingstone for its entry into the global market. Meanwhile, Nio launched its ES8 electric SUV in Oslo, Norway, in September.

Follow Adelia Cellini Linecker on Twitter @IBD_Adelia.

YOU MAY ALSO LIKE:

Is Nio Stock A Buy Right Now?

Is Tesla Stock A Buy Right Now?

Why This IBD Tool Simplifies The Search For Top Stocks

Want To Get Quick Profits And Avoid Big Losses? Try SwingTrader

How To Know It’s Time To Sell Your Favorite Stock

Credit: Source link