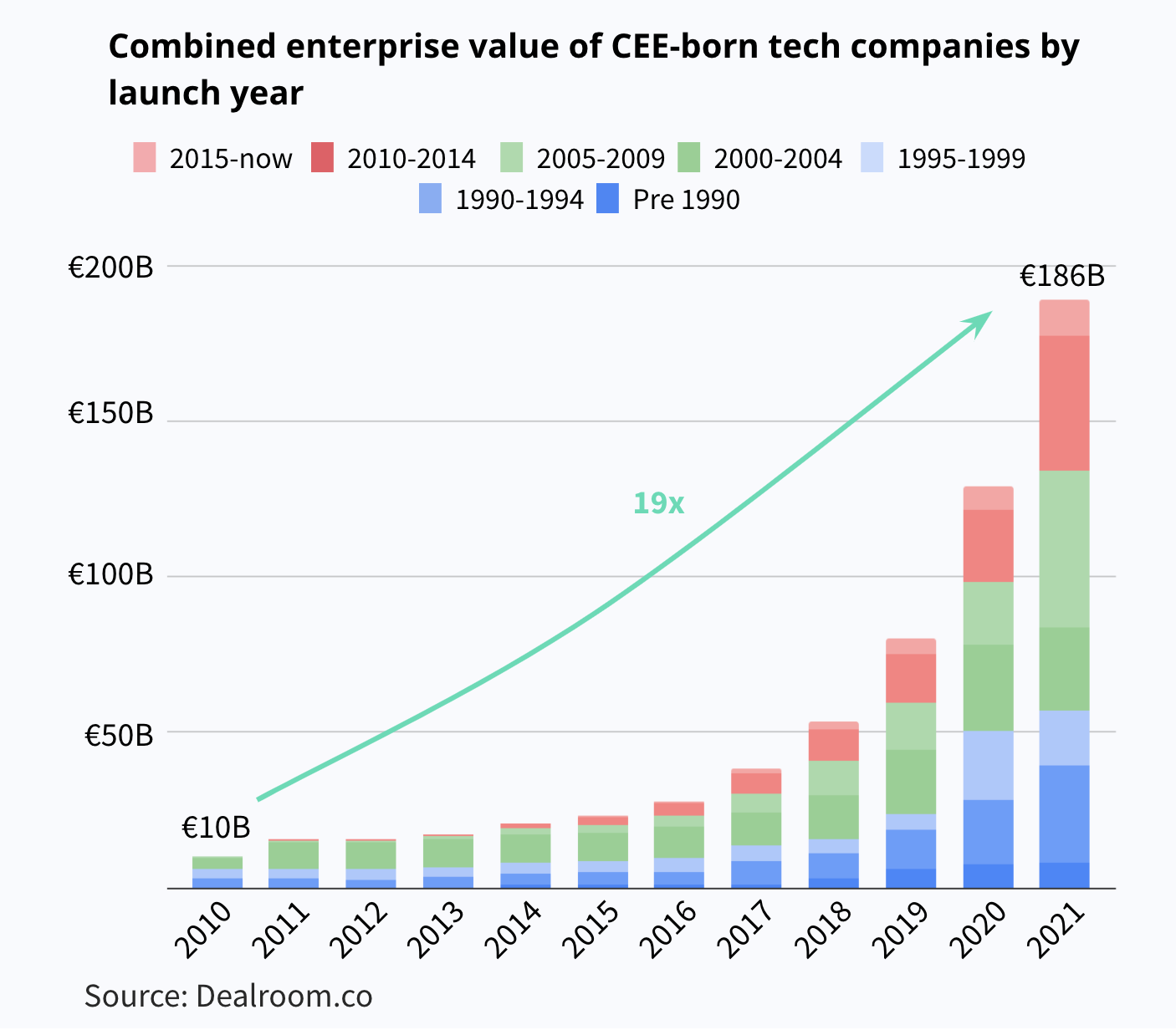

The central and eastern European startup ecosystem is booming. Tech companies from the region are now valued at more than €186bn, a 19-fold increase since 2010, according to a new report released today by Google for Startups, VC firm Atomico and intelligence platform Dealroom.

