An investment fund created by JAM Fintop, a joint venture that seeks to connect community banks with potential technology partners, has announced its first investment: the small-business predictive intelligence company Monit.

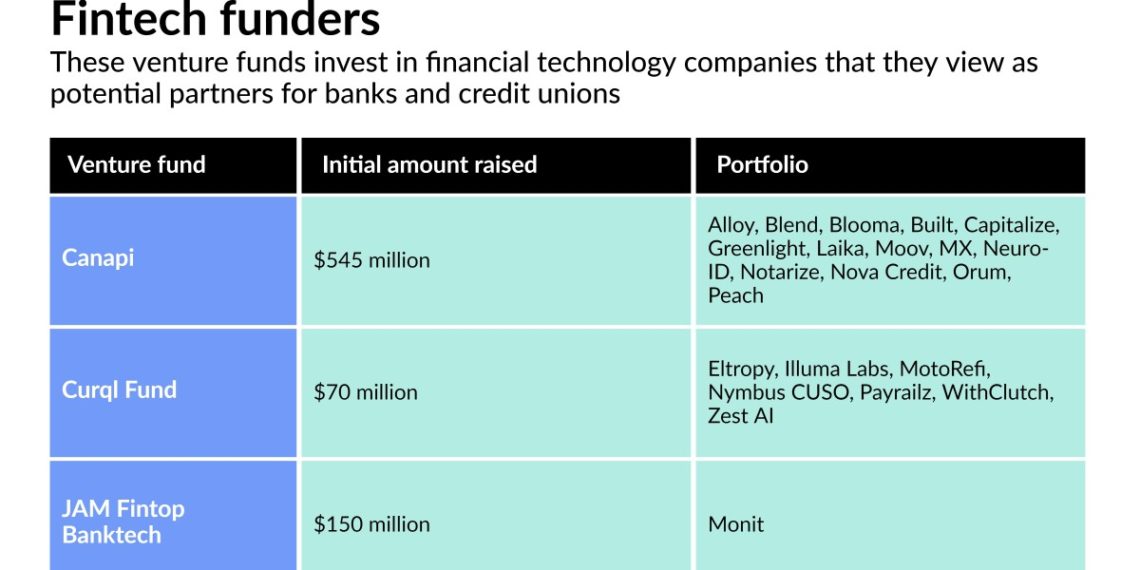

The fund, called Banktech, is the latest in a series of venture capital funds that allow small financial institutions to invest in fintechs that could also be business partners. The long-term value of these funds is unproven, but they appeal to banks that are looking to experiment with new technologies that aren’t reliant on traditional core-systems providers.

“It’s like having a phenomenal research team at your disposal to help educate you on emerging trends,” said Farhan Yasin, chief technology officer of the $11 billion-asset Busey Bank in Champaign, Illinois, which is one of the limited partners of the Banktech fund.

JAM Fintop was created in April by JAM Special Opportunity Ventures — whose affiliate Jacobs Asset Management in New York City invests in community banks — and Fintop Capital, a Nashville, Tennessee, firm that invests in fintechs that serve financial institutions. The joint venture as well as the Banktech fund have 66 community and midsize bank partners, ranging in size from about $500 million to $80 billion of assets. The fund raised $150 million in April; a separate blockchain fund was announced in August.

Other venture capital funds are giving banks or credit unions opportunities to invest in fintechs and gain access to these potential partners as well. Canapi Ventures was announced last year; one of its investment is the online lending software startup Peach Finance. Curql Collective, which runs the Curql Fund for credit unions, completed its first fundraise in April. CMFG Ventures is the venture capital arm of CUNA Mutual Group, an insurer for credit unions. Recently, the founder of the registered investment advisor Mendon Capital Advisors Corp announced the Mendon Ventures BankTech fund, which will target technology providers to small to midsize banks.

Returns aren’t the only purpose of such funds. “Particularly in the last 12 months, [financial institutions] have used fintechs as more of a partner than competitor, but the challenge is who is the best partner, how do I manage that partnership, how do we get visibility on potential partners?” said Vincent Hui, managing director at Cornerstone Advisors.

Funds such as JAM Fintop are one way for institutions with fewer resources than large banks to identify potential partners “without going down a rabbit hole with the wrong partner or wrong space,” Hui said.

This thinking is echoed by Matt Kelly, director of the JAM Fintop bank network.

“There is a deep and growing desire for bank management teams to have a larger seat at the table,” he said. “We’re starting to see banks growing faster through fintech partnerships and breaking out into more significant valuations in the public market. When COVID hit, a lot were forced to innovate faster.”

JAM Fintop’s goals are to provide returns on its limited partner banks’ investments but also understand where its members seek to fill technology gaps and offer a forum where banks can discuss these projects.

“A $500 million-asset bank is not going to have an innovation committee that is 10 to 20 people deep,” Kelly said.

The hope is that over time, many of the banks in the network will become customers of the portfolio companies.

A survey by JAM Fintop of its partner banks in the spring found that faster payments, digital end-to-end lending solutions, business intelligence, banking as a service and embedded banking were among the top areas of concern.

Monit fits under the business intelligence umbrella.

“On the heels of the Paycheck Protection Program, a lot of banks have expressed interest in remaining active in the small business arena,” Kelly said. “Tools like Monit allow banks to have a more robust look at the financial picture of their small-business customers and help in a more customized way.”

Monit debuted in September 2020 as an app offered through banks for small-business owners. Customers could link to their accounting software and scroll through their key numbers, such as revenue and expenses; view historical cash flow and cash-flow projections; receive alerts about potential issues that demand immediate action; and test how different scenarios will affect the business.

It has since evolved to offer features that give banks a holistic view of their portfolio of customers with aggregated, anonymized data, such as the average number of credit and deposit relationships customers have with other banks and their top competitors.

Rather than serve as a stand-alone app, Monit has been working on ways to integrate itself into onboarding flows or online account summaries. The fintech has locked in a handful of bank clients (which pay Monit to make the software available to their customers) that range in size from $15 billion to $150 billion of assets.

Busey and Valley National Bancorp, a $41 billion-asset bank in New York, are two limited partners of JAM Fintop that also hope to be customers of Monit. Yasin, for example, says that Busey already sells software and services to its small-business customers, but is drawn to Monit because of its easy integration for small businesses, user-friendly interface and the critical information it dispenses to small business owners.

His goal is to launch Monit to his customer base in 2022.

This evolution toward fund investors also being potential buyers and users of the technology is relatively new to the banking industry, said Charles Potts, chief innovation officer of the Independent Community Bankers of America. The ICBA operates the ThinkTech Accelerator, a community bank-focused fintech accelerator program, and is one of five partners spearheading a new venture capital fund called BankTech Ventures that is currently in fundraising mode.

“These funds serve a very important role in bringing structured capital investment to early-stage companies to help them scale,” Potts said. “This is something the bankers have been asking for and an obvious next step for innovation in the community bank marketplace.”

Still, it will take time to see if the method is viable.

“It’s an interesting idea, and I can see it being a trend,” said William Whitt, strategic advisor at Aite-Novarica Group. “But the immediate payoff is pretty much nonexistent. Longer term, maybe, but I’d argue there is already technology out there today that can help community banks be more competitive with large firms.”

Credit: Source link