Investing in the stock market can feel daunting, especially for retail investors without the time or expertise to decode complex financial data or earning reports. That’s where stock prediction platforms come in. These services use advanced algorithms, and big data to analyze and recommend which stocks to buy, sell, or hold.

What Are Stock Prediction Services?

Stock prediction services leverage a mix of tools and data to forecast stock performance, including:

- Smart Algorithms: Advanced models analyze historical data to uncover patterns that drive stock trends.

- Traditional Metrics: Financial indicators like earnings and price-to-earnings ratios ensure predictions are rooted in fundamentals.

- Technical Analysis: Insights from chart patterns and moving averages reveal price trends and market movements.

- Alternative Data: Social media trends, web traffic, employment data, etc offer unique perspectives on a company’s health and potential.

By combining these elements, stock prediction services provide actionable insights. Machine learning models sift through massive datasets to uncover trends that may go unnoticed by human analysts. For example, a surge in Reddit mentions or a spike in web traffic could signal rising interest in a stock, giving investors an edge.

These platforms often feature real-time updates to ensure buy or sell signals and use backtesting to validate predictions. This integration of big data and new AI technology makes them essential for investors aiming to get quick stock ideas and make more informed investments.

With this in mind, let’s explore seven standout stock prediction platforms for 2025, each offering unique features to meet different investment goals and strategies.

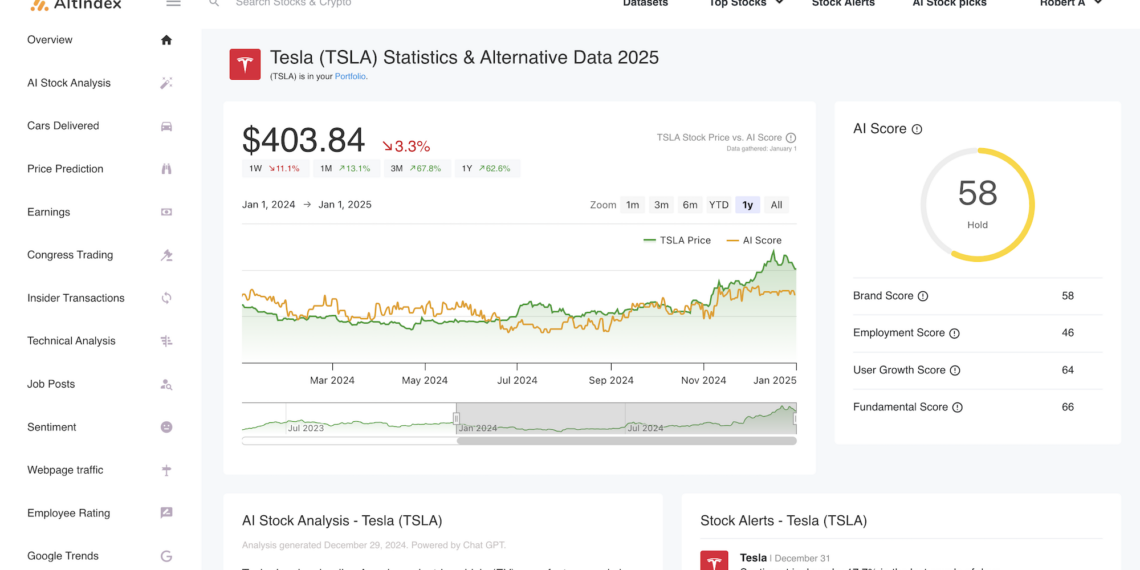

1. AltIndex

AltIndex stands out as a top contender in the stock prediction market, leveraging alternative data and AI-driven insights to empower retail investors. By combining non-traditional data with tools like stock alerts, screeners, and curated top lists, AltIndex offers actionable insights for smarter investment decisions.

- Pricing: Subscriptions start at $29/month.

- Target Market: Retail and institutional investors.

