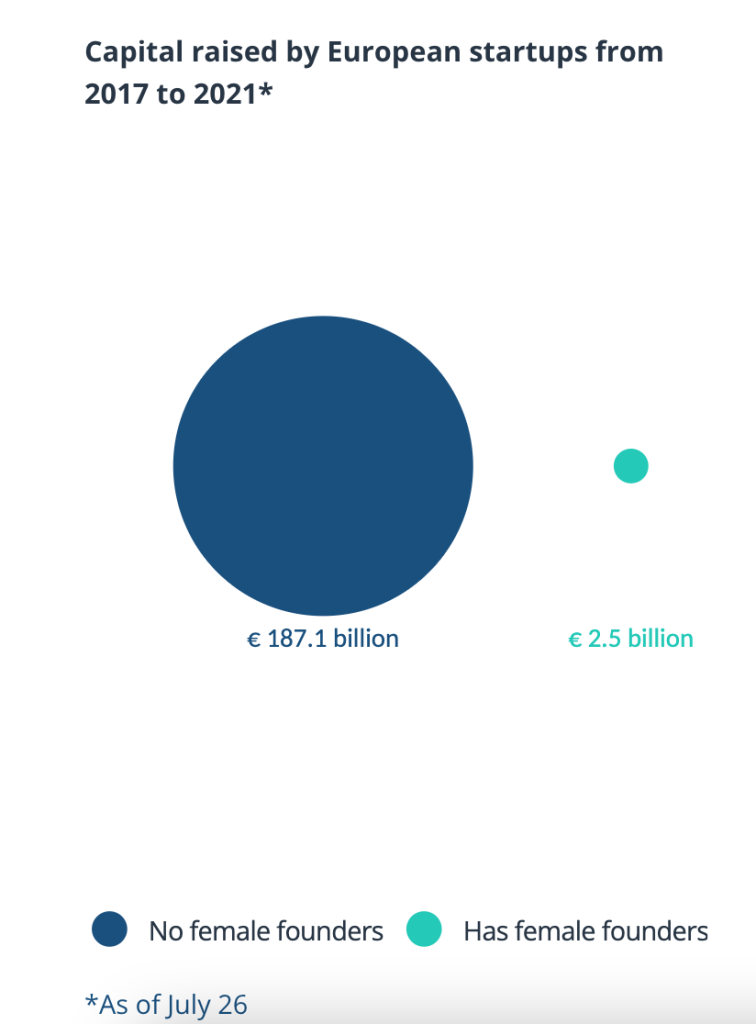

Venture capitalists are at pains to show their support for female founders — a demographic which has scooped up just 13% of all VC funding in Europe since 2017.

But which investors are actually putting their money where their mouths are?

We’ve studied 12 of Europe’s top VC firms to see how many female cofounders they’ve each backed over the last five years. The VCs were selected using the 2021 European Capital report, which ranked local VCs by assets under management.

We collected the data directly from each of the nominated VCs with the exception of Highland, which declined to comment. The ranking is based on how many women each firm backed, rather than how much capital they invested, between 2016 and 2021. It counts startups with at least one female cofounder in it.

The firm that has backed the most women across Europe over the past five years is the British Growth Fund.

At the other end of the scale is Earlybird, which has backed just one female cofounder over the past five years. Earlybird also has no female partners — and 15 male partners — according to its website.

When looking at female funding as a percentage of the total portfolio, firms like Atomico rank better — 22% of its investments included a female cofounder. Among them is Rachel Carrell, who started Koru Kids.

Meanwhile, firms like Partech have made an effort to improve their gender balance, with 31% of its seed funding globally since 2019 going to female cofounders. Their female-led companies are concentrated in the media and supply chain sectors.

But generally it’s not a pretty picture. The analysis shows that female-founder representation at several top VCs still falls below 13% — the share of capital allocated to women in total since 2017.

2021 hasn’t seen much improvement either, with only a handful of women securing backing from Europe’s top VCs so far this year.

The presence of large US firms is slightly massaging the overall figures. Index, which is split between the US and London, has invested in six female cofounders this year alone in Europe, constituting 40% of its new deal flow here.

