Also in this letter:

■ Lightspeed sets up dedicated team for growth deals

■ Mamaearth seeks BBlunt makeover, Cult.fit joins Gold’s Gym

■ Glance set to raise $200 million from Jio Platforms

Amid talent war, startups promise no downsizing, unlimited leave

Indian startups including the likes of Meesho, PhonePe, Upgrad, Purplle, Pristyn Care and Spinny are going all out to rope in and retain talent, promising things like unlimited leave and no downsizing.

What’s else? Also on offer are quarterly promotion cycles, cross-functional movement, stock option plans, gender-neutral parental leave, period leave, mental health breaks, permanent remote working or work from anywhere, and monthly incentives.

Why? According to job market experts and top startup executives, this is due to increasing competition in startup hiring as new-age firms grapple with high drop-offs, job shopping and counter offers amid an intensifying war for skilled tech talent.

Who’s doing what: Headout, an online experiences marketplace for travellers, recently promised no downsizing to its existing employees and new recruits.

- Ecommerce company Meesho recently introduced a “boundaryless workplace model” that allows employees to choose between work from home, office or any location of their choice.

- Pre-owned car retailing platform Spinny has introduced a menstrual leave policy, which provides an additional 12 days of leave annually to its female employees.

- Online beauty products marketplace Purplle offers monthly incentives to ensure that employees are rewarded for their performance in a shorter time cycle.

How hard is it to attract talent? Anshuman Das, CEO of search consultant CareerNet and Longhouse Consulting, cites the case of a newly turned unicorn in the ecommerce space which reached out to him to assist in its search for tech talent. “The company put out 40 offers for a tech role in four months between August and November but no one joined,” he said.

According to an estimate by Longhouse Consulting, the offer to joining ratio, which was around 50-60% for unicorns in pre-pandemic times, has now dipped to 20-30% and in some cases to as low as 10-15%. Even after offer acceptance, the joining ratio is less than 50% compared to 70-80% earlier.

