2021 was ‘The Year Of Unicorns’, with 43 startups achieving a valuation of $1 billion or more. Together, the unicorns even managed to corner most of the record $34 billion worth of venture capital that flew into Indian startups.

LetsVenture, which connects startups with investors, has released a report that uncovers the early-stage investing activity by analysing data from over 7,000 startups and investors who registered in 2021.

Last year, it witnessed a 23 percent rise in startups applying to raise funds and recorded a 30 percent jump in investors wanting to turn angels. Overall, more than 225 deals were closed on the platform — a 120 percent jump over 2020.

Here’re the six emerging trends from the early-stage startup ecosystem of India:

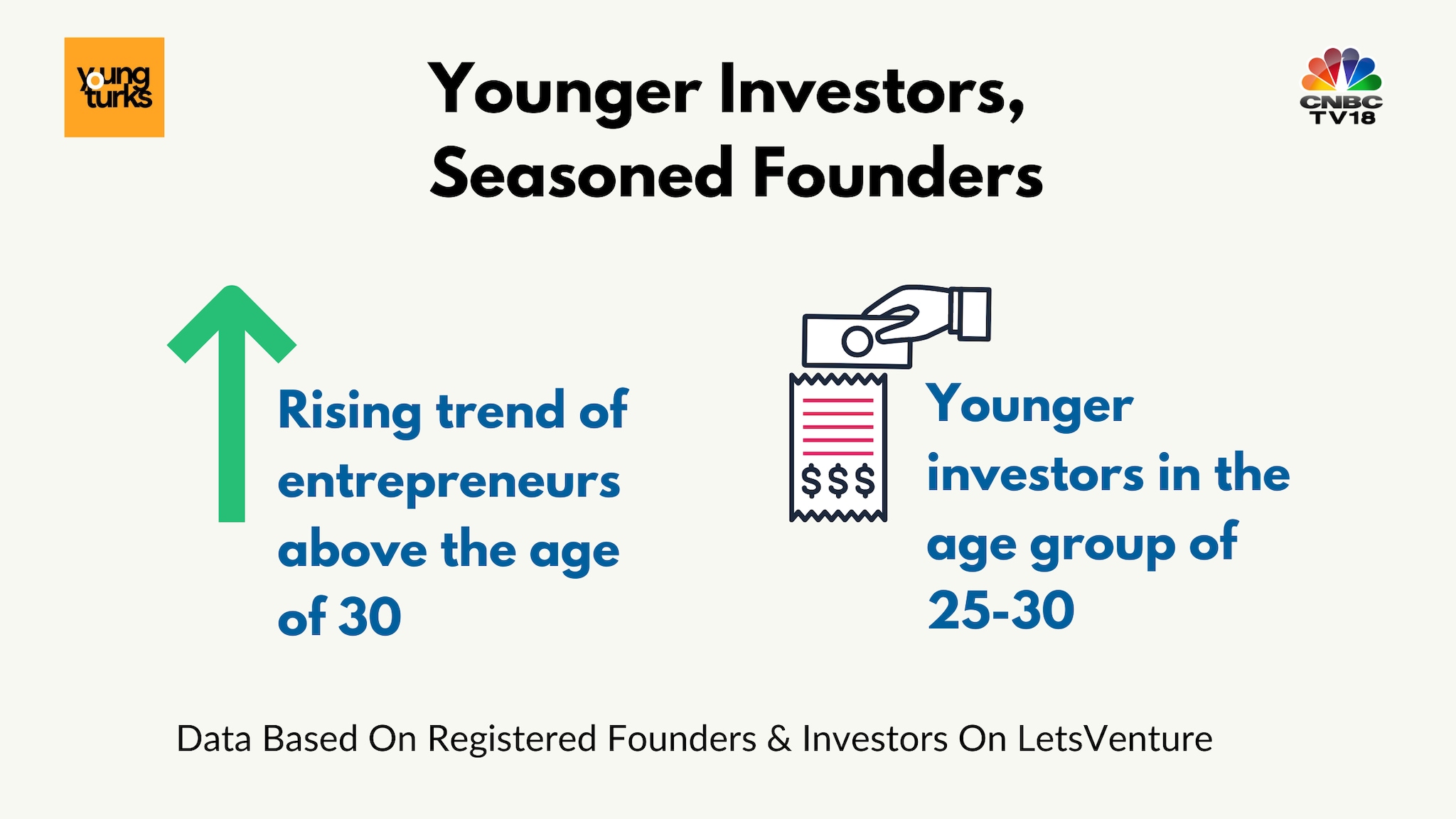

1. Younger investors and seasoned founders rule the roost

In the previous years, the startup ecosystem largely saw seasoned investors and younger founders dominating the sector.

