Also in this letter:

- M2P in talks with Insight Partners for new round

- Urban Company CEO’s interview

- Govt may widen definition of employment to include gig workers

PolicyBazaar’s parent firm gets Sebi approval for IPO

The initial public offering (IPO) of PB Fintech, the parent company of online marketplaces Policybazaar and Paisabazaar, has received Sebi’s approval, three sources told us. One of the sources said the company is looking at a valuation of around $6-7 billion for the listing. Another said it could look to list around Diwali.

IPO details: The company had filed its draft IPO papers with Sebi on August 2, seeking to raise Rs 6,017 crore ($809 million) through an IPO. It said it would raise Rs 3,750 crore ($504 million) by issuing fresh shares and Rs 2,267 crore ($305 million) through an offer for sale (OFS), in which existing investors can sell their stakes on the exchanges.

SoftBank Vision Fund Python, which has a 9.75% stake in the firm, is expected to cash in shares worth around Rs 1,875 crore ($250 million) through the OFS, while the founders — including chief executive Yashish Dahiya — are expected to sell shares worth a combined Rs 392.50 crore ($52 million).

China’s Tencent, which owns more than 9% of PB Fintech, has not been listed as an investor seeking to dilute its stake during the OFS.

Foreign-owned: PB Fintech has been listed as an entity that is “foreign-owned and controlled.” To ease the compliance process, it is looking to list as a professionally managed company that does not have an identifiable promoter. Dahiya, who has a 4.27% stake in the company, has been listed as chairman and executive director.

As of March, Policybazaar had 4.8 crore registered users who had bought more than 1.9 crore policies from its insurer partners. It claims to have a 93% share of India’s online insurance aggregator market, saying it accounts for more than 65% of insurance policies sold online.

‘Tis the season: PB Fintech is one of many Indian tech startups looking to tap the public markets in the next few months. Others include Paytm, Nykaa and MobiKwik. According to a report by PwC, Indian startups raised nearly $880 million in pre-IPO funding in the first nine months of 2021.

■ We reported last week that Paytm’s IPO has garnered interest from a set of new investors, including US-based asset manager Alkeon Capital, and funds managed by Morgan Stanley and Goldman Sachs. Sources said Paytm was expecting the regulator’s approval soon and was racing to be a publicly listed entity before Diwali, which falls on November 4.

■ We also reported that Mobikwik had received Sebi’s approval for its Rs 1,900 crore ($255 million) IPO. The company is expected to launch the IPO before Diwali (November 4) and is likely to fetch a valuation of $1 billion, sources told us.

■ Nykaa’s IPO has also received Sebi’s approval, we reported earlier today.

M2P in talks with Insight Partners for new round that would double its valuation

Madhusudanan R, cofounder, M2P Fintech

M2P Fintech, which provides digital banking infrastructure to fintech and other internet companies, is in talks with venture capital fund Insight Partners for a fresh funding round. If it goes through, the new round will roughly double M2P’s valuation from $355 million to more than $600 million in just a few weeks, sources told us.

Back-to-back rounds: M2P Fintech had announced a funding round led by Tiger Global just last week, a sign of the frenetic dealmaking among Indian startups this year. Sources told us that M2P is clocking an annualised revenue of around $20 million.

The startup said it will use the fresh funds to expand beyond Asia. Besides India, it operates in Nepal, the UAE, Australia, New Zealand, the Philippines and Egypt.

Founded in 2014 by Madhusudanan R, Muthukumar R and Prabhu Rangarajan, M2P was nominated in the Top Innovator category at the Economic Times Startup Awards 2019.

Its existing investors include Beenext Pte, Flourish Ventures, Omidyar Network India, 8i Ventures, Better Capital and the DMI Group’s Sparkle Fund.

Insight’s India charge: New York-based Insight Partners is increasingly eyeing the Indian tech market and has backed startups such as Apna.co, BharatPe, Chargebee, BrowserStack and Atlan. It is now being seen as a direct competitor to Tiger Global in terms of the pace of its deal-making in the US.

It has also been in talks with many other Indian fintech startups, sources told us.

According to a report in The Information, Insight is looking to close a fresh $16 billion fund, its largest ever corpus, on the back of record deals. The report, citing data from Pitchbook, said Insight was the third most active VC investor in the US market behind Tiger and Andreessen Horowitz.

