At the end of July, the product comparison website Finder.com published its research findings from a panel of experts that predicted the crypto asset ethereum would reach $4.5K this year. On October 25, Finder updated its “Ethereum Price Predictions Report” that polled 50 financial technology specialists and ethereum is now expected to reach “$5,114 by the end of this year.”

Finder’s Panel Suggests Ethereum Will Be Over $5K by Year’s End

Finder, an investing companion application and product comparison website, has published numerous surveys and panel forecasts concerning the growing cryptocurrency economy. The comparison website’s researchers delve into a variety of different crypto assets like bitcoin (BTC), litecoin (LTC), and ethereum (ETH). Last July, Finder’s researchers polled experts in the financial technology (fintech) sector and the group predicted that ether would reach $4.5K by the year’s end and $18,000 by the year 2025.

On Monday, Finder.com’s Tim Falk and Richard Laycock published a fresh report that polled 50 fintech specialists who discussed the second-largest crypto-asset, ethereum (ETH). During the last 24 hours, ETH spot prices have been hovering just above the $4K range — between $4,075 and $4,250 per unit. In the latest report, 50 fintech specialists were polled from September 24 to October 11, 2021. Finder said that the researchers leveraged the survey in a “truncated mean,” which means the top and bottom 10% outliers were removed from the data.

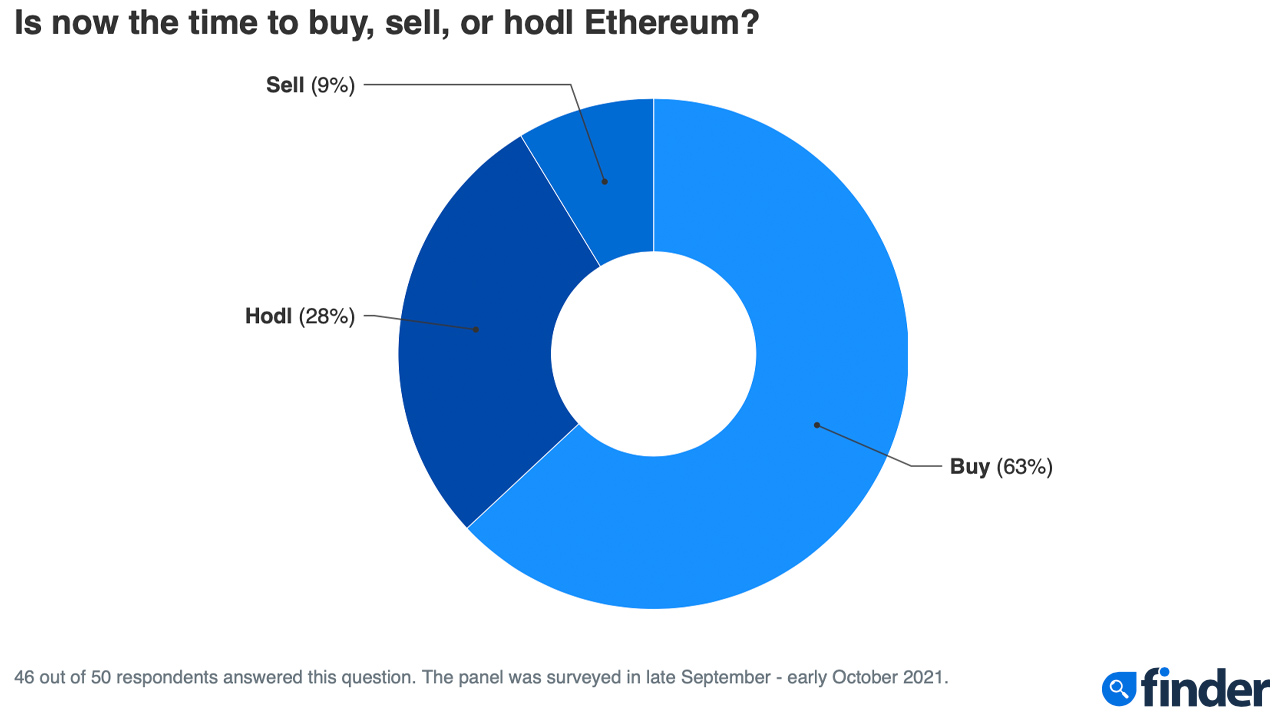

The report shows that while ETH is expected to reach $5,114 by the end of this year, by 2025, the panel predicts ETH’s price will jump to $15,364 per unit. Experts also believe that a single ether can then more than triple by the end of 2030, reaching $50,788 per ETH. Data shows that 63% of panelists think it’s a good time to buy ether, while 9% say sell. 28% of the panel members polled say that ether holders should “hodl.”

Ethereum Expected to Lose 30% of Market Share to Alternative L1 Networks, 13% of Panelists Believe Solana Can Overtake Ethereum

Another interesting statistic noted is that ethereum (ETH) is expected to lose 30% of its market share to alternative layer-1 (L1) networks over the next year. Daniel Polotsky, the founder of Coinflip, thinks that by the end of the year ETH will be valued at $4,500. However, Polotsky thinks Ethereum’s growth may surpass the leading crypto asset bitcoin (BTC) someday.

“Ethereum does a better job of supporting development on its blockchain and will have a more lightweight proof-of-stake mining model than Bitcoin [which] means that it can potentially be the backbone of Web 3.0,” Polotsky remarked in the survey’s notes. He added:

[This] leads me to believe that its rate of growth may even surpass that of bitcoin over the next decade.

Data also shows that one in ten of Finder’s ethereum survey panelists (13%) believe the Solana (SOL) network will overtake Ethereum as the primary decentralized finance (defi) platform. Johannes Schweifer, CEO of Coreledger AG, is a member of the 13% that believe SOL can outperform ETH in this manner. According to Schweifer, Ethereum won’t be able to solve the network’s scaling issues.

“It was not built for high throughput, and developers know that, whereas other layer-1 solutions such as Solana are. The market will expand rapidly with their maturity and they will get the lion’s share of all new business that is not exclusively based on speculation,” Schweifer added.

What do you think about the latest Finder poll that predicts ethereum can reach $5,114 by the year’s end? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Finder.com,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Credit: Source link