This is my second company deep dive. I have been digging deep in the fintech industry lately as I believe it is one of the most exciting battlegrounds for the next few decades, and PayPal is a must-read for fintech investors, given that it pioneered online payments more than 20 years ago. With that said, grab a cup of coffee. This is a deep dive on PayPal (PYPL).

JasonDoiy/iStock Unreleased via Getty Images

Investment Thesis

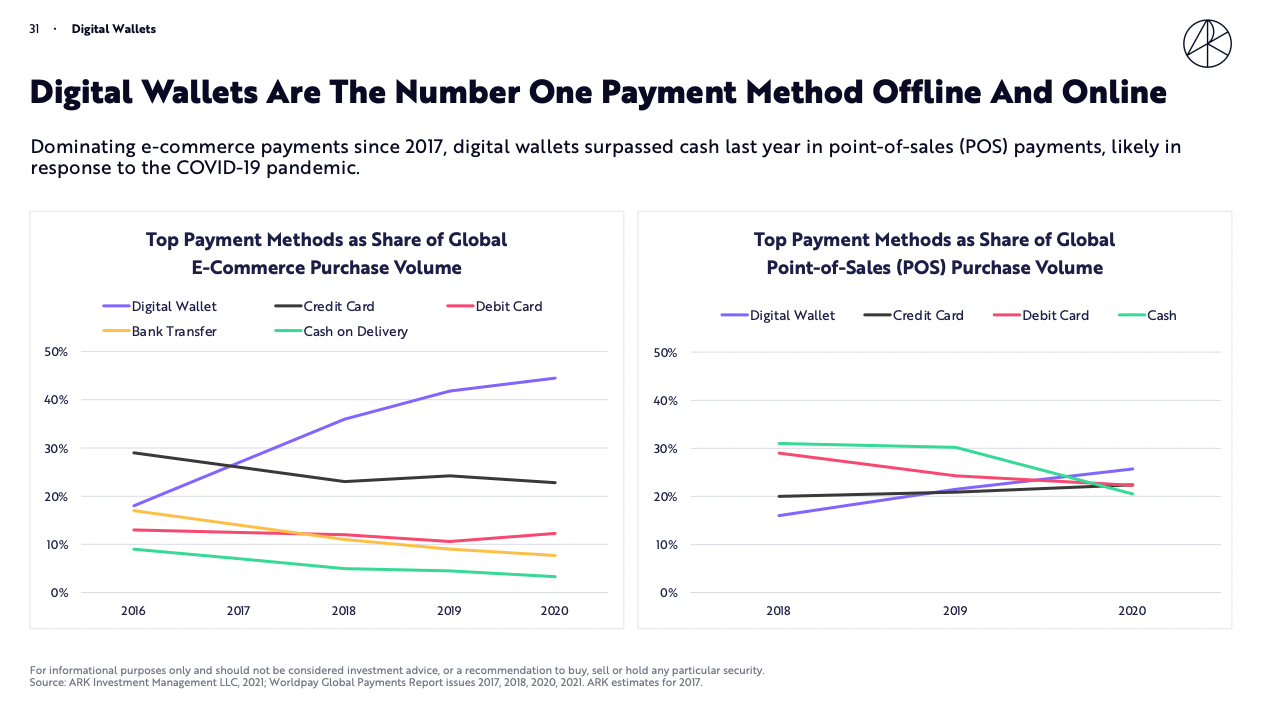

The bull thesis for PayPal is the increasing adoption of digital wallets and PayPal is at the forefront of this shift due to its enormous ecosystem of consumers and merchants. The launch of the SuperApp and management’s shift in strategy to focus on engagement will also be key as PayPal looks to drive meaningful ARPU from this digital wallet trend. However, growth is decelerating quickly due to tough YoY comps and a challenging macro environment. Furthermore, competition from other neobanks and digital wallets is heating up, which may add further pressure in terms of growth. However, PayPal has strong brand and network effect moats that should protect the company from the competition. In addition, the recent crash in the stock puts PayPal at the cheapest valuation multiples since its IPO in 2015. The stock price today provides a substantial margin of safety for investors – PayPal is a deep value fintech play.

Value Proposition

PayPal is the leading digital payments solutions company, offering a variety of financial services and money management tools for consumers and merchants worldwide. Its mission and vision statements can be seen below.

Mission: to democratize financial services to ensure that everyone, regardless of background or economic standing, has access to affordable, convenient and secure products and services to take control of their financial lives.

Vision: to make the movement and management of money as simple, secure and affordable as possible.

PayPal, formerly named Confinity, was founded in 1998 with the sole purpose of enabling people to send payments through email. The company grew in popularity, especially for sellers and buyers in the rising online marketplace, eBay (NASDAQ:EBAY). Initially, payments on eBay were made by checks and money orders sent through regular mail, which was slow and tedious. PayPal replaced it with a safer, easier, and faster payment method. As a result of the success, eBay acquired PayPal in 2002.

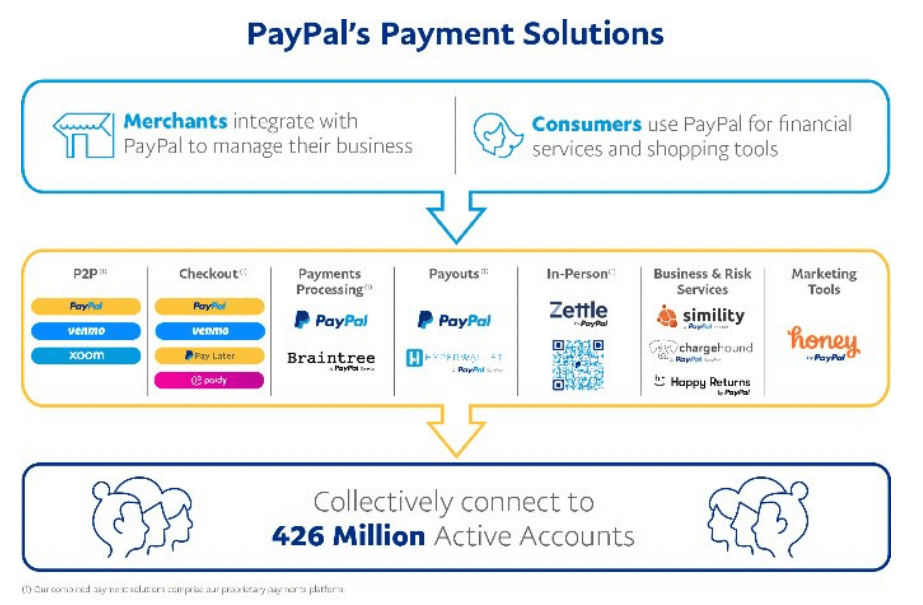

Since then, PayPal has grown into more than just an email payment company. As the company expanded out of eBay, management and investors saw a much bigger potential for PayPal. As such, eBay spun off PayPal and the fintech company became an independent company in 2015. The diagram below shows PayPal’s suite of payment solutions, which it has slowly built over the last two decades.

PayPal FY2021 10-K

-

Braintree – Acquired in 2013 for $800 million, Braintree is a full-stack payments service that enables businesses to accept payments in their app or website.

-

Venmo – Venmo was acquired by Braintree in 2012. PayPal then acquired both companies in 2013. Venmo is a digital wallet and a peer-to-peer (P2P) payment platform.

-

Xoom – Acquired in 2015 for $890 million, Xoom offers fast, easy, and secure ways to make cross-border payments.

-

Hyperwallet – Acquired in 2018 for $400 million, Hyperwallet expanded PayPal’s Commerce Platform, improving its ability to provide payment solutions for global e-commerce marketplaces.

-

iZettle – Acquired in 2018 for $2.2 billion, iZettle expanded PayPal’s offline presence by offering modern physical point-of-sale solutions.

-

Simility – Acquired in 2018 for $120 million to bolster PayPal’s fraud prevention and risk mitigation technology.

-

GoPay (Guofubao) – PayPal took a 70% stake in GoPay in 2019 and finally acquired the company in 2021. GoPay is an online and mobile payments provider in China. As a result of the acquisition, PayPal became the first foreign payment platform to be approved to process transactions in China.

-

Honey – Acquired for $4 billion in 2020, Honey helps online shoppers find deals, apply savings and earn cashback. Honey has 17+ million members and 30,000+ merchants.

-

Happy Returns – Acquired in 2021, Happy Returns enables consumers and merchants to seamlessly process returns at more than 2,600 drop-off locations in over 1,200 unique metros across the US.

-

Chargehound – Acquired in 2021, Chargehound helps merchants automate disputes and chargeback frauds.

-

Paidy – Acquired in 2021 for $2.7 billion, Paidy expands PayPal’s buy now, pay later, or BNPL, offering into Japan. Paidy has over 6 million customers and 700,000 merchants.

Value Proposition: Consumers

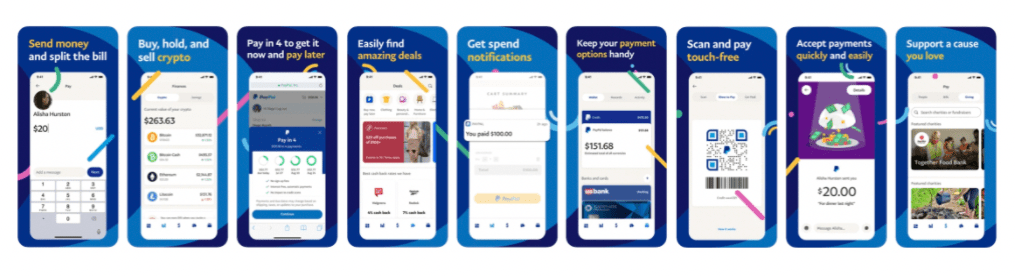

In September 2021, PayPal launched its new app, which in a nutshell, gives investors a good idea of PayPal’s value proposition for everyday consumers.

PayPal App iPhone Screenshots

-

Digital wallet – consumers can store, transfer, and withdraw funds, as well as purchase and receive payments for goods and services through the PayPal mobile app.

-

PayPal checkout – when consumers shop at a merchant’s store, consumers can use a variety of payment methods offered by PayPal. This includes PayPal, Venmo, a credit card, a debit card, cryptocurrencies, gift cards, and eligible credit card rewards. Consumers can also pay via QR codes scans.

-

P2P transactions – PayPal enables consumers to easily move money between family and friends using their PayPal, Venmo, and Xoom products and services.

-

Credit products – consumers can apply for a PayPal- and Venmo-branded credit program. Currently, it is only available in the US, UK, and Australia.

-

Buy now, pay later – launched in August 2020, consumers can now choose pay-over-time as a payment option. There are no late fees for missed payments. It is available in the US, UK, France, Germany, Australia, Spain, Italy, and Japan.

-

High yield savings – In partnership with Synchrony Bank, PayPal offers consumers savings accounts with a 0.40% APY, which is more than 6x the national average of 0.06%. While this sounds attractive, Affirm (AFRM) and SoFi (SOFI) offer higher APY at 0.65% and 1.00%, respectively.

-

In-app shopping tools, deals, and rewards – the new app allows consumers to find exclusive deals from hundreds of popular brands as well as participate in a loyalty program. Consumers can also shop through the in-app browser.

-

Direct Deposit – consumers now have the ability to get paid up to two days earlier with Direct Deposit. Consumers can also configure how much of their paycheck they want to deposit to their PayPal accounts.

-

Bill Pay – consumers can track, view, and pay their bills including TV & internet, utilities, insurance, credit cards, phone, and more.

-

Donations – consumers can support their communities and charities by making donations through the app.

-

Buy, hold, and sell crypto – consumers can manage their crypto holdings in the app.

Value Proposition: Merchants

PayPal’s main value proposition can be summed up into three categories: 1) end-to-end, omnichannel payments and point-of-sale solutions; 2) fraud prevention and risk management solutions; and 3) connect with 400+ million PayPal users.

PayPal helps merchants all over the globe to grow and expand their businesses through the power of digital checkouts. PayPal’s simple and easy-to-integrate solutions enable merchants to quickly deploy digital checkout online and in-store which helps increase sales conversion, increase average order values, and reduce cart abandonment rates.

According to PayPal, merchants experience the following benefits when they offer PayPal as a payment option:

-

Consumers are 3x more likely to complete their purchase

-

Sales conversion increased by 28%

-

19% increase in unplanned purchases

-

13% increase in repeat purchases

-

Higher average order values

PayPal offers great flexibility in terms of payment options as the company accepts all types of online and offline payments. This includes PayPal and Venmo digital wallets, individual credit and debit cards, and even competitor digital wallets like Apple Pay (NASDAQ:AAPL) and Google Pay (GOOG, GOOGL).

Furthermore, PayPal has introduced buy now, pay later, with no additional fee for merchants. It is easy to integrate and poses no credit risk for merchants. According to PayPal, 28% of consumers are more likely to shop at a merchant that offers BNPL and merchants reported a 12% increase in weekly total payment volume and transactions as a result of adopting BNPL.

In addition to digital checkout, PayPal also offers financing for certain small and medium enterprises, which may not be readily available from traditional banks or lenders. The PayPal Working Capital product provides businesses access to fixed-fee loans that are automatically repaid with a percentage of the merchants’ payment volume. The PayPal Business Loan provides businesses with fixed-fee short-term loans based on the health of the business as a whole.

As discussed earlier, recent acquisitions by the company have also amplified the overall value proposition for merchants:

-

Chargehound and Simility – fraud prevention

-

iZettle – physical POS

-

Happy Returns – returns management

-

Honey – increase sales conversion through rewards

PayPal also provides a reliable, secure, and PCI-compliant platform for merchants to conduct business in. The company also provides data analytics tools for merchants to analyze SKU-level data, customer behavior, and business performance. Most importantly, PayPal enables merchants to gain access to PayPal’s network of 400+ million users worldwide. All these are done through PayPal’s two-sided network, which bypasses the card networks (Mastercard, Visa, Discover, and American Express).