- What Makes It Unique? AltIndex shines by aggregating alternative data, such as web traffic, employee sentiment, and social media trends. Its AI Score provides a concise rating of a company’s health, performance, and growth potential, making it easier to understand and predict stock performance.

- Key Features: Investors gain access to detailed stock reports blending fundamental analysis, technical insights, and alternative data. Other highlights include stock alerts and top-performing stock lists.

Why Choose AltIndex?

AltIndex excels at using alternative data to uncover trends that traditional metrics might miss. What also sets it apart is its transparency – users can see the results of its predictions, making it easier to trust the insights. Combined with a simple and intuitive design, AltIndex is a powerful tool for both new and experienced investors.

An AltIndex Stock dashboard highlighting an AI score, a multitude of insights, AI stock analysis and alerts.

2. Trade Ideas

Trade Ideas is a comprehensive platform offering real-time stock scanning, AI-driven trade recommendations, and automated trading features, designed to enhance the efficiency and effectiveness of active traders.

- Pricing: Standard Plan starts at $89/month

- Target Market: Active day traders and swing traders seeking advanced tools for real-time market analysis.

- Unique Features: Trade Ideas utilizes AI to analyze market data and generate high-probability trade suggestions. The platform offers real-time scanning capabilities, customizable alerts, and automated trading options, setting it apart from traditional stock scanners.

- Features Provided: Real-time stock scanning with customizable filters, AI-generated trade recommendations, backtesting tools for strategy development, and live trading rooms.

Why Choose Trade Ideas?

Trade Ideas stands out for its AI-driven approach, providing traders with actionable insights and the ability to automate strategies. Its real-time data analysis and customizable scanning tools enable traders to identify opportunities swiftly, making it a valuable asset for those aiming to enhance their trading performance. However, the platform’s advanced features and pricing may be more suitable for experienced traders committed to active trading.