Lightspeed sets up dedicated team to focus on growth deals

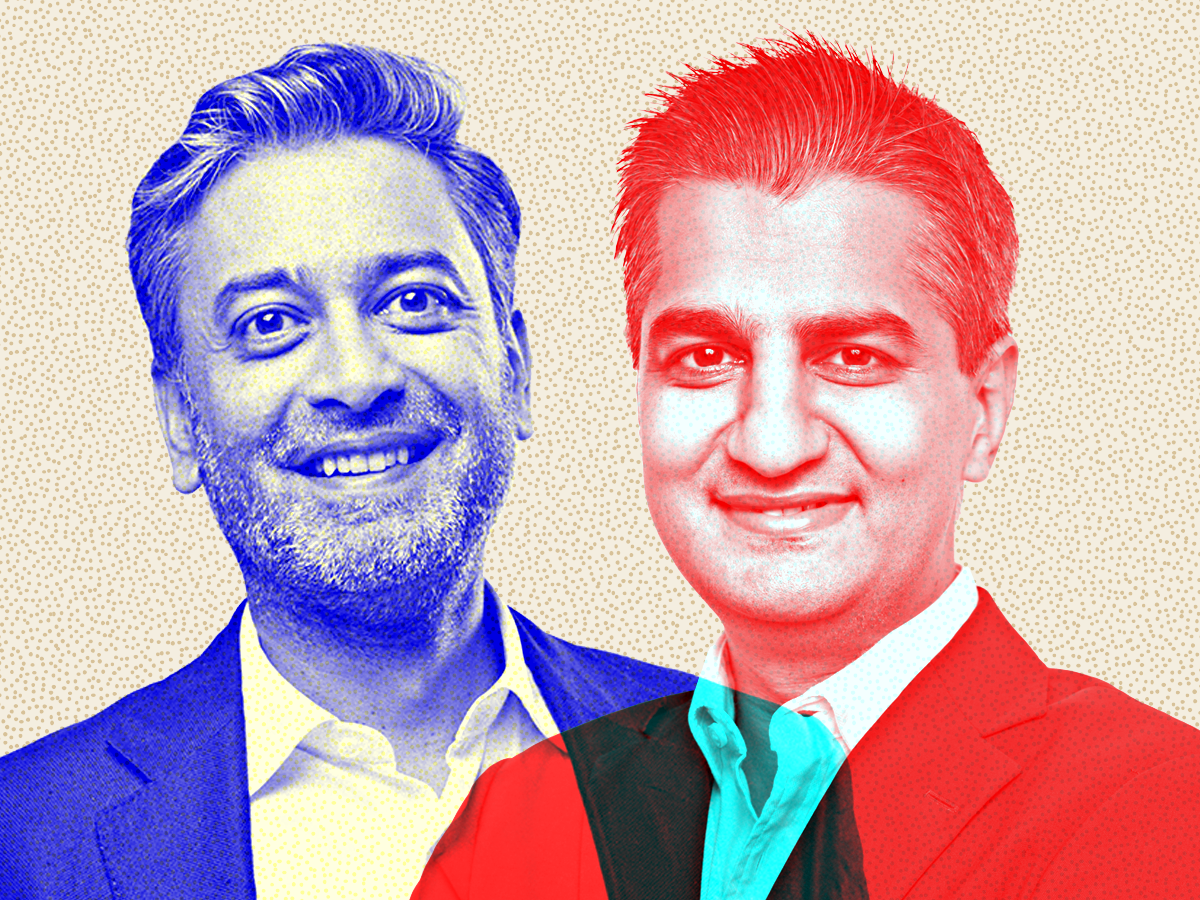

Bejul Somaia and Aditya Sharma

Early-stage investor Lightspeed Venture Partners, which has backed startups including Byju’s, Oyo, Udaan and ShareChat, will focus more on growth deals and has put in place a dedicated team to scout for such opportunities, senior executives told us.

Growth-stage investments typically come after a startup’s first few rounds of funding.

In their words: Bejul Somaia, partner, Lightspeed, told ET in an exclusive interview, “At the early stage, it is somewhat inevitable that we will miss investing in compelling founders and companies, either because we didn’t see those opportunities at the seed or Series A stage, or because we failed to appreciate them fully. By scaling our capital base, we are able to invest in some of these exceptional companies and founders slightly later in their lifecycle,”.

“This isn’t new for the firm globally or in India. What is new is that we’ve formalised and expanded the effort and now have a dedicated team that is executing against this strategy,” he added.