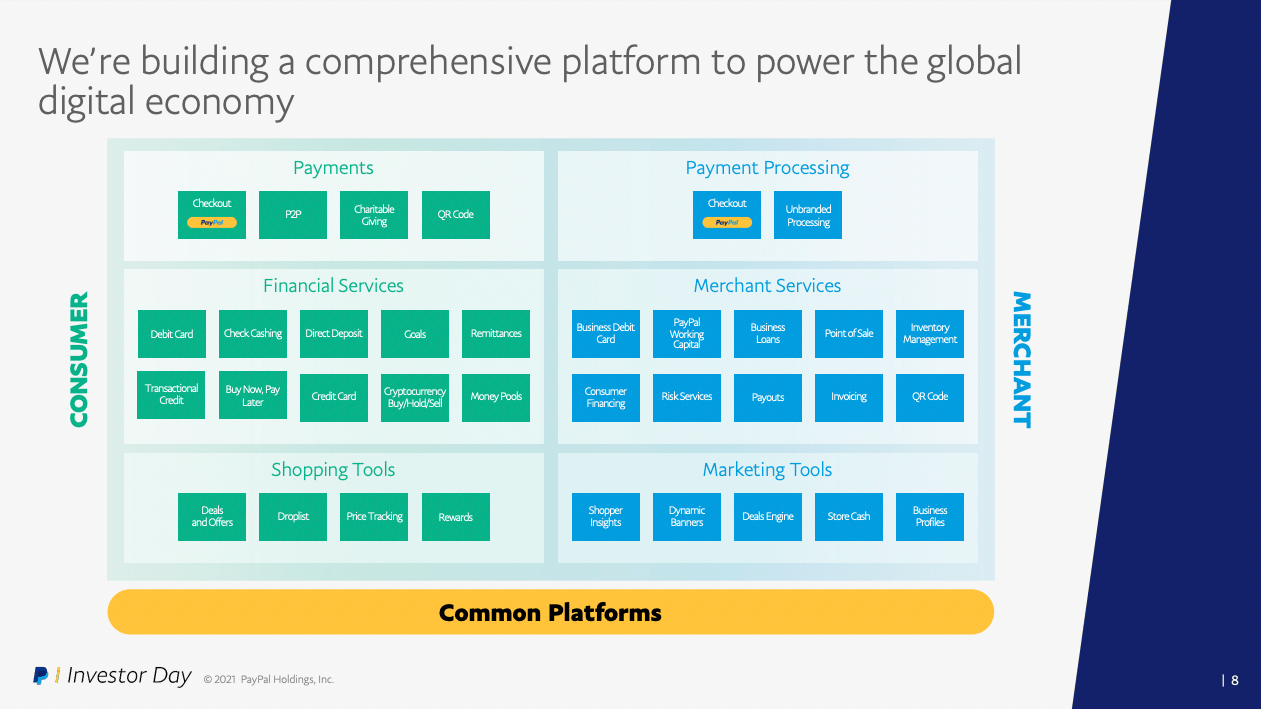

Value Proposition: Summary

PayPal offers one of, if not, the most vertically-integrated payment and money management solutions in the market, which explains why the company is able to grow to the size that it is today.

For consumers, PayPal offers a SuperApp of some sort, providing daily users a one-stop shop to manage their personal finances. Payments, shopping, cashback, crypto investing, savings, the list goes on. And PayPal is adding more and more products each year, which adds to the brand’s stickiness.

For merchants, PayPal offers an omnichannel checkout experience and a seamless payment processing platform. Its platform has proven to increase sales conversion, order value, and repeat purchases, which helps merchants grow their businesses. Ancillary services such as loans, marketing tools, and fraud prevention add even more value to merchants.

PayPal FY2021 Investor Day

Market Opportunity

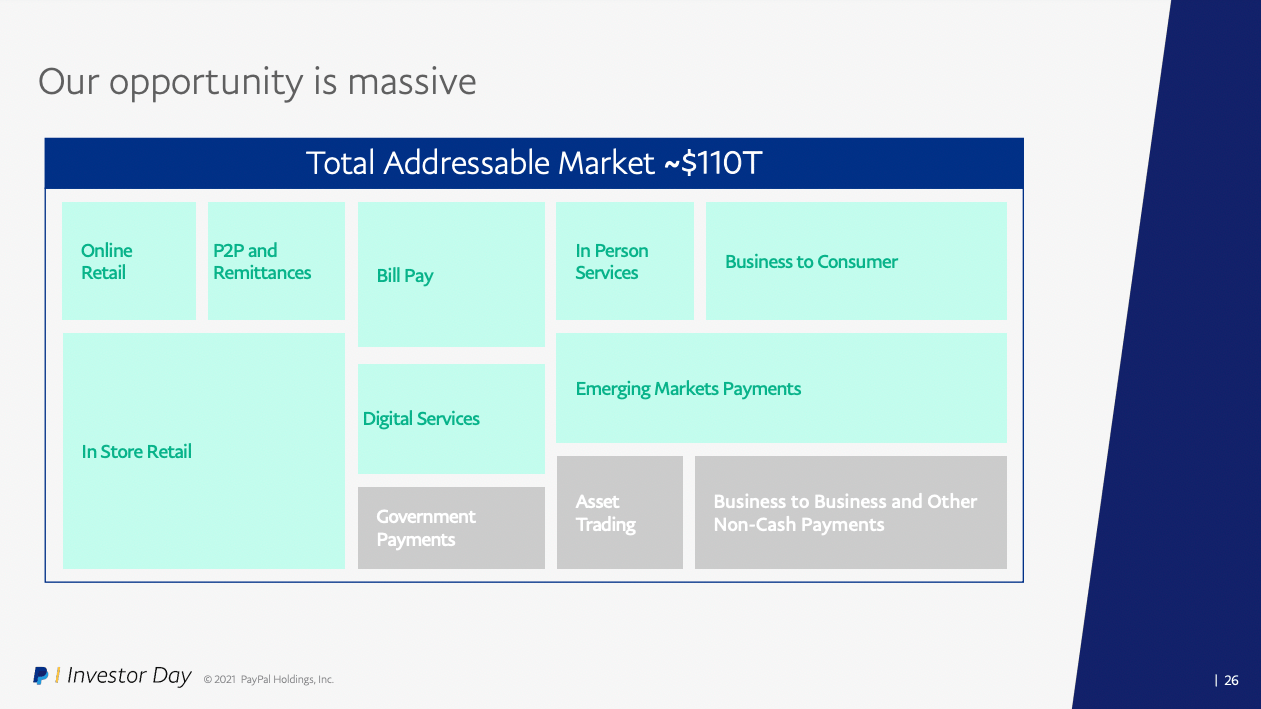

According to PayPal, its total addressable market is $110 trillion. As shown below, the green-colored boxes are areas in which PayPal is already operating in. In the future, PayPal has the potential to expand into the grey boxes. In fact, PayPal is already working on the Asset Trading segment.

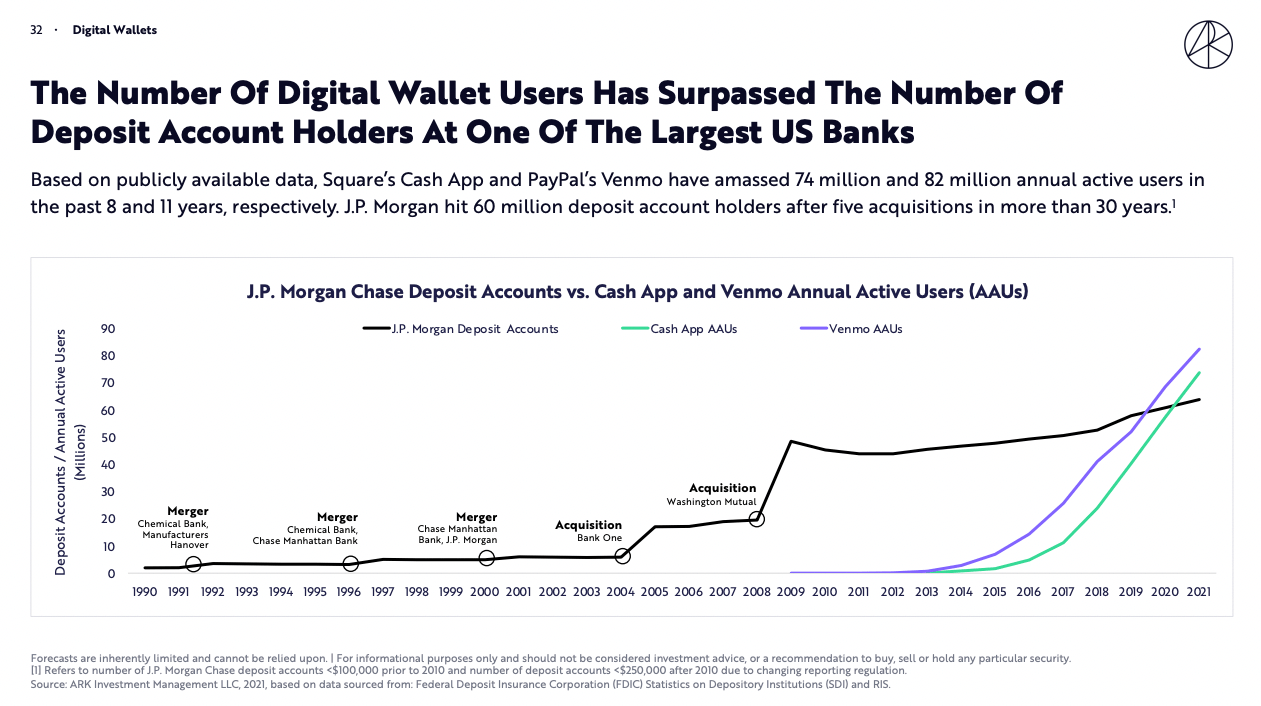

PayPal FY2021 Investor Day ARK Invest

As shown below, digital wallets such as Venmo and Cash App are rising astronomically, surpassing the number of accounts at JPMorgan (NYSE:JPM). Ultimately, ARK Invest expects the US and global digital wallet markets to grow from $400 billion and $1.1 trillion, respectively, to $5.7 trillion and $20 trillion, respectively, from 2021 to 2026.

ARK Invest

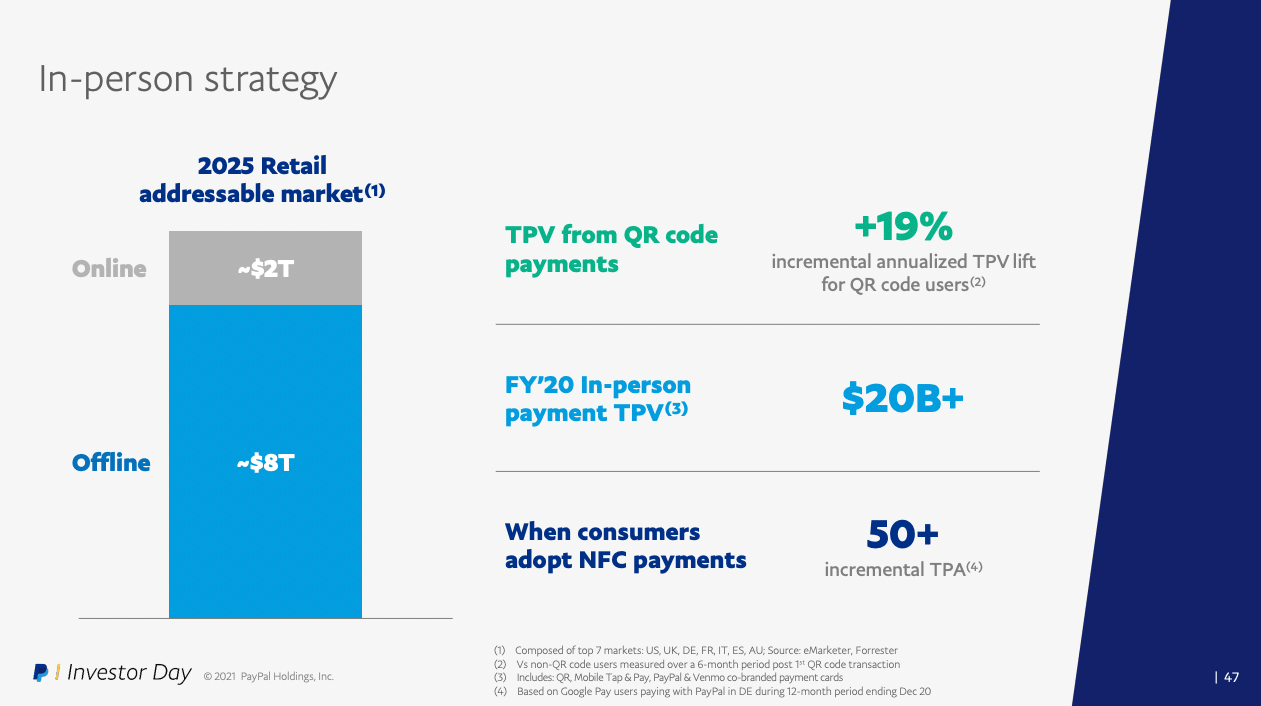

Offline transactions are also a big market opportunity for PayPal as roughly 80% of the $10 trillion retail addressable markets still happen offline. In 2020, PayPal did $20 billion of in-person TPV, which represents only 0.25% of the addressable market. This is the reason why PayPal has recently invested heavily in Zettle, Venmo checkout, and QR Code payments.

(Source: PayPal FY2021 Investor Day)

The BNPL market is also exploding, and PayPal’s recent entry into BNPL is an attempt for the company to capture the growing opportunity. From my Affirm deep dive:

According to Bloomberg, BNPL could increase to $181 billion by the end of 2022, which is double from 2020 levels. BNPL penetration could rise to 4% of e-commerce sales, which accounts for more than 19% of global retail sales. The opportunity in the US is even more attractive. US BNPL penetration was only 3% of e-commerce sales in 2020. For context, Sweden’s and Australia’s BNPL penetration was 23% and 10%, respectively.

Furthermore, PayPal still has a long growth runway ahead as the company capitalizes on the SuperApp opportunity. As we have seen in Asian countries, SuperApps like WeChat, Gojek, and Grab have seen astronomical growth over the years. PayPal is looking to replicate that trend in the US and maybe, globally.