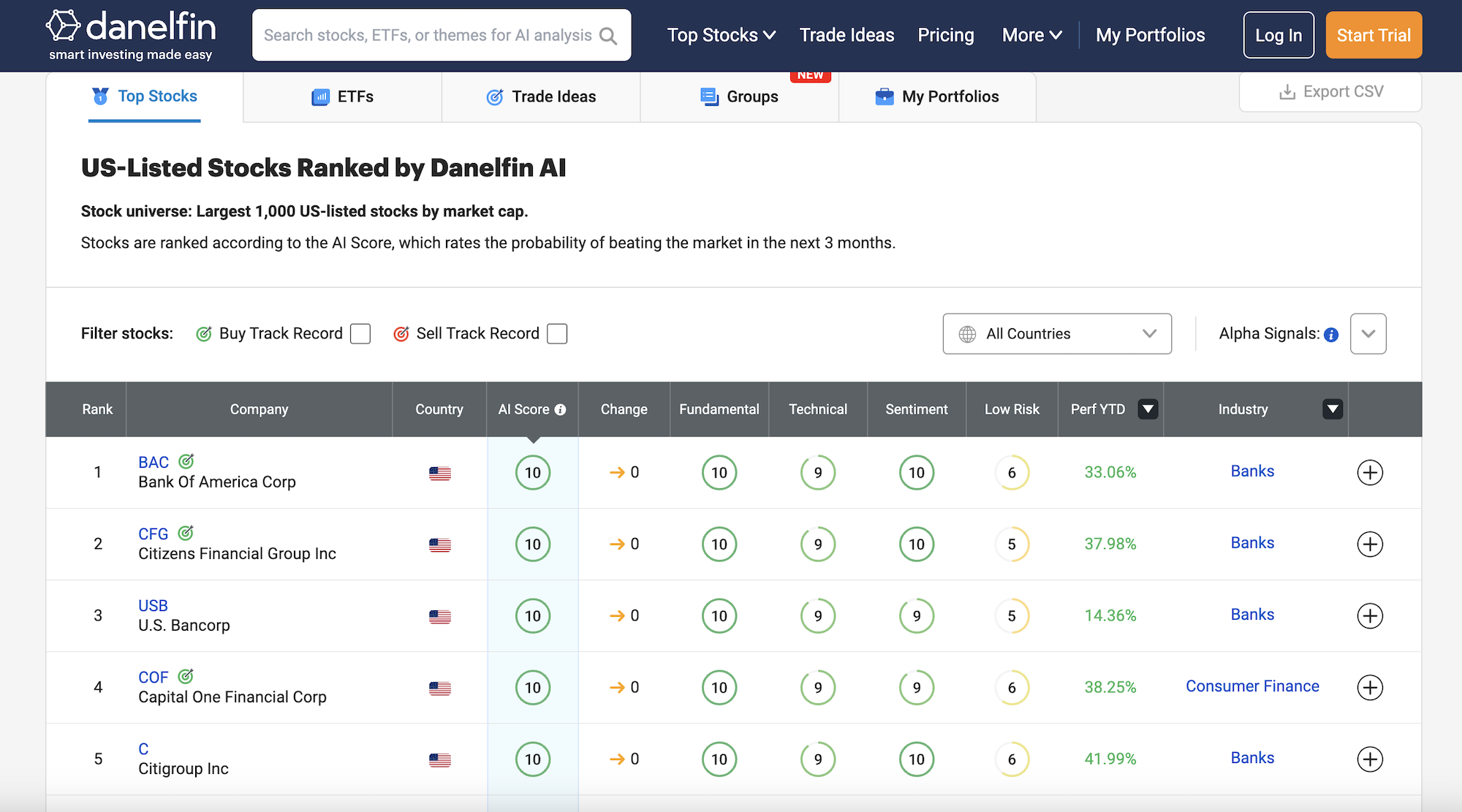

3. DanelFin

DanelFin uses advanced AI to analyze thousands of data points per stock daily, providing investors with clear insights and actionable predictions to improve portfolio performance.

- Pricing: Starts at $25/month for the Plus Plan; Pro Plan available at $70/month or with discounted annual subscriptions.

- Target Market: Individual investors, portfolio managers, and traders.

- What Makes It Unique? DanelFin combines AI and technical analysis to generate highly detailed stock forecasts and trade ideas.

- Key Features: Advanced technical analysis, trade ideas, portfolio optimization, and AI-driven predictions.

Why Choose DanelFin?

DanelFin’s AI tools and clear performance tracking make it a reliable choice for investors looking to optimize their strategies. Its transparency and detailed forecasts provide actionable insights, empowering users to stay ahead in the market.

