ipopba/iStock via Getty Images

A Quick Take On FutureTech II

FutureTech II Acquisition Corp. (NASDAQ:FTII) has raised approximately $100 million from an IPO at a price of $10.00 per unit, according to the terms of its most recent S-1/A regulatory filing.

The SPAC (Special Purpose Acquisition Company) intends to pursue a merger with a company in the sectors of ‘disruptive technologies, for example, artificial intelligence, robotics, and any other technology innovations.‘

My approach is to seek SPACs where the executives have significant industry operating experience as well as at least one SPAC with a track record of success.

So, absent those two characteristics, I‘m on Hold for FTII at the present time.

FutureTech II Sponsor Background

FutureTech II has 2 executives leading its sponsor, FutureTech II Partners LLC.

The sponsor is headed by:

-

Chief Executive Officer Yuquan Wang, who was the founding partner of Haiyin Capital and has been a board member of robotics companies and other technology firms.

-

Chief Financial Officer Michael Greenall, who is the founder of Kairos Villa, an eco-resort in Malaysia and has been the Managing Director and Head of Equity for BNP Paribas Malaysia.

The SPAC is the first vehicle by this executive group, even though the name has the roman numeral ‘II‘ which has typically been used to denote the number of SPACs sharing the same name as part of a series.

FutureTech II‘s Market

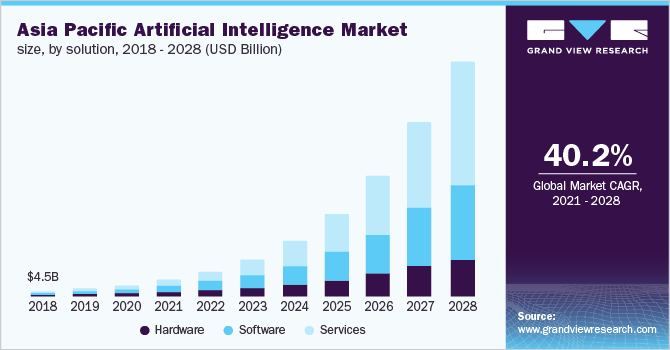

According to a 2021 market research report by Grand View Research, the global market for artificial intelligence applications was an estimated $62.4 billion in 2020 and is forecast to reach $931 billion by 2028.

This represents a forecast CAGR of 40.2% from 2021 to 2028.

The main drivers for this expected growth are a growing use of AI technologies across all industry verticals as companies seek to improve efficiencies and develop new products and services.

Also, below is a chart showing the historical and projected future growth trajectory of AI in the Asia Pacific market:

Asia Pacific Artificial Intelligence Market (Grand View Research)

FutureTech II‘s SPAC IPO Terms

New Rochelle, New York-based FutureTech II sold 10 million units of Class A common stock at a price of $10.00 per unit for gross proceeds of approximately $100 million, not including the sale of customary underwriter options.

The IPO also provided for one warrant per share, exercisable at $11.50 per share at least 30 days after the completion of its initial business combination and expiring 5 years after completion of the initial business combination or earlier upon redemption or liquidation.

The SPAC has 18 months to complete a merger (initial business combination). If it fails to do so, shareholders will be able to redeem their shares/units for the remaining proceeds from the IPO held in trust.

Stock trading symbols include:

-

Units (FTIIU)

-

Warrants (FTIIW)

-

Common Stock (FTII)

Founder shares are 20% of the total shares and consist of Class B shares.

The SPAC sponsor also purchased 415,075 units at $10.00 per unit in a private placement. The units are identical to the public units but may not be transferred ‘until 30 days after the consummation of the Company‘s initial business combination except to permitted transferees and [b] the warrants included as a component of the Private Placement Units, so long as they are held by the Sponsor or its permitted transferees, will be entitled to registration rights.‘

Conditions to the SPAC completing an initial business combination include a requirement to purchase one or more businesses equal to 80% of the net assets of the SPAC and a majority of voting interests voting for the proposed combination.

The SPAC may issue additional stock/units to effect a contemplated merger. If it does, then the Class B shares would be increased to retain the sponsor‘s 20% equity ownership position.

Commentary About FutureTech II

The SPAC is another recently-funded vehicle that seeks to focus on artificial intelligence enabled company targets.

The AI industry is quite large and is more of a horizontal industry as its technologies touch so many other industries. It‘s becoming kind of like the Internet as an industry in that it permeates so many industries.

The SPAC‘s leadership executives have significant investment industry experience but no obvious AI or high tech industry operating experience.

Additionally, this is the first SPAC vehicle by this management duo, so they have no track record of investment returns in the SPAC industry.

Investing in a SPAC before a proposed business combination is announced is essentially investing in the senior executives of the SPAC, their ability to create value and their previous SPAC track record of returns to shareholders.

The cost of that investment is roughly 20% of the upside to the SPAC sponsor, but the time frame for realizing a significant gain can be far faster, a 1- to 3-year time period for a SPAC versus 10 or more years for a typical venture capital fund.

With so many SPACs to choose from and a limited number of high quality targets, it‘s important for investors to be ‘picky‘ about which SPACs to focus on.

My approach is to seek SPACs where the executives have significant industry operating experience as well as at least one SPAC with a track record of success.

So, absent those two characteristics, I‘m Neutral on FTII at the present time.

Credit: Source link