MGP Ingredients has a large inventory of aged whiskey, but must continue to build out their Branded Spirits Segment. kellyvandellen/iStock via Getty Images

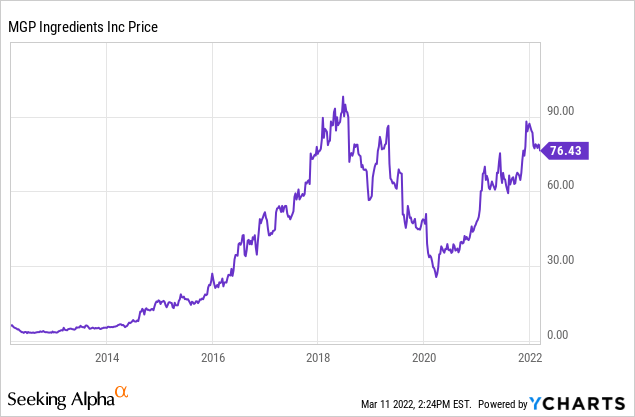

MGP Ingredients (MGPI) has been a stock that we have had a love/hate relationship with over the years. The company’s stock went on one of those great multi-bagger runs from 2014 to a peak in 2018 on the promise investors saw in their brown spirits business; namely aged whiskey. While the company built out additional warehouse space for aging, filled many thousands of barrels for aging, and forged supply agreements with some of the exciting new distilleries being formed across America at the time, investors were most focused on management’s plan to move up the food chain and launch their own brands in order to drive revenues, profits and margins higher. It was a great story until it wasn’t.

After the first quarter of 2018, it was essentially all downhill for investors as the market tired of management announcing each quarter that customers had deferred sales, moved on from supply agreements as their own whiskey had come of age, and brand initiatives were moving slower than many had anticipated. It was a very frustrating time and I vividly remember talking with investor relations and coming away from those conversations wondering if this management team really understood the path forward.

Honestly, we had our doubts but figured that there was still significant value to be realized from the company’s assets. Our belief was that if MGP’s management continued to stumble around that, a takeover offer might materialize even with the concentrated holdings of stock owned by the founder’s family.

M&A Finally Starts in 2021

In January 2021, the company announced that they would acquire privately held Luxco which would help build out MGP Ingredients’ Branded Spirits division and fast track what management had been trying to build out for the last few years. This deal, coupled with the ending of the pandemic and easy comps from 2020, helped the stock propel higher through the end of the year. While the transaction has done a lot of good for MGP, from adding scale, to diversifying revenue streams and even adding some needed expertise and capabilities, we believe the MGP management team needs to continue to make moves and execute on growing the company if they want the stock to continue higher. The Luxco acquisition cannot, and should not, be a one-off event, or one that is not repeated for another few years.

The Path Forward

We believe that MGP management should focus on what they do really well via the Distillery Products segment. If you want to build out production at legacy MGP distilleries and the newly acquired Luxco ones as well, then have at it. BUT, the company should also focus on driving predictable sales for Distillery Products, the continued expansion of Branded Spirits via M&A and the formation of a venture capital arm (to help drive sales, establish a potential pipeline of M&A candidates and create value for shareholders); all of which could help grow revenues and add to shareholder value.

Management should continue to integrate the Luxco transaction but hold off on large-scale M&A while they start a venture capital subsidiary. We believe that a venture capital unit would create significant value for shareholders, establish a deal pipeline for management and help develop captive customers for the Distillery Products segment which could lead to more contract purchases instead of spot purchases. An additional benefit would be that management could work hand-in-hand with some of the best start-ups in the industry and potentially borrow some pages from their playbooks to help grow internal brands.

We envision a scenario where MGP Ingredients would look for viable investments through a venture capital subsidiary via their current clients, past clients and new distilleries looking to become clients. When you control a decent sized supply of new distillate and aged whiskey, and are one of a handful of sellers in this market, deals can be structured in ways that minimize your financial risk while ensuring that any investment you make has minimal downside but a whole lot of upside.

With demand greatly exceeding supply, especially in aged whiskey over 5 years old, it is not unimaginable to see MGP being able to strike a deal whereby they take a minority ownership stake in a smaller distillery in the start-up phase (years 1-5) by supplying them with access to older barrels and charging roughly the market price with deal stipulations allowing MGP the first right of refusal if the distillery were to sell itself and that MGP would be the sole supplier of distillate that was purchased from outside sources.

It would be a win-win, as MGP still gets roughly the same revenue for their inventory, the young distillery gains access to a specific age of barrels they would not have had access to and MGP now gets either a lottery ticket, potential acquisition target or long-term client. Even if a cash investment by MGP was necessary to get the deal done, a supply agreement could be structured in order to make sure potential losses were kept to a minimum and that any capital invested by MGP could be recovered quickly by the profits earned from the barrels sold via the supply agreement.