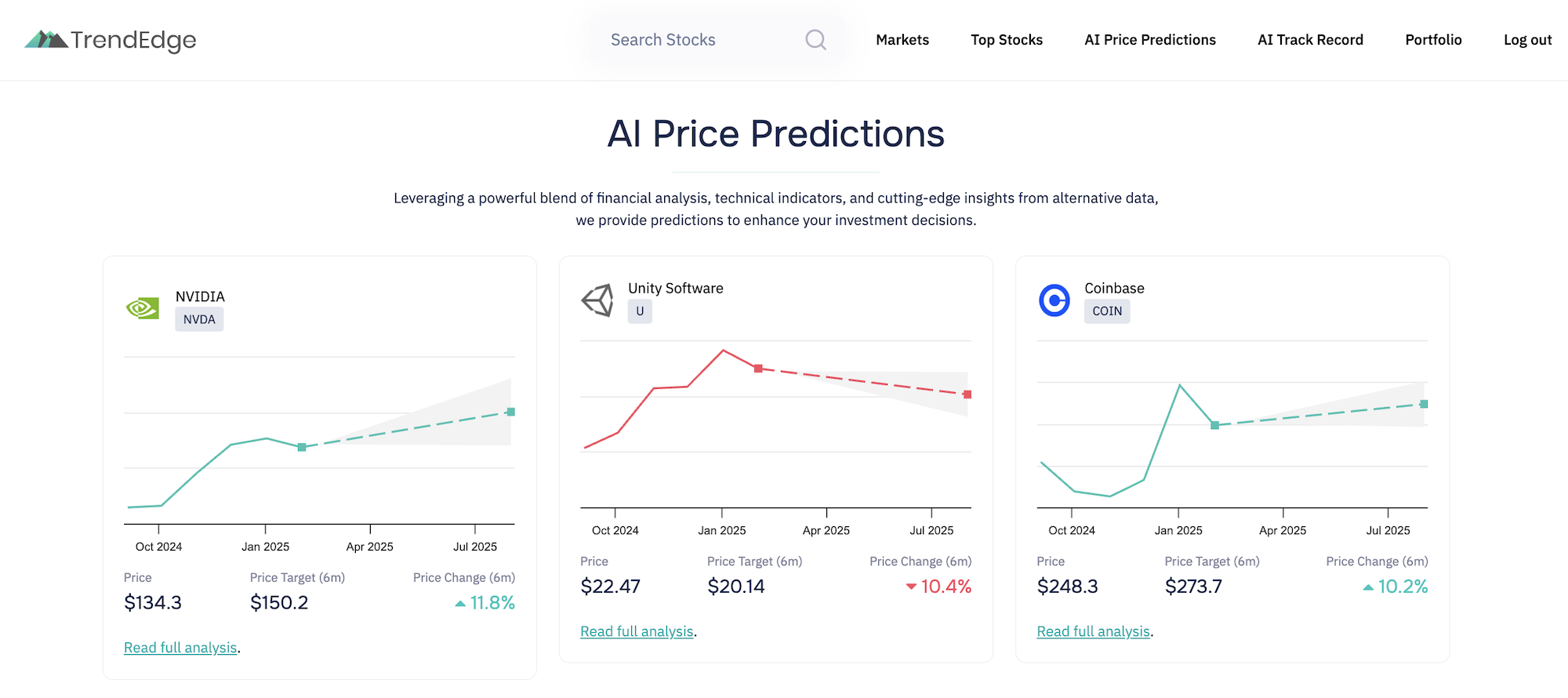

4. TrendEdge

TrendEdge integrates alternative data with traditional metrics to help investors uncover new stock ideas, top stocks, and opportunities.

- Pricing: Premium plans start at $39/month.

- Target Market: Retail investors and hedge funds.

- What Makes It Unique? TrendEdge covers over 6,000 stocks globally and offers alternative data insights and AI-driven scoring for every stock.

- Key Features: AI stock price predictions, stock scoring, top stocks, and data-rich dashboards.

Why Choose TrendEdge?

TrendEdge combines alternative data with AI to provide rich dashboards and AI stock reports. Its global stock coverage, AI-driven predictions, and easy-to-use dashboards make it an essential tool for investors seeking quick stock ideas.

TrendEdge provides AI Price Predictions on thousands of stocks.

