An Australian soil carbon startup has raised $40 million from investors including Silicon Valley tech billionaires.

Key points:

- A soil carbon startup from Orange, NSW, has raised $40 million from venture capitalists worldwide

- Loam Bio was developing a microbial seed application to boost crop yields and help sequester carbon in the soil.

- Industry veterans say private equity funds are searching for ‘green’ investments that align with net-zero targets.

Loam Bio, formerly Soil Carbon Company, was founded in Orange on the Central Tablelands of New South Wales in 2019.

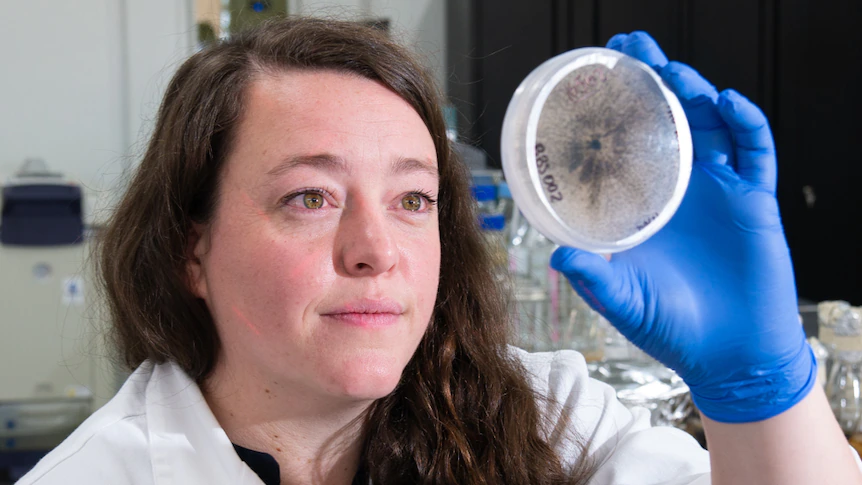

The company has developed fungal seed applications which could help agricultural crops sequester carbon into the soil.

The company aims to develop a product that would help farmers improve yields while also storing tradeable carbon.

Since its founding in 2019, the regional company has raised $50 million from investors, with a $10 million seed round in early 2020.

The main investor from the latest round is TIME Ventures, a venture capital fund run by Silicon Valley billionaire Marc Benioff, the CEO and founder of the software company Salesforce.

Canadian billionaire, Tobi Lutke, the founder of e-commerce company Shopify was another new investor.

Lutke’s Thistledown Capital is a private foundation with the aim of investing in and advancing tech solutions to decarbonisation.

Existing investors involved in the latest funding round include Mike Cannon-Brookes’ Grok Ventures, the Australian government-owned Clean Energy Finance Corporation and the CSIRO-backed Main Sequence investment fund.

Loam Bio’s co-founder and chief product officer Tegan Nock said it was an exciting time for the company.

“For us, it’s really about scale from here,” Ms Nock said.

The company now employs more than 35 people across four laboratories and 25 field sites in Australia and the United States and was set for an expansion with the latest cash injection.

Ms Nock said the company was aiming to have a product widely available on the shelves by 2023.

The company has built a library of almost 2,000 microbial strains and identified those that help plants store carbon in the soil.

Venture capitalists swoop on scalable green assets

Former investment banker and one of the founding directors of the Clean Energy Finance Corporation, Anna Skarbek, said venture capitalists and private equity funds were scouring the world for investments that align with their carbon neutral pledges.

“We’re [Australian] really well placed to attract investment but we are a little bit behind internationally in terms of the policies to help support new businesses,” she said.

Ms Skarbek, the CEO of Climate Works Australia, said private equity investors were not just investing for environmental reasons but were also looking for returns in the long-term.

“They’re looking to buy pathways to growth and they’re looking at what will be profitable.” Ms Skarbek said.

Credit: Source link