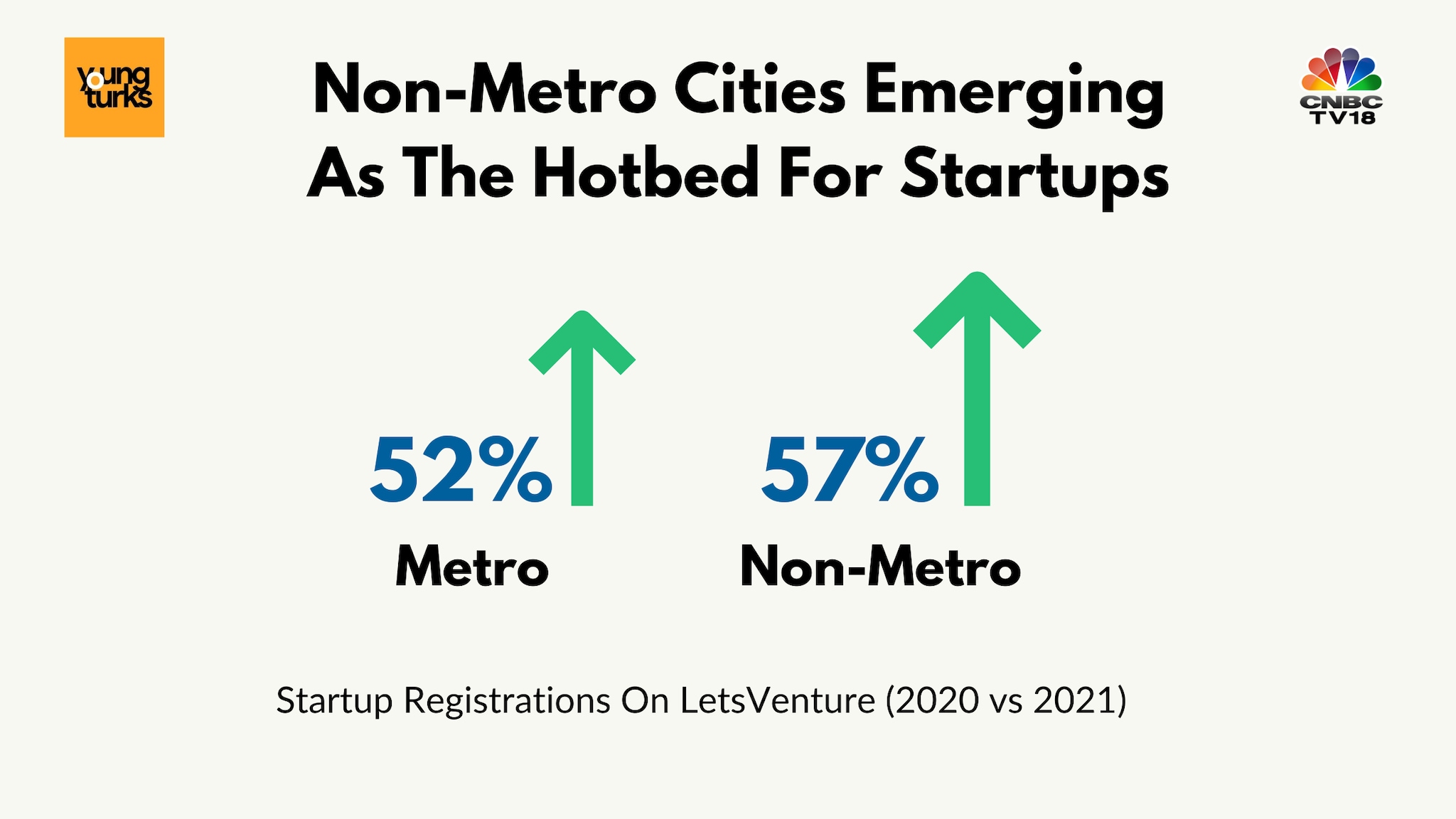

2. Small-town India enters the startup race

During the pandemic, work-from-anywhere enabled startups from non-metro cities to compete with their metro counterparts owing to the larger availability of talent and resources, according to the LetsVenture report.

