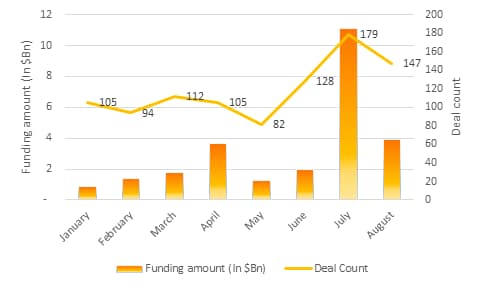

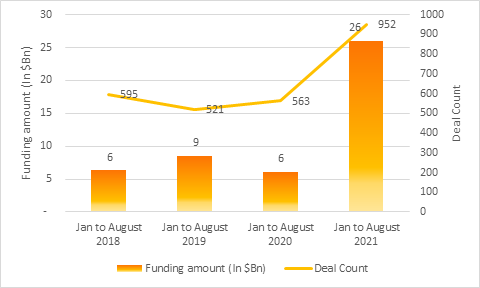

Indian startups have been on a funding spree this year, with a record $26 billion having been raised in the first eight months of 2021. Almost twice as much as the funding recorded in CY 2017 ($13.2 billion).

Unfortunately, matching the plethora of new startups on a lookout for investors/ funding opportunities is an equal percentage of fraudsters keen to leverage this ecosystem to dupe investors. There have been quite a few cases in the recent past that have left a trail of angry investors and wounded customers; with stakeholders bewildered and wondering what they could have done differently.

In our view, investment decisions should ideally be based on the business proposition as well as the work ethics and culture propagated by the founders of the startup.

With an endless list of diligence procedures to keep in mind – profile of promoters, sector, applicable regulations, uniqueness of the solution, financial parameters – here are a few checks that are comparatively simpler and could help potential investors in taking strategic decisions:

1. Source of seed capital

Running the names of founders/directors, related entities on the sanctions database, criminal database, public investigation reports can help you identify potential red flags (if any) raised on the founders or the entities.

2. Authenticity of business solution/ model: Investors need to ascertain if the business solution being projected as an innovative/ unique proposition genuinely belongs to the founders or is a ‘rip off’ from a previous association or past employment.

If the founders were in their recent past connected to an organisation in a similar sector/ industry, it will be useful to check the source of their database or technology used to explain the viability of their business model along with relevant additional checks depending on facts of each case.

Investors should assess if there are any potential breaches relating to data confidentiality/ data privacy/ no competition clause.

3. Dependency on unregulated sectors: Startups in their initial stages may tend to rely on unregulated sectors to source key supplies. However, if this percentage is way too high then it may reflect as a vulnerability of their business model and could also end as a limitation to the scalability of their business.

One of the ways to assess this is to review the entity’s GSTR 2A. Comparison of transactions in GSTR 2A vis-à-vis the overall purchases would help to identify percentage of supplies through potentially unregulated sector. The outcome from here needs to be read in consideration of other relevant factors such as if the supplies are non-taxable or are under negative list of GST etc.

Simultaneously, it is also important to consider the value of cash purchases vis-à-vis overall purchases as the possibility of siphoning off funds increases in cash transactions.

(There are various types of returns which are filed under GST Act such as GSTR 1 which is filled by the seller of the product, once GSTR 1 is filled by the seller the data would automatically start getting reflected in GSTR 2A (view-only dynamic tax return) to the purchaser or buyer of goods and services)

The above measures/ procedures are not an exhaustive list of checks to evaluate all possible exposures but would help to understand the business risks of the potential investment.

It is important that the Indian startup ecosystem is not allowed to get tainted by a few fraudsters and remain a shining beacon of our growing economy. The responsibility for this resides on both sides, the founders as well as the investors.

The author Saurabh Khosla is Director, Financial Advisory, Deloitte India. Yavanika Agrawal (Assistant Manager, Financial Advisory, Deloitte India) and Lokesh Chopra (Deputy Manager, Financial Advisory, Deloitte India) also contributed to the article. Views expressed are personal.

(Edited by : Kanishka Sarkar)

Credit: Source link