European fintech has had an unprecedented year.

It’s welcomed dozens of new unicorns, a wave of IPOs and mammoth funding rounds for early giants like Revolut and Klarna.

2021 has also welcomed several newcomers onto the scene, while others have become serious contenders for the first time. Notably, these startups have raised wads of capital to build the teams of the future — and they’re growing fast.

Using data from LinkedIn and Dealroom, we have shortlisted the fastest-hiring fintechs this year (up to December 7). To avoid the results being skewed by tiny teams with significant hires, we’ve focused exclusively on post-seed fintechs who have raised over €50m in total. All the data presented below has been confirmed the companies featured to guarantee accuracy.

These are the 14 European fintechs who have grown their teams most aggressively over the last 12 months.

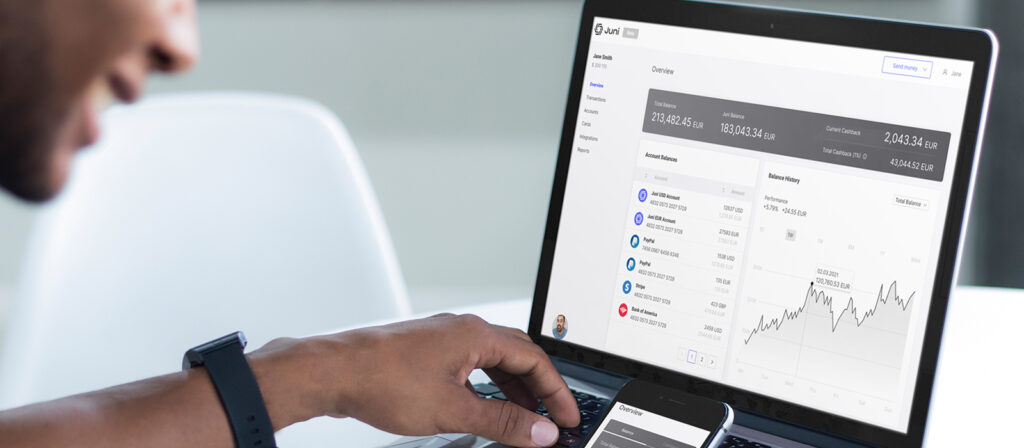

1/ Juni

Juni is the neobank built for ecommerce merchants, hoping to be their financial companion. The startup has quickly expanded into the Netherlands and the UK, which is its biggest market, offering a suite of products from lending to return-on-investment tracking features.

Founded: 2020

HQ: Gothenburg

Team growth this year: 644% (from 9 to 67 employees)

Total funding: $76m

2/ Uncapped

Uncapped plays in the revenue-based financing space, up against ever-more newcomers like Capchase and Pipe. The company offers e-commerce startups who are generating regular income an alternative to VC funding, in the form of specialist loans up to £2m.

Founded: 2019

HQ: London

Team growth this year: 554% (11 to 72 employees)

Total funding: $117m (including debt)

3/ Wayflyer

Similar to Uncapped, Wayflyer also offers loans to eCommerce companies, providing a range of financing and analytics solutions that help improve cash flow. The startup is now active across Europe, aiming to deploy over $100m in Spain and Holland in 2022.

Founded: 2019

HQ: Dublin

Team growth this year: 485% (39 to 228 employees)

Total funding: $76m

4/ Zilch

Zilch has launched what it dubs “an American Express for millennials and Gen Z”, offering a card with a personalised credit line which is then paid back in instalments. The company, which has a consumer credit license from the UK regulator, hit 1.2m downloads last month, after announcing it had secured a $2bn+ valuation.

Founded: 2018

HQ: London

Team growth this year: 453% (38 to 210)

Total funding: $400m (including debt)

5/ Copper

Copper is a London-based startup focused on helping big investors store and manage their cryptocurrency investments. The plan is to be the custodian and regulatory bastion for banks and other large institutions, when they start offering crypto.