In 2021, the platform witnessed a 54 percent jump in investors registering from non-metro cities. Whereas, there was an 88 percent increase in investors from metro cities.

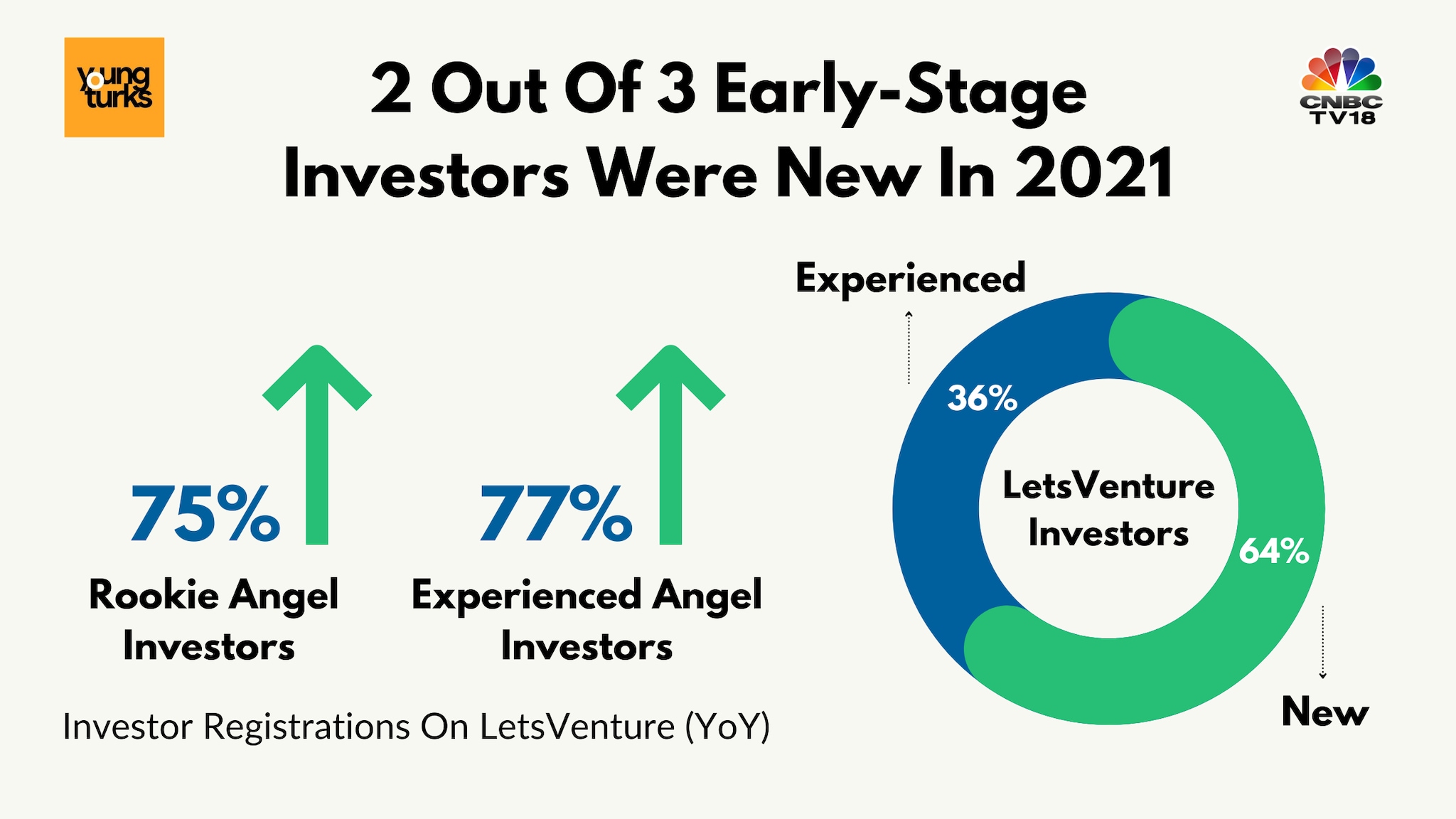

3. Jump in investors with no prior experience of angel investing

Two out of three investors pumped money into a startup for the first time in 2021. Moreover, most of them were keen on entering early (seed and angel rounds) than later (growth rounds). With rising awareness and popularity for startups, LetsVenture expects new angel investors to surpass experienced investors in 2022.

