| The COVID-19 pandemic has accelerated the adoption and use of technology, which has made investments in certain types of financial technology companies more attractive. Source: Chesnot/Getty Images News via Getty Images |

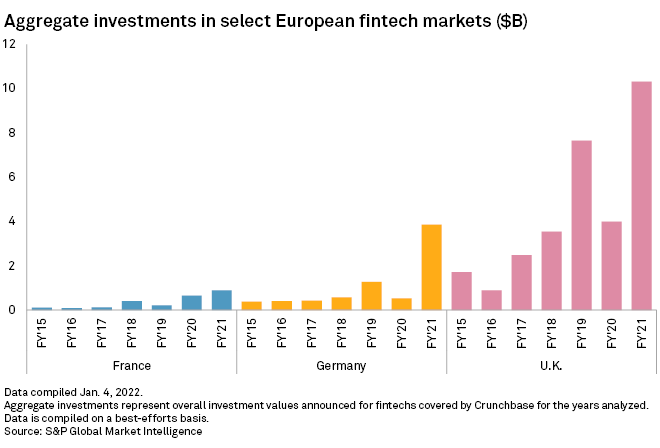

Investment in financial technology firms across Europe’s three largest economies surged in 2021 following a sharp dip in 2020 due to the COVID-19 pandemic.

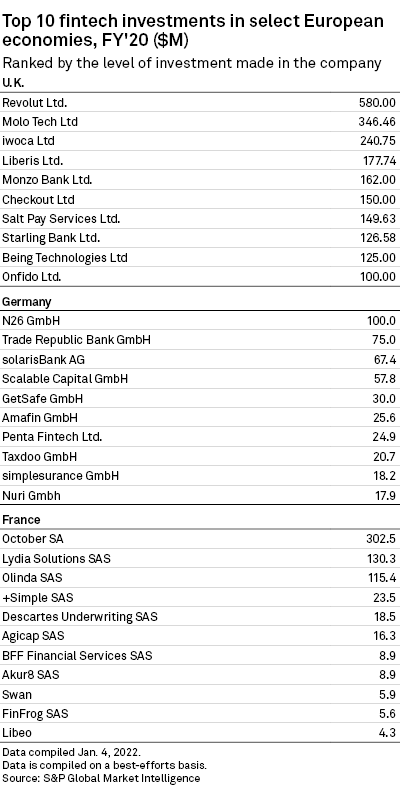

Investors pumped almost three times as much money into fintechs based in the U.K., Germany and France in 2021 than they did in 2020, as confidence returned following the global economic shock delivered by the pandemic, according to data from S&P Global Market Intelligence and business information provider Crunchbase.

Total investment in the three countries rose to more than $15 billion in 2021, from just over $5 billion in 2020, when investment almost halved from the previous year. The U.K., home to Europe’s largest fintech hub — London, led the continent’s investment drive with more than $10 billion raised, surpassing the pre-pandemic total of $7.65 billion in 2019.

“There was a pause in investment [in 2020] and some companies were out of favor, but the vast majority of the market has since begun to accelerate,” Ross Morrison, partner at Adam Street Partners, a global private markets investment manager with $49 billion in AUM, said in an interview. “It’s very clear that within fintech, Europe is a genuine leader.”

Trade Republic, Celsius Network, wefox attract investment

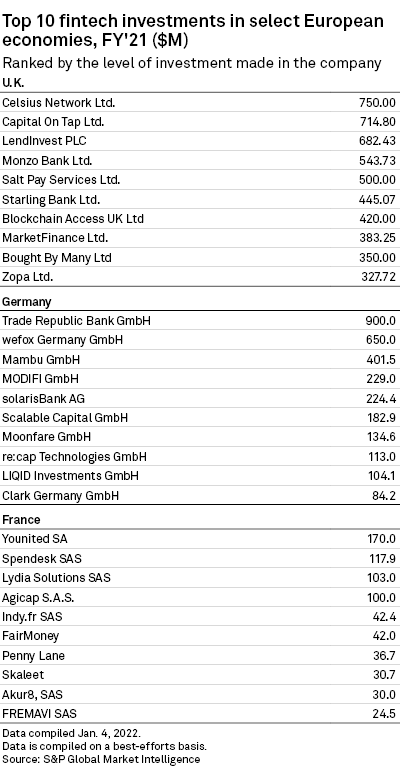

Trade Republic Bank GmbH, a Berlin-based online broker that enables customers to trade securities and cryptocurrencies via a mobile app, attracted the most investment of all European fintechs in 2021, raising $900.0 million in Series C funding, the data showed. Among the investors was venture capital heavyweight Sequoia Capital, famous for its early investments in tech giants such as Apple Inc., Alphabet Inc. and Oracle Corp. Wefox Germany GmbH, a Berlin-based digital insurance provider, raised $650.0 million.