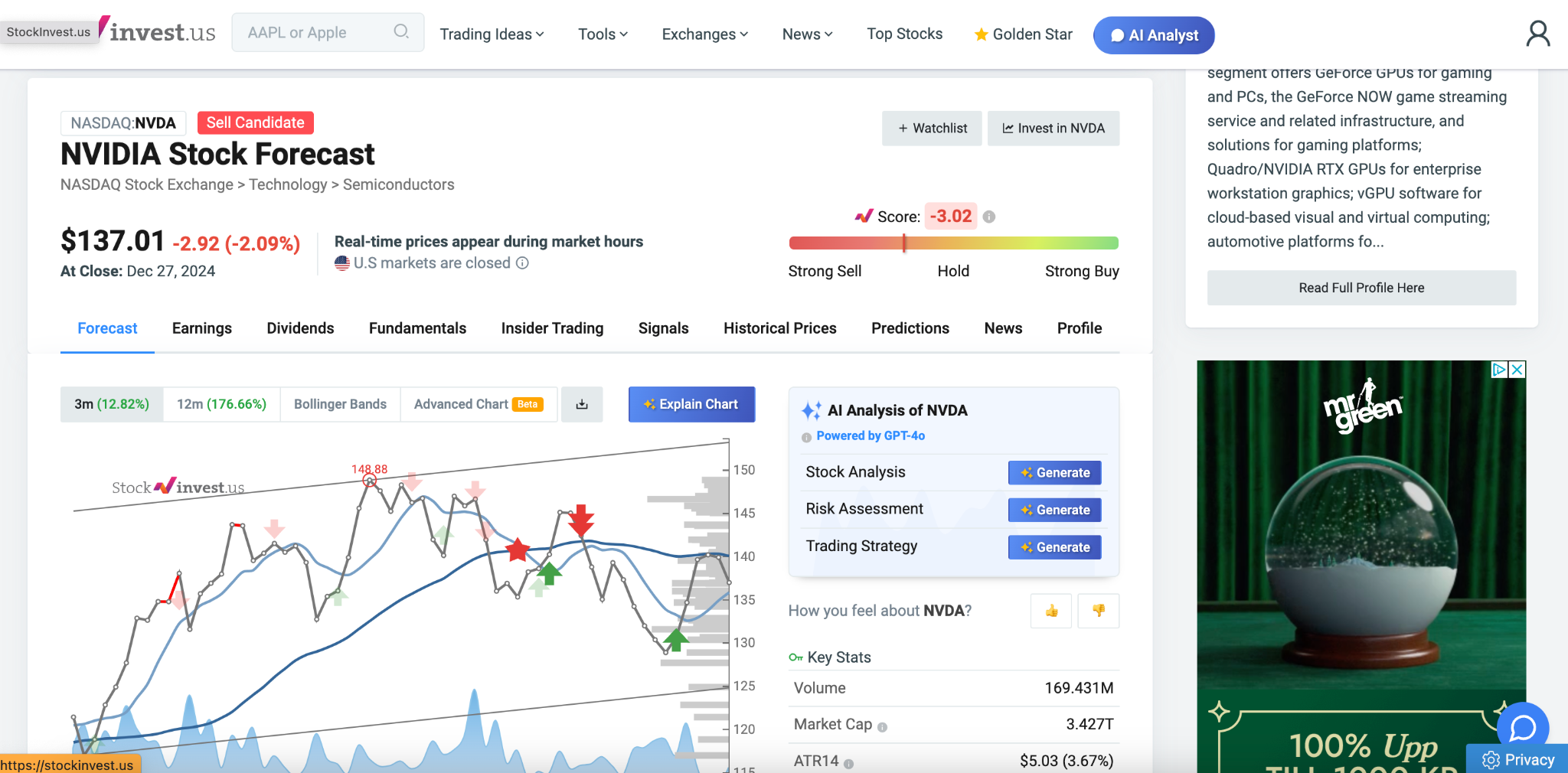

5. StockInvest

StockInvest.us caters to beginner and intermediate traders with a focus on swing trading and short-term technical analysis.

- Pricing: Plans start at $29.95/month.

- Target Market: Beginner and intermediate traders.

- What Makes It Unique? StockInvest provides detailed technical analysis, including trend lines, candlestick patterns, and daily updates.

- Key Features: Technical charts, daily stock updates, stock screeners, heat maps, and price prediction tools.

Why Choose StockInvest?

StockInvest is perfect for traders focusing on short-term strategies. Its user-friendly design, detailed technical indicators, and curated tools make it a time-saver for those honing their trading skills. However, there’s a lot of information to digest and the ads on the webpage can feel a bit intrusive.

StockInvest focuses on providing a deep technical analysis for all stocks along with sell, hold or buy recommendations.

6. Motley Fool Stock Advisor

Motley Fool’s Stock Advisor is a subscription service offering monthly stock recommendations aimed at long-term growth. Since its inception in 2002, the service has achieved an average return of 938%, significantly outperforming the S&P 500’s 178% over the same period.

