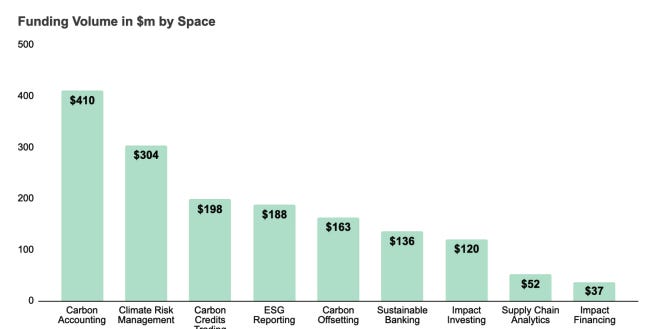

- Climate fintechs had a breakthrough year in 2021, securing $1.2 billion across the US and Europe.

- Carbon-accounting startups took the lion’s share, according to funding analysis from CommerzVentures.

- Partner Paul Morgenthaler has tipped the market to undergo widespread consolidation.

Startups focused on the measurement and mitigation of carbon emissions had a breakthrough year in 2021, with investment soaring to $1.2 billion in the US and Europe in 2021, according to a funding analysis.

CommerzVentures, the venture arm of German bank Commerzbank, analyzed what it described as the rapidly developing space of “climate fintechs” — an umbrella term for

fintech startups

operating in carbon offsetting, carbon accounting, impact investing, carbon credits trading, and other sub-sectors. It identified 228 European climate fintechs, and 60 in the US.

CommerzVentures didn’t conduct a year-on-year analysis, simply noting that 2021’s funding figure was substantially higher than all funding to the sector in prior years.

CommerzVentures

Two major deals in the US included Xpansiv, a US carbon credit marketplace, which raised $100 milion in September 2021, while carbon-accounting platform Persefoni raised $576 million in October.

Europe’s largest rounds included CommerzVentures’ portfolio company Doconomy, which attracted $19 million, and French startup Sweep, which raised $22 million from Balderton Capital.

Both are carbon-accounting startups, which generally which track the emissions output of companies and which overall attracted the most funding, according to CommerzVentures’ analysis. Some carbon-accounting startups also offer offsets — to differentiate the two, CommerzVentures looked at whether the company’s business model focused on recurring software subscription revenues or commissions from offsets.

Carbon-accounting startups, said Paul Morgenthaler, CommerzVentures’ partner and climate fintech lead, usually want to go beyond offsets and help customers reduce emissions. Offsets alone are “often seen as synonymous with greenwashing – and in many cases is just that.”

CommerzVentures

Pure-play carbon-offsetting startups like US startup Patch, which offers customers a portfolio of green projects to invest in, received “relatively little” funding, but grew quickly from a lower base, Morgenthaler said.

CommerzVentures

As the carbon accounting market matures, Morgenthaler expects consolidation in some areas of it.

“Given the enormous complexity involved in accounting for Scope 3 emissions, there is a need for sector-specific standards, and specialist providers can play an important role in establishing them,” he said.

Emissions are typically broken down into three categories: Scope 1 covers direct emissions from owned or controlled sources, Scope 2 includes indirect emissions from electricity and other utilities, while Scope 3 covers all other indirect emissions throughout the value chain.

CommerzVentures

There is already some evidence of consolidation.

Vaayu, founded in 2021, caters specifically to retailers. Its technology integrates with point-of-sale systems to pull data on logistics, operations, and packaging so retailers can monitor, measure, and reduce their full carbon emissions.

Carbon credits are also a rapidly emerging global asset class, Morgenthaler said. Startups trading carbon credits, each of which represents 1 metric ton of carbon dioxide or equivalent that will be removed or prevented, lured $198 million across Europe and the US in 2021, making it the third most-attractive space. The second top-funded sub-sector was climate risk management, raising $304 million.

Morgenthaler said at there were also companies working to build an infrastructure for the tokenization of carbon “at the bleeding edge” of the industry.

Credit: Source link