Gamers love Nvidia computer graphics chips. So do Bitcoin miners and AI gurus. But Nvidia stock (NVDA) is also a darling in ESG investing.

X

The fast-growing maker of high-speed graphics processing units, or GPUs, landed near the top of Investor’s Business Daily’s 2021 Best ESG Companies list. It grabbed the No. 12 position thanks to standout performance for a number of factors that put it ahead in the semiconductor industry.

The company is known for pushing the limits of computer processing. But it wins top ESG ratings for materials sourcing and managing energy use. Plus, profit doesn’t come at the expense of employees, the environment or social responsibility, says Nvidia’s Senior Director of Corporate Social Responsibility Tonie Hansen.

“Our employees are what makes Nvidia great, and why we put them and their families first,” Hansen said. “We focus on creating trusted technology that benefits humanity, and we continually work to make our products more energy efficient to help curb climate change.”

Nvidia is trading above 232 today.

Nvidia Scoring Big Gains For ESG Investing

Corporate social responsibility is no mistake for Nvidia stock. Nvidia routinely keeps investors up to date on how it prioritizes helping humanity and combating climate change.

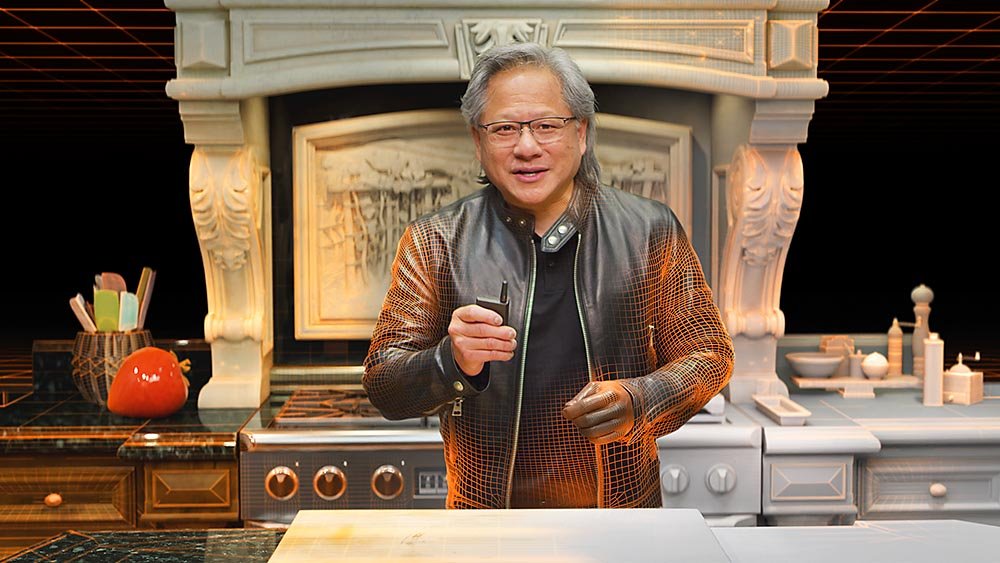

For instance, Nvidia releases an annual corporate responsibility report signed off by Nvidia CEO and co-founder Jensen Huang. “Each year we share in our corporate responsibility report the hard work the people of Nvidia have done to create a more sustainable company and to make a positive impact in our communities, on society, and on the planet,” he stated in the 2021 report.

Specifically, Nvidia tells investors how it’s doing in terms of governance issues like ethics. It also covers economic factors like data privacy and trade issues. In terms of social impact, Nvidia monitors employee health and safety plus community engagement. Environmentally, the company looks at climate change and how its products affect the environment.

“ESG is critical to Nvidia’s mission and a key priority for our board of directors, management, and employees. We believe in transparency and strong engagement with all stakeholders,” Hansen said.

Setting ESG Investing Goals At Nvidia

Nvidia doesn’t just talk ESG investing. It sets tough goals and keeps Nvidia stock investors updated on progress toward them.

The company aimed for 21 ESG investing goals for 2021. They span better disclosures on materials sourcing to keeping work-related injuries below industry averages. It reported hitting more than 80% of the goals. And on the ones it missed, Nvidia reported being within 68% and 98%, respectively.

Last year, Nvidia was ranked No. 1 on IBD’s 50 Best ESG Companies for 2020.

One area it’s most behind on is achieving or exceeding 80% landfill diversion for its Silicon Valley home base. It’s 32% shy of that goal as of the 2021 report. “We set our ESG goals and priorities every year based on feedback from stakeholders, with the intention of being better than what is required of us, going above and beyond regulations and customer requirements,” Hansen said. “For over 10 years, we’ve reported publicly on our priorities, the process we apply to determine them, and our progress in addressing them.”

Nvidia Stock: Big Performer With ESG Investing

Nvidia is a good example of how being ESG investing-aware doesn’t hurt performance, but could arguably help.

“It used to be enough if a company did well financially as part of your portfolio,” said James Katz, CEO of Humankind Investments. “But I think people are starting to realize that the number at the top of their portfolio is just one of the numbers in their life that can impact them.”

Nvidia’s sustainability report points out its gross margin, or percent of profit left from revenue after paying direct costs, actually rose to 62.3% in fiscal 2021. That’s up from 61.2% in fiscal 2019. Additionally, revenue jumped more than 40% in that time.

Additionally, there’s no holding back Nvidia stock, either. Nvidia stock is up nearly 50% over the past 12 months. That easily tops the S&P 500’s roughly 28% rise in that time. Solid fundamentals and stock price action combine into a perfect IBD Composite Rating of 99. And Nvidia stock is part of IBD’s selective Leaderboard list of hand-picked stocks with top-notch prospects.

“ESG matters increasingly to investors interested in social justice and the environment. But even the most coldhearted investor will gravitate to ESG because investors follow the money,” said Jim Kelleher, analyst at Argus Research. “Firms like Merrill and Morgan Stanley — looking ahead to court the next wave of investors, meaning millennials — are heavily promoting ESG. Check out the fund flows into ESG strategies and ETFs in the past 10 years; it is mind-boggling.”

What’s Next For Nvidia Stock And ESG Investing?

Showing it’s far from resting on its ESG investing laurels, Nvidia outlined 24 ESG investing goals for 2022. Some are bold such as a 0% rate of lost-time incident rate in the U.S. It’s also shooting for 100% response rate for standards by cobalt suppliers.

And it’s still going for 80% landfill diversion for its headquarters. “We disclose publicly hundreds of ESG metrics which stakeholders, including investors, have indicated are important for them to evaluate our progress in any given area,” Hansen said.

Soon, many companies will follow Nvidia’s lead. “Eventually, operating ethically will become table stakes, as the alternative will be endlessly defending once-acceptable behavior now seen as abhorrent,” Kelleher said.

Follow Matt Krantz on Twitter at @mattkrantz

YOU MAY ALSO LIKE:

Best Online Brokers For 2021: A Year Of Startling Change

Find The Best Long-Term Investments With IBD Long-Term Leaders

Learn How To Time The Market With IBD’s ETF Market Strategy

MarketSmith Provides Investing Tools That Are Easy To Use

Credit: Source link