Nabventures, an early-stage government-backed venture growth fund, is likely to pare down its average investment size per deal amid tighter startup valuations, chief executive officer Rajesh Ranjan told VCCircle ahead of closing 3-4 more deals over the next two weeks.

“We expect liquidity to be tightened in the face of increasing inflation, which may affect startup valuations. The timing of this tightening is uncertain, but is coming nearer with every passing month. Accordingly, we may have to pare down our new investment size per deal exposure from around north of $3-5 million to $1.5-3 million,” Ranjan said over phone.

“We have been countercyclical so far. When liquidity is tight, we over-invest and when liquidity is abundant, we under-invest,” he said.

Nabventures Fund 1, the flagship fund of Nabventures Ltd, a wholly-owned subsidiary of National Bank for Agriculture and Rural Development (Nabard), was floated as a ₹700 crore (around $100 million) venture capital fund in May 2019. It has a base size of ₹500 crore and a greenshoe option of ₹200 crore.

Apart from Nabard, the fund has SIDBI Fund of Funds, Life Insurance Corporation of India (LIC), and Union Bank of India as its contributors. The fund is also in advanced discussions with other banks, insurance companies and family offices to achieve its target corpus of ₹700 crore.

Nabventures will also increase the overall investments from ₹94 crore at present to ₹150 crore over the next 30 days, Ranjan said.

Last week, the fund marked its first exit clocking 2.5x returns on its three-month investment bet on Fraazo, a direct-to-consumer (D2C) brand in the fresh fruits and vegetable space run by VnF Ideas Pvt. Ltd.

Despite extreme bullishness now, Ranjan says that the US Federal Reserve’s expected liquidity withdrawal requires them to match the reward expectations with the risks. “Hence, we have to be cautious and invest in only those parts of the market that are less crowded and not overvalued,” he said.

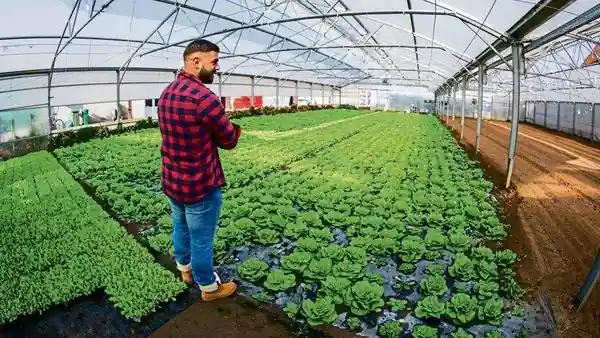

Nabventures is a venture growth equity fund that invests in agriculture, food, rural businesses and agri/rural financial services in early- to mid-stage companies operating in India.

It started deployment of capital in August 2020. “We didn’t invest in the first 15 months as valuations had gone up in a short time despite worsening macro and we were waiting for the right opportunities to invest and didn’t want to invest for the sake of deployment… From August 2020, we went into an overdrive in terms of investments,” Ranjan said.

Since then, Nabventures has deployed around ₹94 crore from the total of around ₹375 crore raised so far.

The investments have been across six startups with seven deals, including two rounds in Jai Kisan, including the recent Series A round in May, which commanded 5x of Nabventures’ entry valuation.

“With a ₹24 crore investment in it, Nabventures is sitting on 162% gross IRR (internal rate of returns) so far. We may invest further in the future rounds as Jai Kisan is the category leading rural fintech player,” Ranjan pointed out.

Overall, the Nabard fund is sitting on estimated IRR of approximately 406% across its portfolio investments.

The fund intends to participate in another follow-on funding round in its two portfolio companies, agri input and produce platform Unnati and omnichannel meat and seafood supplier TenderCuts, over the next few weeks.

Its other bets include soil-tech platform Krishitantra and satellite data analytics startup Satyukt.

Nabventures deployed ₹63 crore in FY21 and aims to invest ₹170 crore in four follow-ons and eight new startups. “In FY23, we aim to deploy ₹225-250 crore,” he said.

“We are proud that in a short period of 12 months, Nabventures Fund has emerged as the best performing agri-food tech VC fund in India today,” said G.R. Chintala, chairman of Nabard.

Nabventures expects to fully deploy the fund between March 2023 and September 2023. “If liquidity tightening happens early, we may accelerate the pace of our investments,” Ranjan said

Never miss a story! Stay connected and informed with Mint.

Download

our App Now!!

Credit: Source link