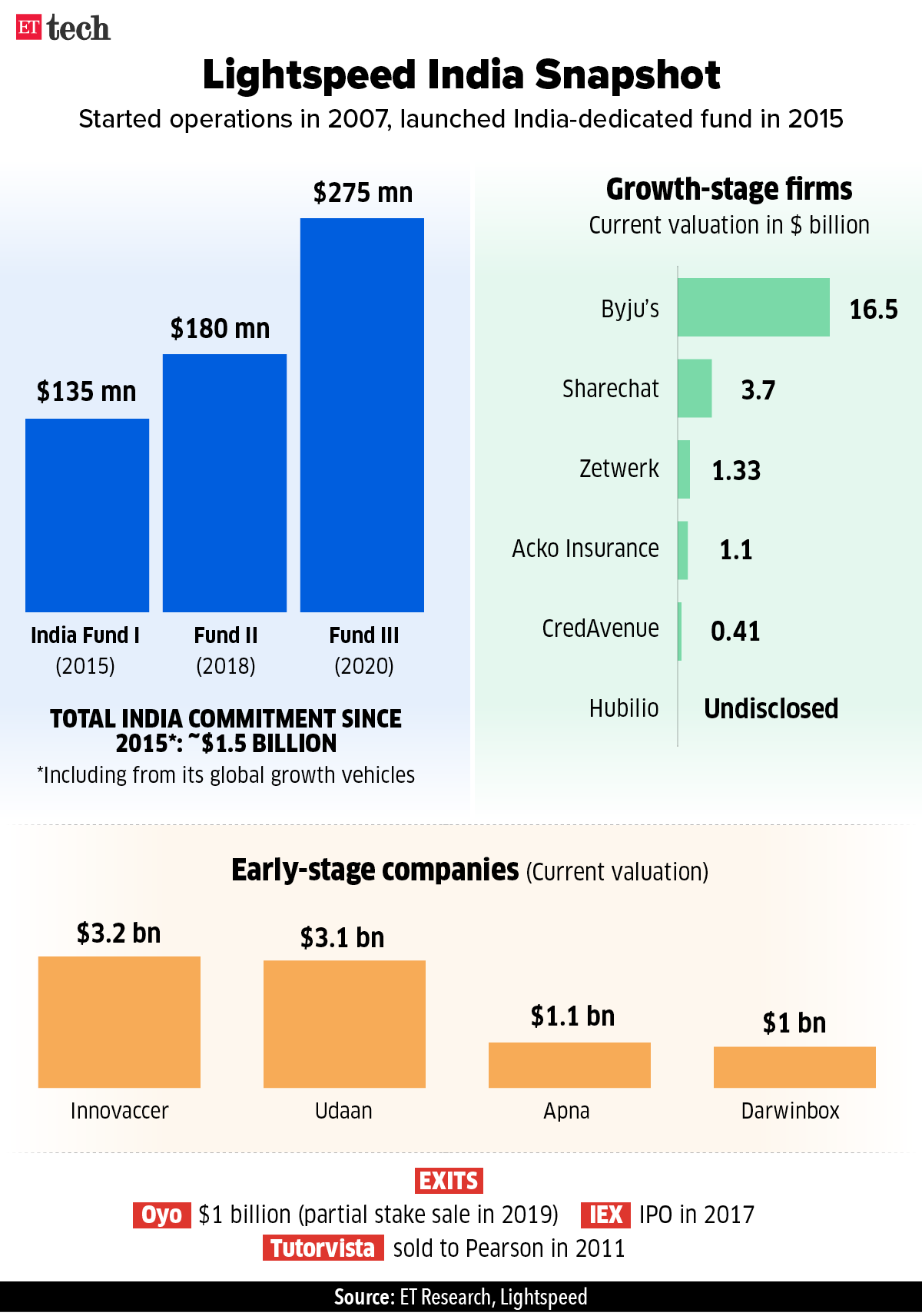

India investments: Lightspeed’s other investments in India include Darwinbox, Yellow Messenger, OK Credit, Apna, Dukaan, and Teachmint.

- In 2020, Lightspeed India mopped up $275 million from limited partners (LPs) or sponsors, for its third fund to invest in the country.

- Before that, it raised $180 million for Fund II and $135 million in its maiden India-dedicated fund in 2015.

Indian startups snagged $34.7 billion in VC investments across 1,070 deals in 2021, according to Venture Intelligence. On this, Somaia said: “You only find out many years later which decisions worked out and which didn’t. And when you look around, there are a lot of very bright, informed people making very different decisions.”

TWEET OF THE DAY

Mamaearth seeks BBlunt makeover, Cult.fit joins Gold’s Gym

Mamaearth cofounders Ghazal Alagh and Varun Alagh

Mamaearth, a direct-to-consumer (D2C) startup, has acquired Mumbai-based BBlunt from Godrej Consumer Products Limited (GCPL) for about Rs 134 crore.

Under the terms of the deal, BBlunt’s hair care and styling products business will be completely owned and managed by Mamaearth parent Honasa Consumer.

The two-decade-old salon business will continue to operate as an independent entity.

Meanwhile, fitness centre chain Cult.fit has picked up a majority stake in F2 Fun & Fitness, thereby becoming the master franchise partner for Gold’s Gym in India.

Cult.fit said it will invest in increasing revenues from existing Gold’s Gym centres, and facilitating centre expansion via franchisees in coming years. Gold’s Gym is the second-largest fitness chain in India, operating more than 140 gyms across more than 90 cities.

Significance: Both deals involve traditional businesses – salons and gyms – that have been badly hit by the pandemic even as startup valuations have gone through the roof.

- Gurugram-based Mamaearth’s parent became a unicorn on January 1 after raising $52 million in a round led by existing investor Sequoia Capital.

- Cut.fit’s parent firm Cult.fit Healthcare was valued at $1.5 billion after a recent investment by Zomato.

These are also not the first traditional businesses to be acquired by startups since the start of the pandemic.

- In January 2021, BharatPe put in a joint bid with financial services firm Centrum to acquire the troubled Punjab and Maharashtra Cooperative Bank (PMC).

- In June 2021 we reported that online pharmacy startup PharmEasy was acquiring a majority stake in diagnostics chain Thyrocare Technologies. It was the first acquisition of a listed company by an Indian unicorn.

- In April 2021, Byju’s acquired tutorial chain Aakash Educational Services for $950 million, sealing its largest buyout. It was also one of the largest acquisitions ever by an Indian startup, bigger than Snapdeal’s purchase of Freecharge for $400 million in 2015 and Flipkart’s acquisition of Myntra for an estimated $330 million in 2014.