4. Singapore topples U.K., but the U.S. continues to send more angel investors

The U.S, Singapore, UAE, UK and Qatar were the leading foreign countries from where angel investors registered on LetsVenture.

IPOs, exits, and China’s crackdown on its tech companies have led to a lot of U.S.-based investors sharpening their focus on the Indian market, explained Ramaswamy.

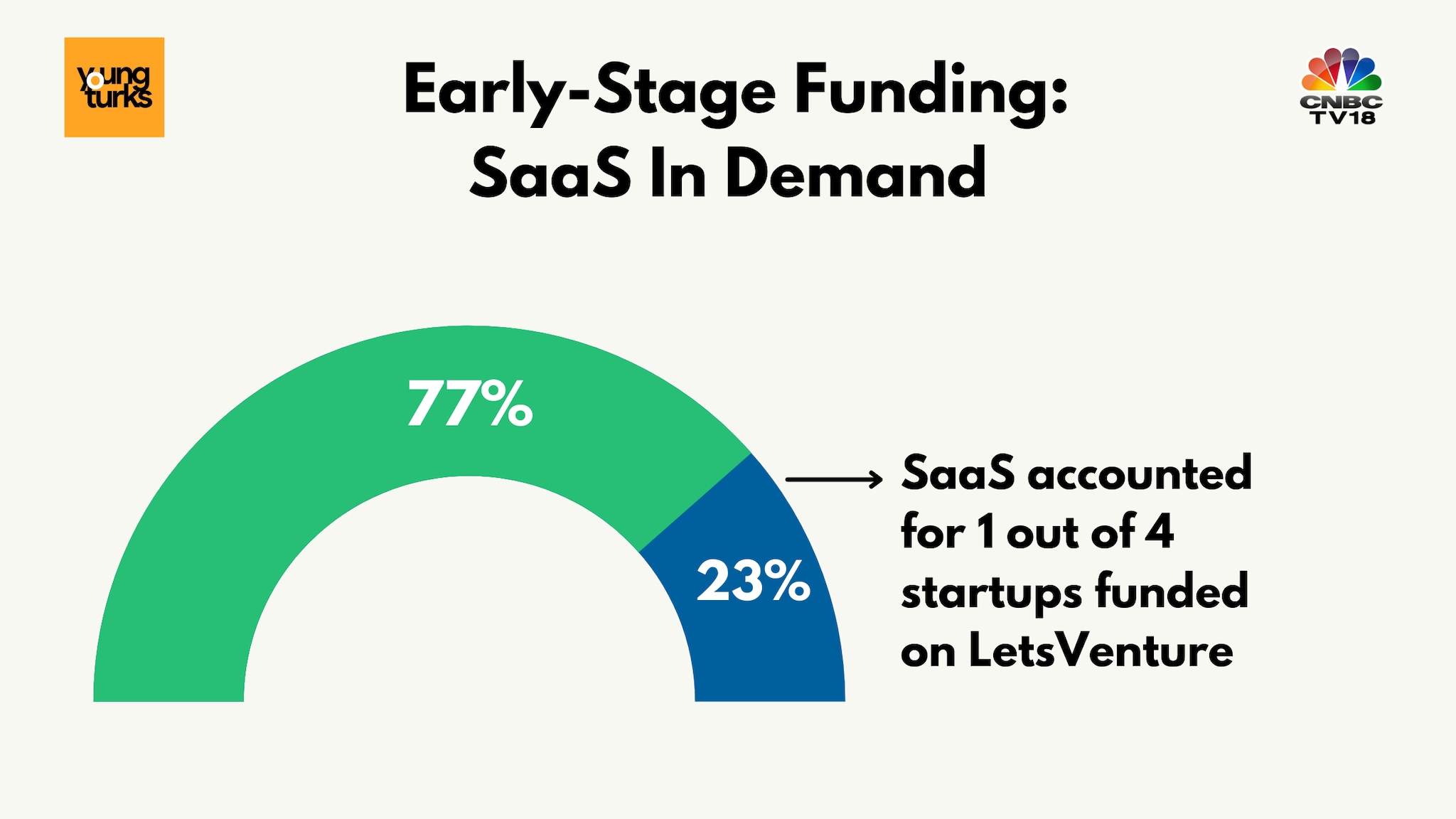

5. SaaS: The darling of the early-stage investor

For investors — new or old, domestic or foreign — Software As A Service is the top pick. With a rise in digitisation and adoption of web-first tools, SaaS was an investor favourite accounting for one out of four startups funded on LetsVenture.