Already in 2021 startups from the region have raised over €4bn in VC funding, the report found. If it continues at this pace, this year would see more than double the amount raised in 2019, the previous record high.

“The enormous successes of companies like UiPath, born in Romania, have put a spotlight on the region once again. International investors are taking notice, and are keen not to miss out on the next decacorn from central and eastern Europe (CEE),” Yoram Wijngaarde, founder of Dealroom, tells Sifted.

Unicorns leading the way

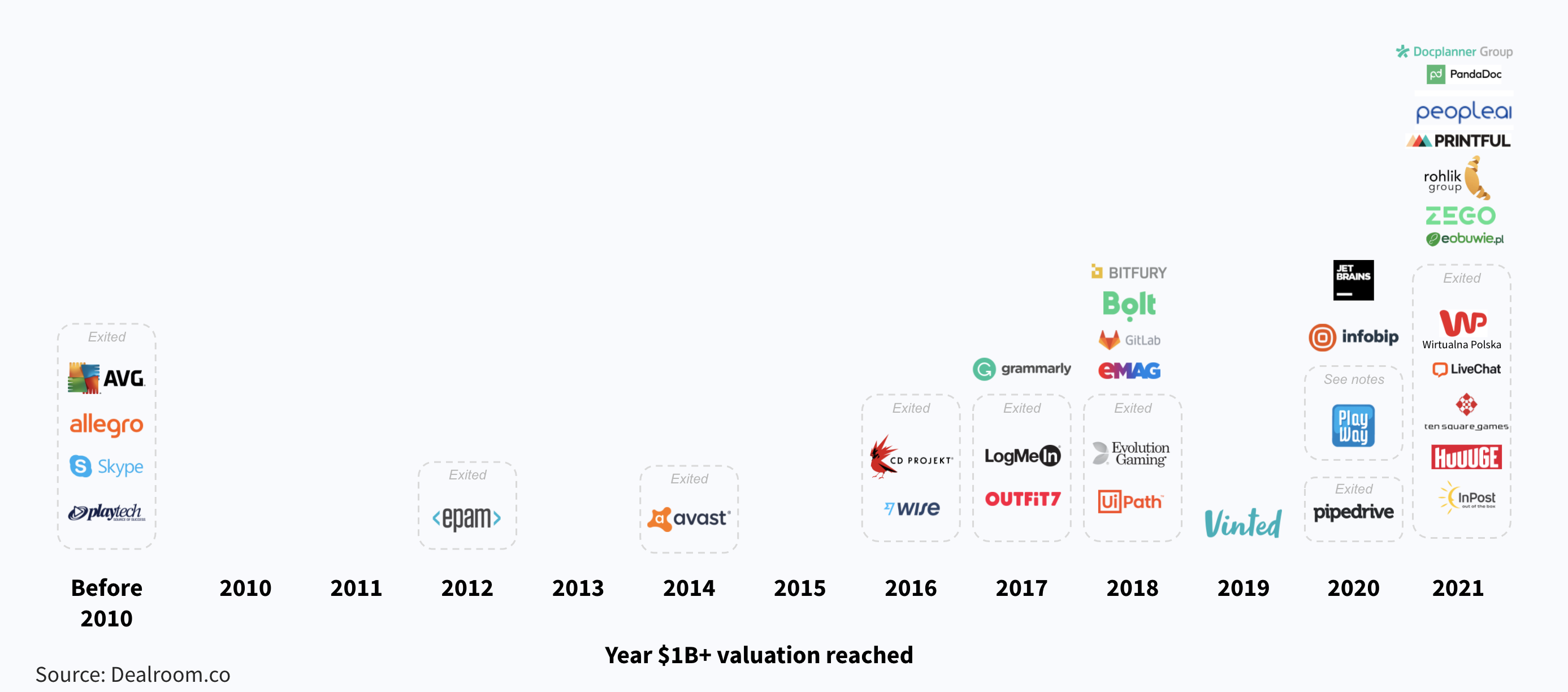

The success of companies like UiPath in Romania, InPost in Poland and GitLab in Ukraine, not to mention Baltic-founded unicorns like Wise, Skype, Bolt and now Vinted, have raised the global awareness of central and eastern Europe as a startup hub.

