Although final restrictions related to COVID-19 have been all but lifted, their effect marks the UK SME landscape as we pass the second anniversary of the pandemic’s start.

During the height of restrictions, many companies were forced to rethink their business models altogether. Employees were sent to work from home, and practices were migrated to function online where possible and where not possible, businesses had to close their doors. For some, it was for the last time.

SMEs account for 50% of the total revenue generated by UK businesses and 44% of the labor force. SME turnover growth was seen to have fallen by 30% on average during 2020, with the turnover rate still low but recovering slightly by December 2020.

According to The Bank of England, Impacts of the COVID-19 Crisis Staff working paper, 44% of small businesses had to cut jobs, and GDP was at an all-time low, falling by 10% between 2019 and 2020, making it the most significant annual fall in 300 years.

Despite this, according to Goldman Sachs, 99% of businesses expected to survive, assuming no other national lockdowns due to quick response, adaptation to online practices, and government support.

Government support essential to recovery

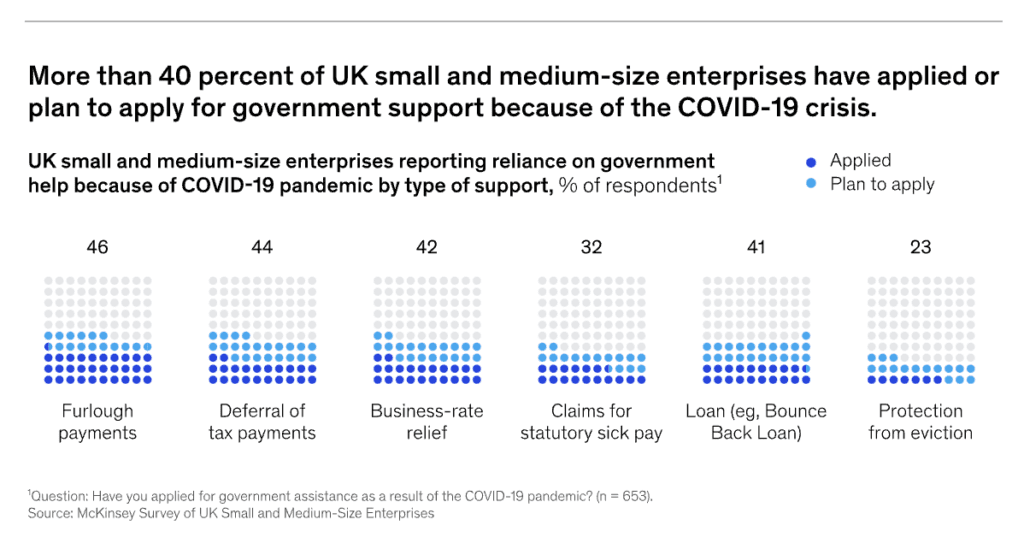

The government was fundamental to this recovery, introducing multiple loan schemes to help tide the deficit in revenue for SMEs. During 2020 £70bn of the £80bn of new finance raised by businesses came from these schemes.

The Bounce Back Loan Scheme (BBLS) was one of the most popular, with a 100% risk guarantee and no repayment during the first 12 months. The government issued 1.5 million of the BBLS loans with a value of up to £50,000. The Coronavirus Business Interruption Loan Scheme (CBILS) offered similar terms for loans up to £5 million with 80% guaranteed by the government.

In addition, the Recovery Loan Scheme (RLS) was introduced, offering loans to businesses of all sizes of up to £10 million with 80% guaranteed by the government, a scheme still available for SMEs.

During the pandemic, 67% of SMEs took on external finance such as these loans, with 80% saying that the current support is enough to ensure their business survives. More than four out of five stated they believed their business to have the capacity to grow using the COVID19 subsidies.

The future looks bright when looking at these figures, and the pandemic recovery is well underway.

According to Ravi Anand, Managing Director of ThinCats, we are not out of the woods yet.