Revenue Model

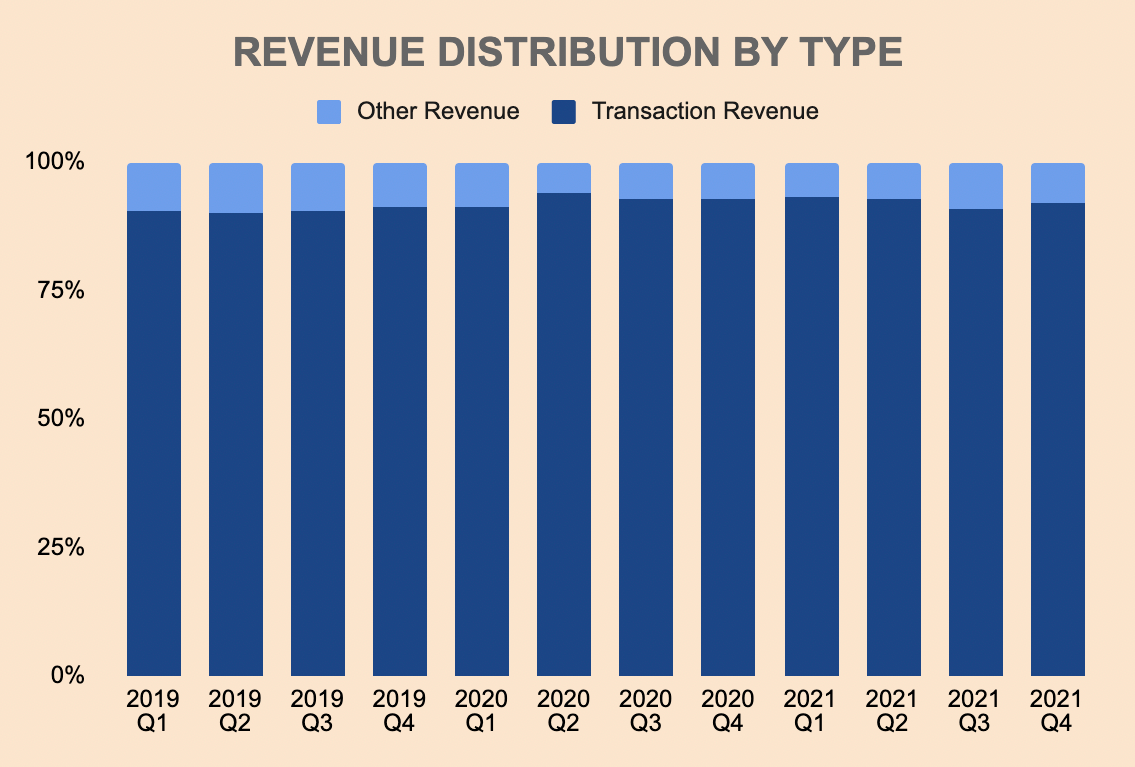

PayPal’s revenue model is fairly simple – the company has two revenue segments, with Transaction Revenue accounting for 90%+ of revenues.

Transaction Revenue

Transaction Revenue consists primarily of fees charged to customers for completing payment transactions. From consumers, PayPal charges fees for foreign currency conversion, instant transfers, buying and selling crypto, using PayPal’s credit products, and other miscellaneous fees. From merchants, PayPal charges for completing payment transactions and other payment-related services.

Transaction Revenue is impacted by:

-

Total Payment Volume, or TPV

-

Merchant, product, and service mix

-

Domestic and cross-border transactions mix

-

Geographic mix

-

Loans receivable outstanding with merchants and consumers

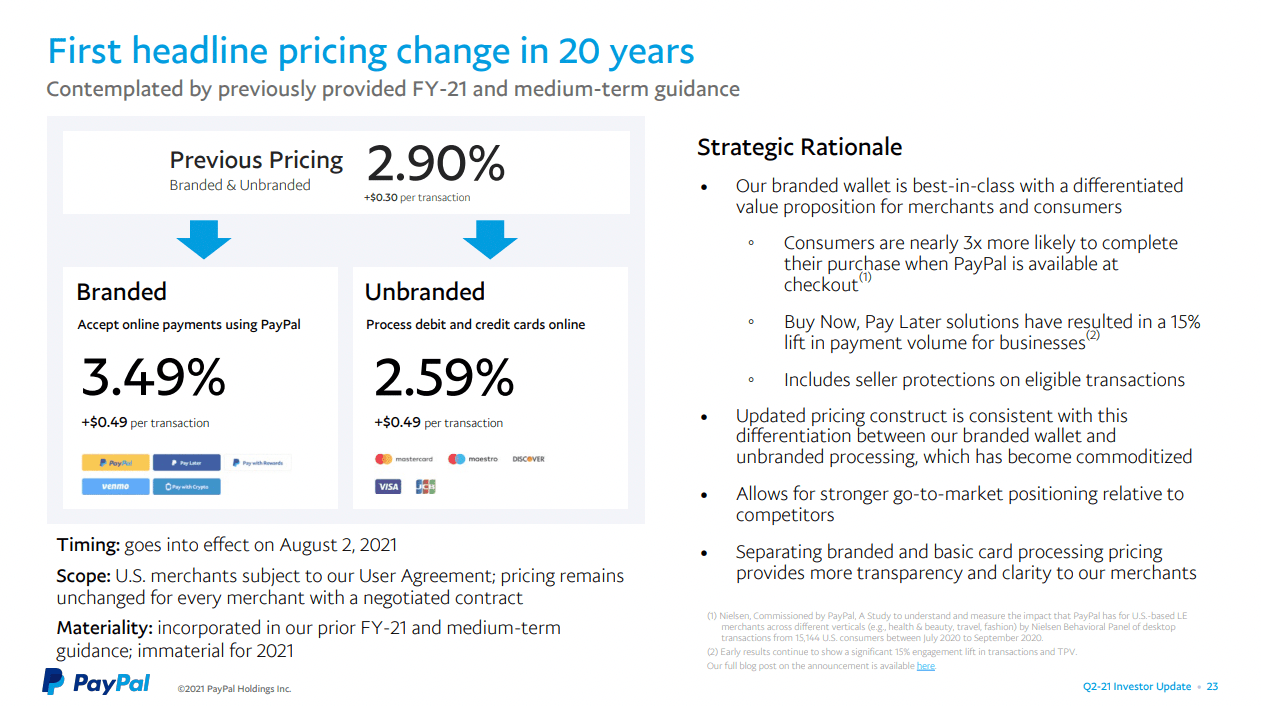

Do note that PayPal made a major price change in Q2 of 2021. For a full list of fees, see here.

PayPal FY2021 Q2 Investor Update

Other Revenue

Revenues from other value-added services consist of revenue earned through partnerships, referral fees, subscription fees, gateway fees, and other services. PayPal also generates interest and fees from loans receivables.

Income Statement

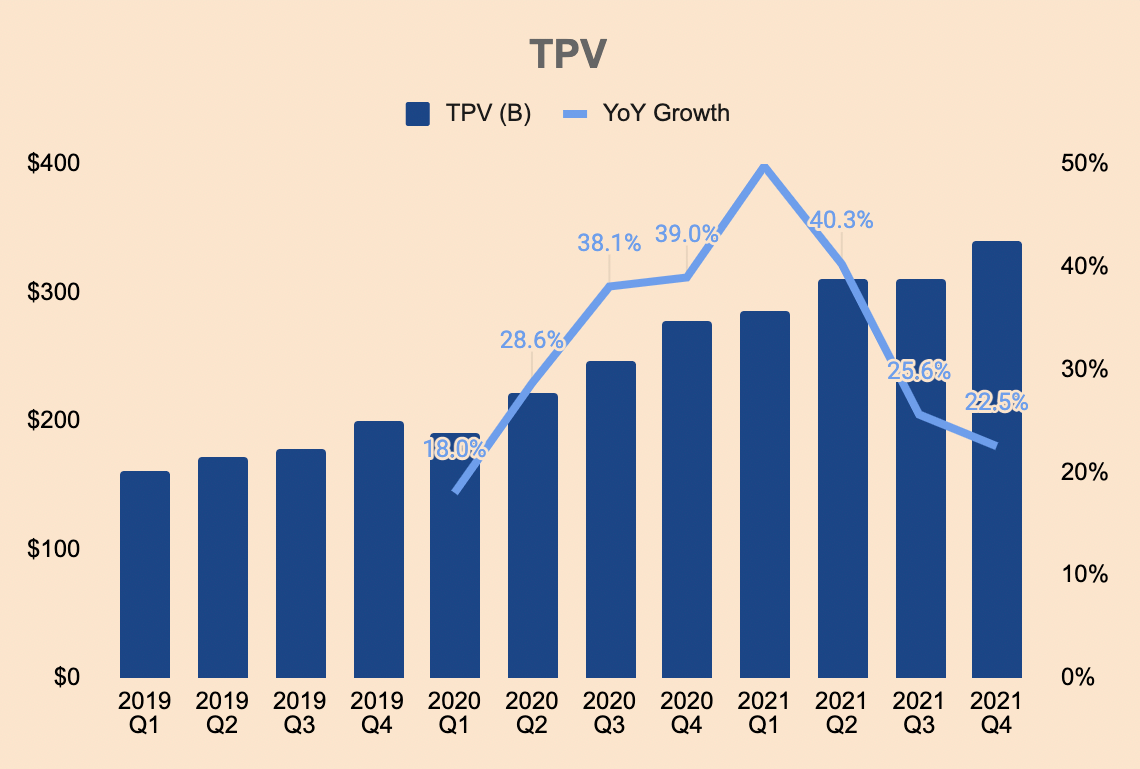

Starting with key metrics, TPV has been in a consistent uptrend. Growth was the strongest during the onset of the pandemic (FY2020) but has experienced deceleration as of recent. TPV in FY2021 was $1.2 billion, up 33% YoY. The latest quarter, however, only grew by 23%, to $340 million. Given the law of large numbers, this deceleration is quite expected as years of growth have been pulled forward due to the pandemic.

PayPal Investor Relations and Author’s Analysis

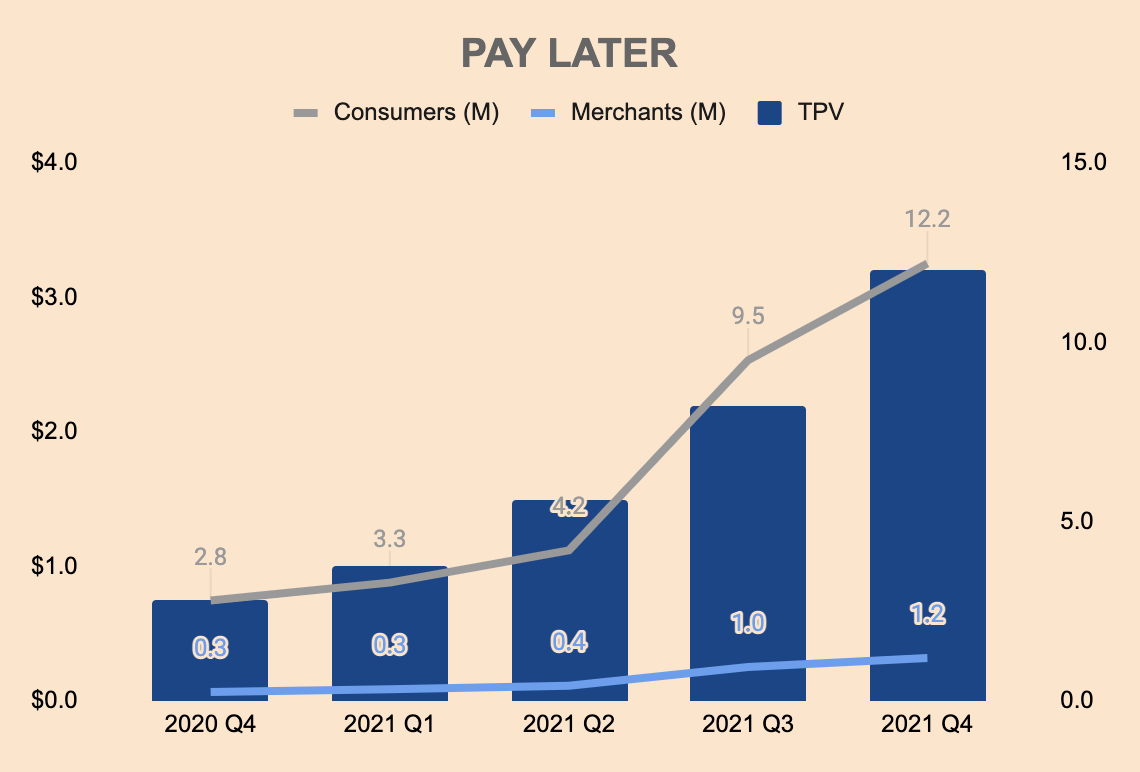

On a side note, PayPal’s newly launched BNPL segment has seen rapid growth, reporting an estimated $7.9 billion of TPV, amassing 1.2 million and 12.2 million merchants and consumers, respectively. For context, Affirm’s TTM TPV was $12 billion, with 168,000 and 11 million merchants and customers, respectively.

PayPal Investor Relations and Author’s Analysis

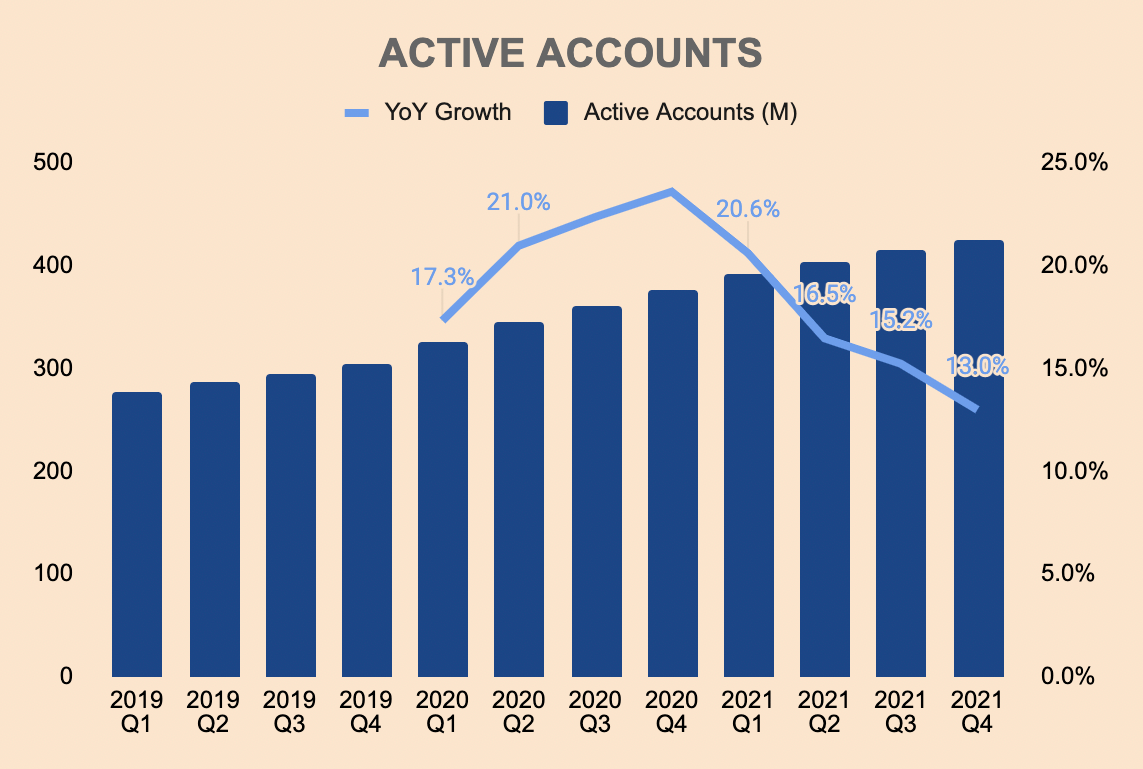

TPV growth was primarily due to growth in Active Accounts in the PayPal ecosystem, which grew 13% YoY to 426 million. Similar to TPV, Active Accounts growth is decelerating.

