The recent announcement by Intuit Inc. to shut down Mint on January 1, 2024, sent shockwaves through the financial management industry. Mint, a popular budgeting app with millions of users, was a beloved tool for those seeking to track their spending and manage their finances. With its impending demise, many are left wondering what alternative options exist to fill the void left by Mint. This is the time when Sequence steps in. As the world’s first financial router, Sequence aims to revolutionize the way individuals and businesses manage their money.

Mint, which had been acquired by Intuit in 2009, offered users a comprehensive suite of features, including account linking, budget tracking, and net worth analysis. However, the announcement that Mint would be discontinued as part of Intuit’s reimagining of the app left a vast user base searching for a new solution to their financial management needs. This is where Sequence steps in as a worthy alternative, poised to deliver more than just budgeting tools.

Financial Router Overtakes Budgeting Apps

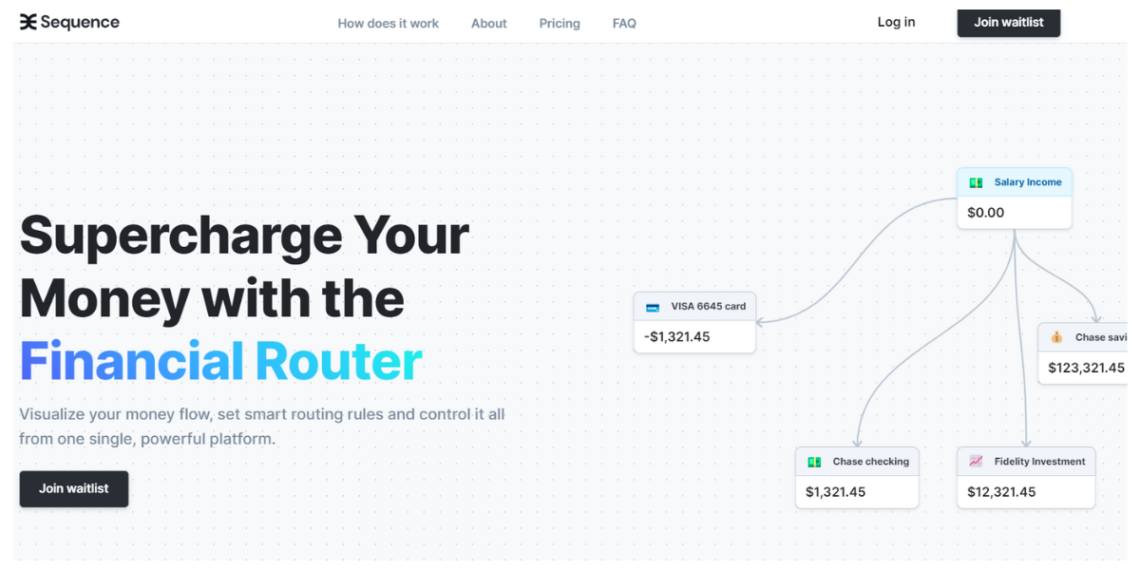

Unlike traditional budgeting apps, Sequence’s approach to financial management goes beyond creating a monthly budget. It acts as a financial router, offering users the ability to visualize their cash flow, establish smart routing rules, and exert control over the distribution of their finances across various accounts. In essence, Sequence integrates all their financial services, from banks to apps, loans, credit cards, and investment accounts, into one unified platform, allowing them to manage, automate, and transfer their finances seamlessly.

With Sequence, the promise is clear: users can take control of their money like never before. This financial router empowers users to automate the allocation of funds, making it easy to pay down debt, build long-term investments, optimize interest, and prepare for unforeseen circumstances. No longer do they need to manually juggle multiple accounts and apps; Sequence brings them all together in one cohesive system.

Sequence is widely known for its ability to provide a comprehensive view of users’ entire financial landscape. All their accounts, banks, apps, and credit cards work together harmoniously within the Sequence platform. It’s like having all their financial tools neatly organized in one place, making their financial life significantly more manageable.

The power of Sequence becomes evident when users realize that their money is now working tirelessly for them. They can set up smart routing rules to distribute their income as it comes in, ensuring their financial goals are met without manual intervention. For example, they can allocate a portion of their salary to pay off a credit card, invest in a retirement account, or build an emergency fund. Sequence ensures that their money flows where they want it, automatically and efficiently.

Post-Mint Era

The demise of Mint leaves a gap in the financial management industry, and Sequence is perfectly positioned to fill that void. While Mint was primarily a budgeting app, Sequence takes a broader and more dynamic approach. It allows users to take control of their finances in a way that’s intuitive, automated, and efficient.

This financial router empowers individuals to manage their money comprehensively, efficiently, and conveniently. Traditional budgeting apps are dead, and so is the hassle of managing multiple apps and accounts. As Mint fades into the past, Sequence becomes the future of financial management, and it’s here to stay. They shouldn’t just budget their money; they should sequence it to work for them.