French startup Lydia appears to be more popular than ever.

It’s now the second-most downloaded fintech app in France, allowing 5.5m customers to bank, invest and ping money to each other. Giant investors like Tencent and Accel are also Lydia supporters, joining its $133m Series B.

And — finally — Lydia is a unicorn, having been valued at over $1bn in a new $100m round, flanked by US funds Dragoneer and Echo Street.

The new feat is accompanied by a fresh set of ambitious goals.

Over the next three years, Lydia wants to become the primary account for 10m users. It will also use the funds to spin out new credit and investment products (having recently launched crypto trading), as well as expanding into at least two new European geographies, including Portugal and Spain.

Perhaps Lydia’s most ambitious target is to become a financial “super-app” for millennials and Gen Z, following in the footsteps of China’s WeChat and even Revolut.

“The superapp is really the future of banking services as we know them. The bank app has gained some improvement, but they haven’t really changed over the last few decades,” says Lydia cofounder and CEO Cyril Chiche. “Apps should really hide all the complexity [of banking]. It should be an interface as close to the actual intention.”

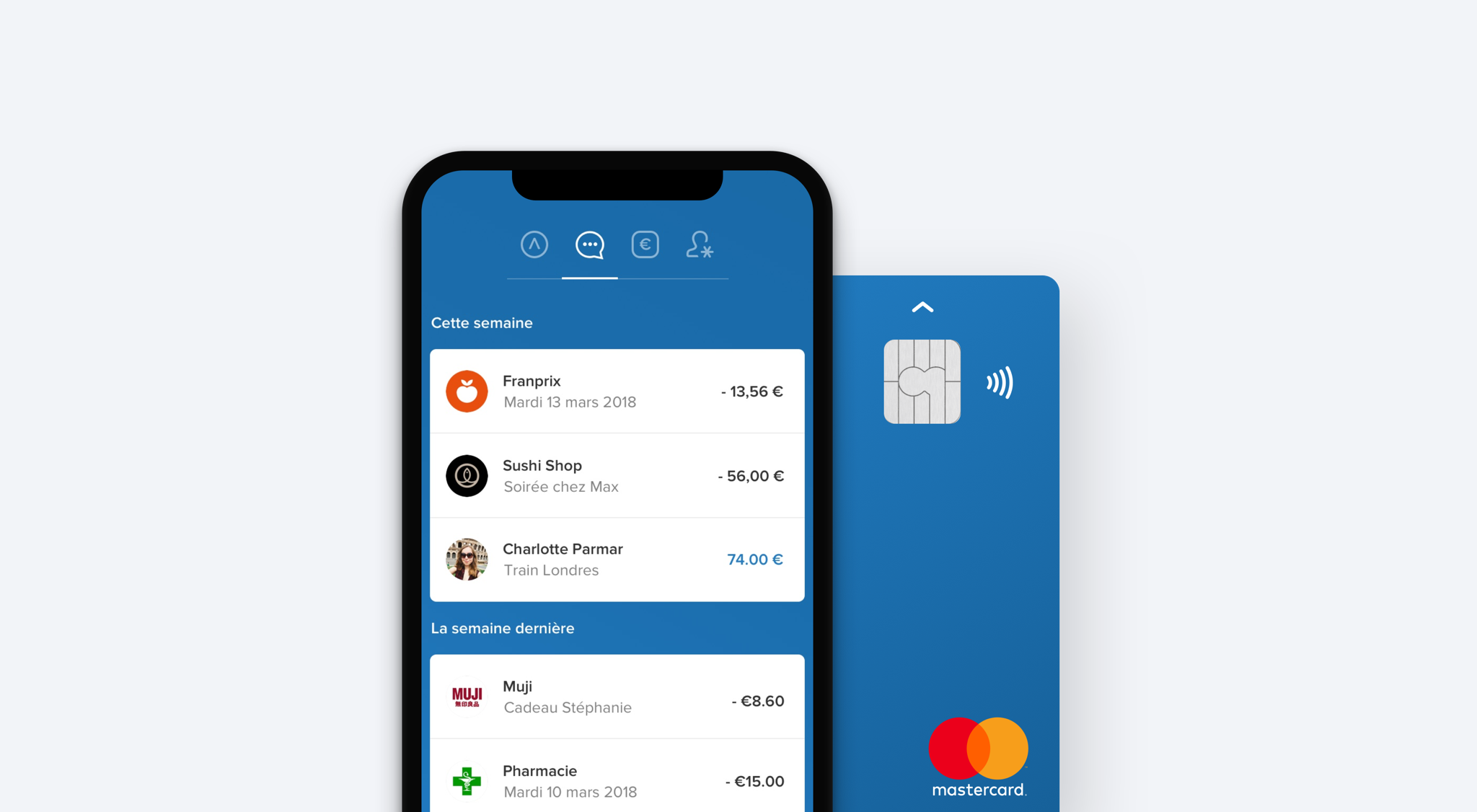

Since its founding in 2013, Lydia has evolved from being a peer-to-peer payment app like Venmo, into a full banking app — with lending, deposits accounts, insurance, and an entire suite of wealth products.

Still, there’s debate around the benefits of a European superapp. The unbundling of financial services means there are already plenty of strong apps that specialise for different financial needs.

So is the superapp a business-model gimmick, or genuinely beneficial to users?

“We want to get 10m customers. That won’t come with just doing stuff for ourselves,” argues Chiche.

“The big change [with adding investment features] is that you don’t need to send the money to the investment app. So it’s instantly debited. And if you think about it philosophically, we just give you access to all your money at once … It’s always available to you. So if you want to buy a computer, and you have £900 in investments, you can enjoy it anytime.”

Chiche adds that the strategy will ultimately help newcomers like Lydia lure users from banks — but not destroy them.

“I don’t believe big tech is going to kill banks or anything like that,” Chiche says. “It’s like what happened in e-commerce. If you look at the US, number one is Amazon, sure. But Walmart is number two.”

To hit its target, Lydia wants to double its 160-strong team over the next year.

Notably however, only a handful will get equity in the company. Chiche confirmed that stock options are not automatic for new joiners, and most employees are not rewarded options.

The profitability question

Unlike British startups, French companies like Lydia are not obligated to share all of their financials. That means there’s little transparency around its revenues, although the company confirmed it was still loss-making.

It’s a change of plan for Lydia, having told Sifted in 2019 it aimed to be profitable by now.

“No we did not make that [milestone]…but we had a lot of unexpected situations since 2019,” Chiche laughs, including pulling out of the UK. “Profitability remains an important objective for us. We now expect it for the French part of the business in 2023.”

Assuming it reaches that new deadline, it will have taken Lydia ten years to break even.

Nonetheless, the company has kept costs unusually modest compared to Revolut and Monzo, raising just €257m in total and avoiding any marketing. Moreover, the vast majority of its revenues come from subscription fees, rather than interchange, which is arguably more sustainable.

Its new investment platform could also be a big moneymaker, with the average trade size so far standing at €30. Companies make money from these trades by charging a spread or commission. They can also make a margin on international stocks by charging on foreign exchange.

Profits aside, Lydia’s journey illustrates the evolution of France’s tech ecosystem.

The country has gone from having zero tech unicorns at the start of 2021 to having a herd of five, with Lydia standing alongside Ledger, Alan, Sorare, and Owkin.

The French government has doubled down on making France a ‘fintech hub’ in recent years, and it seems to be working. France is now among the top three destinations in Europe for fintech investors, new data shows, having narrowly overtaken Sweden for the first time.

Credit: Source link