The region has now created 34 unicorns, up from just six in 2015, with Poland topping the list (8), followed by Estonia (6), the Czech Republic (4) and Ukraine (4). The combined value of earlier stage startups has also grown significantly in recent years, to roughly €21bn.

“The CEE region today is not an overnight success. It was built on a generation of entrepreneurs who know how to start and scale successful businesses”

Joanna Nagadowska, venture capital partnerships manager at Google for Startups and one of the coauthors of the report, says what is remarkable is how positive trends in the region largely withstood the turbulence of the pandemic.

“Significant growth factors remained stable — record amounts of VC money, large pool of highly skilled developers and emerging founder role models. Undeniably, CEE is still on the rise, and will only continue to do so,” she tells Sifted.

Nagadowska adds that nowadays almost every country in the region has its own home-grown hero around that the local ecosystem is building around.

The rising of the mega-rounds

Some of the funding data in CEE is heavily influenced by the successes of only one or two players. Romania is responsible for the second largest combined startup value created in the region since 2000, but the vast majority of that comes from just one company: UiPath, which listed in the US earlier this year at a valuation of $35bn.

The disparity is less stark in other countries, but still points to a larger reality: while more than €733m was raised in pre-Series B rounds by CEE-born startups over the first half of 2021, mega-rounds, those of over €100m, have accounted for 55% of funding raised so far this year.

This obviously benefits the already successful companies, though it should have a knock-on effect further down the food chain.

One of the more eye-catching details in the report is that a significant number of the most successful startups from the region were bootstrapped throughout much of their existence.

“One of the most interesting trends is that a third of CEE unicorns were bootstrapped, compared to 7% for the rest of Europe,” says Dealroom’s Wijngaarde. “This suggests not only that there has been a lack of available capital, but also that the region has strong entrepreneurial fundamentals, creating sustainable scalable businesses.”

