“The pandemic has strengthened the case for fintechs, and we believe that venture capitalists are likely to remain invested even as a market pullback clouds the outlook for IPO or blank-check exits,” says Celeste Goh, Fintech Research Analyst at S&P Global Market Intelligence. “The uncertain market conditions ahead, however, may nudge investors toward mature fintechs that have demonstrated financial discipline and B2B companies, which tend to have better unit economics than their consumer-facing counterparts. As established fintechs have exhibited a propensity to acquire for growth when flush with liquidity, we expect a robust M&A outlook as these mature firms continue to draw in private capital.”

Key highlights from the report include:

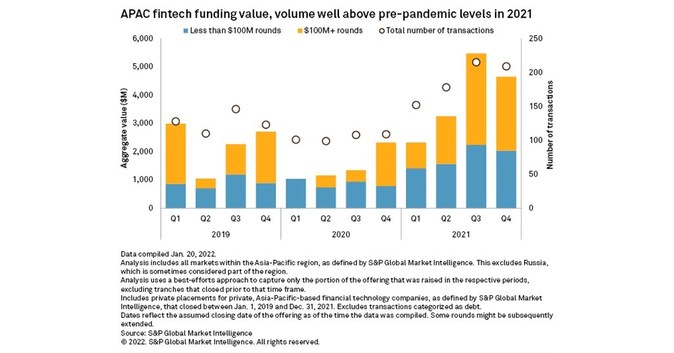

- Venture capital investments in APAC-based fintechs surged to a record high of $15.69 billion in 2021, more than double the prior year’s figure of $5.87 billion. While this growth followed subdued funding activity in 2020, the 2021 figure also represented a 74% jump from 2019’s pre-pandemic levels.

- Payment companies ranked in the largest amount of funding, reflecting investors’ bullishness in the sector as the region noted a huge surge in digital payments amid the pandemic. In APAC, the uptake in cashless payments has largely come from non-card payment methods with fintech arms of large digital conglomerates increasingly taking market share.

- Consumers’ shift to mobile payments has adversely impacted banks, which have historically focused on growing their lucrative credit card businesses. In 2020, we estimated that Southeast Asian banks lost $778 million in interchange revenue in Singapore, Malaysia, Thailand, and Indonesia as credit card activity took a hit, while Indian banks lost $524 million in fiscal 2021 ending March 31, 2021.

- In response to the potential threat of banks being disintermediated in the payment value chain, central banks across several countries in the region have launched interbank systems for retail payments to help incumbents stay relevant. While real-time payment systems may help lenders wrestle back market share in payments, the low transaction charges and waiving of fees in these payment schemes limit revenue opportunity.

- While fintechs may be encroaching on banks’ turf, incumbents seem to have recognized that maintaining a collaborative relationship with the technology players may be their best bet at staying competitive. Over the years, large APAC banks have been increasing their investments in fintech companies in hopes of tapping new customer segments and revenue streams.

To request a copy of the 2022 APAC Fintech Market Report, please contact [email protected].

S&P Global Market Intelligence’s opinions, quotes, and credit-related and other analyses are statements of opinion as of the date they are expressed and not statements of fact or recommendation to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security.

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. We integrate financial and industry data, research and news into tools that help track performance, generate alpha, identify investment ideas, perform valuations and assess credit risk. Investment professionals, government agencies, corporations and universities around the world use this essential intelligence to make business and financial decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI), the world’s foremost provider of credit ratings, benchmarks and analytics in the global capital and commodity markets, offering ESG solutions, deep data and insights on critical business factors. S&P Global has been providing essential intelligence that unlocks opportunity, fosters growth and accelerates progress for more than 160 years. For more information, visit www.spglobal.com/marketintelligence.

Media Contact

Kriti Khurana

S&P Global Market Intelligence

+91 971-101-7186

[email protected]

SOURCE S&P Global Market Intelligence

Credit: Source link