Yet not all American funds have improved the scoreboards. Indeed, Tiger Global has backed 26 European startups so far in 2021, but just two — Lifebit and Vestiaire Collective — have a female cofounder, according to Dealroom. Meanwhile, Accel has backed 12 new companies this year — none of which had female cofounders.

In response, a group of VCs recently launched an appeal to boost funding for women in Europe, proposing a $3bn venture package dedicated to female entrepreneurs.

Other initiatives like Included VC and Diversity VC offer internships to train marginalised groups as VCs, hoping to diversify the flow of funds further down the road. These organisations also act as lobbyists and publish research into the state of play in VC.

The general ranking

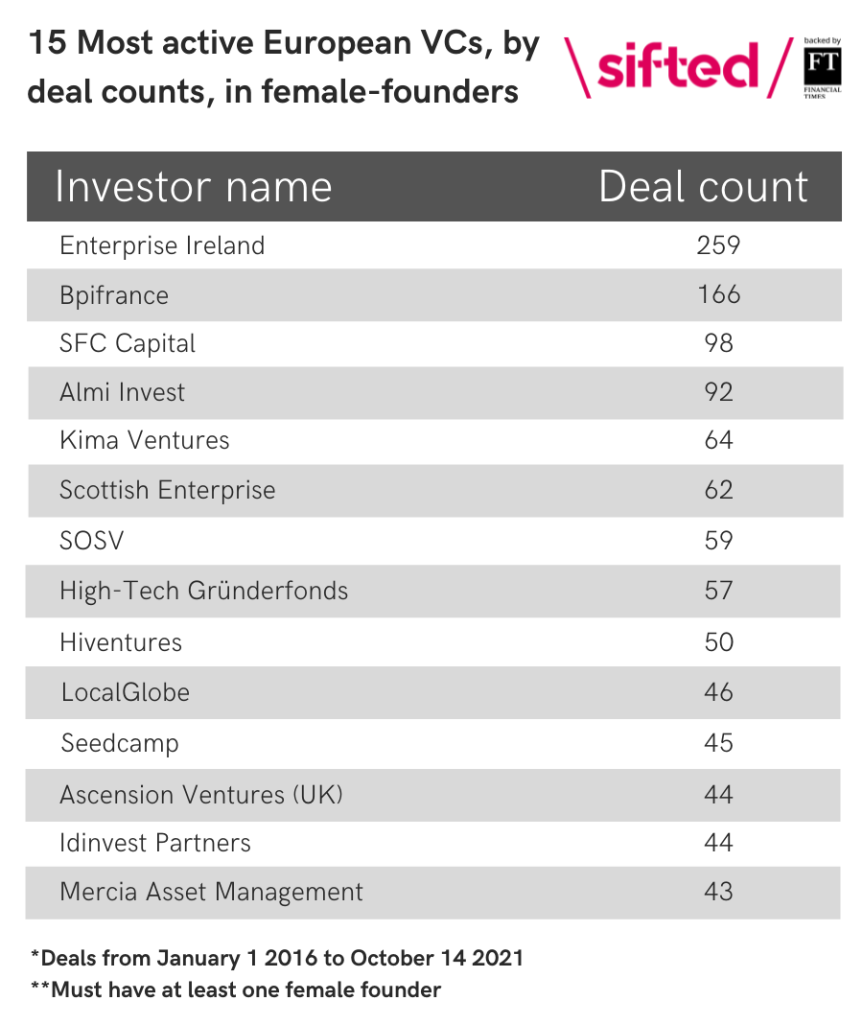

Top VCs aside, it’s also worth assessing which investors in general have backed the most female entrepreneurs.

The following ranking, curated by Pitchbook, shows the European VCs who partook in the most deals with female founders over the past five years.

Deal count is slightly different to a portfolio count, but it gives a good insight into which firms have been the most active and consistent in their investment of women.

The list flags important firms like LocalGlobe, which has backed women like Andrea Berchowitz and Rebecca Love, cofounders of personalised menopause platform Vira Health.

It’s worth noting that none of Europe’s top VCs by assets under management (AUM) make the ranking.

