Brazilian lender Creditas announced today that it has raised $260 million in a Series F funding that values the company at $4.8 billion.

That’s up from the fintech’s $1.75 billion valuation at the time of its $255 million raise in December 2020. With the latest financing, São Paulo-based Creditas has now raised more than $829 million in funding over six rounds, with the bulk of that capital ($745 million) coming in over the last three years.

It’s a robust start to a new year that follows one which saw venture investments into fintech startups in Latin America skyrocket — to over $13.2 billion in 2021 compared to $2.3 billion in 2020.

Notably, Fidelity Management & Research LLC led Creditas’s latest investment, which also included participation from other new investors Spanish fintech fund Actyus and Greentrail Capital. Existing backers also put money in the Series F round, including QED Investors, VEF, SoftBank Vision Fund 1, SoftBank Latin America Fund, Kaszek Ventures, Lightock, Headline, Wellington Management and Advent International, via affiliate Sunley House Capital.

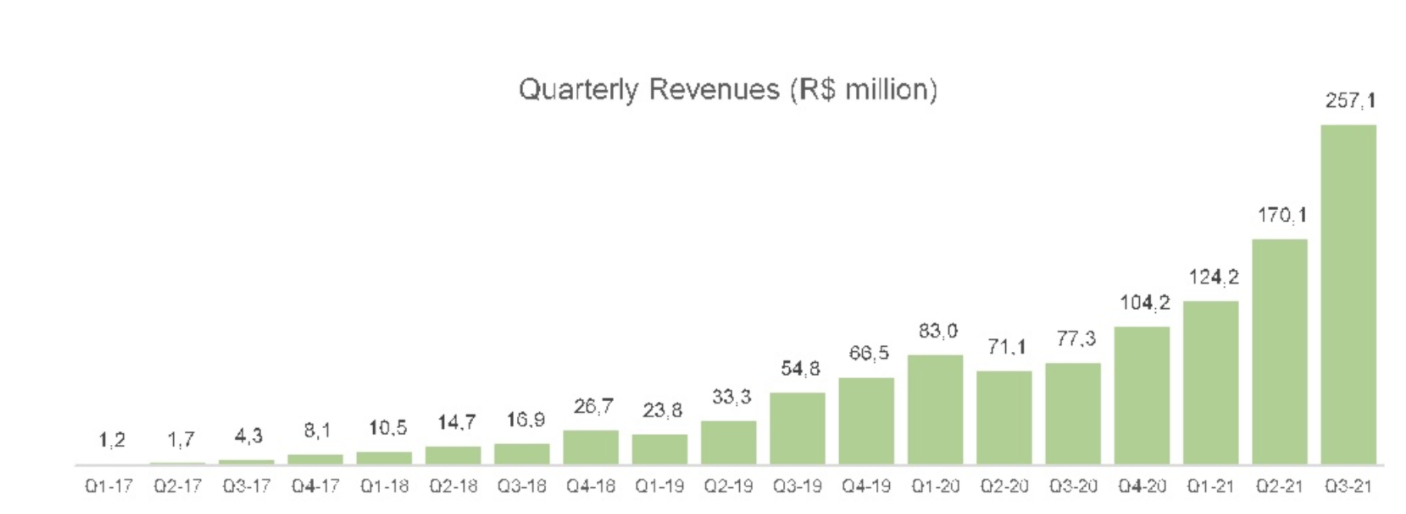

Creditas is one of those rare and refreshing startups that gives us a glimpse into their financials. Such transparency is not common and has the benefit of preparing the company well for its eventual path to the public markets. In the third quarter of 2021, Creditas notched US$46.8 million in revenue – up 233% from $14 million in the 2020 third quarter. At the same time, as it has been investing in its growth, the company’s net loss widened to $14.8 million compared to $8.25 million. Founder and CEO Sergio Furio projects annualized revenue of about $200 million for 2021.

Such rapid revenue growth is more often seen in younger startups. A company that is now 10 years old seeing that kind of revenue growth is quite impressive.

Image Credits: Creditas

As of the 2021 third quarter, the company’s credit portfolio under management had reached $532 million — up from $189.3 million in the third quarter of 2020.

Creditas began its life in 2012 as a collateralized lender operating via a marketplace model. It partnered with banks to deliver collateralized lending at rates that were significantly lower than compared to traditional interest rates (around 30% APR compared to 85% APR).

In 2016, the company essentially took the bank out of the equation and built its own platform so that instead of the banks, Creditas was the entity securing funds for loans.

Then in 2019, the company evolved into more of an ecosystem around its customers. Say, if a customer owned a car and wanted cash, Creditas would take the car as collateral, deliver a “very low” rate for the loan and then say a few years later if that customer wanted to get another car, they could do that through Creditas’ marketplace. It also could provide insurance for that new car.

“Today, we are a fintech company that uses those assets to deliver cheaper financing,” founder and CEO Sergio Furio told TechCrunch. “Beyond that, we also deliver protection and a marketplace for other verticals beyond cars.”

Or in other words, Creditas is working toward being “a one-stop solution for those seeking a digital-first experience in everything related to their house, car, motorcycles, and salary-based benefits.” For example, it operates a car marketplace called Creditas Auto. It also runs Creditas Store, an e-commerce platform with a payroll-deductible buy now, paylater model and Voltz, a manufacturer of electric motorcycles in Brazil (and after its strategic investment in Voltz Motors, next-generation EV motorcycles and scooters). And it’s building financial software for all those operations.

Eighteen months ago, Creditas expanded out of its home market of Brazil into Mexico. The country, Furio said, “has proven to be a strategic engine for growth.”

“We believe Creditas can become a true disruptor in the Mexican market being able to democratize access to financial products and consumer solutions alike,” he added.

“We plan to continue growing by nurturing and expanding our ecosystem, such as providing financial solutions to our marketplace customers, launching new products, extending our geographic reach — including our recent successful entry into Mexico and the expansion of our tech hub in Valencia, Spain — and selectively pursuing strategic M&A opportunities,” Furio said.

Image Credits: Founder and CEO Sergio Furio / Creditas

The company also has a tech hub in Spain (Furio’s home country), where about 20% of the company’s tech team is based.

Presently, Credit has more than 4,200 employees, and plans to, naturally, continue to hire with its new capital. While its headcount doubled over the past year, Furio envisions a slower pace of hiring (no more than 50% growth) over the next 12 months.

“This funding round will help us increase our tech, marketing and operations teams but the speed of growth from an employee perspective will probably slow down,” he told TechCrunch.

The company also plans to continue investing in acquisitions. In 2021, it acquired four companies. Part of the proceeds from the round will go toward “adding specialty products or niches” that it does not currently operate in.

Its investors are, naturally, bullish on the company’s continued potential.

Will Pruett, managing director of Fidelity, described Creditas as “the rare fintech that actually builds deep relationships with their customers, drastically lowering the cost of credit and improving the quality of life of those they serve.”

QED Managing Partner Bill Cilluffo notes that his firm first invested in Creditas at the time of its Series A in 2015.

“By broadening its strategy away from being purely a finance company, Creditas can now leverage a number of end-to-end solutions from insurance to car sales to support more customers than ever before,” he said.

“Creditas is one of those special fintech assets given its ability to marry hyper-growth with high revenue economics into an ever-growing TAM. We continue to back them harder and see shareholders like Fidelity and Wellington in the cap table as reinforcement of our thesis that Creditas is a successful listed company in the making,” said David Nangle, CEO of VEF.

As to timing of going public, Furio said the company is “continuously monitoring the market to see when it’s due time for that.”

Credit: Source link