Welcome to Startups Weekly, a fresh human-first take on this week’s startup news and trends. To get this in your inbox, subscribe here.

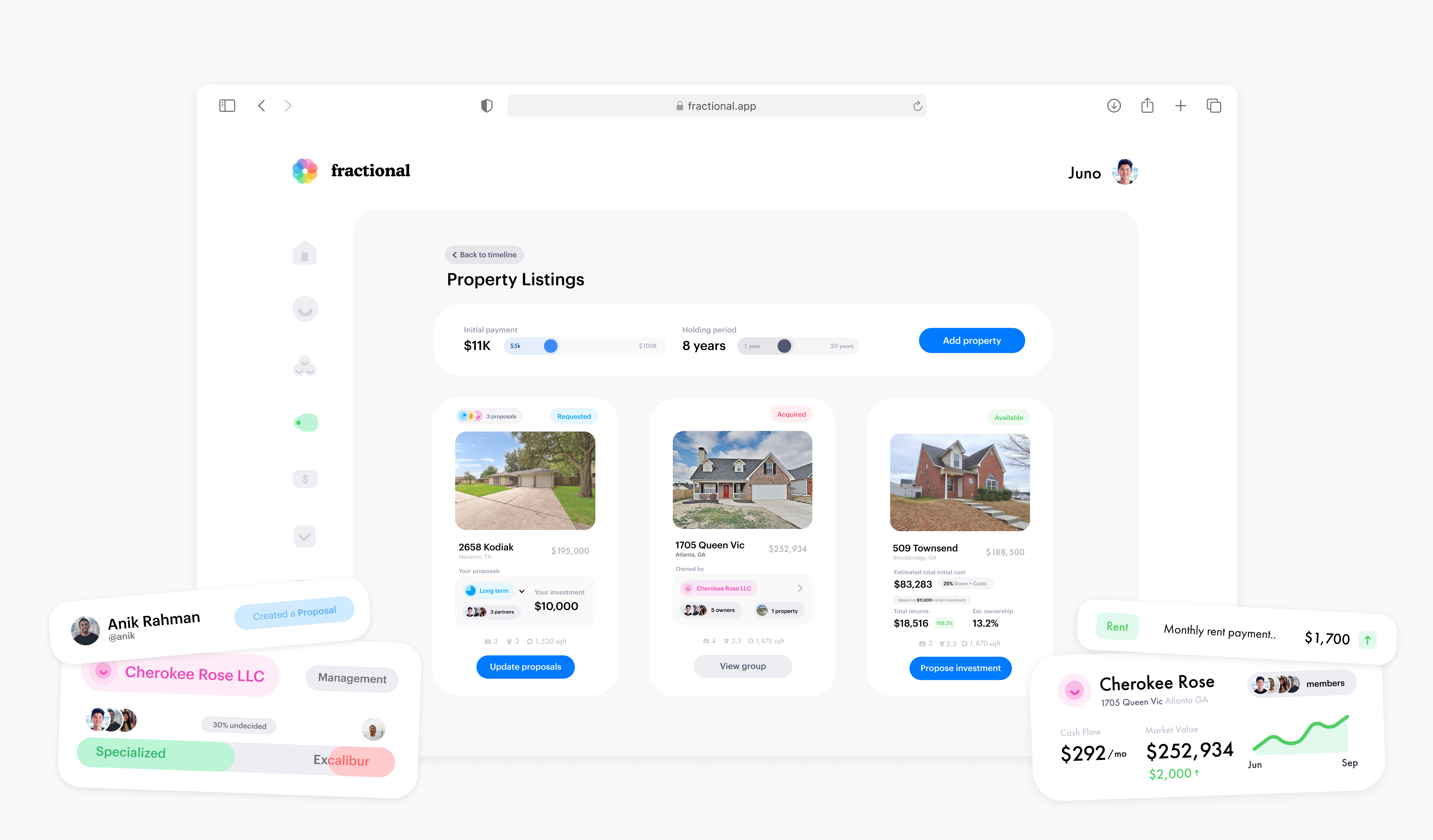

This past week, I wrote about the launch of Fractional, a startup that wants to make it easier for friends (and strangers) to co-own real estate together. The co-founders, Stella Han and Carlos Treviño, bonded over their shared background of growing up in real estate families while working at Affirm, the buy now, pay later giant. However, the mission of “pay at your own pace” at Affirm clashed with the duo’s firsthand experience of the taxing time commitment and high costs that come with owning real estate; a contrast that eventually seeded the idea for Fractional.

