Swap, a São Paulo-based BaaS startup, announced today it has raised $25 million in a Series A led by Tiger Global Management.

The financing was “heavily oversubscribed,” according to the company, which has now raised $28 million since its October 2018 inception. Endeavor, Tinder co-founder Justin Mateen, partners of DST Global, ONEVC, Global Founders Capital and Flourish Ventures all participated in the latest round. Previous backers include Canary Ventures and other angels such as Ariel Lambrecht, co-founder of 99 – the first Brazilian unicorn and Guilherme Bonifácio, iFood’s co-founder.

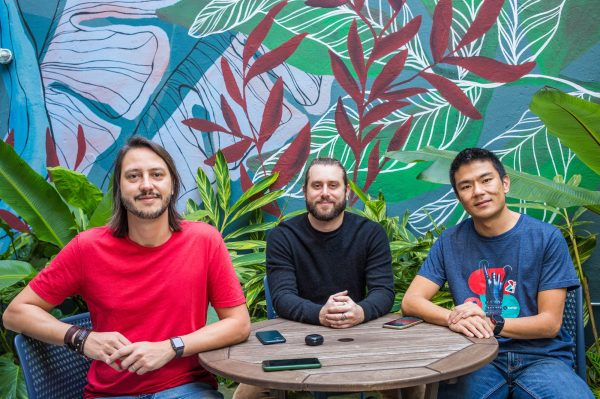

Founded by Douglas Storf, Ury Rappaport and Alexandre Takinami, Swap aims to empower companies to transform their financial operations via its APIs, which it says offers users “the infrastructure for various financial solutions, allowing them to monetize their platforms.”

The inspiration behind Swamp came from Storf and Rappaport’s own experience at 99 (formerly known as 99Taxis), where the two sought to create a series of financial products for the transport app’s partner drivers. It was there that the pair recognized the opportunity for an infrastructure service that would help any company provide financial products for their customers.

Swap’s growth as of late has been impressive. Over the past year, it has seen its customer base expand by 300%. During that same timeframe, it has been consistently growing 30% per month and 7,500% year-over-year with profitable results in the third quarter, according to Swap CEO Douglas Storf. (Of course, we don’t know the base from which it grew, but the multiples are noteworthy).

“We’ve demonstrated product-market fit and are helping more and more companies embed finance offerings into their products,” Storf said.

Swap operates in its home country of Brazil, and is looking to use its capital to expand the use cases it serves there. The company aims to specialize by segment, from a market and a technological perspective.

“We have always sought to be a fully integrated solution that truly allows companies to launch their fintechs quickly and efficiently,” said Storf. “Rather than being just a card processor, we specialized in providing the full solution to specific segments, being at the same time their bin sponsor, their card processor, their partner bank and providing all the core infrastructure to make them operational.”

The CEO says that full-service approach sets Swap apart from other BaaS companies in the market. The company also has a strategy around solving the pains of specific segments. For example, it launched Multiflex in early 2021, an offering aimed at flexible benefits companies and in September 2021, the Swap Credit platform, aimed at companies in that segment. In short, the company aims to be “LatAm’s fintech factory.”

It is currently working with 15 customers such as Swile, Portão 3, Z1, BMP Money Plus and A55.

Looking ahead, Storf notes that its customers are expanding to other Latin American countries so it will be a natural evolution to grow into new markets outside of Brazil.

Swap started 2021 with 27 employees and today it has 60 employees. It expects to double that number in 2022 with its new capital hiring across product development, operations and sales.

Tiger Global Partner Alex Cook notes that the number of fintech companies and use cases in Latin America has “increased dramatically, lowering costs and improving experiences for consumers and businesses.”

“We are thrilled to partner with Doug, Ury, and the Swap team as they build a modern card issuing and banking infrastructure platform for the next generation of financial services companies in Brazil,” he wrote via email.

The latest financing marks Global Founder Capital’s third time investing in Swap. Says Partner Fabricio Pettená: “Swap has completely reinvented banking as a service in Brazil, going beyond card acceptance and into credit and vertical solutions.”

Bruno Yoshimura, general partner and co-founder of ONEVC points out that Swap today, has two major products: card-as-a-service and infrastructure for credit.

“Now, they plan to listen to their customers’ needs to develop the other building blocks,” he said. “With three former CTOs in the core team, I believe they have the right DNA to build AWS for fintechs in Latam.”

Credit: Source link