Melpomenem/iStock via Getty Images

Introduction

Both PayPal (NASDAQ:PYPL) and Block (NSYE:SQ), two of the world’s leading fintech companies, have gotten off to a rough start in 2022. PayPal and Block are down 45% and 24% year to date, respectively, as tech stocks continue to face downward pressure resulting from rising interest rates and geopolitical concerns. The war on cash, which refers to a broader shift towards digital payments, has picked up serious momentum in recent years. PayPal’s management team suggests that the company has a total addressable market around $110 trillion. The industry is large enough to support several secular winners, and I believe both PayPal and Block are well-positioned to lead the industry moving forward. The companies are in different stages of growth and possess unique characteristics that investors should examine closely. In this article, we will explore the similarities and differences between PayPal and Block to help investors decide which stock is the better investment for them today. My choice? PayPal.

So, how do PayPal and Block size up?

Generally speaking, PayPal is most known for its mobile payments system, meaning the company primarily generates revenue via transaction-based fees. Accepted at 76% of the 1,500 largest online retailers across North America and Europe, PayPal has built a reputation as one of the most recognized digital wallets in the world. In 2021, the company surpassed $1 trillion in total payment volume for the first time ever, further solidifying its status as a fintech juggernaut. Naturally, PayPal has expanded beyond its core business – the company now offers P2P money transfer services via Venmo, provides buy now, pay later options at checkout, and is stretching into the cryptocurrency arena. Venmo experienced 44% growth in total payment volume in fiscal year 2021 up to $230 billion and remains the biggest player in P2P payments with a market share of ~58%. Venmo users can also buy, sell, and hold cryptocurrency on the platform. The company’s Buy Now, Pay Later service, which allows customers to pay for products in equal installments over a specific time period, enjoyed transaction volume of nearly $8 billion in 2021. Today, PayPal has a market capitalization of $124 billion and trades at 30 times earnings.

Block, while it competes with PayPal on many fronts, is focused on helping businesses facilitate in-person payment transactions with its Square ecosystem of more than 30 products and services. In 2021, the company’s Square ecosystem experienced growth of 47% year over year up to $5.2 billion. Block generates a large chunk of revenue by serving as a middleman in Bitcoin (BTC-USD) transactions on its Cash App platform. Essentially, Block purchases Bitcoin from a private broker and then sells it to Cash App users at a slight markup. Cash App, which directly competes with PayPal’s Venmo, grew revenue by 106% in fiscal year 2021 up to $12.3 billion. Excluding Bitcoin, Cash App’s revenue increased 42% up to $590 million. We’ll explain that substantial difference shortly.

The company closed its acquisition of Afterpay on January 31st, which is a buy now, pay later service similar to PayPal’s offering. Because Bitcoin’s price fluctuation and demand significantly affects Block’s top-line, the company reports its revenue items both including and excluding Bitcoin. While it’s important to note Block’s exposure to Bitcoin, investors should know that growth is primarily driven by Cash App and the company’s Square ecosystem. When looking at Block’s 2021 income statement, you’ll notice that Bitcoin revenue accounted for 57% of the firm’s top-line. This is rather deceiving, however, because Bitcoin represented only ~5% of the company’s gross profit. So while it’s essential to consider the company’s Bitcoin exposure as an intrinsic risk, Bitcoin is not the prime mover of the business. This is why management gives priority to revenue excluding Bitcoin and gross profit. Today, Block has a market capitalization of $71.5 billion and trades at 382 times earnings.

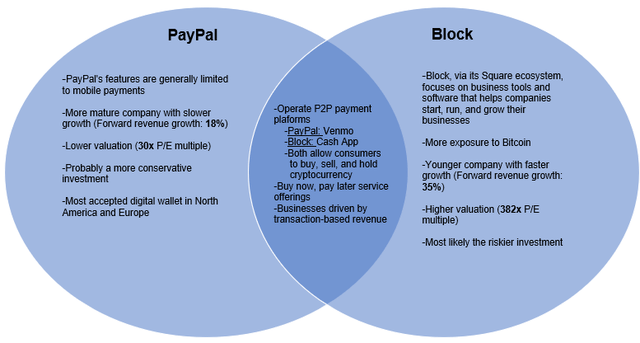

The Venn diagram below summarizes the similarities and differences between PayPal and Block.