However, some of these large firms argue they’ve written the biggest cheques for female founders, meaning their impact is highly concentrated. Others make the point that they have several female CEOs who are not founders within their portfolios, like Depop’s CEO Maria Raga.

Some of the biggest deals involving a female founder over the past five years in Europe include:

- Darktrace — Poppy Gustafsson (UK)

- Karma Kitchen — Gini & Eccie Newton (UK)

- Lendable — Victoria van Lennep (UK)

- Starling — Anne Boden (UK)

- Kry — Josefin Landgard (Sweden)

- Vinted — Milda Mitkute (Lithuania)

Resources

Female-first funds

If you’re a female founder in Europe, it’s worth familiarising yourself with firms and investors that explicitly focus on women entrepreneurs.

These tend to be smaller and less active, but they have a clear thesis around the benefits of diversifying the flow of capital.

Funds exclusively backing female entrepreneurs which are active in Europe include:

- Merian Ventures — US/UK firm focused on women in deeptech.

- January Ventures (previously Jane VC) — US firm focused on women but also active in the UK.

- Unconventional Ventures — Nordic early-stage firm focused on women and minorities.

- Sie Ventures — Upcoming capital platform focused on women, led by Triin Linamagi (watch this space!)

- The Better Fund — Upcoming Eastern European tech fund, currently in the process of raising €30m. It will be focused on early-stage, ESG-first startups with female founders or gender-balanced teams.

- Borski fund — a Dutch €40m fund investing in female entrepreneurs or gender-first startups.

- Astia — US firm focused on women-led startups with one GP in the UK.

- The Helm — US early-stage venture firm backing women, with 15% of its $25m fund available for Europe.

- Forerunner Ventures — US firm for women but has invested in the UK’s Thingtesting and Finland’s Oura.

- Female Founders Fund — New York-based firm but has invested in the UK’s Peanut and Switzerland’s Fave.

Interestingly, female-first firms in the UK say one obstacle is that they can’t count the British Business Bank as an LP. That’s because the bank doesn’t make investments that exclude based on gender or ethnicity at present.

Female VCs

Separately, there are also a small number of VC firms in Europe that are female-led. While these don’t have a specific founder preference, data shows that female investors are more likely to back female entrepreneurs.

Among the female-led venture firms based in Europe are:

- Revaia — recently closed a €250m growth fund — led by Alice Albizzati and Elina Berrebi.

- Livonia — first fund closed at €150m — led by Kristine Berzina.

- Crowberry Capital — based in Iceland, recently closed a €90m fund II — led by Hekla Arnardottir, Helga Valfells and Jenny Ruth Hrafnsdottir.

- CapitalT — a €40m Dutch fund for European tech — led by Janneke Niessen and Eva de Mol.

- Voima Ventures — a €50m fund — led by Inka Mero.

- ESPIRA Investments — a private equity/growth fund in the Czech Republic — founded by Emilia Mamajova.

- Ada Ventures — a $34m UK fund for marginalised founders — cofounded by Check Warner.

- Blossom Capital — last fund raised was $185m, and a $400m fund is rumoured to be in the works — cofounded by Ophelia Brown.

- Experior Venture Partners — Polish firm cofounded by Kinga Stanislawska.

- La Famiglia — Berlin-based female-led firm that invests in European B2B seed-stage tech startups — founding partner is Jeannette zu Fürstenberg.

Another option is to focus on traditional VCs which have a decent number of female partners (there are 200+ women VC partners in Europe). Funds with a high proportion of female partners are generally deemed “female-friendly” — particularly given women only make up 20% of UK investment teams.

This list, curated by Forbes, also highlights a handful of VCs active in Europe that are consciously supporting female founders from ethnic minorities.

Female angels

For earlier stage companies, it’s also worth looking at this list of female angels in Europe. Among them there are also angels that only invest in women like Sarah Turner, who started Angel Academe, and Jana Bakunina.

Other angel groups focused on women include Poland’s Black Swan and Lumus in Slovakia.

Have we missed someone? Let us know!

Isabel Woodford is a senior reporter. She tweets from @i_woodford and coauthors our fintech-focused newsletter. Sign up here!

Steph Bailey is an editorial contributor. She tweets from @steph_hbailey.

Credit: Source link