metamorworks/iStock via Getty Images

By Royston Roche, Equity Analyst for I/O Fund

Fintech companies are disrupting the global economy with their innovative products. The global growth is expected to continue despite medium-term challenges like higher interest rates and Covid-19. We believe that the recent sell-off once again provides opportunities to pick stocks for the long term.

PayPal (NASDAQ:PYPL) released its results earlier this month. Q4 revenue grew by 13% to $6.9 billion and beat estimates marginally by $30 million. The soft revenue guidance of 6% growth in Q1 disappointed investors. On the other hand, Dutch payment processor Adyen (OTCPK:ADYEY) reported strong results as its 2H revenue grew by 47% to €556.5 million and EBITDA (Earnings before Interest, Tax, Depreciation, and Amortization) grew by 51% to €357.3 million.

In this earnings preview, we cover Upstart (NASDAQ:UPST), Block (NASDAQ:SQ), Coinbase (NASDAQ:COIN), Sea Limited (NASDAQ:SE), MercadoLibre (NASDAQ:MELI), Remitly (NASDAQ:RELY), and DLocal (NASDAQ:DLO).

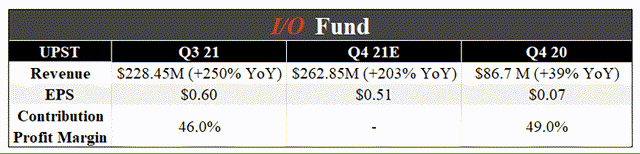

Upstart – Earnings on February 15th

YCharts, Earnings Reports, and I/O Fund

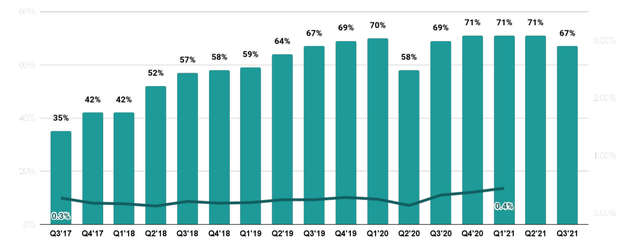

Upstart has gained popularity due to its Artificial Intelligence lending platform, which saves time in loan processing. 67% of the Upstart loans were fully automated in Q3.

Q3 Earnings Presentation

The management sees a huge opportunity in the auto lending market as it is larger than the personal loan market. They also believe that auto loan customers pay higher interest rates for car loans, making their AI platform an ideal choice.

Last year, it bought Prodigy Software, an automotive retail software provider, which further helped the company increase its focus in the auto sector. Revenue grew 250% YoY in Q3 to $228.45 million and the consensus analysts estimate revenue to grow 203% to $262.85 million in Q4.

Atlantic analyst Simon Clinch is optimistic about the company as he believes that there is upside potential to EBITDA from the auto segment.

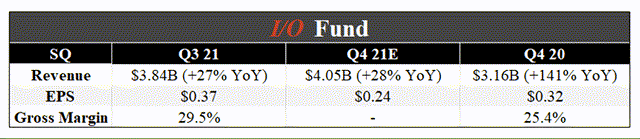

Block (Square) Inc. – Earnings on February 24th

YCharts, Earnings Reports, and I/O Fund

The company’s revenue grew 27% YoY to $3.84 billion. Analysts expect revenue to grow 28% to $4.05 billion. It has recently completed the acquisition of Afterpay and has integrated Afterpay’s Buy Now Pay Later (BNPL) functionality to Square Online sellers in the U.S. and Australia. It is a positive deal as Buy Now Pay Later is becoming a preferred payment option for customers. It gives the flexibility to make the payments later interest-free.

According to Grand View Research, the BNPL market is expected to reach $20.4 billion by 2028, growing at a compound annual growth rate of 22% from 2021 to 2028.

J.P. Morgan analyst Tien-tsin Huang is optimistic about the deal and expects it to boost its gross profits. He also believes, “positive catalysts de-risking the hard/soft landing concern for stand-alone Cash App growth deceleration near-term.”

Barclays analyst Ramsey El-Assal believes that “While app download and usage data point to continued strength at Cash App and Square, the company continues to lap very tough COVID-related comps.” He also expects investor focus to be on the reacceleration of Cash App, the Afterpay acquisition, and Block’s crypto initiatives.

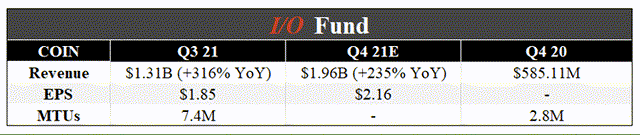

Coinbase Global Inc. – Earnings on February 24th

YCharts, Earnings Reports, and I/O Fund

The company’s revenue grew by 316% to $1.31 billion in Q3. For Q4, analysts expect revenue to grow 235% to $1.96 billion. Due to better trading activity in October, the management believes that the retail Monthly Transacting Users (MTUs) will be higher in Q4 than Q3. For the month of October, it was 11.7 million.

The company announced the waitlist has begun for the company’s NFT platform in October last year. It is expected to launch in the coming quarters, which should help the company provide more stability to its earnings as the cryptocurrency market can be volatile.

Bank of America analyst Jason Kupferberg has upgraded the company from a neutral to buy rating. He is optimistic about launching the NFT trading platform, as it was diversifying its revenue sources to rely less on cryptocurrency trading.

Mizuho analyst Dan Dolev believes that the zero-commission business model adopted by Robinhood is better than the fee-based model adopted by Coinbase. In his words, “If you think about three years from now, everything that’s fee-based right now, like crypto trading, is going to be free.”

