Imprint, a one-year-old startup that offers branded payments and rewards products, today announced a $38 million Series A funding round co-led by Kleiner Perkins and Stripe.

It’s not every day that a leading fintech player and top-tier venture capital firm co-lead an investment. Notably, Imprint was also co-founded by a VC — Thrive Capital partner Gaurav Ahuja (chairman) along with Daragh Murphy (CEO).

Thrive Capital, Affirm, Allen & Co., Late Show host James Corden, Lloyd Blankfein and unnamed CEOs of consumer brand companies also participated in the financing, which brings New York-based Imprint’s total raised since its 2020 inception to $53 million. The startup had previously raised about $15 million in seed money from Affirm and Thrive Capital.

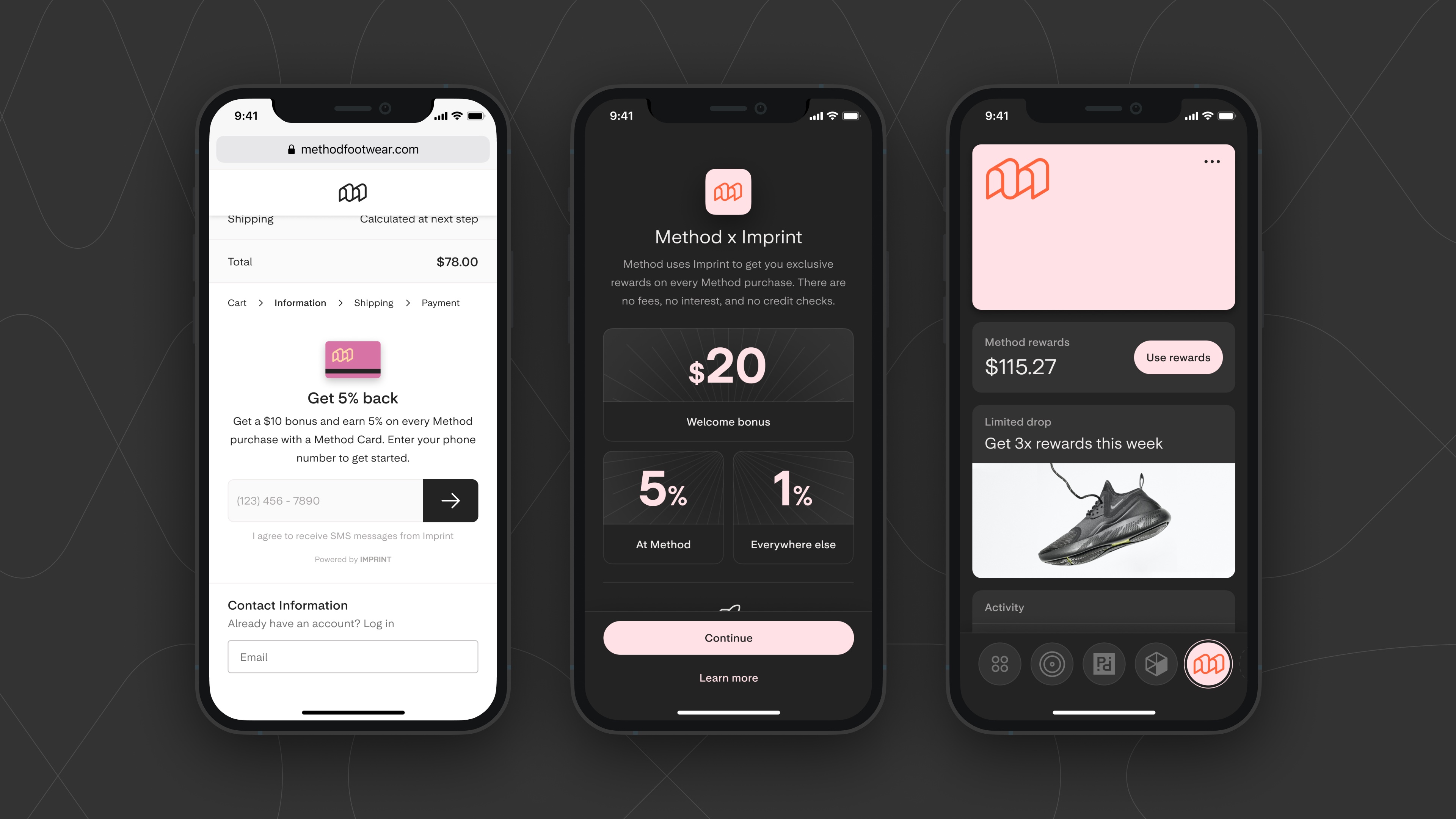

These days, all sorts of cards abound — from virtual cards to co-branded credit cards. Imprint aims to stand out in the increasingly crowded space by partnering with businesses to provide branded rewards cards for customers. Those cards work like debit cards in that a user doesn’t have to undergo a credit check or pay interest and fees, and as they spend, their balance draws down over time. At the same time, a customer has access to a “rich” reward program while a brand “can take ownership of how their customers pay and significantly reduce their cost to process payments,” the company claims. A brand also can benefit from increased retention, notes Murphy.

“We’re really focused on the fact that all brands today have to pay an incredible amount of money for their top line revenue process of payment, and yet none of them get anything in return,” Murphy told TechCrunch. “But if you look back over the last 15 or 20 years one of the most valuable ways for you to get a customer to pay was with a branded card. It used to be credit cards, but we’ve kind of reinvented the model a little so it’s taken away the nastiness of the credit but giving brands the ability to really deepen the relationship with their customers.”

Imprint, instead, saves a brand somewhere between 60% and 90% of the cost of the process of payment. An advantage for merchants, according to Imprint, is that they can use the money they save in payment processing costs toward funding rewards, which in turn theoretically will foster greater loyalty from their customers. For example, each time a customer uses the card with that particular brand, he or she will get a minimum of 5% back. And each time they use it toward a purchase at another brand, he or she will get 1% back. Imprint says it works with each brand to tailor their rewards program.

“We ask the brand to give some of that value back to their customers and so in effect, brands get stickier customers for free, and customers get a much better, much more rewarding way to pay,” Murphy said.

Image Credits: Imprint

The company’s commerce platform apps and APIs also will eventually give merchants a way to integrate their payment method at checkout or anywhere else on their site or in their app.

Chris Sperandio, corporate development lead at Stripe, believes that as consumers’ purchasing behavior continues to evolve, that it makes sense to offer them merchant-specific cards. Not only is Stripe investing in Imprint’s business, but its Issuing infrastructure is also powering its product.

Kleiner Perkins Partner Mamoon Hamid believes that Imprint is offering an “Apple Pay-like experience” for merchants and consumers.

“Imprint is the first company that extends the incredible innovation in fintech to co-branded credit cards,” he wrote via email. “There is an enormous opportunity for modern brands to deliver customer value with new co-branded payments and rewards products, and Imprint is offering a rewarding way to pay without the traditional strings attached.”

Thrive Capital Partner and Imprint Chairman Ahuja said the startup can empower brands by cutting out the middlemen, “pointing economic value traditionally captured by legacy banks back to brands and their customers.”

“This results in customers who are more loyal and higher spenders,” he said in a statement.

Credit: Source link