While many investors probably think of venture funds, or even venture subsidiaries, as a “tech thing”, we disagree. One has to look no further than Diageo (DEO) and their efforts over the years, especially with Distill Ventures, LLP. That venture fund, which is independently managed but funded with Diageo’s capital, has made over $150 million in investments to help portfolio companies grow and continue to prove out their strategy. If MGP Ingredients is going to seriously try and grow via M&A, the venture effort is necessary to create a sandbox in which to evaluate deals and gain deal-making expertise, as well as create relationships that could lead to something more down the road.

Distill Ventures has invested Diageo’s capital in various companies over the years. (Distill Ventures’ website)

In order to maximize returns on M&A, we think that the company might do best to focus on non-distiller producers, or NDPs as they are known in the industry. If MGP has plenty of capacity, and we know that they do as they are adding more in their latest capital allocation plan only for specific brands and geographic regions relating to Luxco, then their money is best spent by adding brand power, not additional production capacity. Management needs to view this transition from an industrial producer to brand producer in a holistic way rather than just moving from Point A to Point B.

Embracing brands and what they do, or can, mean to consumers is key. Yes, you can spend a lot on commercials and advertisements and sink millions into various ad campaigns, but in today’s world the brands that take off resonate with consumers on a different level than buying something just because you saw an ad in a magazine. Most importantly, if the brand resonates deeply with consumers, it is possible to use cheap social media campaigns to drive word of mouth and gain brand recognition and loyalty (for anyone who disagrees, there is a long list of start-ups who did just this utilizing MGP’s aged distillate and some quick search engine queries would quickly prove our point).

Just like the brewery space, modern day distilleries are succeeding by providing consumers with experiences. MGP should view their brands just like they view their barrels in storage; a perfectly curated library. Focusing on M&A targets which create experiences for consumers, and have made their distilleries destinations, would be ideal. Focusing on those distilleries which have done this, all while using your distillate, would be even better as it would enable an easy consolidation and even easier paths for growth.

What many investors miss, and it is a rather important point, is that MGP Ingredients can offer liquidity and a tax-friendly M&A transaction to people in an industry where many companies are family owned or closely-held private entities. There is value in this, and the Luxco deal proves it.

Summary

When the company set up their credit line a few years ago, they were limited to using a max of $100 million per year for acquisitions. That can go a very long way when a company is not using it solely for outright acquisitions and instead is looking at joint-venture opportunities and venture capital investments that would only be available to an industry player such as MGP Ingredients. We believe that the minimal capital that might be required for the venture capital arm would be a very prudent risk for management to take as it could de-risk potential future acquisitions, while driving sales in the present.

Venture investments and additional M&A are the only ways we see MGP Ingredients getting anywhere close to $1 billion in revenues in the next five years. They do not have the brand power or consistent aged barrel sales to grow revenues consistently outside of the low single-digit growth figures they have posted in years past (excluding results tied to the Luxco transaction). After this next quarter, it will become quite obvious to investors that management will have to do more deals to grow both revenues and profits moving forward.

For anyone who thinks otherwise, simply look at the predicament management is about to find themselves in. Based off of current estimates, the company is estimated to report a little over $706 million in revenues for FY2022, compared to $626.7 million for FY2021. For a headline that appears great, as it looks to investors that management has found a way to grow the company’s revenues at 12.5% to 13% a year.

The problem with that is after you get out of Q1’s (the last quarter in 2021 before the Luxco transaction closed) growth of roughly 60% year-over-year, you then have estimates where revenues are flat for Q2, and then show growth of 4% in Q3 and Q4. Worse yet, EPS is projected to be essentially flat to down even with the revenues growing. Outside of selling or spinning off the Ingredient Solutions division, we have a hard time seeing how investors stay excited with the company’s stock trading at roughly a 20 P/E (on a TTM basis and forward looking as well), a yield below 1% and growth not exceeding 10%.

There just does not appear to be a catalyst, other than revenue surprises, that could organically help continue to push the stock higher. Multiple expansion is out of the question without strong EPS growth, revenue growth is about to slow to pre-merger levels and the company is unable to increase payouts to shareholders as they continue to build out their infrastructure and add inventory.

Conclusion

If MGP management had deployed strategies such as this over the last 5-10 years, they might very well already have a majority of their revenues coming from the Branded Spirits segment and have margins trending dramatically higher on the strength of a branded business. They also might have been able to maintain some of the relationships they had with the marquee names among the successful start-ups and created joint ventures so that they did not lose that business when those companies’ own distillates had finished aging in their own barrels.

With the industry still looking for solid aged whiskey, we think that MGP Ingredients’ management team should seriously look at some of the low-hanging opportunities available to them, because some of their potential targets have far more value to MGP Ingredients as a roll-up or bolt-on acquisition than to competitors, or in some cases to their current owners.

Credit: Source link