It seems there’s news every day about startup funding reaching record highs, new unicorns being minted and tech firms going public. There’s no question that we are in the middle of a long-running and accelerating venture bull market.

All of this impresses upon us that every indicator in startup funding points up and to the right: Venture firms have more dry powder, deal sizes are growing rapidly, valuations are soaring and investment terms are more founder-friendly than ever. And all that is indeed happening.

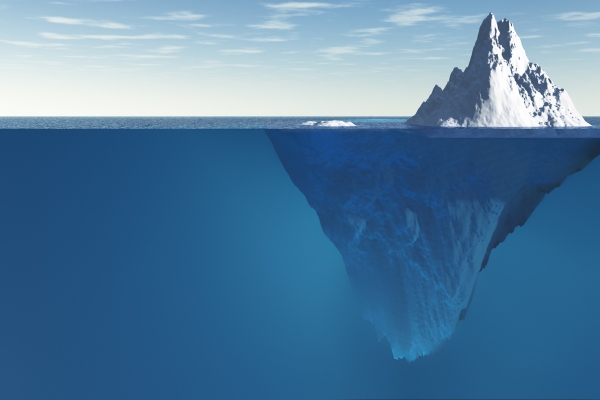

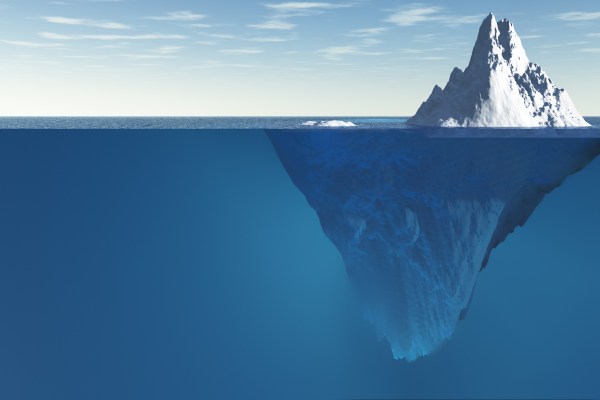

But a closer inspection reveals that these trends are a lot more nuanced and apply very unequally across the funding continuum from seed to the late stage. What’s more, most of the underlying truths and rules are not changing.

The venture alphabet soup of “A, B, C rounds” suggests it’s all the same, just one after the other, but it is not. It is more like playing an entirely different sport.

Beware of the outliers

The stage definitions in venture, from seed to late-stage Series D, E or F rounds, have always been open to interpretation, and general patterns are challenged by outliers at each stage. Outliers — unusually large financings with high valuations relative to the company’s maturity — are as old as the industry itself. But these days, there are more of them, and the outliers are more extreme than ever before.

For example, Databricks raised two massive private rounds, a $1 billion Series G and a $1.6 billion Series H, in 2021. These funding rounds are bigger than many IPOs in the recent past, and Databricks is far from the only company to do something like this. There were an average of 35 “megadeals” (with over $100 million raised) per month from 2016 to 2019, according to Crunchbase. In 2021, that number stands at 126 per month.

This is mainly due to two major trends. First, the extremely lucrative exit market has created the economics to support mega late-stage rounds and venture rounds of $100 million or more. And, companies are staying private longer, and they need additional late-stage capital before an IPO that companies historically did not need. More on that below.

What is important for now is to acknowledge the simple truth that aggregates and averages don’t tell the real story of the broader market. The median of funding round sizes and valuations give a better view of how the market is really doing. So when you see the next report on a record venture funding month, pay close attention to what is being heralded.

Stages behave very differently

Most people think the substantial growth applies across the funding continuum, but that is not really the case. In fact, the venture bull market affects different stages very differently. The following is based on Cloud Apps Capital Partners’ analysis of PitchBook data on fully documented U.S. financings (seed through Series D) in the cloud business application space since 2018 through the first half of 2021.

The biggest impact appears to be in the late stage. For Series C and D financings as a group, median round sizes more than doubled to $63 million in 2021 from $31 million in 2018. Pre-money valuations grew by 151%, and ownership — the share equity investors in the round collectively own after the financing — dropped to 12% from 18%. So the money involved has doubled, but Series C and D investors ended up owning a third less than they used to.

Credit: Source link