The ‘high street’ banking giant says its Bink partnership will create a new channel for retailers to reach millions of customers.

Image source: Bink

Lloyd bank has signed a new “strategic partnership” with Bink, a loyalty-focused fintech it recently invested in, connecting its vast pool of retail customers with retailers’ rewards.

The banking giant, which has 26 million customers, will embed Bink’s technology into its digital channels and offer loyalty programmes to its retail banking customers.

At the start of 2022 Lloyds invested in Bink, which was founded in 2015, following on from fellow incumbent Barclays which invested in the company in 2019.

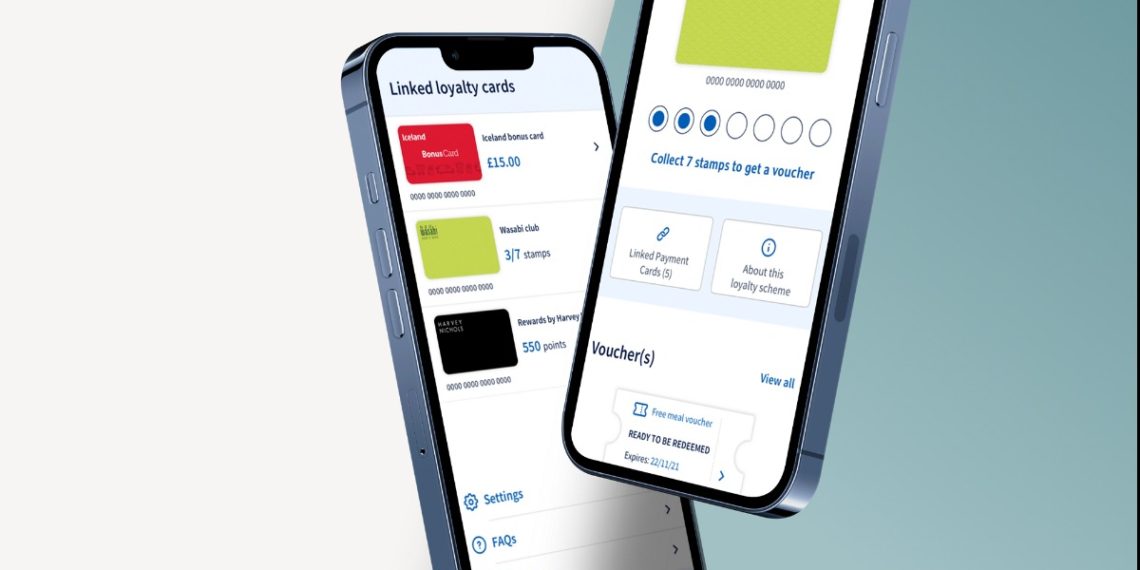

Customer’s payment cards are linked via Bink’s digital infrastructure to participating retailers’ loyalty programmes allowing for a seamless collection of loyalty points stored in Lloyds smartphone app without the need for physical cards.

Bink says the process also allows retailers to get closer to their customers and build “highly accurate customer insights” that can shape business decisions as well as remove friction.

Retailers already offering loyalty programmes through Bink include Harvey Nichols and a number of food retailers such as Iceland, and Wasabi, with SquareMeal.

“Our goal is to make it simpler and more rewarding for retailers and their customers to connect. Our technology allows loyalty programmes to evolve as consumers adopt new payment methods. This partnership adds real scale to our mission, and we are exceptionally excited,” said Mike Jordan, CEO Bink.

Linking payment and loyalty cards together means customers can significantly reduce the amount of plastic in their wallets, and it’s simple to manage all of the schemes through the mobile app or internet banking,” Philip Robinson, Lloyds Banking Group Payments Director, said.

Sign up for our newsletters

Credit: Source link