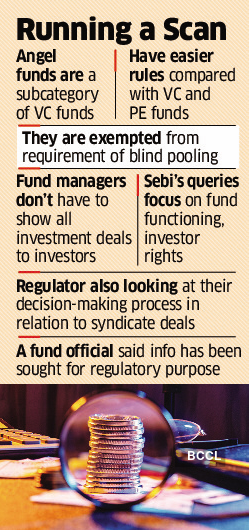

In a communique to angel funds, which have easier rules compared to regular venture capital and private equity funds, the Securities and Exchange Board of India (Sebi) has asked them to spell out “in what manner the pro-rata rights of all investors is maintained in all the investments,” three persons familiar with the development told ET.

The funds have to also share the number of investors in the pool, whether investors can exit before the tenure of the fund expires, the ‘commitment period’ till when a fund can cut deals to buy into startups, the target corpus, and the timelines for initial and final closings of a fund, according to Sebi’s email sent last week. The information, according to the email, is being collected for “regulatory purpose”, said a fund official.

Sebi has also sought details of investments by angel funds which have a single investor.

Decision-making Process

Instead of investing directly, some ultra high net worth individuals (HNIs), according to fund circles, form angel funds and invest through them to mask their identities and strike a better deal.

The market regulator’s queries come after two years of active fundraising by startups, surge in investors betting on the next unicorn, emergence of ‘lead syndicators’ who act as brokers, and amid recent fears that the roaring party is fizzling out. So, what is Sebi planning?

Tejesh Chitlangi, senior partner at IC Universal Legal, said, “Sebi AIF (alternative investment funds) regulations exempt angel funds from the requirement of blind pooling – i.e. investors are not mandatorily required to proportionately participate and have exposure in all the underlying investments made by the angel fund, which is otherwise the general requirement for all other categories of AIFs (like VC and PE funds). This should therefore as a natural corollary also exempt angel fund managers from showcasing all their investment deals to all the investors in the fund, an aspect which Sebi seems to be currently undetermined on and examining.”

“The regulator also seems to be analysing the decision-making process of angel fund managers from Sebi’s outsourcing guidelines perspective, particularly in relation to the syndicate deals being carried out by angel funds,” Chitlangi said.

In deals cobbled together by a ‘lead syndicate’, the latter, having invested in a startup in the embryonic stage, steps in at a later point when the company needs more money. Playing the role of a glorified broker, the syndicator introduces the startup founder to a wider pool of investors with the help of a fundraising platform.

But savvy HNI investors disapprove of this. “Lead syndicators make a killing by cutting sweetheart deals with startup founders who are desperate for funds. A syndicator invests initially. At the next stage when other investors come in through a platform, the syndicator invests little or no money, but nonetheless charges a ‘carry’ 5 to 15%. So, they simply monetise their right (to invest) and receive a high carry in return. Sebi-registered AIF platforms are happily lending their facility for this. Some deals are privately circulated among founders and directors of VC funds and platforms who invest in their personal capacity before the deal is displayed on the platforms to other investors,” said a senior banker who has investments in some of the angel funds. Carry is a share of profit.

Indeed, big-ticket investors, having sensed the game and scoffing at the idea of syndicators walking away with hefty carry, sponsor AIFs to directly invest in startups. “Besides keeping their identities undisclosed, they get a better deal. Startups are also happy to have institutional investors in the cap table, even though behind such an angel fund is just one investor,” said an industry person.

Early-stage funding

Some of these practices stem from the very nature of the industry. “The angel fund regime was evolved to focus investments on very early-stage concepts and companies. Given the high-risk profile, the regime filters investors to determine eligible participants in such funds. The manager is required to share deal specific term sheets with Sebi and investors (otherwise not required for other AIFs). The regime permits investors to make a soft commitment and retain a degree of investment discretion, deciding whether to invest on a deal-by-deal basis. Given this disconnect from the traditional blind-pooling of investors which otherwise applies across each of the other categories of funds under the AIF regulations, the conditions of angel funds tend to vary more than those of traditional blind pool funds. But the fund sponsors are still bound by fiduciary obligations including ensuring transparency and uniformity of treatment across investors,” said Richie Sancheti, founder, Richie Sancheti Associates.

Under the regulatory framework, angel funds are a subcategory of VC funds. Unlike retail investors in mutual funds, an individual investor in an angel fund is required to have net tangible assets of at least Rs 2 crore (excluding the value of his residence); and, if the investor is a corporate, then it must have a minimum net worth of Rs 10 crore. The minimum investment in an angel fund is Rs 25 lakh.

At the moment it’s unclear whether Sebi would make the angel fund regime less flexible, or whether the regulator plans to end some of the practices in the industry. A Sebi spokesperson could not be contacted for his comments.

Credit: Source link