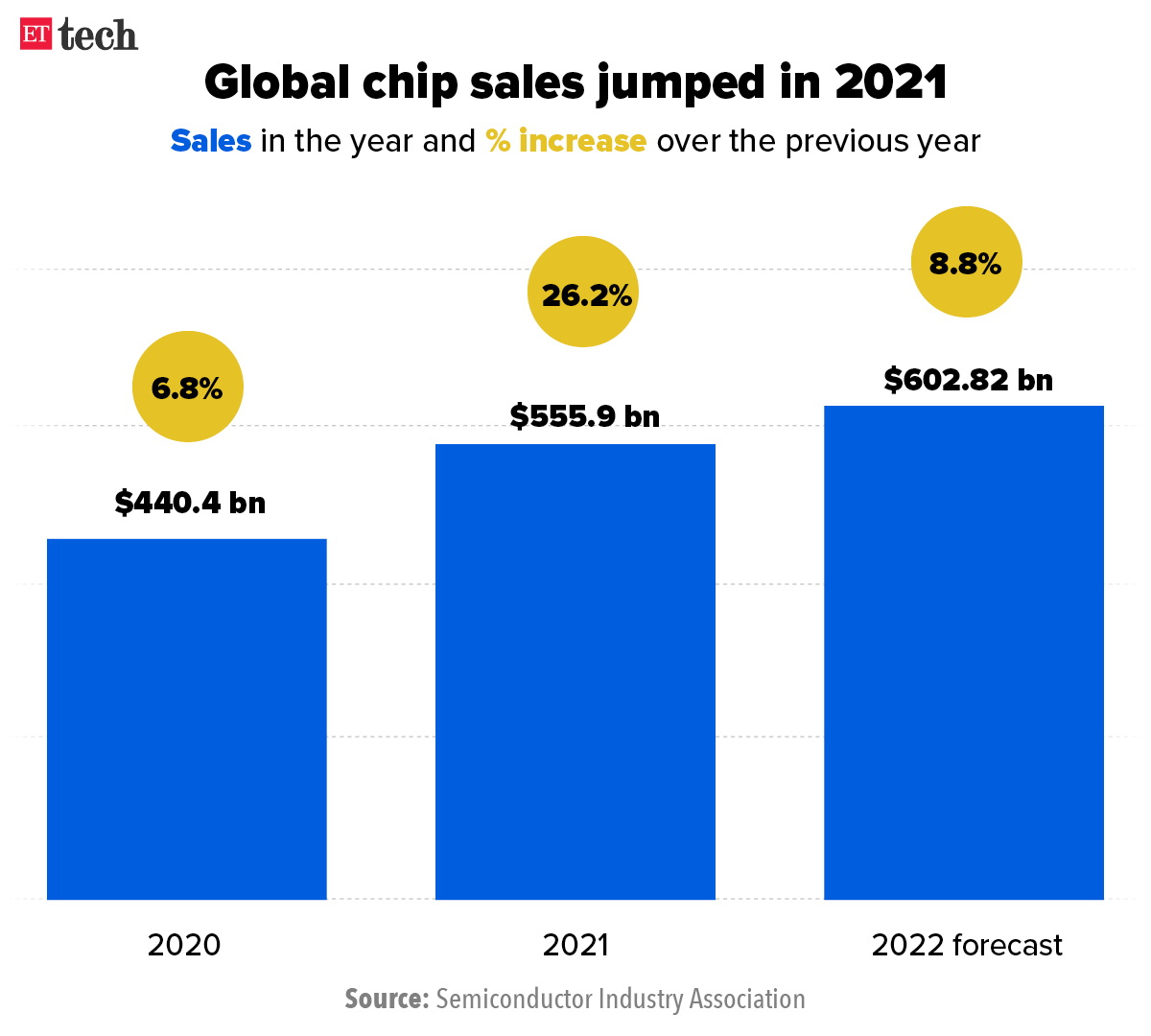

Infographic Insight

Glance set to raise $200 million from Jio Platforms

Lockscreen platform Glance, which is part of the InMobi Group, on Monday said that it will raise $200 million from Reliance’s Jio Platforms Ltd.

Deal details: The transaction is subject to the satisfaction of customary closing conditions and regulatory approvals. The investment will value Glance at $1.7 billion to $1.8 billion post-money, according to a Reuters report.

The proposed investment by Jio is aimed at accelerating Glance’s launch in several key international markets outside of Asia including the US, Brazil, Mexico and Russia. With the investment, the entity is now looking to further bolster its live content capabilities and enable its commerce ecosystem further.

Glance has also entered into a business partnership arrangement with Reliance Retail Ventures, providing for Glance’s ‘lock screen platform’ to be integrated into the JioPhone Next smartphones.

ETtech Done Deals

- Debt marketplace CredAvenue said it has acquired a 75.1% stake in digital collections company Spocto to expand its product offerings.The acquisition will help CredAvenue include a digital collection solution for lenders and help mitigate risk and curb fraud on its platform, the company said.