PayPal Investor Relations and Author’s Analysis

This slowdown in Active Account growth is the sole reason why management is changing its customer acquisition/retention strategy. At the start of the year, management laid out an ambitious plan to amass 750 million accounts by 2025. However, management abandoned that goal following its remarks during the Q4 earnings call:

We are evolving our customer acquisition and engagement strategy, and we now expect to add 15 million to 20 million net new customer accounts this year. In addition, we no longer believe that the 750 million medium-term account aspiration we set last year is appropriate.

The reasoning behind this is due to the fact that management sees little ROI from less-engaged customers:

There are always a number that are low-engaged or have done one transaction and nothing else. And we drove some programs, incentive-based programs to see if they would reengage and then engage back with the base. And what we found is that they were due one transaction and then fall dormant again. And so our view is spending money on lower-value NNAs (Net New Accounts) that are not engaged in the base becomes an increasingly expensive proposition over time and does nothing for our revenue growth.

As such, moving forward, management will be focusing their efforts on driving engagement, that is, increasing Transactions and Transactions per Account. Some of the strategies to drive engagement include launching new products and services.

With a digital wallet, where if somebody adds one more service to the digital wallet, their average revenue per active goes up by 25%. The average revenue per active of the digital wallet user is 2x that of a checkout only.

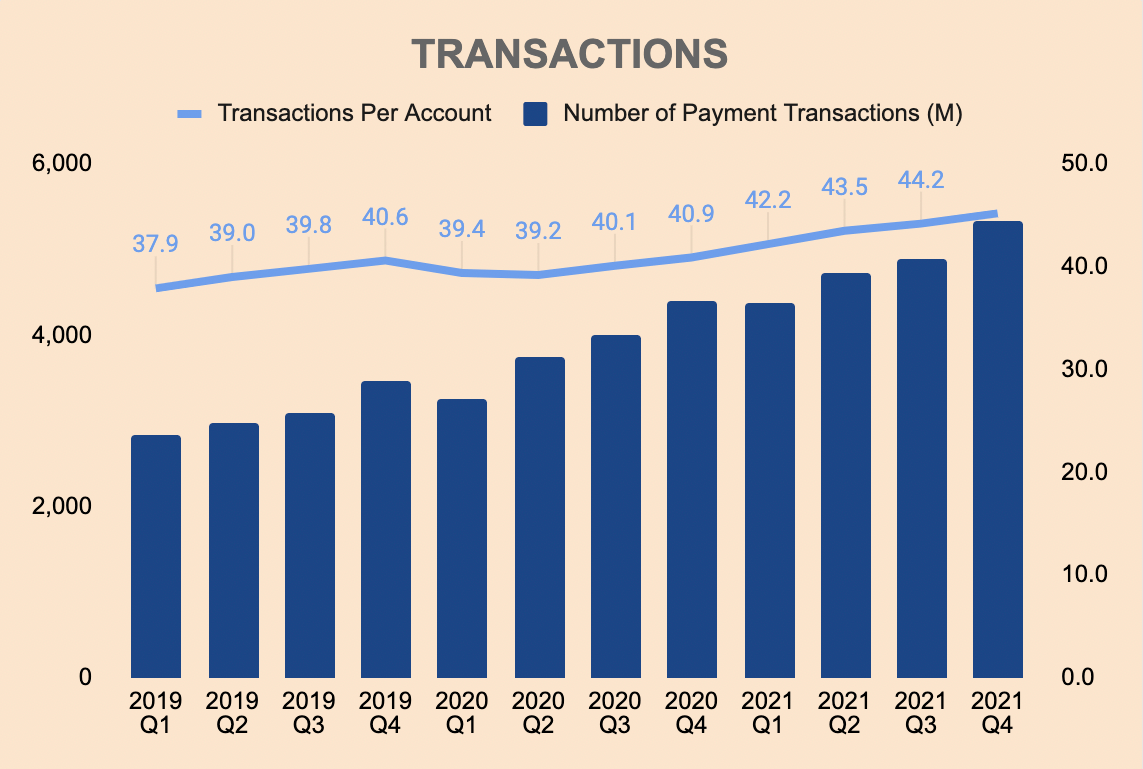

As shown below, management’s priority will be improving these two metrics, instead of aggressively acquiring new accounts. FY2021 Number of Payment Transactions 19.3 billion and Transactions Per Account ended the year at 45.2x.

PayPal Investor Relations and Author’s Analysis

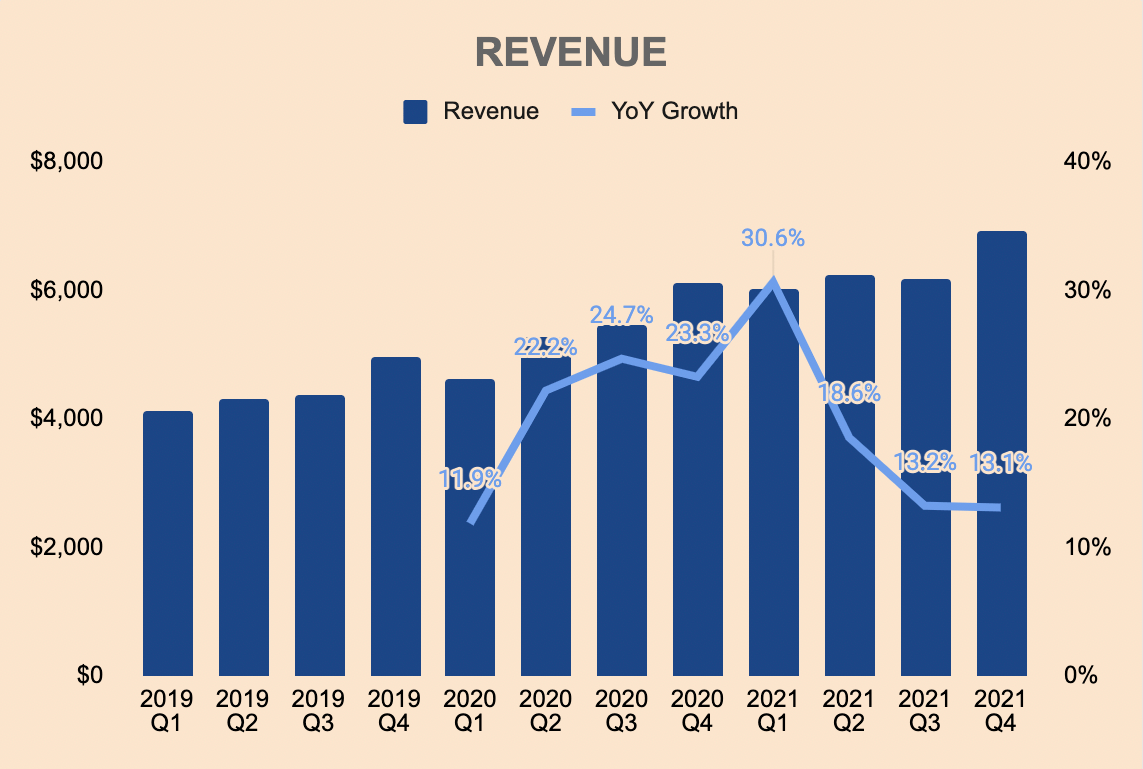

As a result of the items discussed above, FY2021 Revenue grew 18% YoY, to $25.4 billion. Q4 Revenue grew only 13% YoY, to $6.9 billion, as the company faces tough comps during the holiday season. Again, notice the quick deceleration.

PayPal Investor Relations and Author’s Analysis

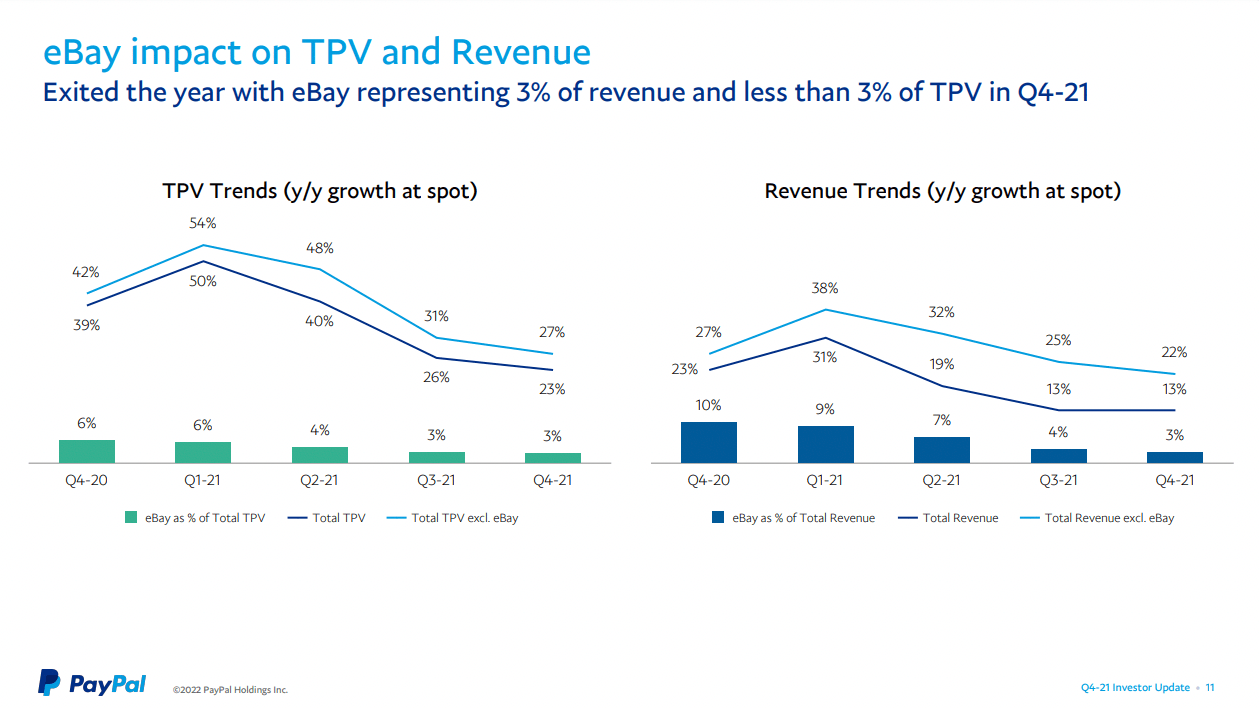

FY2021 Transaction Revenues grew 17% to $23.4 billion. Growth in the segment was negatively impacted by a decline in TPV and revenue from eBay as the company becomes less and less dependent on the online marketplace. In the short term, management expects further headwinds from eBay.

eBay’s transition will put an incremental $600 million of pressure on our top line, approximately $400 million in Q1 and $200 million in Q2.

Despite the eBay challenges, growth ex-eBay has been consistently above 20%, which shows the underlying strength of PayPal’s platform. eBay’s revenue contribution also dropped from 10% in Q4 of FY2020 to Q4 of FY2021.

PayPal FY2021 Q4 Investor Update

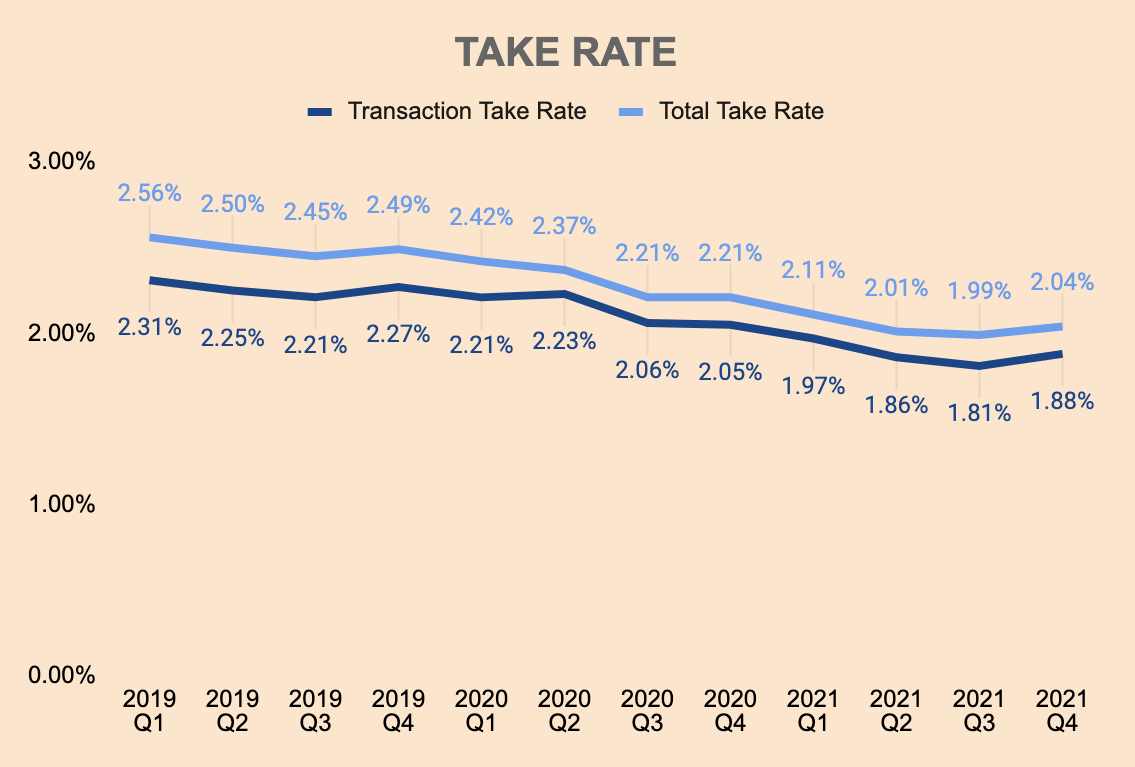

Transaction Revenues grew more slowly than TPV (18% vs 33%) due to a decline in eBay’s revenue contribution where PayPal earned higher rates, lower growth in foreign exchange fees, as well as higher contribution from Braintree which has lower fees. As a result, PayPal’s take rate has been falling. The decline in take rate is also due to the growing TPV from Venmo, which predominantly consists of P2P transactions with no fees to consumers.

