In today’s interconnected world, remittances play a crucial role in supporting families and communities across borders. For countries like South Sudan, these financial inflows are vital, constituting a significant portion of the nation’s economy.

However, traditional methods of sending money to South Sudan are often fraught with challenges, including high fees, slow transaction times, and limited access to financial services. Enter Pesabase, a blockchain-based remittance platform poised to revolutionize the way money is sent and received in South Sudan.

The Importance of Remittances to South Sudan

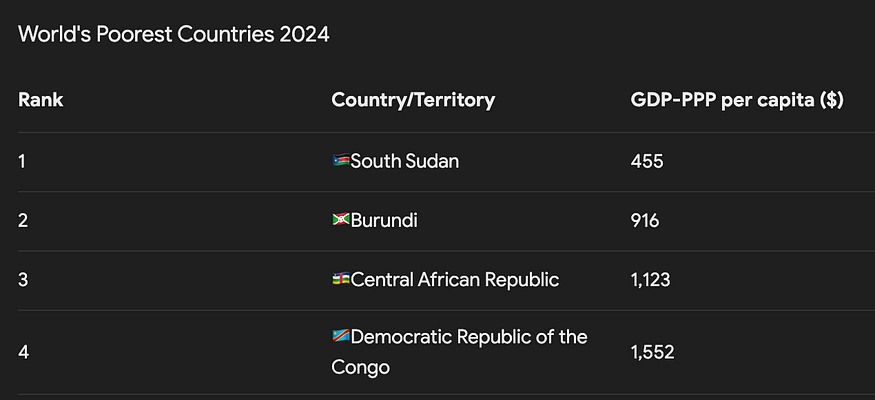

Remittances are a lifeline for many South Sudanese families. According to data, remittances account for approximately 23.9% of South Sudan’s Gross Domestic Product (GDP), underscoring their significance in the nation’s economic framework. These funds are essential for daily living expenses, education, healthcare, and other critical needs. However, the process of sending money to South Sudan has historically been cumbersome and costly.

Challenges in Traditional Money Transfer Methods

Traditional remittance channels, such as banks and established money transfer operators like Western Union, often impose high fees and involve lengthy processing times. For instance, average remittance fees in Africa can range between 10-15%, significantly reducing the amount received by beneficiaries. Additionally, recipients in South Sudan may face challenges accessing financial services due to limited infrastructure and political instability.

Introducing Pesabase: A Game Changer in Remittances

Pesabase aims to address these challenges by leveraging blockchain technology to provide a more efficient, cost-effective, and secure method of transferring money to South Sudan. By eliminating intermediaries, Pesabase can offer lower transaction fees and faster processing times. The platform’s decentralized nature enhances security and transparency, instilling confidence in both senders and recipients.

How Pesabase Works

Users can access Pesabase through its mobile application, which is currently undergoing an upgrade with a new version scheduled for release in June 2024. The app allows users to send money directly to specified recipients, eliminating the need for local agents. Transactions are processed on the blockchain, ensuring speed and security. Pesabase’s blockchain-based and regulated service guarantees that funds are received in full, minus a small average fee of 2%, which is significantly lower than the standard 6-9% fee charged by other channels, sometimes reaching 30%.

The $PESA Token: Empowering Users and investors

In addition to its remittance services, Pesabase has introduced the $PESA token, advancing its presence in the blockchain industry. The $PESA token is designed to facilitate transactions within the Pesabase ecosystem, providing users with a seamless and efficient means of transferring value. By utilizing the $PESA token, users can further reduce transaction costs and benefit from the platform’s innovative financial solutions.

At the same time, investors can also choose to invest independently in the PESA token, poised to increased in value over time as the platform grows in use.

Comparing Pesabase to Traditional Remittance Services

When compared to traditional remittance services like Western Union, Pesabase offers several distinct advantages:

Lower Fees: Pesabase’s average transaction fee of 2% is significantly lower than the 10-15% charged by traditional services.

Faster Transactions: Blockchain technology enables near-instantaneous transfers, whereas traditional methods can take several days.

Enhanced Security : The decentralized nature of blockchain ensures that transactions are secure and transparent, reducing the risk of fraud.

Accessibility: With the Pesabase mobile app, users can send money directly to recipients without the need for intermediaries, making the process more convenient.

The Vision Behind Pesabase

The founder and CEO of Pesabase, Phil Somh, an African native turned successful Australian entrepreneur, has built diverse financial infrastructure with major telecommunication companies and banks in Africa over the past five years, with over $2 million in seed funding. His vision is to financially connect Africa on the blockchain, providing innovative solutions to longstanding challenges in the remittance landscape.

The Future of Remittances in South Sudan

As Pesabase continues to develop and expand its services, it holds the potential to significantly impact the remittance landscape in South Sudan. By offering a more affordable, efficient, and secure method of transferring money, Pesabase can enhance the financial well-being of countless South Sudanese families. Furthermore, the platform’s commitment to leveraging cutting-edge technology positions it as a leader in the evolving world of digital finance.

Conclusion

Pesabase represents a transformative approach to remittances in South Sudan, addressing the challenges of traditional money transfer methods through the innovative application of blockchain technology.

By providing lower fees, faster transactions, and enhanced security, Pesabase is poised to revolutionize the way money is sent and received in South Sudan, offering a promising solution for individuals and families who rely on remittances as a vital source of support.

As the platform continues to evolve and expand, it will be essential to monitor its impact on the remittance landscape and the broader financial ecosystem in South Sudan. With its innovative approach and commitment to financial inclusion, Pesabase has the potential to serve as a model for remittance solutions in other regions facing similar challenges.

In a world where financial connectivity is increasingly important, Pesabase stands out as a beacon of innovation, offering hope and tangible benefits to those who need it most. By harnessing the power of blockchain technology, Pesabase is not only transforming remittances but also contributing to the broader goal of financial empowerment and inclusion for all.