Author’s Material, Seeking Alpha Data

PayPal Vs. Block – Financial statement analysis

PayPal and Block are in different phases of maturity. PayPal was founded in 1998 and spun-off from eBay (NASDAQ:EBAY) in 2015. Block was established over a decade later in 2009, so naturally, the companies’ financial situations are markedly different. PayPal’s growth – although I believe has been strong given its mammoth size – lags behind that of Block’s. Over the past three years, PayPal’s revenue and EPS grew at a compound annual growth rate (CAGR) of 18% and 27%, respectively. In 2021, the company’s top-line and bottom-line increased by 18% and 19% year over year to $25.4 billion and $4.60/share. Looking ahead, analysts are forecasting PayPal’s revenue in fiscal year 2025 to reach $49.6 billion, indicating an average annualized growth of 14%. Earnings per share in 2025 are expected to be around $9.11/share, suggesting an average annualized growth of 15%. PayPal’s balance sheet and cash flow generation are robust. At the end of 2021, the company boasted a cash position of $5.2 billion and a debt-to-equity ratio of 45%. In its most recent quarter, PayPal’s cash from operations and free cash flow grew by 31% and 38% up to $1.8 billion and $1.6 billion, respectively. Over a five-year time horizon, PayPal’s free cash flow CAGR is 17%, demonstrating the company’s full ability to generate cash.

Block’s three-year revenue CAGR is 75%. In 2021, the company grew its top-line by 86% up to $17.7 billion. Gross profit, which is the better metric to examine, increased 62% year over year to $4.4 billion. Block’s EPS saw growth of 104% up to $1.71/share. Wall Street analysts are forecasting an average annualized growth in revenue and EPS over the next five years of 19% and 21%, respectively. Total revenue estimates could fluctuate significantly depending on Bitcoin’s price movement and demand in the future. Similar to PayPal, Block’s balance sheet and cash flow generation are strong. Block has $4.4 billion in cash and a debt-to-equity ratio of 166%. Note that the company’s debt-to-equity ratio has climbed above its five-year average of 97% in recent quarters. An upward trend in a company’s debt-to-equity ratio is worth itemizing because it shows that more debt it being acquired to fund operations. I like to see debt-to-equity remain stable – or decline – over time. In its most recent quarter, Block recorded cash from operations and free cash flow growth of 390% and 102% amounting to $175 million and $139 million, respectively. Block’s three-year free cash flow CAGR is 45%. The company’s ability to increase its cash flow generation at such a rapid pace should be taken as an extremely positive signal by investors.

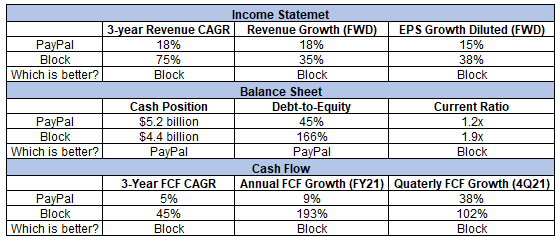

The table below summarizes PayPal and Block’s financials and areas where I think each company is superior to the other. Block’s growth in recent years has been more impressive, but there is plenty to say about PayPal’s track record. PayPal has enjoyed success over a longer time horizon, all while continuing to expand its top-line. From a net income standpoint, Block is growing faster, but again, PayPal has demonstrated years of consistent profitability. Growth investors will probably be more interested in Block, but those who want growth at a reasonable price may favor PayPal. Now let’s assess the companies’ valuations.

Author’s Material, Seeking Alpha Data

PYPL Vs. SQ Valuation

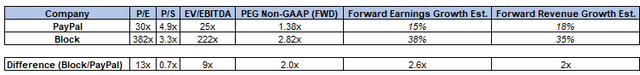

On the valuation front, Block is more expensive than PayPal. Block is trading at a P/E multiple of 382x, nearly 13 times higher than PayPal’s 30x P/E multiple. I would expect Block to trade at a loftier valuation provided that its growth is forecasted to outpace PayPal’s in the coming years. According to Seeking Alpha data, Block and PayPal carry forward earnings growth estimates of 15% and 38%, respectively. So while Block is expected to grow earnings at 2.5 times the rate of PayPal, I don’t think the significant discrepancy in their P/E multiples can be justified. The recent selloff has made Block’s valuation more attractive, but that doesn’t suggest it’s still not ugly. It would take a steeper decline in its market value for Block to qualify as a compelling investment. At its current price levels, PayPal presents us with a nice combination of value and growth. Investors would be wise to consider PayPal over Block today.

Author’s Material, Seeking Alpha Data

So, which stock should you invest in today?

I think both PayPal and Block are intriguing investment opportunities. In many ways, I believe holding both stocks in your portfolio could be a good play on the rising fintech industry. In today’s market, however, I would suggest PayPal over Block. The company is currently trading at a more attractive valuation, and while growth is weaker than Block, I’m confident in PayPal’s long-term commercial prospects. I’m also not exactly in favor of Block’s Bitcoin obsession. And while I understand that Bitcoin is not the guiding force of Block’s gross profit and bottom line, the company’s exposure to the cryptocurrency should be closely monitored by investors. Bitcoin muddies the waters and makes it challenging for investors to forecast the company’s future. PayPal is on a more transparent route and is easier to analyze for investors. Nonetheless, I’m eager to see both of the companies’ journeys play out. The fintech industry will continue to make noise moving forward, and I’ll be damned if PayPal and Block aren’t in the front leading the way.

Credit: Source link