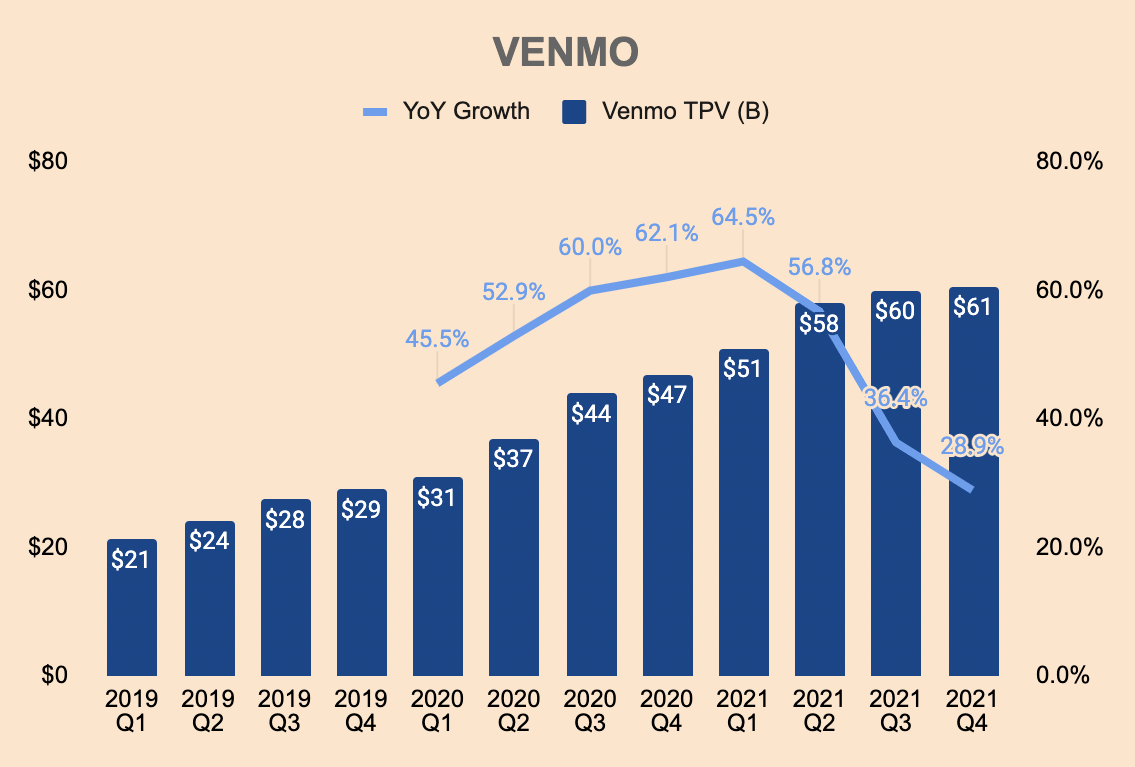

PayPal Investor Relations and Author’s Analysis

Speaking of Venmo, 2021 Q4 Venmo Revenue was $250 million, growing at 80%+. For the full year, Venmo did $900 million and management expects Venmo Revenue to grow another 50% as it is “still at the beginning of our monetization journey, with Amazon implementing the option to pay with Venmo later this year.” This should help increase PayPal’s overall take rate. Venmo’s FY2021 TPV was $230 billion, which grew 44% YoY. Venmo has over 83 million users in the US.

PayPal Investor Relations and Author’s Analysis

FY2021 Other Revenue was almost $2 billion, which grew 28% YoY. As shown below, you can see the revenue distribution between the two revenue segment with Transaction Revenue making 90%+ of total Revenue.

PayPal Investor Relations and Author’s Analysis

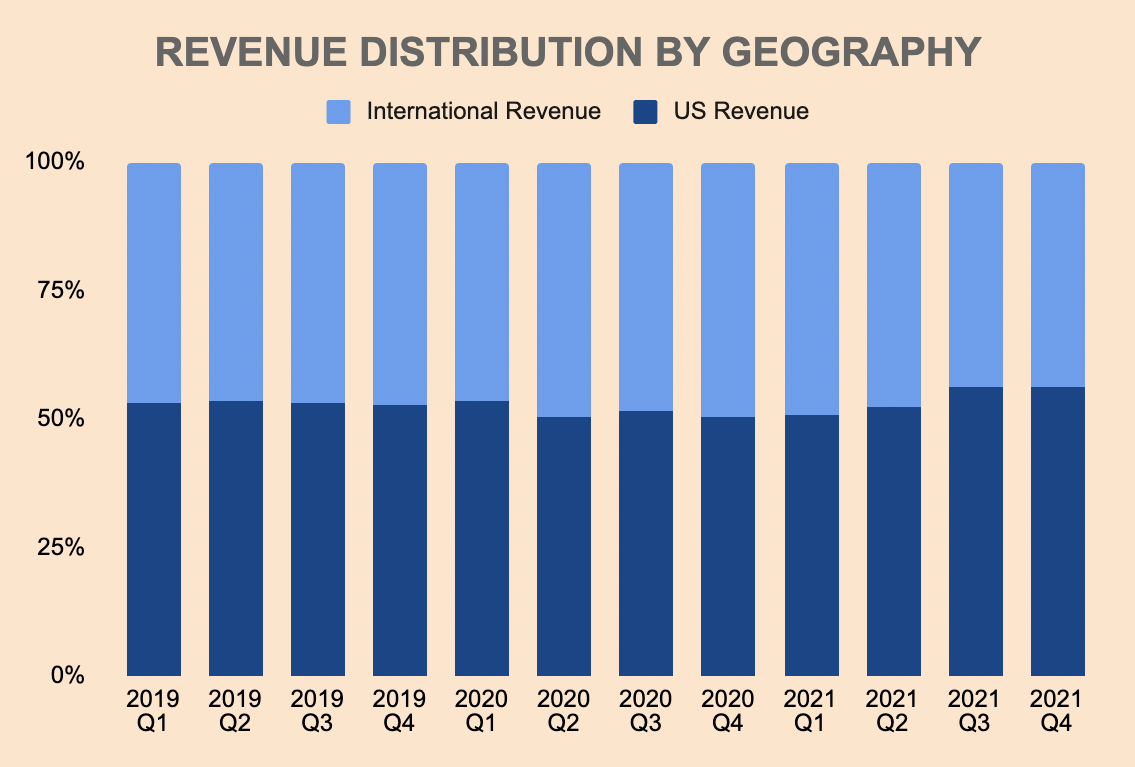

In terms of geography, revenue is roughly split 50-50 between the US and other countries.

PayPal Investor Relations and Author’s Analysis

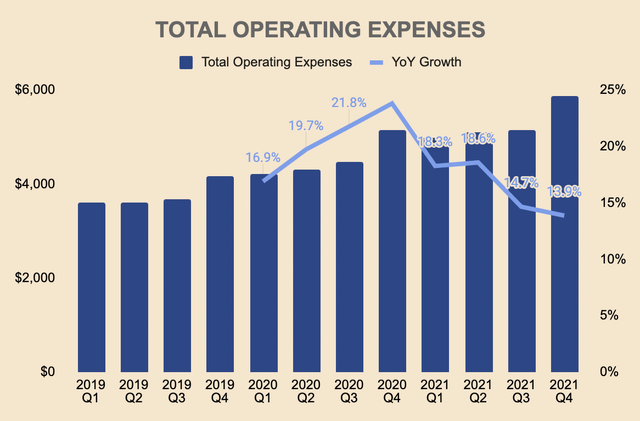

Moving down the income statement, Total Operating Expenses grew 17% to $21 billion in FY2021, in line with revenue, which shows little to no operating leverage.

PayPal Investor Relations and Author’s Analysis

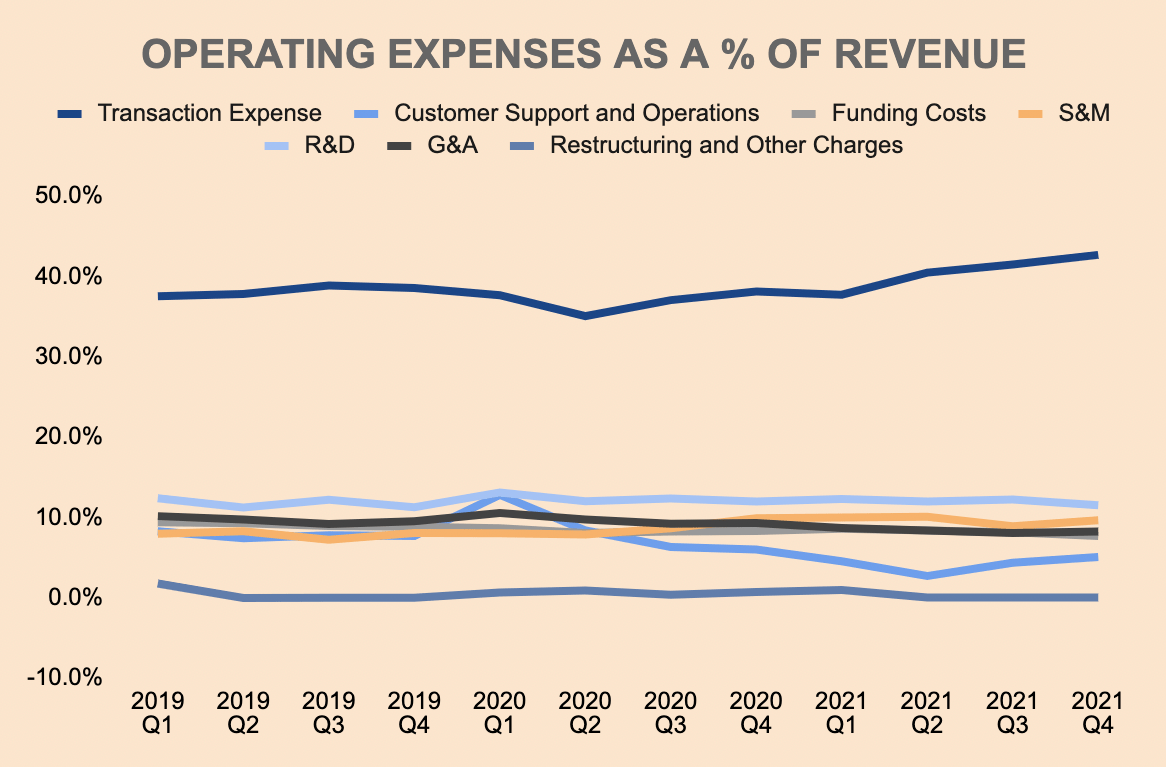

Transaction Expense – costs PayPal incurs when the company accepts a customer’s funding source of payment – makes up the bulk of Operating Expenses. As a % of Revenue, it is trending up slightly, most likely due to a shift in the geographic mix where US TPV and revenues grew faster than that of the International segment. PayPal generally pays lower rates for transactions funded with credit or debit cards outside the U.S.

PayPal Investor Relations and Author’s Analysis

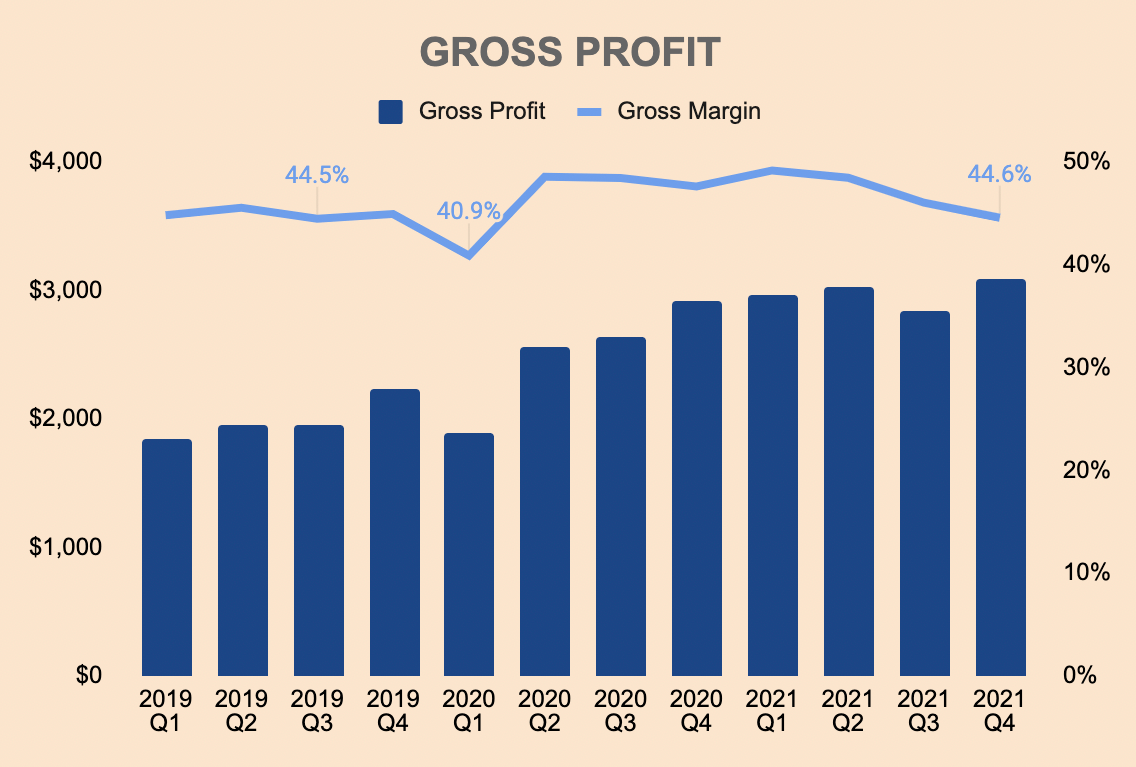

Gross Profit – Revenue minus Transaction Expense, Customer Support and Operations, and Funding Costs – stayed stagnant, which shows no economies of scale.

