All About AI, a leading platform for artificial intelligence news and insights, has released a comprehensive report on how artificial intelligence (AI) is revolutionizing stock trading and market forecasting. Titled “How AI is Disrupting Stock Trading and Market Forecasting,” the report delves into the transformational impact of AI on the financial industry.

With the exponential growth of AI technologies, financial institutions and individual traders are leveraging sophisticated algorithms and machine learning models to predict market trends, automate trades, and reduce human error. The report highlights key areas where AI is creating significant shifts in stock market operations.

Artificial intelligence (AI) is changing the way people trade stocks. By using AI, investors can analyze data faster and make better trading decisions. This technology helps create efficient strategies and improve market predictions. As discussed on AllAboutAI.com, a leading AI resource, AI-powered trading tools can execute trades up to 10 times faster than manual methods, and the accuracy of AI-driven trading can increase by up to 20%.

To stay ahead in understanding the impact of AI on finance, explore the in-depth insights and tools available to help traders make smarter decisions.

AI’s Role in Stock Trading

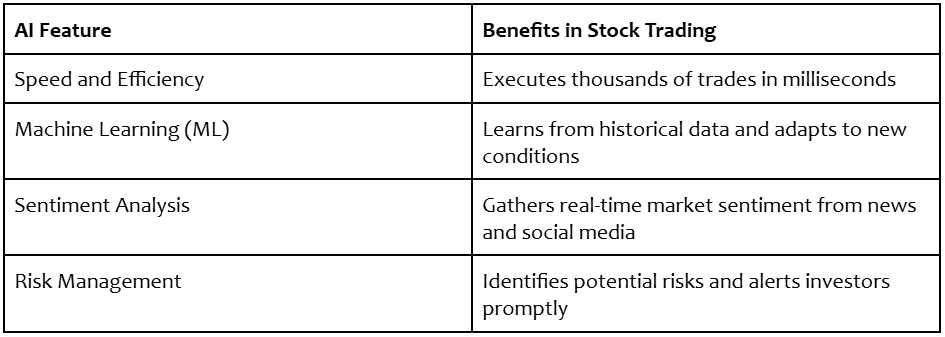

AI is revolutionizing stock trading by providing significant advantages over traditional methods. AI-driven trading now accounts for over 60% of global stock trades, utilizing algorithms to analyze data, detect trends, and make rapid decisions.

This speed is crucial in high-frequency trading, where AI executes thousands of trades within milliseconds. Machine learning (ML) enhances predictive models by learning from historical data and adapting to market conditions. Unlike human traders, AI operates tirelessly and adheres to strategies, minimizing emotional bias.

Machine Learning in Market Forecasting

AI-powered forecasting models improve prediction accuracy compared to traditional methods. AI-driven analytics helps traders make well-informed decisions using complex datasets. Traditional models struggle with forecasting trends due to many variables, but ML models can analyze vast data to predict price movements. AI can anticipate downturns and help investors adjust portfolios to mitigate risks.

Sentiment Analysis: Reading the Market’s Pulse

AI also plays a key role in sentiment analysis, gauging market emotions through news articles, social media, and other sources. Market sentiment impacts stock prices, and investors use AI to analyze this information in real time. Research indicates that sentiment analysis can predict market movement with an accuracy of around 70%.

Using natural language processing (NLP), traders assess market mood, detect trends, and adapt strategies. Positive sentiment may signal a price surge, while negative sentiment could indicate a drop. AI helps traders understand investor psychology and react quickly, giving them an edge.

AI-Powered Robo-Advisors

Robo-advisors are a prominent example of AI’s impact on trading. These platforms provide investment management services with minimal human intervention. They analyze an individual’s risk tolerance, goals, and market conditions to create customized portfolios.

Robo-advisors are popular due to accessibility, lower fees, and a personalized approach. They make financial planning easier, allowing users to make informed decisions without deep market knowledge. These tools adjust portfolios based on real-time data, keeping strategies aligned with objectives.

AI for Risk Management

Risk management is key to successful trading. AI identifies and mitigates risks by monitoring conditions and predicting pitfalls. Machine learning detects abnormal patterns, like price volatility or unusual trading volumes, which may indicate market shifts.

AI helps investors minimize risks by alerting them to changes and suggesting strategies. To see how AI is impacting financial technologies more broadly, check out SoundHound AI’s efforts to create effortless conversations between people and machines. Automated stop-loss mechanisms ensure traders can minimize losses by automatically selling assets at a certain threshold.

Ethical Considerations and Challenges

While AI offers significant benefits in trading, it also brings challenges. Ethical concerns about transparency and fairness are critical. AI systems are often seen as “black boxes” because they make decisions without clear explanations, leading to mistrust.

Bias in AI algorithms is another issue. If an AI model is trained on biased data, it may make unfair predictions, disadvantaging some participants. Another concern is market manipulation. AI’s rapid trading capabilities could create artificial price movements, affecting market integrity.

Traders must address these challenges by implementing ethical AI practices, ensuring fairness, and providing transparency in decision-making.

The Future of AI in Stock Trading

AI’s influence on stock trading and market forecasting is expected to grow. As options trading grows among retail investors, the tremendous rise in options trading highlights the increasing adoption of AI-driven tools. By 2030, AI in the financial market is projected to reach a value of $40 billion, driven by increased adoption in trading and risk management. As AI evolves, we will see hybrid models, where human traders and AI systems work together to create effective trading strategies.

Advancements in quantum computing could further enhance AI-driven stock trading. Quantum computing promises to solve complex problems at speeds unimaginable today, enabling more sophisticated trading models.

AI-powered platforms will continue to democratize access to trading by lowering costs and barriers for entry-level investors. This shift will make stock trading more accessible, transforming the financial industry.

Conclusion

Artificial intelligence is disrupting stock trading and market forecasting, providing traders with advanced tools to analyze data, predict trends, and manage risks effectively. While there are ethical challenges that need addressing, the advantages AI brings to trading are profound.

The future of AI in stock trading is bright, with new technologies continually pushing boundaries. Whether through enhanced robo-advisors, advanced risk management systems, or quantum computing-powered algorithms, AI is set to redefine how we understand and participate in the stock market.

Media Details:

Organization: allaboutai

Contact Person Name: Team allaboutai

Contact Person Email: hello@allaboutai.com/

Website: https://www.allaboutai.com/

Country: USA