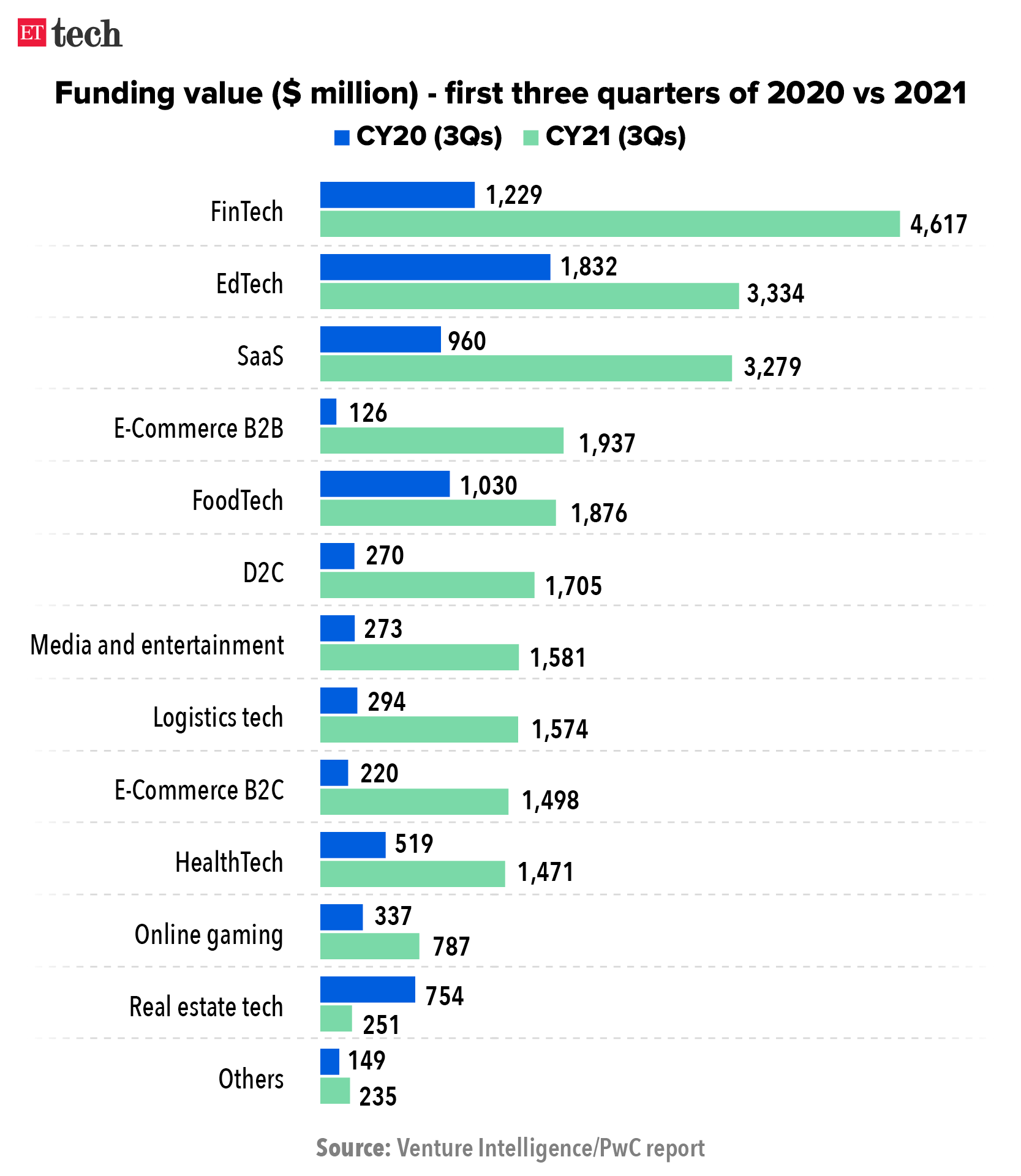

Fintech on fire: Indian startups have raised record funding this year, leading to the creation of 31 unicorns.

New-age companies raised a total of $10.9 billion across 347 deals between July and September, according to a PwC India report released today, titled ‘Startup Perspectives – Q3 CY21’. That’s twice the amount they raised in the same three months in 2020, and 41% more than in April-June.

Three sectors—fintech, edtech and software-as-a-service (SaaS)—accounted for nearly half the funds raised in the three-month period, with fintech leading the way. The report said India’s fintech firms raised $4.6 billion in the first nine months of 2021, nearly four times more than in the same period last year.

Tweet of the day

Urban Company CEO says new policy will increase partners’ pay

Abhiraj Singh Bhal, cofounder, Urban Company

Abhiraj Singh Bhal, the cofounder and chief executive of Urban Company, has had a busy two weeks. Last week, his company – which bagged the top spot in the Covid-led Business Transformation category at the Economic Times Startup Awards 2021—revamped its policies for service partners. This followed protests by about 100 women beauticians over poor pay and working conditions.

In an interview, Bhal told us why the company brought in these changes, adding that more such moves were in the pipeline and that all companies that employ gig workers should not be measured in the same way.

On Covid-19: Bhal said the company battled the two Covid-19 waves by shifting its focus to newer categories that worked well instead of sticking to its traditionally strong categories such as beauty, which took a hit due during the pandemic.

Quote: “The challenge was to refocus the company towards things which were seeing tailwinds versus being stuck to how we were doing things earlier and being wedded to the categories where we were originally stronger,” Bhal said.