PayPal Investor Relations and Author’s Analysis

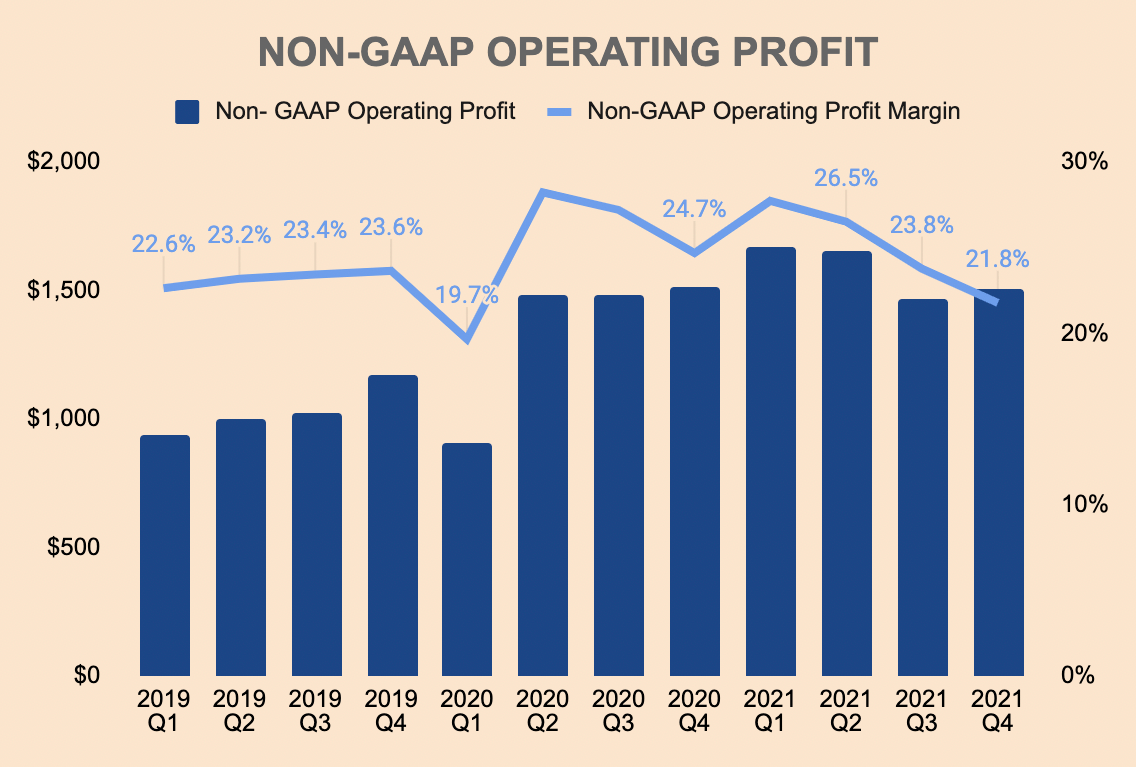

Non-GAAP Operating Profit, which adjusts for Stock-based Compensation and other one-time charges, is hovering around 25%. The recent downtrend is due to an acceleration of Volume-based Expenses, which grew by 22%, as opposed to non-Transaction-related Expenses, which only grew by 10%.

PayPal Investor Relations and Author’s Analysis

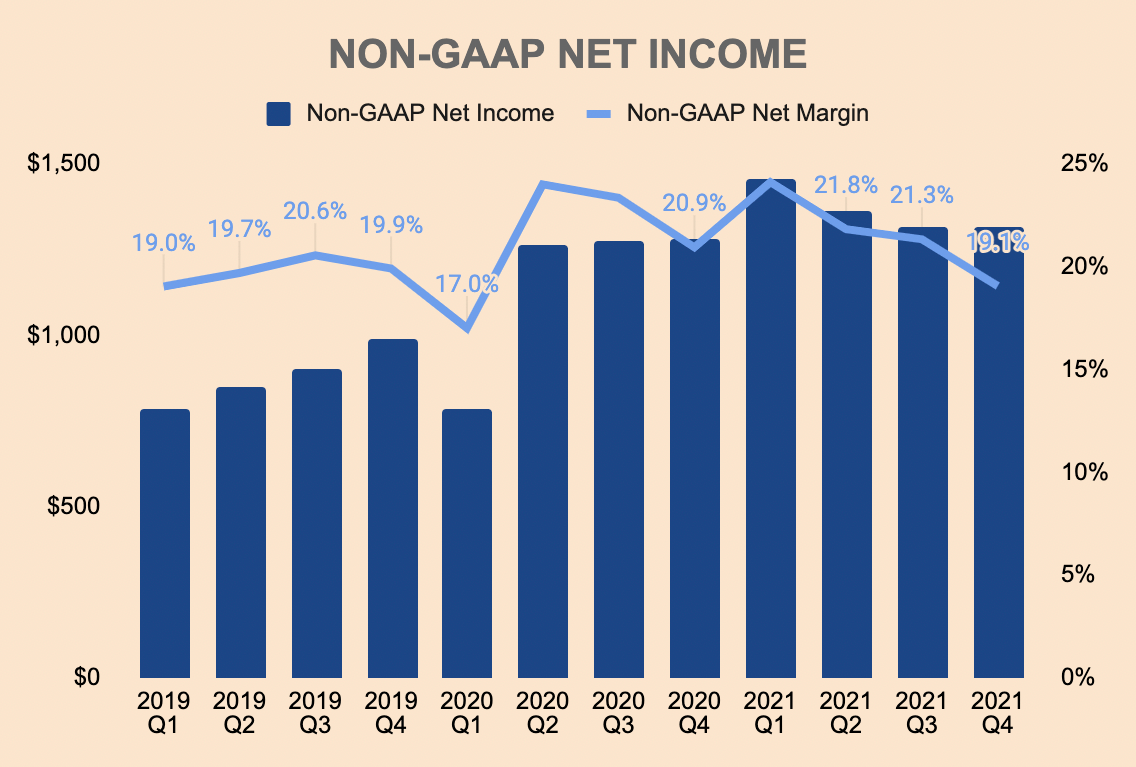

We see a similar trend for Non-GAAP Net Income.

PayPal Investor Relations and Author’s Analysis

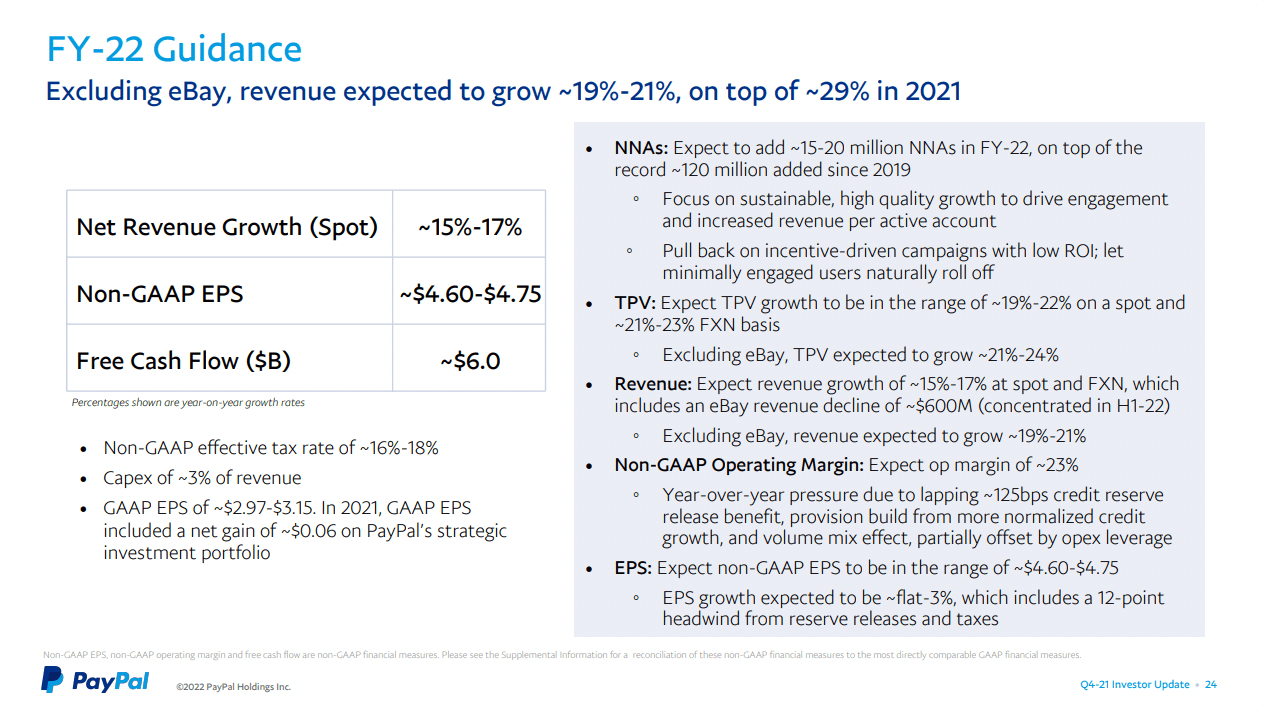

In terms of outlook, management expects Revenue to grow 6% and 16% in Q1 and FY2022, respectively. This includes the $600 million or so negative impact from eBay. More than likely, the disappointing Q1 guidance took investors by surprise, which saw the stock crashing down. However, for FY2023 and beyond, PayPal should continue robust Revenue growth as eBay becomes a less important part of the overall business.

PayPal FY2021 Q4 Investor Update

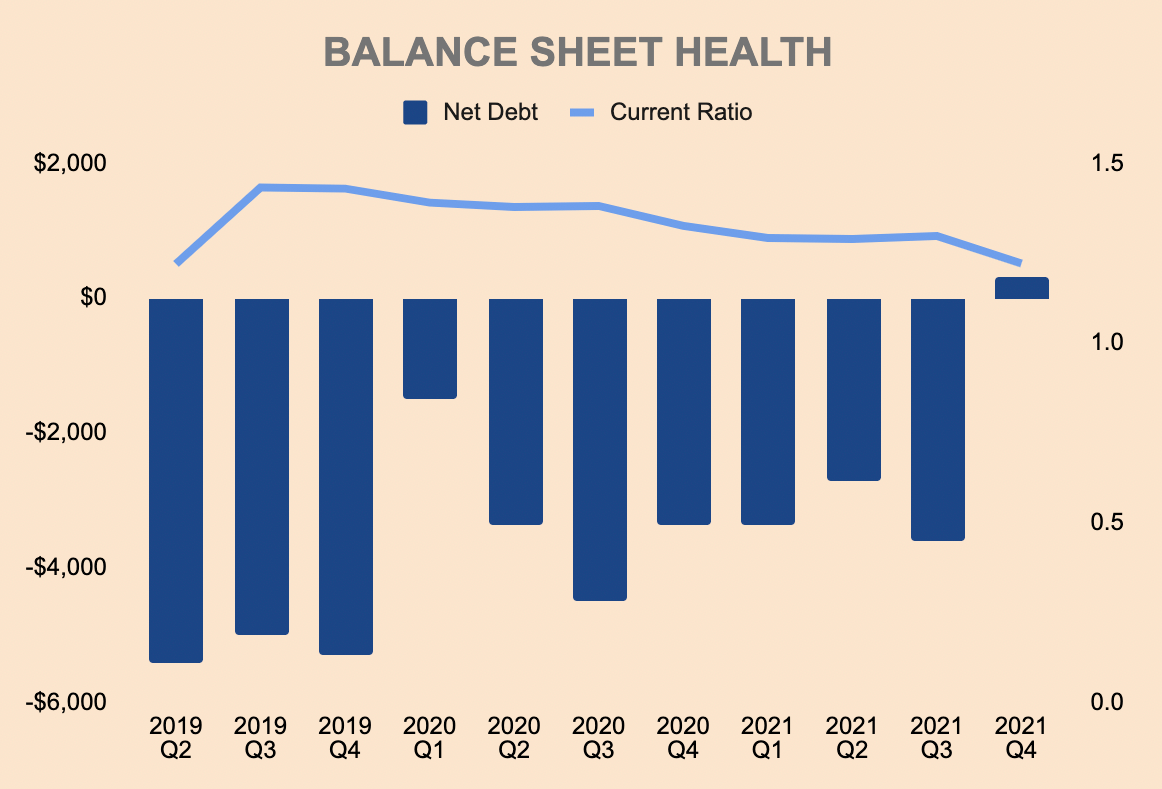

Balance Sheet

Turning to the balance sheet, PayPal ended the year with $9.5 billion worth of Cash and Short-term Investments. Total Debt was $9.8 billion, which brings a Net Debt of $0.3 billion. Current Ratio sits at around 1.2x – not the best figure but PayPal is relatively liquid.

PayPal Investor Relations and Author’s Analysis

Also of important note, PayPal has access to a $5 billion unsecured revolving credit facility if necessary. As of year-end, there are no borrowings under the revolving credit facility.

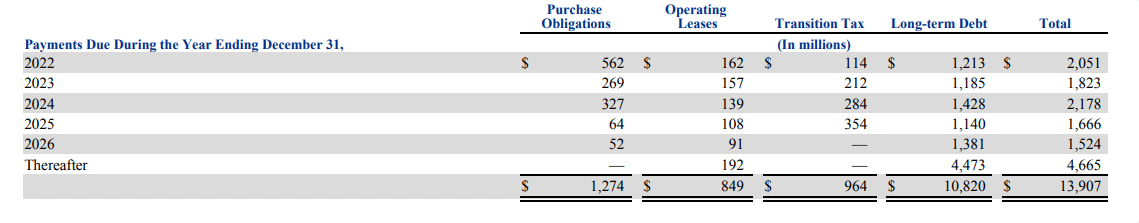

The table below shows PayPal’s contractual obligations. PayPal is obligated to pay around $2 billion a year, which is a third of PayPal’s Non-GAAP Operating Profit. As such, PayPal is well-positioned to cover near-term obligations.