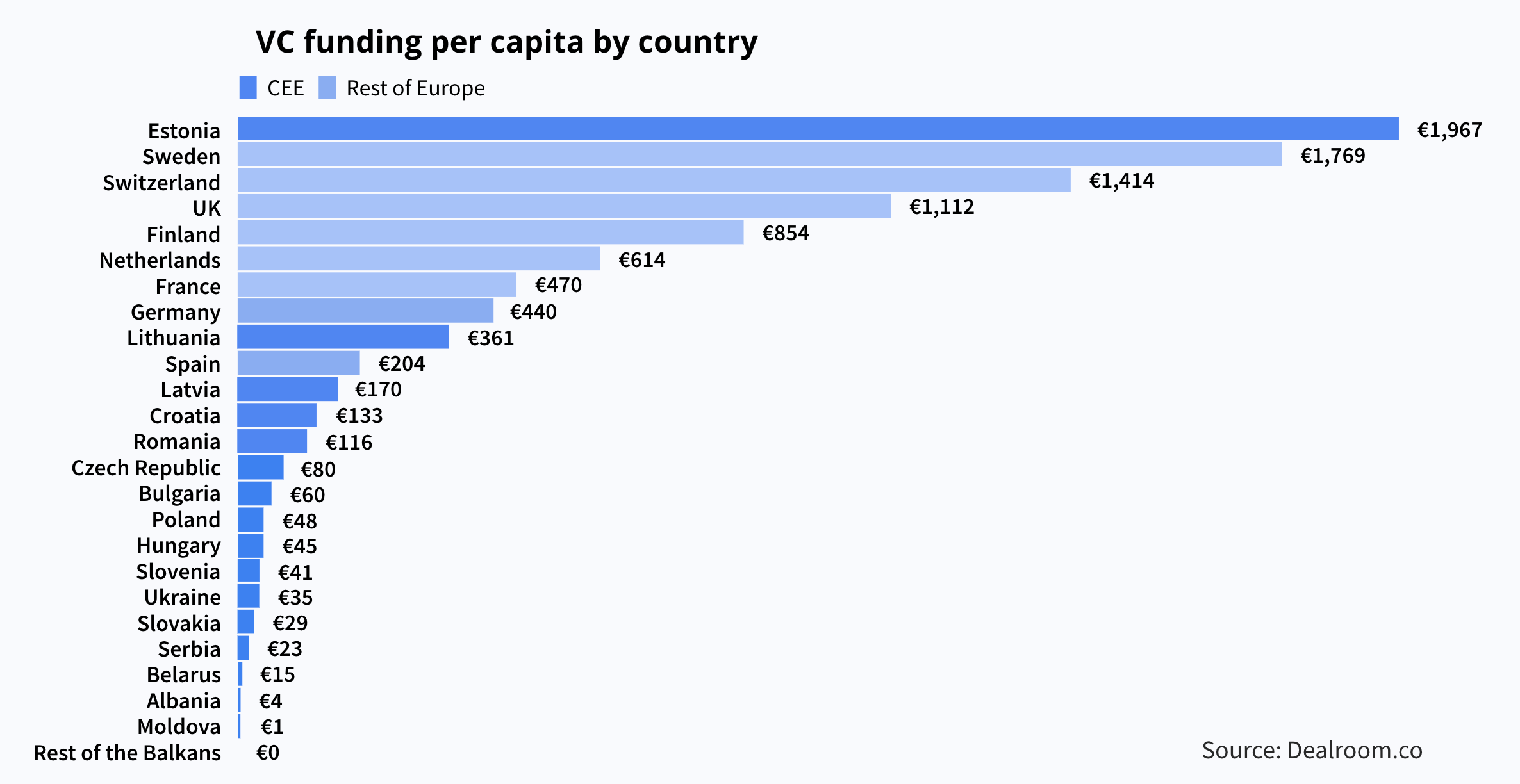

Estonia pulling in the money

Estonia, one of the smallest countries in the region, leads the whole of Europe when it comes to VC investment per capita as well as startup creation — €1,967 per capital raised and one startup per 1,048 people — which won’t come as a surprise to many readers.

However, the rest of the region lags far behind much of western Europe.

Meanwhile the region is heavily reliant on international investors, far more than the rest of Europe, with American money accounting for more than half of funding invested in CEE startups.