I get more into the specifics of Fractional’s product and its recent fundraise in my story, but today I want to focus on a bit of my interview with Han, the co-founder, that has stuck with me. During our phone call, we chatted about how the future of alternative investing is built on on-ramping folks into a long-exclusionary asset class; we’re seeing it with private equity, art ownership and, now, real estate. While lowering the check size for entry matters — it’s one of Fractional’s hooks — so does the social aspect. Can you meaningfully educate a cohort of people to understand the value that they’re going to get from putting money into a home versus an index fund? Can you “disrupt” hesitation to get into business with friends? Can you plan for the unplanned twists and turns of life and someone in your investment group wanting liquidation sooner rather than later? These questions are all far more interesting, and thorny, than the logistical argument of making home ownership accessible. Fractional, I hope, will make it collaborative as well.

The way that Fractional has been preparing for the unexpected, so far, looks like some classic curation. Han explained that they’re building investment communities around specific properties, with the goal of putting together like-minded folks. “It doesn’t make sense for someone who’s thinking about flipping a property in a year versus someone who wants to hold for like five years,” she said. By eliminating major core differences upfront, and then getting lawyers involved, the startup is beginning to pacify early concerns. Still, the startup’s heaviest lift — like any business promising to bring access to a new asset — will be governance and transparently establishing expectations.

Fractions aren’t enough of an answer when trying to resolve divisions, and that’s a lesson for both startups and the pumpkin pie lovers among us. In the rest of this newsletter, we’ll tease some gift guides, and, um, estate management. As always, you can follow me on Twitter @nmasc_ or on Instagram @natashathereporter.

Image Credits: Fractional

Tools to enhance your work-from-home setup, or just your home

TechCrunch Gift Guide 2021.

TechCrunch is beginning to roll out our annual gift guides! For those who are new, we have a tradition of publishing niche-yet-nerdy wish lists every year to help gift-givers make decisions. It can range from gadgets to upgrade your work-from-home setup, or gifts to make you less lonely.

Here’s what to know: So far, we’ve published gift guides for the work-from-home office, the video call setup and the cohort of homeowners who want to upgrade their home into a smart home. Oh, and we also published a wishlist for plant lovers and for kids who love STEM toys. Can you tell that we’ve all been inside for way too long?

Speaking of hardware:

- Subscribe to Actuator, Brian Heater’s soon-to-be-launched newsletter about robotics by the week.

- For my gift guide, I need you to DM me who your favorite solo-entrepreneur is (I know, mysterious, but how else do we build up suspense‽)

And the startup of the week is…

Image Credits: New Culture

New Culture! Anyone who listens to the podcast knows that I absolutely love a cheesy startup, both figuratively and literally. This week, New Culture raised $25 million in seed funding to commercialize its cheesy vegan mozzarella. Maybe it’ll get to grocery stores soon enough!

Here’s what to know: The alternative cheese manufacturer claims that it’s far better for the environment than dairy-based cheese, which can require 56 gallons of water just to produce one ounce. New Culture also touted progress when it comes to land use.

Honorable mentions:

Not to be bleak but…

Image Credits: RiverNorthPhotography / Getty Images

Let’s talk about estate planning (partially because the topic is core to the latest season of “Insecure,” and partially because it feels like one of those parts of life no one, understandably, wants to plan for). In a column for TechCrunch+, Gentreo CEO and founder Renee Fry gave founders some basic estate planning tips, both for high-net-worth individuals and simple startup owners.

Here’s what to know: Fry argues that estate plans should constantly be adjusted throughout a person’s life, especially if they’re in charge of a thriving business. The fluidity of a business’ success is exciting in real time but could bring challenges when it comes to succession planning.

You must decide whom you trust to take over your company if something happens to you. It is not just about having an estate plan that expresses your wishes — it’s almost equally important to communicate it with a written succession plan. — Renee Fry

And, there’s always a succession angle:

Around TC

Give our newest TechCrunch Podcast, Found, a listen. Co-hosted by Darrell Etherington and Jordan Crook, Found is about how founders do what they do, twists and turns preferred.

Across the week

Seen on TechCrunch

Tidal is investing in direct artist payments, a step toward fair streaming payouts

Paytm’s rocky debut gets rockier

Small creators are big business

Klarna offers ‘Pay Now’ option in US, Klarna Card coming soon

Seaya Ventures, Cathay Innovation launch $125M fund for LatAm startups

Seen on TechCrunch+

$10B is the new $1B, and we need a new framework for startup valuations

Binance CEO Changpeng Zhao talks regulation and platform’s activities in Africa

In Amazon scuffle, Visa’s loss could be Affirm’s gain

Growth marketing experts survey: How would you spend a $25,000 budget in Q1 2022?

5 must-have board slides for SaaS sales and revenue leaders

— N

Credit: Source link