PayPal FY2021 10-K

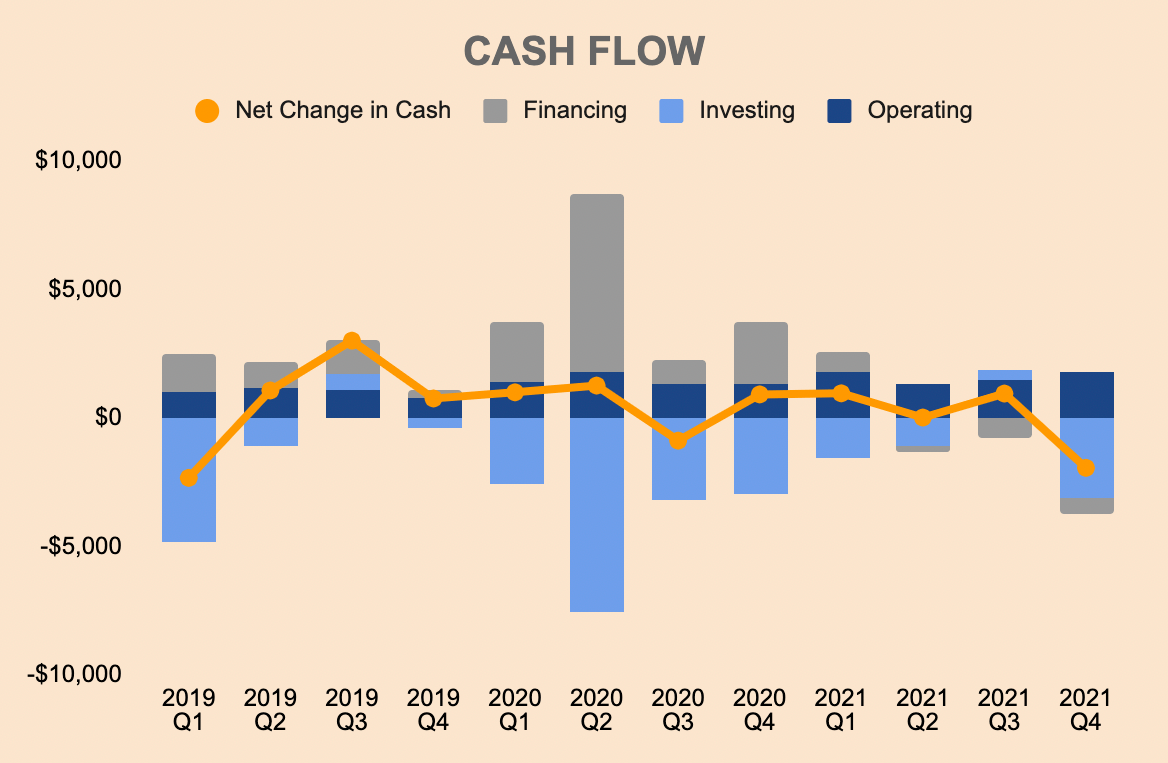

Cash Flow Statement

PayPal’s cash flow activities can be seen below. Most of the cash used from Investing activities is for business acquisitions, as seen by the occasional downward spikes. Stock-based compensation has been consistently around 5% to 6% of revenue.

PayPal Investor Relations and Author’s Analysis

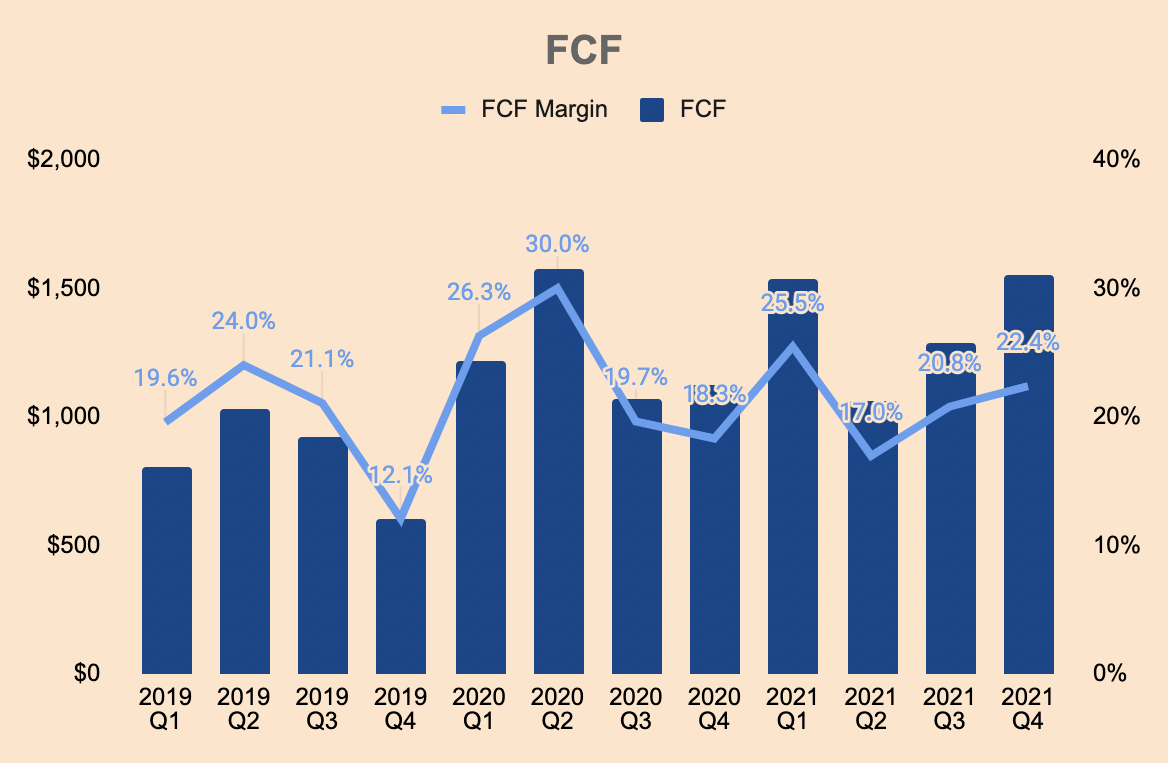

PayPal is an FCF-generative machine, which is commendable given its long-term growth prospects. PayPal generated $5.4 billion of FCF at a margin of 21%. As such, PayPal has strong earnings potential as well as the ability to reward shareholders. In the long term, the company is aiming for a 30% to 40% FCF margin.

PayPal Investor Relations and Author’s Analysis

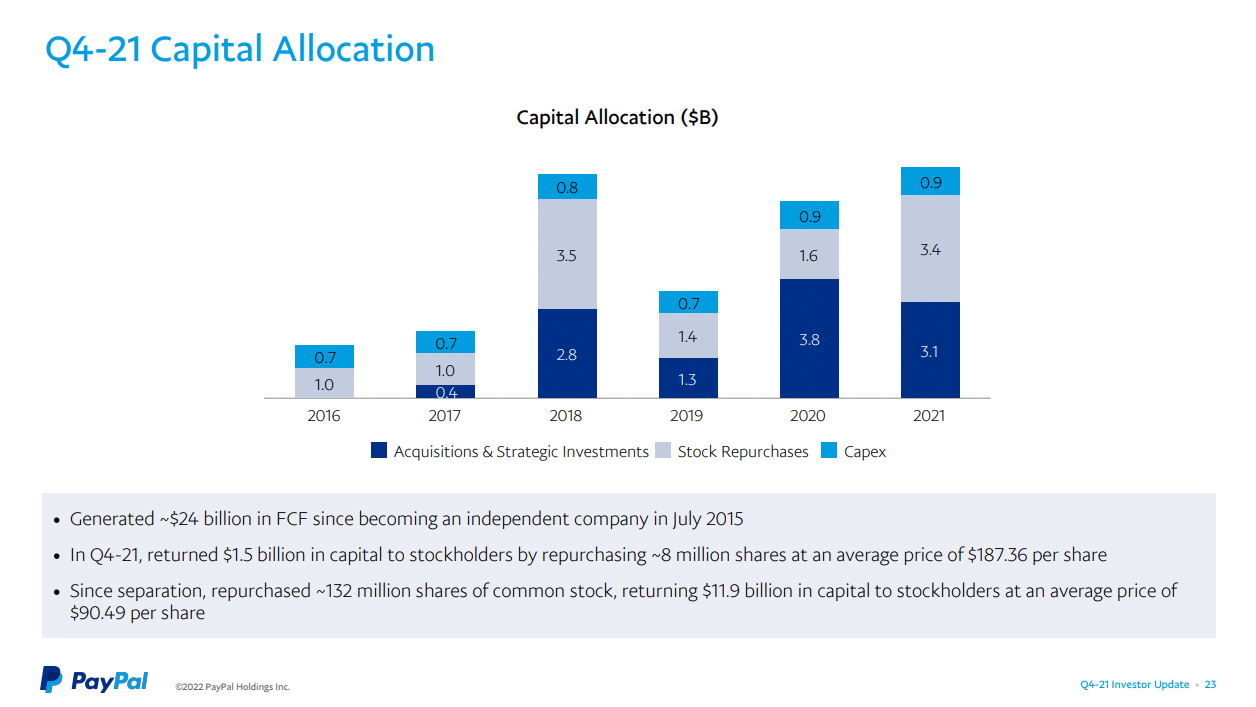

In fact, that is what PayPal has been doing with its cash recently. PayPal has bought back $11.9 billion worth of stock over the last 6 years, which is roughly half of the $24 billion of FCF it generated over the same period. Given the stock’s recent meltdown, PayPal is likely to accelerate its buyback program.

PayPal FY2021 Investor Update

Competitive Moats

Based on my research and analysis, I identify two competitive moats for PayPal: network effects and brand.

Network Effects

PayPal is arguably the largest fintech player and digital wallet provider in the world today. As discussed in previous sections, PayPal has a network of 400+ million customers and 30 million merchants, spanning across 200+ markets and 100+ currencies – this type of scale is unmatched and is unlikely to change anytime soon.

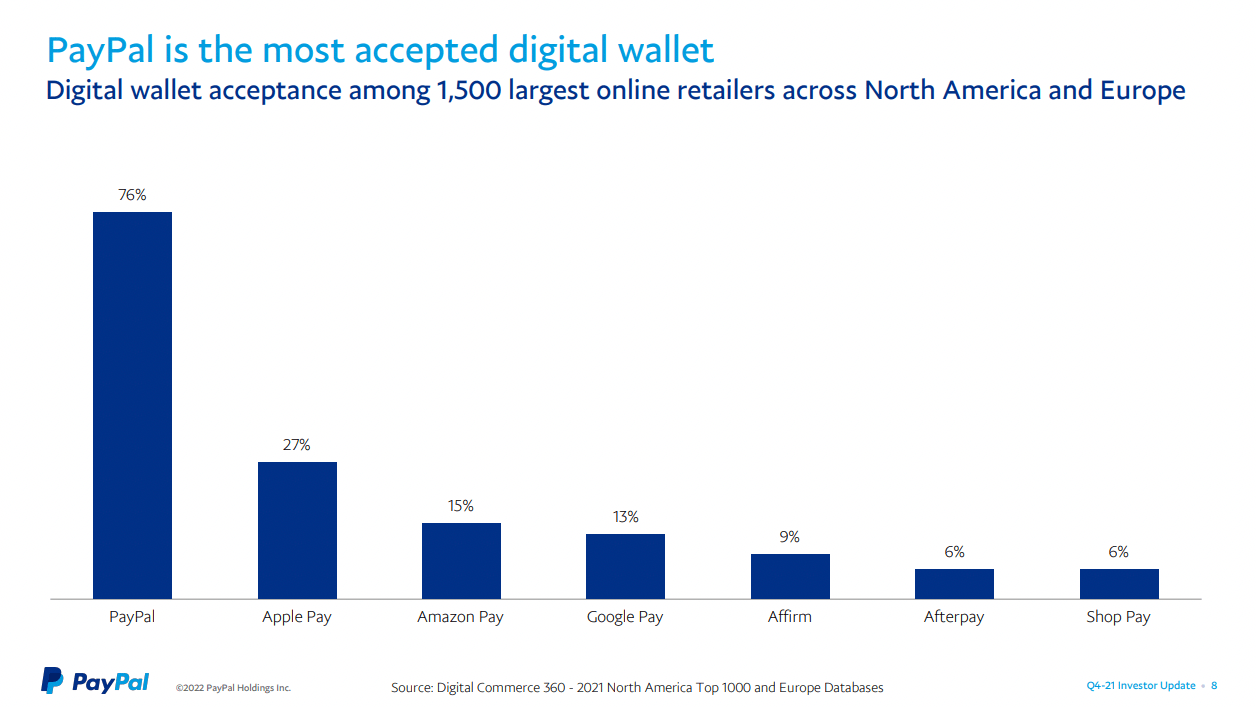

PayPal’s industry-leading digital wallet is also accepted among 75% of the largest online retailers across major markets, and competitors do not even come close. As such, PayPal is the most widely accepted digital wallet in the market.