Healthcare and fintech too were in vogue alongside the regulars — consumer internet and marketplaces.

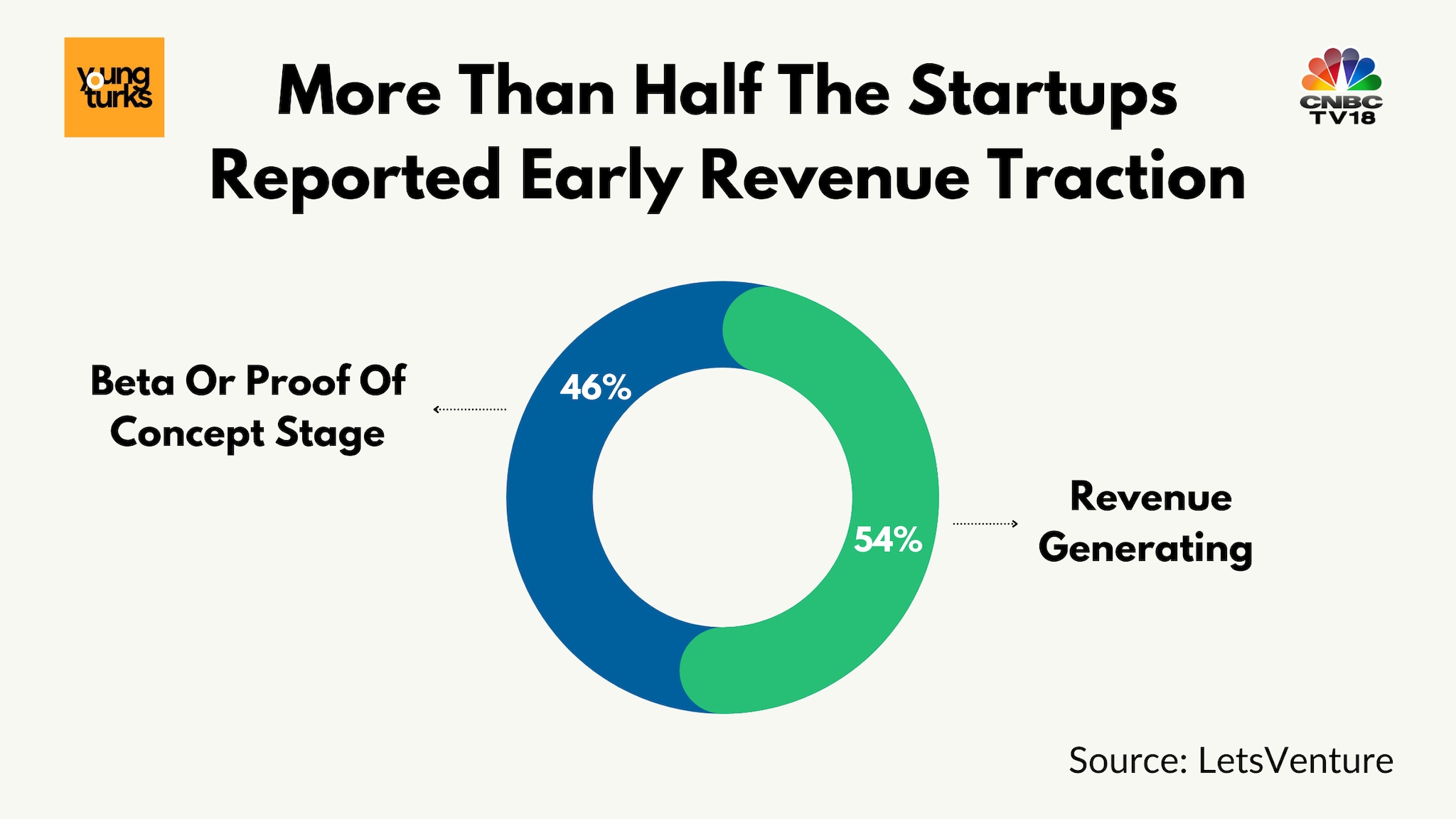

6. More early-stage startups start to show revenue

Amidst the rising competition for funding, early revenue traction is a strong sign in the maturing startup ecosystem in terms of product-market fit and customer affinity, according to LetsVenture.

The platform saw 54 percent of early-stage startups reporting revenue while 46 percent were still in either beta or proof of concept stage.

(Edited by : Kanishka Sarkar)

Credit: Source link