China apps ban: Gaming, beauty and dating apps dominate latest list

Chinese apps banned by the Union government in its fifth and latest crackdown include a host of games including Garena Free Fire; Isoland 2: Ashes of Time Lite; Rise of Kingdoms: Lost Crusade; Conquer Online and Twilight Pioneers.

New avatars: Many of these apps belong to large Chinese tech firms such as Tencent, Alibaba and gaming firm NetEase, and are “rebranded or rechristened avatars” of apps that have been banned in India since 2020.

ET reported on Monday that the ministry of electronics and IT had ordered a ban on 54 more China-origin apps in India, terming them a “threat to national security”.

Other casualties: The latest round of bans also included messaging and dating apps such as CuteU: Match With The World, CuteU Pro and FunChat Meet People Around You. Also on the list were video-based social media platforms such as SmallWorld, FancyU, MoonChat and RealU.

Round 5: This is the fifth round of major bans of Chinese apps by the Indian government following border tensions with China in 2020. In June that year, the government blocked 59 apps including hugely popular ones such as TikTok, Shareit, UC Browser and WeChat. Since June 2020, the government has banned around 224 Chinese apps in total.

Delhi High Court dismisses Zostel’s attempt to halt Oyo IPO

Oyo dodged a bullet on Monday when the Delhi High Court dismissed an interim appeal filed by Zostel (Zo Rooms) that had sought to halt its IPO. Zostel had said Oyo’s IPO was ‘non-maintainable’ as the company’s capital structure was not ‘final.’

Catch up quick: The dispute between the two companies dates back to 2015, when they signed a contract for Oyo to acquire Zostel.

- The deal fell through, but Zostel said that it still deserved about 7% in Oyo’s parent firm Oravel Stays.

- A Supreme Court-appointed arbitrator said in March 2021 that the term sheet between Oyo and Zo was binding and that Oyo, after a point, stopped taking steps to fulfil obligations under it. It said Zo was “entitled” to make “appropriate proceedings”.

- Since the dispute landed in court, Oyo has maintained the said term sheet was non-binding and challenged the arbitrator’s order.

- On October 11, we reported Zostel had asked Sebi to reject Oyo’s draft IPO papers and suspend its IPO.

Appeal incoming: Sources told us Zostel was likely to challenge the latest Delhi High Court order.

What they said: Zostel’s legal counsel Abhishek Malhotra said, “While it does not have an impact on the final award (7% stake in Oyo) that we have received, the immediate relief that we sought – a stay of the IPO – has been denied at this stage. We are evaluating our options including filing an appeal before the division bench.”

A spokesperson for Oyo said, “While we await the full order, we believe that Zostel’s demand for issuance of 7% shares of Oyo under the arbitration award has also been rejected. This verdict vindicates our stand that Zostel has been trying to mislead the public.”

Other Top Stories By Our Reporters

K’taka HC strikes down major portions of online gaming law: The Karnataka High Court on Monday struck down the contentious amendments to the Karnataka Police Act, 1963, which ban online ‘games of chance’, while allowing the petitions filed by the All India Gaming Federation (AIGF) and gaming companies. A division bench said the amendments violated the Constitution. But it said it was not striking down the entire law, only some offending provisions.

Vashu Bhagnani’s Pooja Entertainment buys virtual land: Film producer Vashu Bhagnani’s Pooja Entertainment has bought virtual land in the metaverse, becoming the first Indian production house to have stepped into the virtual universe. The company will use the land, named Poojaverse, to create first-of-their-kind immersive experiences for viewers, starting with its recently announced project ‘BadeMiyan ChoteMiyan’ which will be the first Indian film to be announced in the metaverse.

Slice, Bizongo complete Esop buybacks: Fintech firm Slice and supply chain enablement platform Bizongo announced the completion of their first employee stock ownership plan (Esop) buyback programmes. Slice said around 60 current and former employees were eligible for its buyback programme, worth Rs 65 crore (around $8.6 million). Bizongo said 102 of its current and former employees with vested options were eligible for its buyback.

Global Picks We Are Reading

■ No, The New York Times did not make Wordle harder (The Verge)

■ 74% of ransomware revenue goes to Russia-linked hackers (BBC)

■ Divorcing Couples Fight Over the Kids, the House and Now the Crypto (NYT)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant in Mumbai and Judy Franko in New Delhi. Graphics and illustrations by Rahul Awasthi.

Credit: Source link