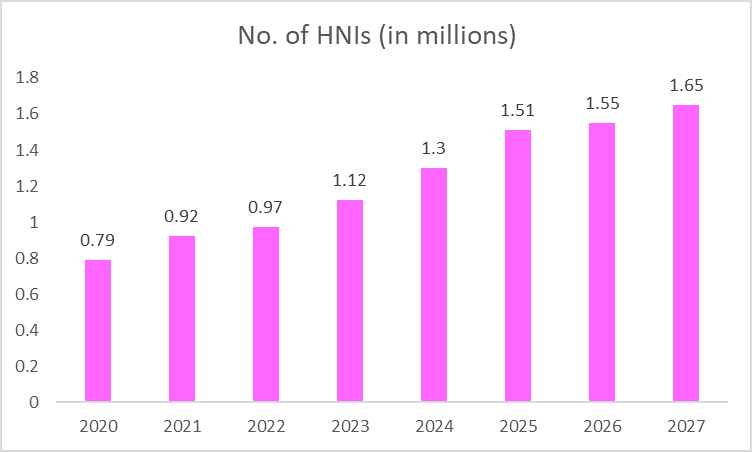

The landscape of wealth management in India is undergoing a dynamic shift, driven by a surge in the number of High Net Worth Individuals (HNIs) and their evolving investment preferences. With a projected Compound Annual Growth Rate (CAGR) of 16%, India’s HNI population is expected to reach 1.65 million by 2027. This growth is catalyzing new trends in wealth management and presenting lucrative opportunities for investors looking to tap into India’s expanding wealth ecosystem.

As HNIs continue to grow in number and wealth, their investment preferences are also diversifying. From traditional assets like equities, mutual funds and gold to emerging avenues like private equity, SMEs, and Alternative Investment Funds (AIFs), the wealth management industry in India is gearing up to cater to a sophisticated and discerning investor class. This article delves into the key trends and preferences of HNIs, with a special focus on the wealth management landscape in India, including the role of family offices and various investment avenues such as private equity, SME financing, and Alternative Investment Funds (AIFs).

Market Dynamics of Wealth Management in India

The wealth management industry in India is evolving rapidly, driven largely by the growing number of High Net-Worth Individuals (HNIs). India has seen a significant rise in the HNI population due to increased economic growth, stock market performance, and wealth creation from sectors like technology and real estate.

The above chart illustrates the rapid growth of the HNI population in India, highlighting the expanding wealth base and the opportunities for wealth managers to tap into this lucrative market.

The wealth management sector in India is undergoing rapid transformation. This growth is driven by a ‘Triple Multiplier Effect’ comprising the increase in the number of HNIs, asset appreciation, and incremental growth in individual incomes. The sector itself is experiencing a CAGR of 25-30%, fueled by these primary growth drivers. This robust growth is creating significant opportunities for wealth management firms, financial advisors, and related service providers.

Prominent platforms and financial advisory firms that cater to investment opportunities:

Platforms such as Planify, Altius Investech, and Kap Table are emerging as key facilitators in this space, offering HNIs access to exclusive deals in unlisted shares and private equity.

Planify offers a wide range of unlisted investment opportunities; it also it delivers detailed financial analysis, due diligence, and advisory services to help investors make informed decisions. Planify provides HNIs and investors with an unparalleled mix of investment opportunities, financial insights, and dedicated client support to help them achieve superior returns through strategic wealth management.

Planify’s Venture X Fund is particularly noteworthy, designed to help HNIs and ultra-high-net-worth individuals (UHNIs) tap into high-growth startups and private companies. Planify Venture X is a carefully curated fund that offers exposure to some of the most promising companies in India before they hit the public markets.

Family Offices: A Growing Trend in Indian Wealth Management

One of the most significant trends among Indian HNIs is the rise of family offices. Family offices act as dedicated entities managing the wealth of ultra-high-net-worth individuals (UHNIs) and families, providing personalized investment strategies, estate planning, tax optimization, and philanthropy management.

In India, family offices have grown in prominence over the past decade, as more HNIs look to streamline their wealth management activities and ensure long-term preservation of wealth. These offices manage diversified portfolios across various asset classes and focus on sustainable wealth creation for future generations.

Family offices are also playing a pivotal role in the rise of private equity (PE) and venture capital (VC) investments among HNIs. With more HNIs seeking exposure to high-growth sectors, family offices are increasingly participating in private equity deals, investing in startups, and taking a hands-on approach to portfolio management.

Investment Preferences of Indian HNIs: A Shift Toward Diversification

The traditional investment vehicles such as real estate and equities continue to remain popular among Indian HNIs, there is a notable shift toward diversification. HNIs are now looking to diversify their portfolios across alternative investments like private equity, SMEs, AIFs.

- Private Equity and Venture Capital

Private equity is becoming a key avenue for Indian HNIs, particularly those with entrepreneurial backgrounds. HNIs are increasingly investing in high-growth startups and private companies, either directly or through private equity funds. This allows them to participate in the long-term value creation of emerging businesses while diversifying their investment portfolios.

- Alternative Investment Funds (AIFs)

AIFs have gained significant traction among HNIs in recent years. These funds offer HNIs access to a range of alternative asset classes, including hedge funds, private equity, infrastructure, and real estate. With the Securities and Exchange Board of India (SEBI) providing a regulated framework for AIFs, more HNIs are turning to this vehicle to explore new opportunities for portfolio diversification and capital appreciation.

- Investments in Small and Medium Enterprises (SMEs)

HNIs are increasingly interested in SMEs, particularly in sectors like manufacturing, technology, and consumer goods. SMEs offer attractive growth prospects and the potential for significant returns, particularly for HNIs who are willing to take a hands-on approach to their investments. By supporting these businesses, HNIs can also play a role in fostering economic growth and job creation in India.

Conclusion

The wealth management industry in India is at a pivotal moment. With a growing HNI population, increasing asset appreciation, and the rising popularity of alternative investment avenues like private equity, SMEs, and AIFs, the future looks promising for both investors and wealth management firms.

The key for HNIs will be to stay ahead of market trends, diversify their portfolios, and leverage the expertise of family offices and wealth managers to optimize returns. As technology continues to reshape the wealth management landscape, investors will also need to embrace digital solutions to enhance their investment strategies and gain a competitive edge.

Investors looking to capitalize on India’s growing wealth ecosystem should pay close attention to the evolving preferences of HNIs and explore new opportunities in alternative investments. By staying informed and adapting to the dynamic market environment, they can unlock the full potential of their wealth and achieve long-term financial success.