Wondering why many businesses fail? Oftentimes, it’s not because of lacking profits but something else in cash flow.

Poor business cash flow management leads to messy finances, turning your dreams of success into a terrifying reality.

But why wait for disaster when you can improve your cash flow strategy today?

This article explores setting realistic cash flow targets to ensure financial health and growth.

Ready? Time to dig in.

What Exactly Is Cash Flow, and Why Should You Care?

Cash flow shows your money’s movement as you operate daily:

- Cash Inflow: The money you receive from customer payments, loan proceeds, or investments.

- Cash Outflow: The money you pay for bills, suppliers, and loan repayments.

But why should you care?

It’s simple: you can still run out of money despite huge sales. Without a steady cash flow, you can’t pay your dues, give salaries, or plan for the future.

Why Setting Realistic Cash Flow Targets Will Change Your Business Game

Feeling like you’re flying blind when it comes to money? Realistic cash flow targets can change everything. Here’s why.

- Improved financial stability. Clear goals help you anticipate cash shortages, allowing you to act proactively.

- Enhanced decision-making. Knowing your cash flow capacity means you can make better financial decisions.

- Reduced stress. Good business cash flow management means less worrying about how to pay your dues.

In short, realistic targets allow you to control your finances, leading to business growth.

How To Set Cash Flow Targets That Actually Work for Your Business

Don’t know where to start with your realistic cash flow targets? Follow these steps, and you’ll find the process simple and effective.

1) Know your money flow.

Start by tracking your money. How much is coming in and out? Your activity in the past 6 to 12 months will give you hints on your money’s movement.

And if you’re unsure, a cash flow forecasting software like Cash Flow Frog can help you.

2) Identify your baseline. Your activity in the past 6 to 12 months will give you hints on your money’s movement.

Now comes the crucial part: figuring out the minimum cash flow to keep your business running. This is your baseline, the “must-have” cash to cover expenses like utilities, rent, and salaries.

3) Set your goals

Want your business to grow? Then, you’d better think ahead over 3 years further into the future:

- Short-term: Lay out how you’ll pay for immediate needs like bills and inventory restocks.

- Long-term: Plan for growth-promoting activities such as expansion, purchasing new equipment, or further investment.

4) Plan for the unexpected

Things happen when you least expect them, so always prepare for these surprise moments.

Build a cash buffer that can cover 2 to 3 months of your expenses, and you’ll always be prepared for anything.

5) Use smart tools

Why guess when you can have technology on your side? Cash flow management software like Cash Flow Frog tracks your money and modifies your targets as necessary.

These steps make cash flow targets a tool for growth, not just another to-do on your list.

Tips and Best Practices for Nail-Perfect Cash Flow Targets

Cash flow tracking can be tricky, especially if you’re unaware. Here’s how to keep it simple, straightforward, and effective.

Check-in regularly

Your business changes, and so should your targets. Review your numbers monthly to stay on top of things.

Be realistic, not perfect

With several external factors like inflation affecting your business, finding the perfect numbers for your cash flow targets is impossible. Close estimates work just fine.

Use your past data to identify your target numbers. These numbers can guide you even when you adjust your cash flow targets.

Keep your finances separate

Always remember not to mix business money with personal funds. It’s messy and more difficult to manage. Keep it in a separate account to better understand your business health.

Tools and Resources to Help You Set and Monitor Cash Flow Targets

Are you stressed out about cash flow management? These tools simplify the process, providing intuitive forecasting and real-time insights.

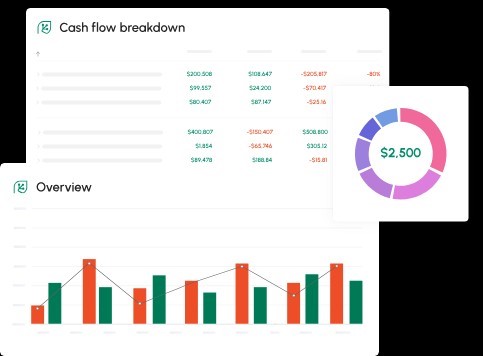

- Cash Flow Software. Software like Cash Flow Frog lets you see your finances in real-time, making it easy to track and forecast.

- Accounting Tools. These tools handle invoices, expenses, and reports in a few clicks.

- Budgeting Templates. A spreadsheet template helps you track your cash flow manually, which is perfect for beginners.

In Conclusion

Cash flow is as essential as other aspects of your business. Without it, you can’t pay your dues or open up growth opportunities. Cash flow management software can help you set realistic targets for your cash flow, ensuring you’ve got everything covered plus a little (or more) extra to grow your business.

Do you have cash flow management software for your business? Share your insights, and let’s empower entrepreneurs together!