PayPal FY2021 Q4 Investor Update

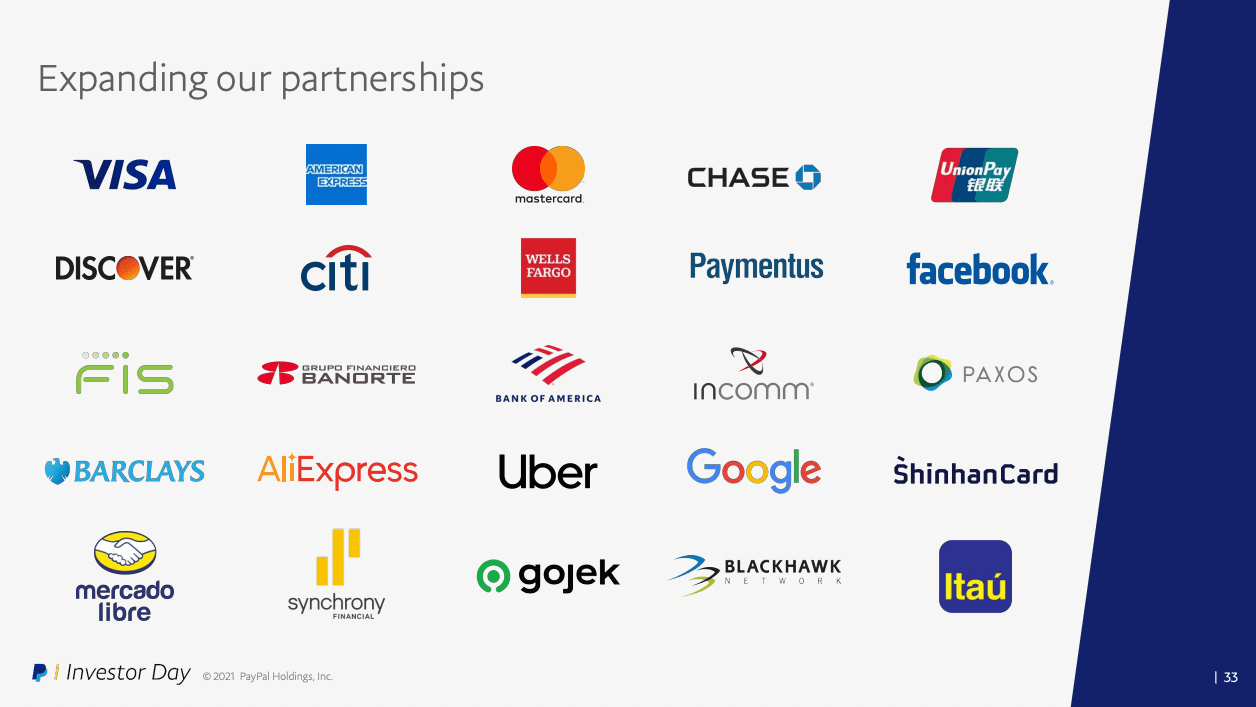

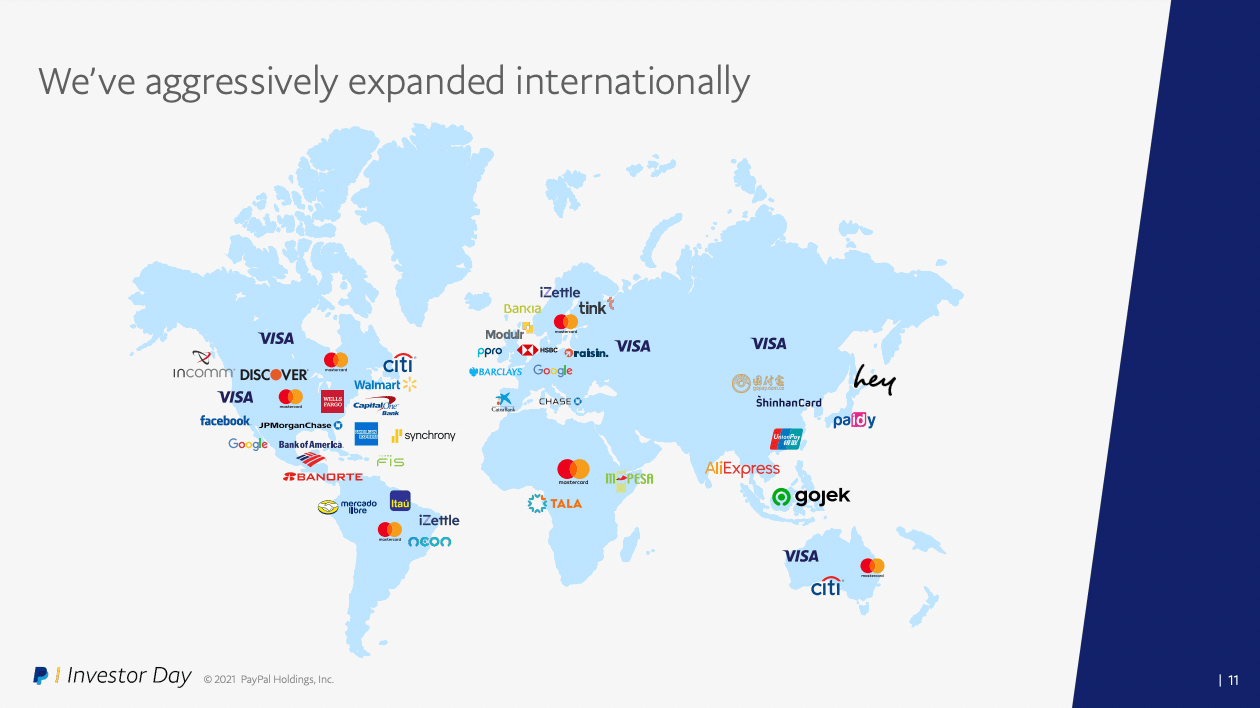

Its partnership base is also vast, as shown below. As PayPal forms more partnerships and rolls out more products and services in its platform, the company will enjoy powerful network effects as a result of its scale.

PayPal FY2021 Investor Day

Brand

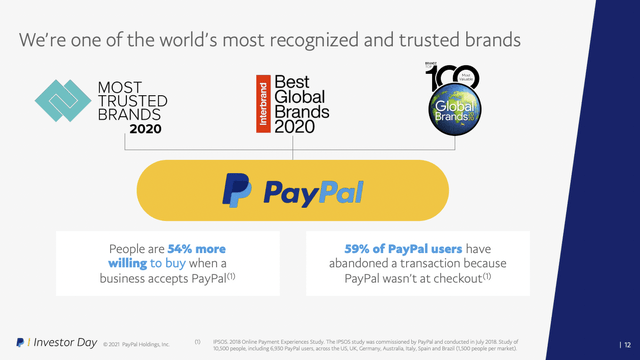

PayPal pioneered the digital wallet and online payments revolution. It has been in the game for 20+ years and has grown to be the most trusted fintech brand in the world. Consumers and merchants trust PayPal given its industry experience and global scale. Furthermore, years and years of operation allow PayPal to build a user-friendly interface, maintain a secure and minimal-fraud payments platform, as well as remain compliant with different financial regulatory bodies.

In addition, the company hosts a portfolio of well-recognized brands such as Venmo, Honey, and Happy Returns. The PayPal brand is so powerful that people are 54% more likely to transact with a business that accepts PayPal.

PayPal FY2021 Investor Day

Valuation

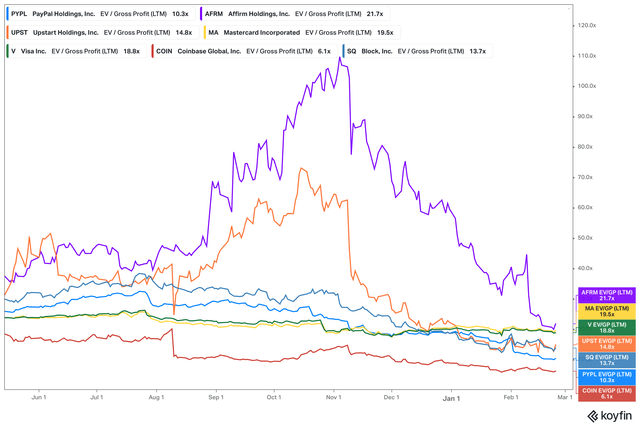

After a 60%+ drawdown from its all-time highs, PayPal looks like an interesting buy at current levels. Compared with peers, PayPal is valued attractively at 10x EV / Gross Profit.

Koyfin

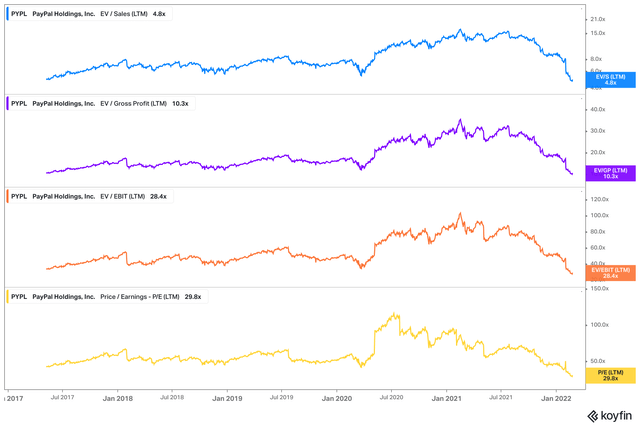

However, if we look at PayPal’s historical valuations, we can find that PayPal is trading at the lowest valuation multiples since its IPO back in 2015! It is trading even cheaper than its March 2020 lows. Of course, the markets are discounting PayPal’s slowing growth as well as a challenging macro environment characterized by higher inflation, rising interest rates, and supply chain constraints. Nonetheless, those issues are outside of the company and should be temporary. In addition, PayPal’s fundamentals remain strong and the long-term growth thesis remains intact. I believe PayPal is a deep value stock at these levels.

(Source: Koyfin)

Catalysts

There are several positive developments that could serve as catalysts for PayPal’s next stage of growth. Here are some things to keep in mind:

-

Cryptocurrency – Digital currencies are still in their early stages and increasing adoption of cryptocurrencies could be a tailwind for the fintech company. PayPal launched crypto investing in October 2020. In March 2021, PayPal began accepting crypto as a form of payment. In March as well, PayPal acquired Curv, a crypto security startup. Moreover, CNET reported that PayPal is considering launching its own cryptocoin.

-

Stock investing – There have already been reports that PayPal is working on expanding to the stock market. This will further solidify PayPal’s SuperApp status. There’s also speculation of PayPal acquiring Robinhood (NASDAQ:HOOD) given the latter company’s recent plunge in stock price.

-

BNPL – the rising pay-over-time market is also growing rapidly, which should contribute meaningfully towards PayPal’s topline.

-

Pinterest (PINS) – In October 2021, speculation rose about PayPal acquiring the social media company. PayPal then issued a press release saying “In response to market rumors regarding a potential acquisition of Pinterest by PayPal, PayPal stated that it is not pursuing an acquisition of Pinterest at this time.” Keywords are “at this time”, which at that time, Pinterest was trading at a $35 billion market cap. Today, Pinterest is worth only $15 billion.

-

SuperApp – PayPal has long growth potential in regards to its SuperApp. Here’s what management pointed out during its recent earnings call (emphasis mine):

Our super app is showing extraordinarily promising early results. Now, we only rolled that out fully in the middle of October across all of iOS and Android, so we are three months or four months into it. But what are we seeing, we are seeing double the average revenue per active account when somebody uses our app versus just checkout. When somebody uses the app their propensity to churn is 25% less. The discoverability and first-time users of people coming into the app, crypto is up 40%, in-app donations are up 300%, people coming into our shopping tab is up 35%, people going from the shopping tab to merchants to shop is up over 700%. And so we are really encouraged by what we are seeing on the app. And by the way, the app, only about 50% of our base has the app right now. So, it still has quite a bit of ways to go to penetrate and we want to spend marketing dollars on moving people into that app. And inside the app, like things like bill pay, like you and I have talked about many times, we are seeing a 200% increase in first-time users there. We want to make sure that people can discover the services because every time they add another service, it grows ARPA by 25%. And so we are going to focus heavily on digital wallet.

-

International expansion – PayPal is also proactively expanding into international markets. In 2019, PayPal invested $750 million in MercadoLibre (MELI), the largest online marketplace in Latin America. As discussed previously, PayPal also acquired GoPay (Guofubao) to expand its operations into China. Lastly, PayPal also made a strategic investment in Gojek, the Indonesian SuperApp, which has also completed its mega-merger with local online marketplace Tokopedia.

(Source: PayPal FY2021 Investor Day)

Risks

-

Competition – There are many big tech companies out there that are expanding aggressively into the payments space. This includes Google Pay and Apple Pay. For example, Apple Pay partners with a vast number of banks all over the globe to make payments dead simple for consumers. In early February, Apple announced that it will introduce Tap to Pay on iPhone. Consumers and businesses in the US can transact by just using their iPhones – no other hardware devices needed – using NFC technology which is fast, secure, and contactless. Apple will work with leading payment platforms, app developers, payment networks, and banks across the US, although it has yet to be announced as to whether PayPal will be included in this initiative.

Another major competitor is Block (SQ), which owns Square and Cash App. Block is rapidly taking market share both domestically and internationally. It is also vertically integrated, with many features that PayPal has yet to offer. Unlike PayPal, Block already has a bank charter.

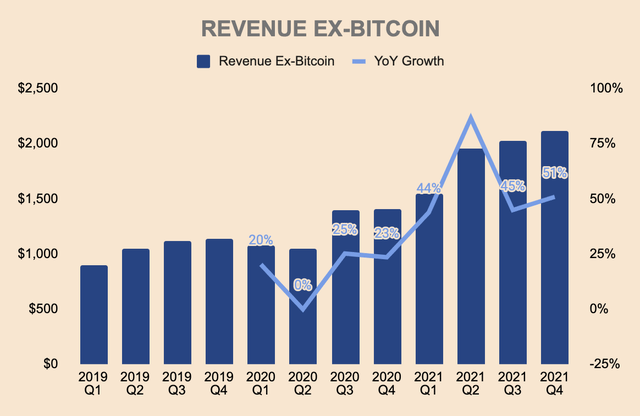

As you can see from the chart below, Block’s Revenue Excluding Bitcoin is growing rapidly, posting 51% growth in Q4 of FY2021. Its FY2021 TPV was $167.7 billion, only a fraction of PayPal’s $1.25 trillion TPV, but it is growing fast, which could be a big threat for PayPal.

(Source: Block Investor Relations and Author’s Analysis)

-

Neobanks and other startups – Hundreds of top-quality neobanks, or digital-only banks, as well as other fintech startups that are also taking market share from PayPal. Most of them offer a modern user interface as well as specialized services that are reinventing the consumer banking and personal finance experience. Some examples include Chime, M1 Finance, Acorns, Coinbase (COIN), and many more.

-

SuperApp – Given PayPal’s SuperApp ambitions, questions still loom as to how PayPal will execute this strategy. For instance, would PayPal’s different brands be integrated into the SuperApp? If not, wouldn’t the SuperApp, the one-stop shop for personal finance, cannibalize sales volumes from other brands such as Venmo and Xoom? These are questions worth considering as there are significant overlappings between PayPal’s different brands.

-

Change in acquisition strategy – As mentioned previously, management announced a new customer acquisition strategy during the latest earnings call, which may alter PayPal’s growth story. In addition, management abandoning the 750m Active Accounts goal may be indicative of the company losing out accounts to alternative providers like Square. It may also mean switching cost problems as using PayPal may not be as sticky as some might think.

Conclusion

PayPal will enjoy secular tailwinds as consumers and merchants increasingly adopt and engage with digital wallets – the world is shifting into a cashless economy and PayPal stands to benefit from this trend. However, PayPal is not alone in this trend. There are many other companies that are equally, or even more, capable of capturing this opportunity. Despite the heavy competition, PayPal has established itself as the go-to payments platform in every corner of the world. Its scale is unmatched and its brand is powerful, which should give the company strong network effects as it launches new products and services. This includes the SuperApp, which is an exciting opportunity in the rapidly evolving digital economy.

Valuation multiples are at a historical low, which could present an attractive buying opportunity for investors. However, there are reasons why valuations have contracted: unfavorable interest rate environment, supply chain constraints, inflation, competition, change in strategy, and slowing growth. Nevertheless, PayPal is a cash flow machine with a strong balance sheet and high earnings potential, which should reward shareholders in the long run. That said, PayPal looks like a compelling buy after the recent selloff. PayPal is a deep value fintech play for investors.

Thank you for reading my second company deep dive. If you enjoyed the article, please let me know in the comment section down below. If you have any suggestions or feedback, don’t hesitate to share your thoughts as well.

Credit: Source link