Founded: 2018

HQ: London

Team growth this year: 350% (~40 to 180+)

Total funding: $84.3m (next round set to close imminently!)

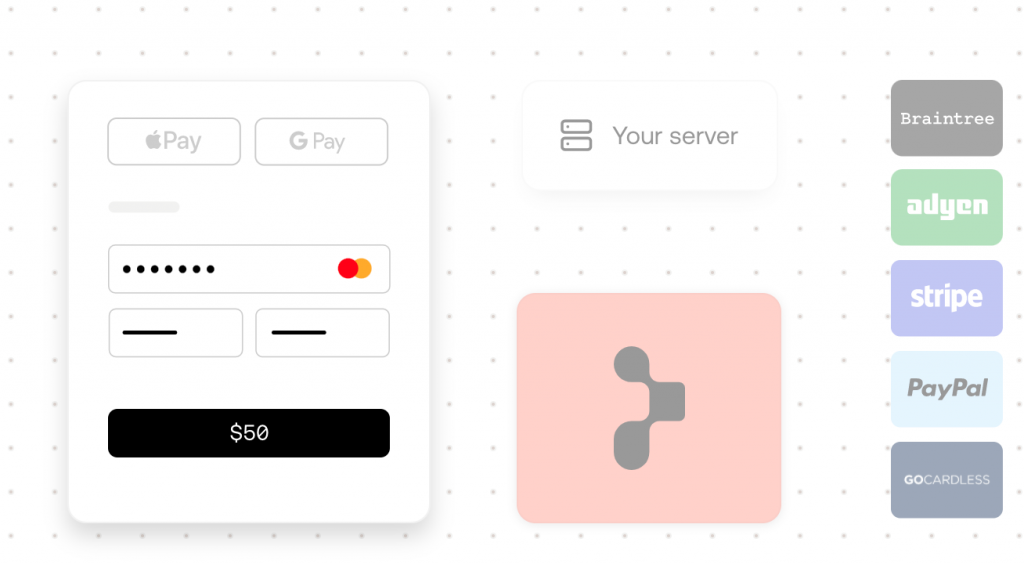

6/ Primer

Primer is a no-code payments integration. It allows merchants to easily aggregate various payment providers, avoiding reliance on a single tool or having to clumsily manage multiple providers at once.

Founded: 2020

HQ: London

Team growth this year: 329% (24 to 103)

Total funding: $73.4m

7/ Alma

Alma is France’s leading Buy Now Pay Later player. Led by Louis Chatriot — a second-time founder — Alma boasts a unique credit scoring system, providing instant lending decisions to shoppers.

Founded: 2018

HQ: Paris

Team growth this year: 311%

Total funding: €65m

8/ Scalapay

Scalapay has positioned itself as yet another Klarna rival, playing in the red-hot Buy Now Pay Later space. The startup went live in summer 2019 and, within months, had convinced over 1k merchants across France, Italy, and Germany to sign up. It is led by 32-year-old Simone Mancini.

Founded: 2019

HQ: Dublin (operational in France and Italy)

Team growth this year: 250% (40 to 140)

Funding: €170m (including debt)