Growth, profits, IPO: According to Bhal, the company aims to become profitable even as it remains focused on growth and hitting certain milestones before going public in about 18-24 months.

12-point programme: In a blog post last week, Urban Company listed a 12-point programme to improve earnings of service professionals on its platform. It promised to slash the highest commission it charges beauty service professionals to 25% from 30%. The startup said it would also marginally increase prices of several high-demand services across categories to increase the take-home pay of partners.

Govt may widen definition of employment to include gig workers

The government is considering tweaking rules and widening the definition of employment to include new types of workers such those in the so-called “gig economy”, before announcing a new national policy that will seek to ensure a fair deal for all types of employees.

The news comes almost a month after a gig worker association approached the Supreme Court seeking social security benefits for food delivery workers and cab drivers with Zomato, Swiggy, Ola and Uber.

What’s the plan? “The new form of workers, including gig and platform workers, needs to be factored in when the government comes up with India’s first National Employment Policy,” an official said.

The revised definition is expected to address the widespread issue of disguised employment, under which workers are denied their rightful dues as they are not recognised as employees under the current rules.

In fact, gig workers in India do not have any formal protection under existing labour laws. The more than three lakh delivery partners of Swiggy and Zomato are part of a fledgling gig economy that also includes delivery partners for ecommerce firms such as Flipkart and Amazon India, which have at least one lakh such workers each.

Earlier this year, finance minister Nirmala Sitharaman had proposed a social security scheme for gig workers.

Also Read:Food delivery workers protest ‘exploitation’ on Twitter; companies deny charges

HCL expects a strong showing in Q3, says CEO

HCL Tech chief executive officer C Vijayakumar

HCL Technologies is eyeing a strong showing in the third quarter of the financial year on the back of keenly anticipated deal closures in its products business and existing momentum in its services business, chief executive officer C Vijayakumar told us.

This comes at a time when there’s a massive spike in global IT spending, which is unlikely to abate after the pandemic.

Quote: “October-December will be a strong quarter. It is a slightly long-term strategic bet that HCL has taken, you can go through some ups and downs and that’s certainly part of any business,” said Vijayakumar.

The Noida-headquartered company, which saw profits before tax decline in the September quarter, in large part due to a softening in its products and platforms business, is still seeing “robust demand” for its products, which accounts for a little over a tenth of its overall revenue, the CEO said.

Revenue from services contributes over 88% to HCL’s top line while platforms and products chip in around 11.7%.

Also Read: TCS says its platforms and products business is worth about $3 billion

Explained: Blockchains and their disruptive power

Imagine a world where you can send money to anyone without the need for a bank. A world where there are no bank fees, where you have complete control over your assets, and no government can manipulate the value of your hard-earned money. Sounds like a dream, right?

But this world is not imaginary. It is being created bit by bit as you read this, on the back of blockchain technology.

What is a blockchain? A blockchain is simply a shared ledger or database, that can be accessed, filtered, and manipulated quickly and easily by any number of users at once.

It stores information in groups called blocks, which have a certain storage capacity. When full, they are linked, or “chained”, to the previous block. Any subsequent information is put into a freshly created block and the chain continues to grow.

In a blockchain, each participant computer, or “node” has a full record of the data that has been stored on it since inception. The Bitcoin blockchain, for example, has a record of every bitcoin transaction ever made.

Blockchains can record information in a way that makes it close to impossible to change, hack, or cheat the system. That’s because the record is distributed, not copied or transferred, creating an immutable record of an asset. It is also decentralised, allowing full real-time access and transparency.

While cryptocurrencies are currently its most popular use case, blockchain technology can also be used to track any kind of asset—from houses to land and even patents.

This gives it the potential to disrupt almost every sector.

For example, the Election Commission of India is working with IIT-Madras on using blockchain technology for remote voting. And Plymouth University explained in a paper how blockchain could be used to make the elections more transparent.

Read the full explainer here.

Other Top Stories By Our Reporters

LTI’s Q2 net profit up 21% to Rs 552 crore: Mid-tier IT services company Larsen & Toubro Infotech’s (LTI) consolidated net profit rose 20.8% year on year to Rs 551.7 crore for the fiscal second quarter, while consolidated revenue from operations grew 25.6% to Rs 3,767 crore.

Devas eyeing foreign assets of Indian govt: Devas Multimedia’s investors are eyeing several properties owned by the Indian government across the world, as they seek to enforce a $1.3 billion arbitral award the satellite company won against Antrix, the commercial arm of India’s space agency

Global Picks We Are Reading

■ China weighs opening Tencent, ByteDance content to search (Bloomberg)

■ Singapore billionaire and Cristiano Ronaldo to marry football and tech (Bloomberg)

■ Five US lawmakers accuse Amazon of possibly lying to Congress (Reuters)

Credit: Source link