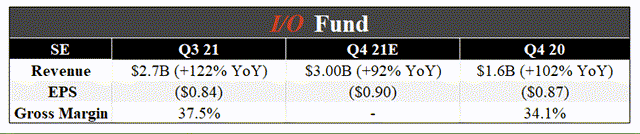

Sea Limited – Tentative Earnings Date is 25th February

Seeking Alpha, Earnings Reports, and I/O Fund

Sea Limited operates in digital entertainment, e-commerce, and digital payments & financial services segments. The company’s revenue grew 122% in Q3 and the analysts expect revenue to grow 92% to $3.0 billion in Q4.

It is an exciting company to watch since it derives its significant revenue from South East Asia, and more recently, it has been focusing on Latin America. Both the regions have better growth opportunities than the developed nations due to the untapped opportunities in e-commerce and digital payments.

Barclays analyst Jiong Shao lowered the firm’s price target to $218 from $427 and has kept an Overweight rating. He believes, “The post-COVID economic reopening is having a negative impact on both the company’s gaming and e-commerce business as consumers spend less time online.”

Goldman Sachs analyst Miang Chuen Koh has removed the stock from the Goldman’s Conviction List. “While Sea (SE) remains on a growth path, with an expanding e-commerce footprint and its multiple studios finalizing games to be released in the next few quarters,” the analyst cautions that the slower economic growth will limit the growth of its three business lines.

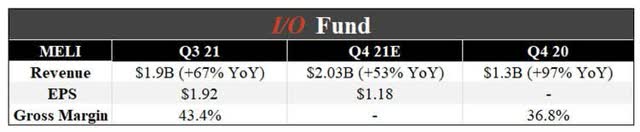

MercadoLibre Inc. – Tentative Earnings Date is March 01st

YCharts, Earnings Reports, and I/O Fund

MercadoLibre has been popularly known as the Amazon of Latin America. The company is benefitting from the region’s robust e-commerce and fintech growth. The stock rose about 450% in the past five years. MELI’s quarterly active users showed strong growth in Q3, growing 50% YoY to 78.7 million and unique Fintech users grew by 13% to 31.6 million. The company’s revenues grew 67% in Q3 and the analysts expect Q4 revenue to grow 53% to $2.03 billion.

YCharts

Stifel analyst Scott Devitt lowered the price target on the company to $1,600 from $2,200 and has kept the Buy rating. He forecast GMV growth of 26% to $7.71 billion and revenue estimate of $2.09 billion for the next quarter, slightly ahead of consensus. However, as the comparable valuation multiples of the company’s publicly traded peers have declined, he has lowered his price target.

Jefferies analyst John Colantuoni has downgraded the company to Hold from Buy with a price target of $1,250, down from $2,000. He makes a note that the heightened macro uncertainty in Brazil, which represents 60% of the company’s revenue, could hold back MercadoLibre’s near-term valuation. He believes that the company is in an ideal position to benefit over the long term from attractive secular shifts in e-commerce and payments across Latin America and expects the stock to trade at the low end of its historical trading range until macro uncertainty subsides.

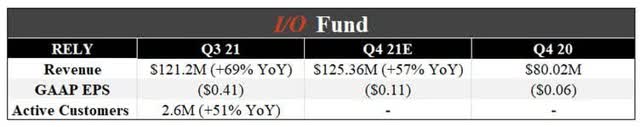

Remitly Global Inc. – Earnings on March 02nd

YCharts, Earnings Report, and I/O Fund

Global remittance provider Remitly’s Q3 revenue grew by 69%. It was the first earnings report since it became a public company in September 2021. The full lock-up expiry is expected next month. It is a very popular platform for international remittance. This is also evident as the active customers were up 51% and the average revenue per active customer was up 12% YoY to $47.34 in Q3.

Adjusted EBITDA came at $0.3 million compared to $0.6 million in the same period last year. The analysts expect revenue to grow 57% to $125.36 million in Q4. The management expects full-year revenue to grow about 74% YoY in the range of $445 million to $450 million.

JMP Securities analyst David Scharf has lowered the company’s price target to $40 from $52 and has kept the Outperform rating. The analyst remains positive on Remitly’s leadership position as a mobile-first, all-digital network serving a large and expanding total addressable market and believes that its secular tailwinds will continue. However, he cautions that the shares might be volatile in the near term due to the negative market sentiment.

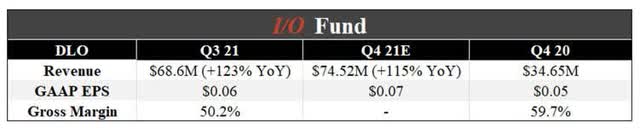

DLocal Ltd – Tentative Earnings Date is February 28th

YCharts, Earnings Report, and I/O Fund

Uruguayan payment company, which also had its IPO last year, is another promising startup. The company’s revenue grew by 123% in Q3 and the analysts expect revenue to grow 115% to $74.52 million. The total payment value (TPV) increased by 217% in Q3 to $1.8 billion.

The net revenue retention rate was 185%. The management expects NRR in the range of 150% to 160% in the medium term and to come down to about 120% to 130% in the long term. However, the take rate fell to 3.8% in Q3 from 4.1% in Q2. It would be a key metric to watch in the upcoming quarter.

Goldman Sachs analyst Tito Labarta has upgraded the company to Buy from Neutral and has a price target of $55. He believes that “The company should experience relatively minor impacts from higher interest rates considering that it has no debt on its balance sheet and does not focus on the pre-payment of receivables.”

Credit: Source link