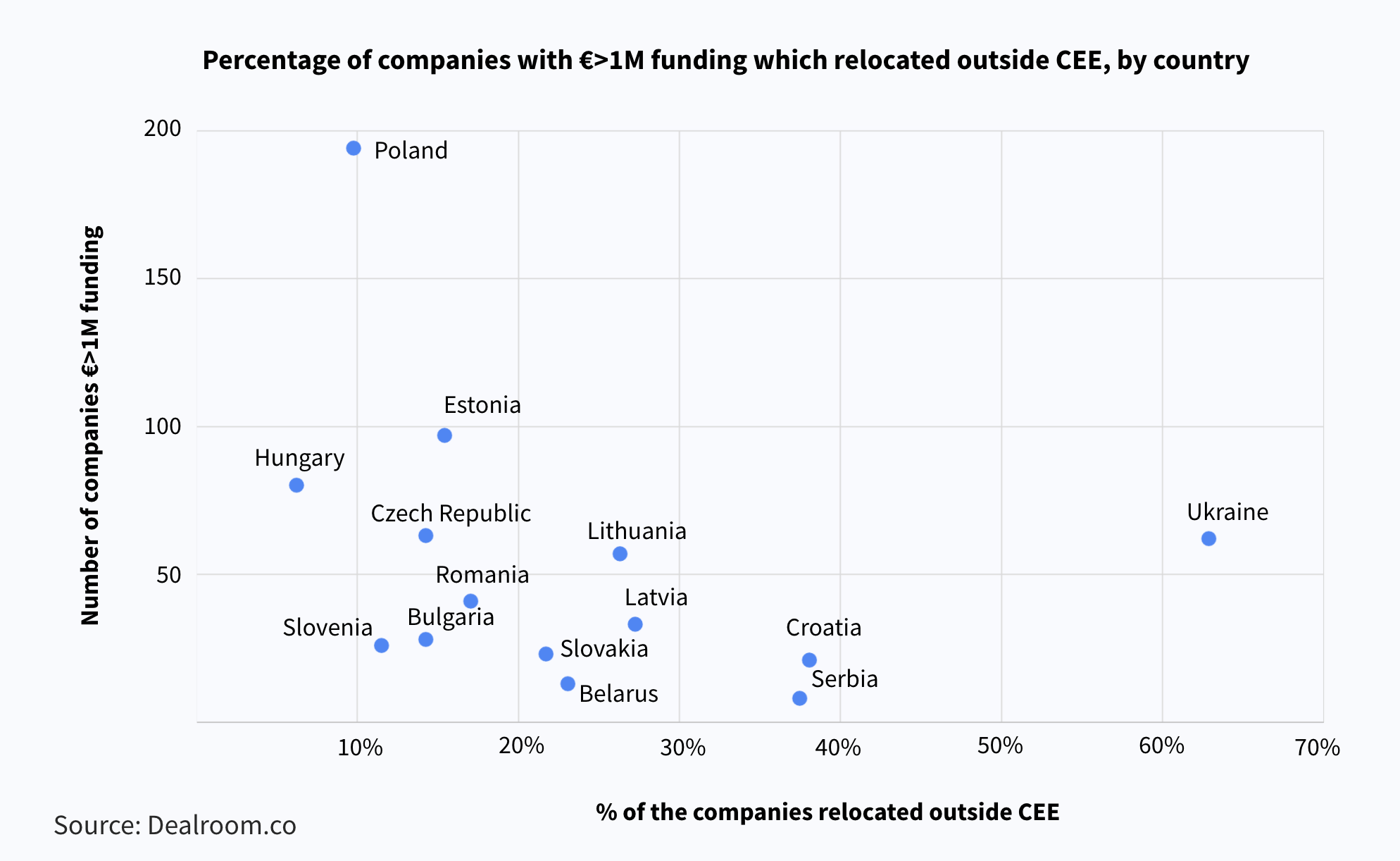

CEE startups are also continuing to leave the region, or at least move their headquarters to cities like New York and London, while keeping most of their development teams back home.

Ukrainian-born startups (among those that have raised more than €1m) are by far the most likely to have relocated, the report found, which should come as little surprise given the years of conflict and political instability in the country, with Polish and Hungarian startups the least likely.

Years of progress

While the headline numbers in the report are impressive, Google for Startup’s Nagadowska stresses that it’s been a long process to reach this stage for a region that is well-known for its tech talent but who’s homegrown companies were often overlooked.

“The CEE region today is not an overnight success,” she says. “It was built on a generation of entrepreneurs who know how to start and scale successful businesses, who have the right network and capital to start their next venture.”

The future is looking bright for the CEE startup ecosystem.

“CEE is reaching a point of critical mass,” says Dealroom’s Wijngaarde. “Big exits, like those this year for InPost and Avast, renew the ecosystem with talent, capital and expertise, fuelling the next generation of startups.”

Kit Gillet is Sifted’s eastern Europe correspondent. He tweets from @KitGillet

Credit: Source link