By: Medha Agarwal and Emily Man

Financial services are — once again — being totally reimagined, this time to meet end-users at the point of need. Early fintech innovation helped reduce the time and effort associated with accessing financial services: digitization and automation made it possible to pay bills, make investments, and send money internationally, all from a smartphone.

This first wave of successful fintechs focused on unbundling the bank — rebuilding single product lines unencumbered by legacy systems and technology. But with the exception of no physical branches, distribution and customer acquisition strategies largely remained the same. Until recently, the consumer has had to actively seek out these services when a need arises and to select one from a sea of similar seeming options. As a result, hundreds of millions of venture dollars have gone towards advertising and customer acquisition.

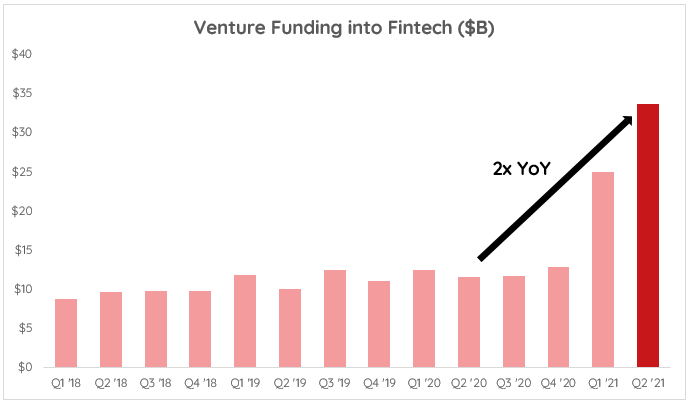

At the same time, infrastructure players like Stripe and Plaid have taken the keys away from bankers and “relationship managers” and put it in the hands of developers. These players are enabling new types of experiences to be built while abstracting away the complexities of the underlying financial system. Fintech is clearly here to stay and the banks are scared sh — less. And this innovation is clearly just getting started:

Source: CB Insights

Enter embedded fintech, which promises to do away with active discovery. By integrating financial products tailored to the needs of specific sets of users within platforms where they already are, it’s possible to offer tailored suites of products magically, at the point of need, with zero friction to adopt.

This new wave will leverage contextual data and signals to offer relevant financial products in a thoughtful, targeted way — creating a seamless experience for users to adopt them within platforms they are already using.

We’ve seen the term “embedded fintech” used broadly across different contexts — from TikTok creating a fund for creators to Ikea buying a bank to Google’s now-abandoned plans to offer checking accounts. So much so that we’re starting to hear the same question from operators and entrepreneurs: What does “embedded fintech” really even mean?

In this series we will outline the promise of embedded fintech across not only the “what” and “why” but also the “how.”

The “What”: So what does “embedded fintech” really mean?

In our view, an embedded fintech product has 3 key characteristics:

- The base platform is not a fintech company — an embedded fintech offering sits within a platform that did not start as a fintech nor does it look like one at the surface. Most frequently, these are marketplaces (e.g., Uber) or vertical SaaS solutions (e.g., Shopify).

- Native UX/UI — the entire user experience resides within the platform itself and does not kick out to a different provider at the point of application. If done right, financial products should be surfaced at the point of need with no discontinuity in the customer journey. This would exclude solutions such as affiliate marketplaces and traditional BNPL experiences.

- Leverages contextual data — appropriate offers are provided that already have the context of who, what, when, why, and how much. No additional application flow, no generic offers & rates, no rejections. These should be low friction experiences that leverage information that the platform already has, streamlining or even eliminating a more traditional sign up, application, or underwriting flow.

For example, Anvyl’s core business helps supply chain teams streamline work by providing a platform for collaboration with a brand’s suppliers. Anvyl can embed a trade financing offering allowing brands to pay suppliers with a click of a button. As purchase orders are accepted, the platform would automatically spread the cost of the transaction over 90 days instead of requiring payment upfront. The brands would be instantly prequalified based on their payment history and scale — characteristics that Anvyl is uniquely able to assess proactively given the data that already exists within its platform. Today, to do this sort of financing through a third-party requires a hefty manual application and at least a dozen steps to remit payment across multiple platforms.

Another example is what Shopify has done to allow brands to receive payments, financing, and logistics support seamlessly within the core platform. Shopify originally started as an e-commerce platform that enabled merchants to create online storefronts. Checkout and payments capabilities were clear areas to expand to. Having this rich transaction data gives Shopify a deep understanding of a merchant’s financial health. This enables them to seamlessly offer inventory and credit financing based on historical sales and collect repayments off of incoming transactions — none of which a traditional lender could do.

The “Why”: Why should platforms care?

If done right, embedded fintech can be highly accretive to a platform’s core offering for a couple reasons:

- Improvements in customer retention and LTV: By layering in financial service products, platforms can drive up customer lifetime value (LTV) significantly. Revenue from financial services products improves per customer monetization while reducing churn. Introduction in an existing offering can impact each component of LTV — revenue, retention and engagement — in a meaningful way.

- High attach rates without incremental customer acquisition costs (CAC): Platforms can introduce the appropriate services to an existing user base natively. Because this happens at the point of need, conversion and attach rates on the upsell are stronger and there are no additional associated acquisition costs.

- Strong economics and pricing flexibility: Unit economics on an embedded financial offering can be stronger than that of a standalone solution. Access to rich data improves underwriting quality leading to lower losses. Native distribution and a captive base means users aren’t shopping for the best offer — giving platforms the ability to charge a “convenience” premium. While ultimately, each platform can determine how to price based on individual business goals, the “embedded” nature allows for more flexibility.

While we believe that embedded fintech is here to stay, it can be easy to get out over one’s skis because of balance sheet requirements, investments in team & product, and time allocation. Being thoughtful and measured in scoping out requirements and figuring out when and how to add these offerings is key.

We hope this series helps founders and builders looking to explore an embedded fintech opportunity. Future posts will explore:

- The types of businesses that are good candidates for embedded finance

- The types of financial services that can and should be embedded and what the tradeoffs are to implement them

- The infrastructure-as-a-service companies that help offer embedded fintech capabilities, and the right framework for evaluating a partner

- The considerations in the build vs buy decision and how to get started

If you have any feedback, questions, or additional things you’d like to see us cover, drop us a line below.

Credit: Source link