Midimarket SMEs more resilient

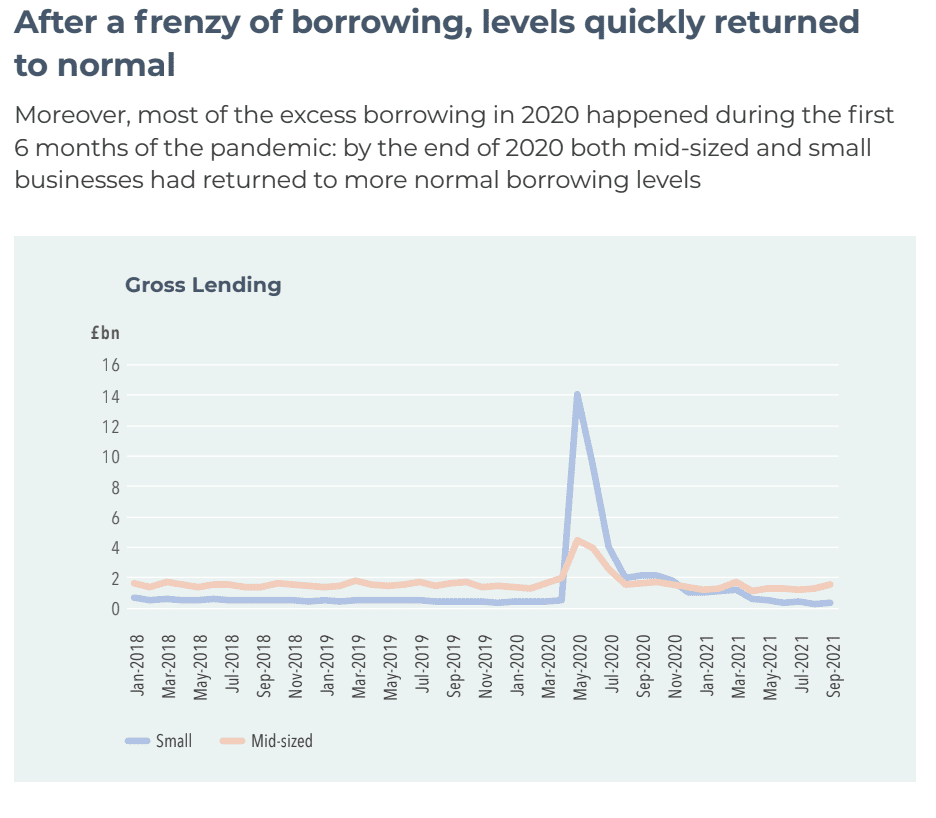

“The number of small SMEs that borrowed using the schemes is about six times more than would usually borrow. When we move to look at mid-market, it’s only about twice as much,” said Anand

“What does this say to us? It says that mid-market SMEs are more resilient, are more robust, and have more levers to pull.”

ThinCats is an alternative lender focusing on mid-sized SMEs. They have reported having lent more than usual during the pandemic but have found their clients to have grown.

“When we look at net cash balance sheets after borrowings, mid-market net cash has gone up 60%. Smaller SMEs are relatively flat (at 5%). So smaller SMEs borrowed a lot of money to stand still in net cash,” said Anand.

The company issued various CBILS to their clients, all of which were over £1million and averaged at £3million.

“(Our borrowers) have borrowed a bit more than they would normally borrow but not in a way that has been damaging to them coming out of the pandemic,” Anand said.

Delayed effects on SME sector

“What’s happened in the smaller end of the market, particularly with BBLS…a lot of people were borrowing money, way beyond what they would normally take,” said Anand.

“There has been a lot of fraud, which we are yet to see come through, but it also allowed businesses that would naturally go insolvent to carry on. So insolvency is at an all-time low, whichever market you look at”

According to Anand, although the loan schemes offered by the government during the pandemic were effective at keeping businesses going, they have caused a bubble that is waiting to pop.

“There will be a massive catch-up over the next two or three years. And because smaller SMEs borrowed that much more, the catch-up is going to be more severe.”