- Pricing: $199/year, with a discounted rate of $99 for new members in the first year.

- Target Market: Long-term, buy-and-hold investors seeking expert stock recommendations.

- What Makes It Unique? Subscribers receive two new stock picks each month, selected by Motley Fool. The service emphasizes companies with strong growth potential and provides in-depth analyses to support each recommendation.

- Key Features: Monthly stock recommendations, access to a library of past stock picks and a lot of educational content.

Why Choose Motley Fool Stock Advisor?

Stock Advisor’s impressive track record and straightforward approach make it a valuable resource for investors seeking to build a market-beating portfolio over time. The service’s focus on long-term growth and its educational resources cater to both novice and experienced investors looking to make informed decisions without the need for complex analysis.

7. Alpha Picks by Seeking Alpha

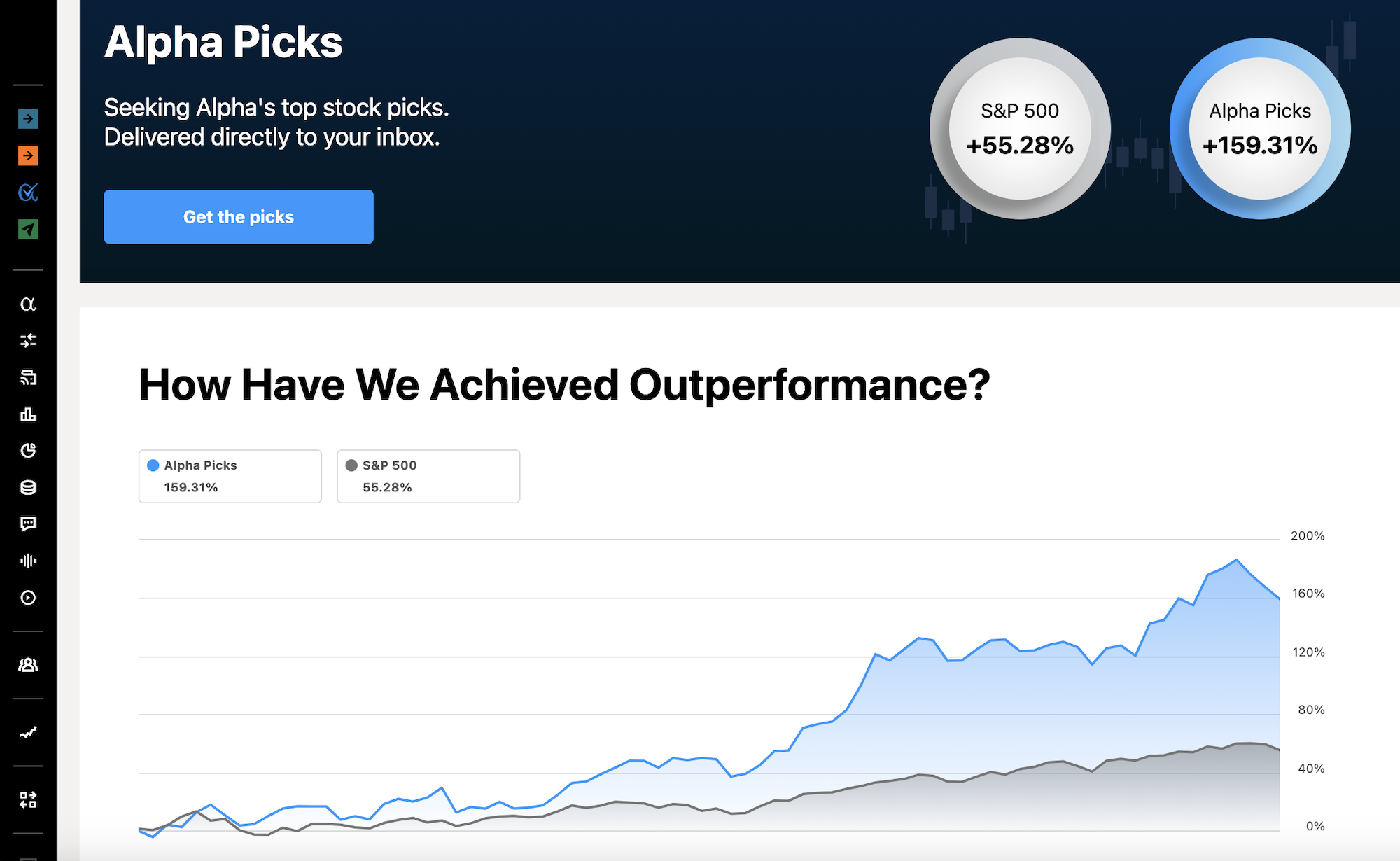

Alpha Picks, by Seeking Alpha, delivers strong results with a total return of 184.4% since July 2022, far outpacing the S&P 500’s 59.7% return in the same period.

- Pricing: $499/year.

- Target Market: Long-term, buy-and-hold investors.

- What Makes It Unique? Each month, the service provides two stock recommendations based on a proprietary system that evaluates growth, valuation, momentum, and profit potential.

- Key Features: Value-driven stock picks, in-depth analysis, professional recommendations, and a focus on long-term growth.

Why Choose Alpha Picks?

Alpha Picks is ideal for investors seeking reliable, data-backed recommendations without delving into complex technical or alternative data. Its long-term focus and strong performance make it a great fit for building market-beating portfolios.

Alpha Picks boosts an impressive win rate compared to the S&P 500.

Choosing the Best Stock Prediction Service For You

Selecting the best stock prediction service for you depends on your goals, preferences, and budget. Keep these factors in mind:

- Investment Style: Whether you’re a day trader, swing trader, or long-term investor, pick a service that aligns with your strategy. Day traders may prioritize real-time data and technical analysis, while long-term investors might value fundamental insights and stock scoring.

- Budget: Decide how much you’re willing to invest in a service. Free or affordable options may work for beginners, while active traders might find advanced, feature-rich platforms worth the extra cost. Try to find free trials before signing up and paying a premium.