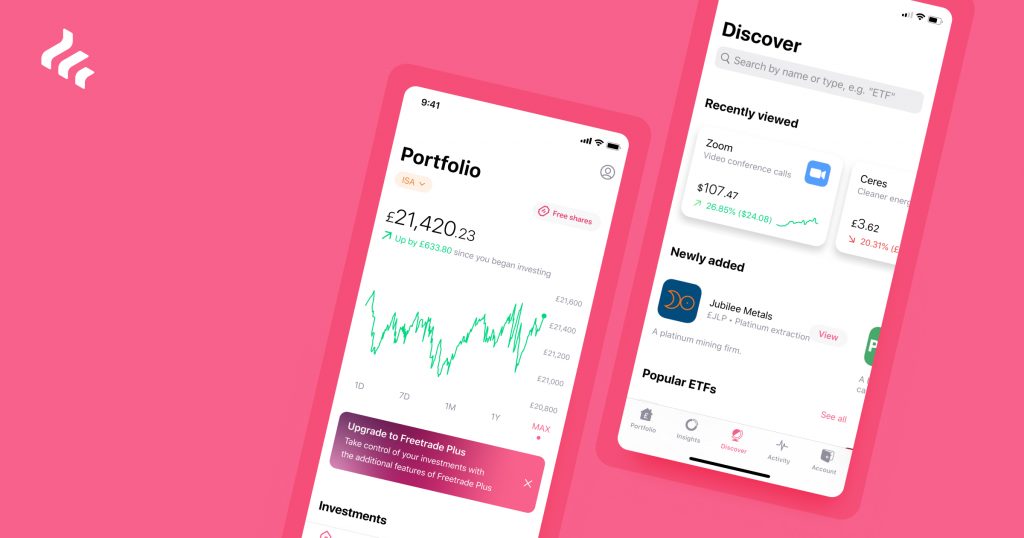

9/ Freetrade

Freetrade is one the UK’s top neobrokers. It allows users to buy UK stocks for free, as well as offering cheap access to overseas stocks. The startup recently hit 1m users.

Founded: 2016

HQ: London

Team growth this year: 212% (80 to 250)

Total funding: $88.7m

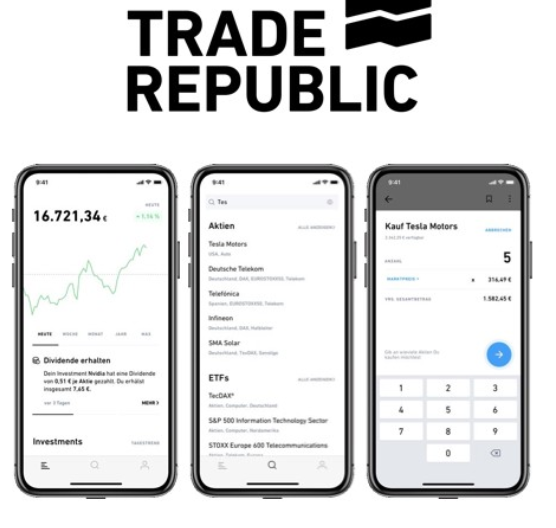

10/ Trade Republic

Trade Republic is Europe’s largest commission-free, stock-trading app — similar to Freetrade and the US’s Robinhood. Backed by Accel, Creandum, and Sequoia, the company now employs more than 600 people. It serves over 1m customers across Germany, Austria and Switzerland.

Founded: 2015

HQ: Berlin

Team growth: 200% (from 200 to 600+)

Funding: $995.5m

11/ Payhawk

Payhawk is an accounting tool for businesses, offering a single place to manage everything from company cards to expenses to bills and invoices. The startup claims it can save companies huge amounts of manual work and potential errors. The startup currently works with companies across 27 countries.

Founded: 2018

HQ: London / Sofia

Team growth: 160% (25 to 65)

Total funding: $136.5m

12/ Zego

Zego offers tailored insurance to London gig workers. The company hit a $1bn+ valuation earlier this year.

Founded: 2016

HQ: London

Team growth: 143% (217 to 529)

Funding: $200m+

13/ yulife

YuLife sells directly to employers, offering perk packages to their staff. It focuses on insurance and financial products.

Founded: 2016

HQ: London

Team growth: 137% (59 to 140)

Total funding: $86.6m

14/ PrimaryBid

PrimaryBid is a platform that allows private individuals to take part in capital raises on the public markets. They recently partnered with Deliveroo, to allow their customers early access to their (somewhat anti-climatic) IPO.

Founded: 2016

HQ: London

Team growth: 112% (51 to 108)

Funding: $59m

***

Other notable fast-growing fintechs:

Which fintechs do you think are set to have a promising 2022? Drop a message to [email protected]

*To check out the fastest growing fintechs by revenue rather than team size, check out the Financial Times ranking.

Credit: Source link