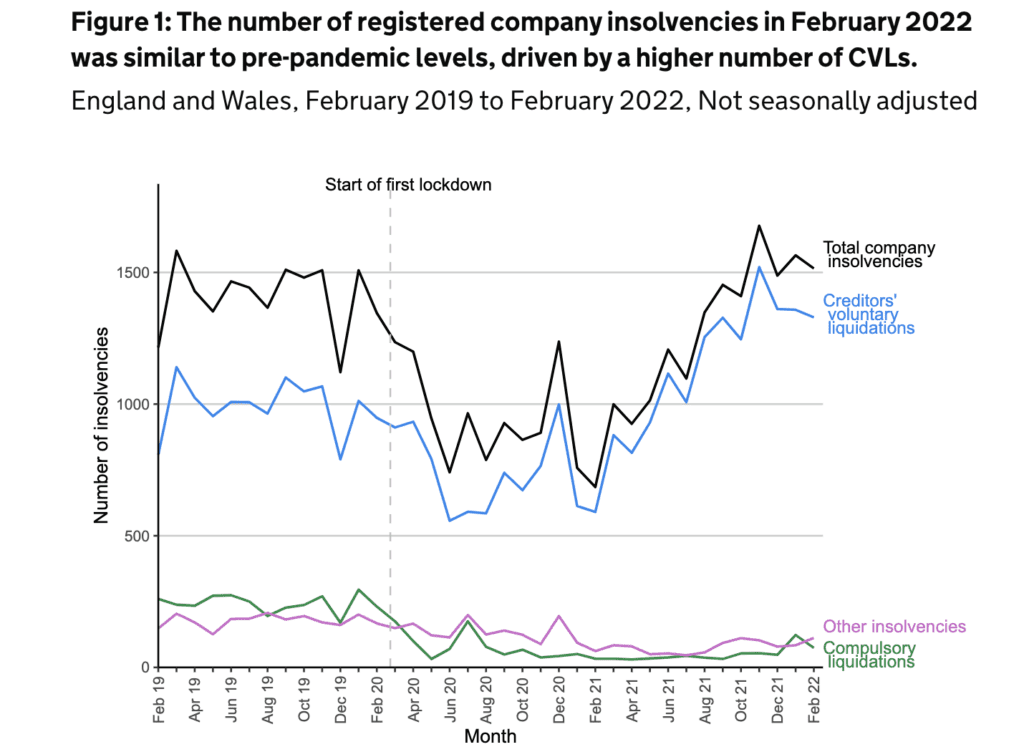

In July 2021, insolvency was reported by The HM Insolvency Service to be 13% higher than in July 2020. It was 24% lower than two years previously.

Fast forward to February 2022, and the graph shows a different story, with insolvency 13% higher than February 2020, total company insolvencies at a similar level to pre-pandemic, and creditors’ voluntary liquidations at an all-time high compared to three years prior.

Due to the higher borrowing levels, these levels could continue to soar.

A pandemic of fraud

As we move further away from the initial shock to the market created by the pandemic, government schemes are slowly being discontinued, and business is attempting to return to normal.

With this shift, ever more reports of fraudulent activity regarding the government loans, especially the BBLS, are coming to light.

“We don’t exactly know the numbers, but market commentators talk about 25-30% of bounce back being fraudulent,” commented Anand.

“So there have been different instances of fraud, borrowers borrowing money and then making the company insolvent and stripping the cash-out, borrowers creating ten companies and borrowing £50k per company. There are all sorts of fraud that have gone on and will also increase insolvency.”

On March 15, 2022, the Financial Times reported that official estimates suggest that anywhere between £3.3bn and £5bn could be lost in fraud. Banks under the BBLS lent more than £46bn with only minimal checks conducted.

The British Business Bank, which oversaw the scheme for the government, has identified 22,000 loans that appeared to be duplicate and expect this number to rise.

‘A lot of noise’ but subdued impact

“Mid-sized SMEs are not just stronger due to the schemes. They have also become more efficient. People have enabled tech into their businesses…they are in a really good position to come out and take advantage of opportunities and weather the storm somewhat.”

Of the national GDP contribution, around 25% is small businesses, 25% is mid-size, and 50% is large corporate companies. Ninety percent of the BBLS went to micro businesses, amounting to £39.7bn, indicating that the effects of the BBLS bubble are likely to center on the small business sector.

This differs from the global economic crisis of 2009, the most recent period of significant economic decline.

The crisis saw medium-sized businesses bearing the brunt of the reduced available liquidity during this time, restricting their ability to continue borrowing at the same rate, and insolvency spiked by 1.5%, resulting in a GDP dip and a massive wave of closures.

Within this 2009 picture, only 2% of small businesses borrowed from banks, compared to the 35% during 2020 and 2021.

Many of these businesses were so small and their borrowing so insignificant that many were not registered in the official insolvency statistics.

“The thing about smaller micro-businesses is that they can phoenix. If you go bust because you’re a sole trader, you can start again on a different premise. So the rate of change of micro SMEs will always occur, and the impact on GDP is slightly more subdued.” said Anand.

“There will be a lot of noise, absolutely, but the true impact has got mitigants to it.”

- About the Author

- Latest Posts

Isabelle is a creative project manager and freelance journalist with a BA Honours Degree in Architecture and a MA in Photography and Visual Media.

With over 5 years in the art and design sector, Isabelle has worked on a variety of projects, writing for real estate development magazines and design websites, as well as project managing art industry initiatives. She has directed independent documentaries on artists and the esports sector, and assisted in the production of BBC Two’s Venice Biennale: Britain’s New Voices.

Isabelle’s interest in Fintech comes from a yearning to understand the rapid digitalisation of society and the potential it holds for our future, a topic she has addressed many times during her personal academic pursuits and journalistic career.

Credit: Source link