- Data Transparency: Opt for services that clearly explain their predictions and provide access to the underlying data or performance history. Transparency builds trust and allows you to evaluate the reliability of the tools.

- Ease of Use: Choose a platform with an intuitive design and accessible support. Whether you’re a beginner or an experienced investor, ease of navigation and helpful resources can save time and reduce frustration.

By considering these factors, you will find a stock prediction service that meets your needs and enhances your investment journey.

A Word of Caution: Think Beyond Predictions

Stock prediction services can be valuable tools, but no platform can or should guarantee flawless accuracy. Markets are complex and influenced by unpredictable factors like geopolitical events, regulatory changes, or sudden shifts in investor sentiment. Even the most advanced algorithms can misinterpret data or overlook unforeseen developments.

To use these tools effectively, always complement their insights with your own research. Choose services that prioritize transparency, offering clear explanations of their predictions and the data behind them. Understanding how a platform generates its recommendations empowers you to make better-informed decisions.

Remember, stock prediction services are most effective when integrated into a broader investment strategy, not as the sole basis for your actions. Diversify your information sources and apply critical thinking to maximize your investment success.

Conclusion

Stock prediction services are powerful tools for navigating the complexities of the market, offering insights that can help investors make smarter, more confident decisions. Whether you’re a day trader, swing trader, or long-term investor, choosing the right platform depends on your unique goals, risk appetite and priorities.

Each service brings distinct advantages, from AI-driven insights and alternative data to real-time updates and transparent predictions. By evaluating what matters most to you, such as pricing, features, and ease of use, you can select a stock prediction service that enhances your investment strategy and positions you for success in 2025 and beyond.

While no tool guarantees success, combining a trusted stock prediction service with your research and strategy can greatly increase your chances of achieving your financial goals.