U.K.-based Celsius Network Ltd., a cryptocurrency loan platform, raised $750.0 million — the second-highest amount in the sample. Also based in the U.K., small business finance firm Capital On Tap Ltd. and nonbank mortgage lender and investing platform LendInvest PLC raised $714.80 million and $682.4 million, respectively.

The Trade Republic Bank and wefox deals helped the German fintech market to a record year in which it saw investment increase more than sevenfold from 2020, the largest annual increase across Europe’s three largest economies. Investment in U.K. fintechs more than doubled in 2021 from 2020, while French fintech investment rose by around 36.1% to $893.4 million, led by a $170.0 million funding round for peer-to-peer lending platform Younited SA.

The U.K. remained the dominant force in European fintech, attracting almost three times as much investment in 2021 as Germany. London’s position as Europe’s financial and tech capital continues to make it a natural home for the crossover sector of fintech, said Ronit Ghose, global head of banking, fintech and digital assets at Citi Global Insights.

The U.K.’s legal and regulatory framework, which is more supportive to startups generally than its two largest European rivals, also helps it maintain its edge, Ghose added.

“It’s harder for foreign investors, whether they’re individuals or even venture capital firms, to invest in these countries compared to a more open economy or more pro–enterprise economy such as the U.K. or the U.S.,” Ghose said.

The COVID-19 pandemic appears to have had some benefits for the European fintech sector. The surge in investment seen in 2021 owes something to the financial landscape faced by investors since central banks and governments responded to the economic crisis generated by the outbreak of the virus, said Ghose.

“There’s a lot of money looking for a home because interest rates are close to zero or negative in large parts of the world,” Ghose said. “When interest rates are so low, people are looking for alternative places to put their money.”

From unicorns to cockroaches

The pandemic had initially forced investors used to thinking about $1-billion-valued “unicorns” to focus on companies capable of surviving the escalating economic crisis, or “cockroaches” as Ghose described them.

“The amount of liquidity that came flooding back in very quickly as part of policymakers’ stabilization efforts meant investors went from thinking about cockroaches to unicorns and rainbows again,” said Ghose.

The pandemic’s impact on human behavior, such as how we work, shop and bank, has also accelerated the demand for certain fintech platforms and services. Startups focused on digital payments and exclusively digital neobanks are just some of the fintechs to benefit.

“People realized very quickly that tech was actually the solution during the pandemic,” said Morrison. “There’s been a huge explosion in certain behaviors that has just re-rated tech [for investors],” said Morrison.

The finance sector has itself “rethought” the role of technology in its operations, said Jakob Drzazga, CEO and founder of Scaling Funds, a Berlin-based alternative investment platform based on blockchain technology that has raised €3 billion in funding from investors.

“Especially in the alternative investment fund industry, the technology adoption rate drastically increased,” Drzazga said. “What I would have anticipated taking seven years seems feasible in the next two years now.”

Other areas of European fintech that have enjoyed growing investor interest in the last couple of years are online broking, investing and trading, as well as cryptocurrency and blockchain, said Ghose.

The European fintech landscape and tech landscape generally is expected to become much less concentrated in locations such as London, Berlin and Paris in the coming years, said Morrison. Europe has “a long tail of Tier 2 cities” where there has been an “explosion of startups” in the last two years.

“There’s about 30 mini [tech] ecosystems that exist all across Europe, ecosystems of capital know-how, talent, VCs,” said Morrison. “When you look at what’s happening on a pan-European basis, we’re going to blink and in five years’ time it’s going to be a really positive story, and we’re all going to be talking about it.”

Credit: Source link