South Africa’s retail trading volume has skyrocketed by 159% since 2020, surpassing growth rates in many other emerging markets. This surge is particularly evident in the growing popularity of forex, stocks, and cryptocurrency trading. Digital platforms have made these financial instruments more accessible, allowing traders to diversify their portfolios. Among the preferred trading options, the USD/ZAR currency pair, JSE-listed equities, and Bitcoin stand out. Understanding the unique attributes of these instruments is essential for navigating South Africa’s dynamic trading environment.

Forex Trading in South Africa

For traders exploring the best platforms to access these opportunities, a look at the top 10 online brokers in South Africa reveals a competitive landscape offering a wide range of tools and resources. These brokers provide access to diverse markets, robust risk management features, and educational materials to support informed decision-making.

Forex trading is a cornerstone of South Africa’s financial market, with the USD/ZAR pair leading local trading activity. This pair is significant due to its direct link to the South African economy. Other major currency pairs, such as EUR/USD and GBP/USD, also attract South African traders looking to expand their portfolios. Peak trading volumes often coincide with the overlap of European and South African trading sessions, offering enhanced liquidity and narrower spreads.

Why Forex Trading Stands Out

Forex trading’s popularity in South Africa stems from its flexibility, accessibility, and profit potential. Key attributes include:

- High Liquidity: With a daily trading volume exceeding $6.6 trillion globally, liquidity ensures smooth entry and exit points, reducing the risk of price manipulation.

- 24/5 Market Access: Traders can operate on their schedules, analyzing markets during business hours or late at night.

- Leverage Opportunities: Leverage allows control of larger positions with smaller capital, though managing associated risks is vital.

- Predictable Economic Indicators: Currency pair movements often align with macroeconomic trends, creating opportunities for informed trading.

- Risk Management Tools: Stop-loss orders and position sizing empower traders to control risks effectively.

With proper education and discipline, forex trading provides an accessible gateway to financial independence for South African traders.

Key Currency Pairs in South Africa

South African traders gravitate toward currency pairs that offer strategic advantages:

- USD/ZAR: A primary focus for its economic relevance and volatility.

- EUR/USD: High liquidity and relatively predictable trends make this pair appealing for diversification.

- GBP/USD: A strong option for leveraging British-South African economic ties.

Understanding currency pair correlations and global market impacts is essential for maximizing returns. By analyzing overlapping trading sessions between Johannesburg, London, and New York, traders can uncover opportunities for arbitrage and risk mitigation.

Stock Trading in South Africa

The Johannesburg Stock Exchange (JSE), Africa’s largest stock exchange, offers access to over 300 listed companies. Local traders can invest in JSE-listed stocks or international shares through brokers providing global market access. The rising popularity of stock trading reflects its potential for both short-term gains and long-term wealth creation.

Factors Driving Popularity

Stock trading appeals to South Africans for several reasons:

- Local and Global Access: Brokers enable trading in JSE-listed and international stocks.

- Dividend Income: Stocks and ETFs offer opportunities for passive income.

- Fractional Shares: Lower entry barriers make stock trading more accessible.

- Inflation Protection: Exposure to real company growth can hedge against inflation.

- ESG Investments: Traders can align portfolios with personal values through sustainable stocks.

Improved financial literacy and digital tools have further fueled stock trading’s appeal, making it a key avenue for wealth generation.

Key Stock Exchanges for South African Traders

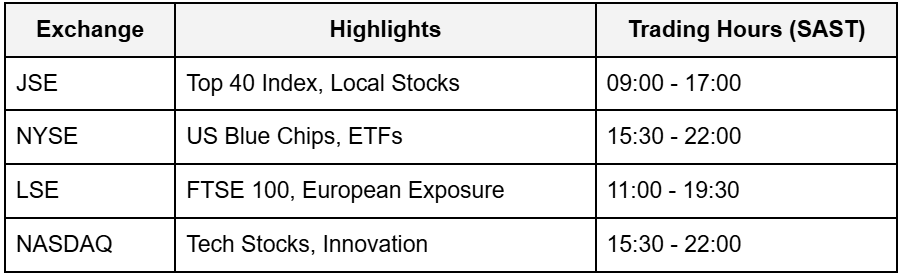

South African traders often balance local and international investments. Key exchanges include:

Successful traders often diversify their portfolios, combining local stocks with international investments to adapt to market conditions and capitalize on global trends.

Cryptocurrency Trading in South Africa

Cryptocurrency trading is experiencing rapid growth in South Africa, fueled by high mobile penetration and the appeal of decentralized finance. Bitcoin remains the dominant cryptocurrency, followed by Ethereum and Ripple. Traders are drawn to the 24/7 availability and high return potential of these digital assets, despite their inherent volatility.

Why Cryptocurrencies Are Gaining Traction

Several factors contribute to the rising interest in cryptocurrencies:

- High Return Potential: Despite volatility, cryptocurrencies attract traders with aggressive strategies.

- 24/7 Market Access: Constant availability allows flexibility for traders.

- Decentralization: Freedom from traditional banking systems appeals to many.

- Blockchain Innovation: Applications extend beyond trading, influencing various industries.

- Ease of Access: A growing number of platforms simplify entry into global crypto markets.

South Africa’s relatively favorable regulatory environment supports cryptocurrency adoption, enabling traders to explore this market while adhering to financial compliance.

Popular Cryptocurrencies in South Africa

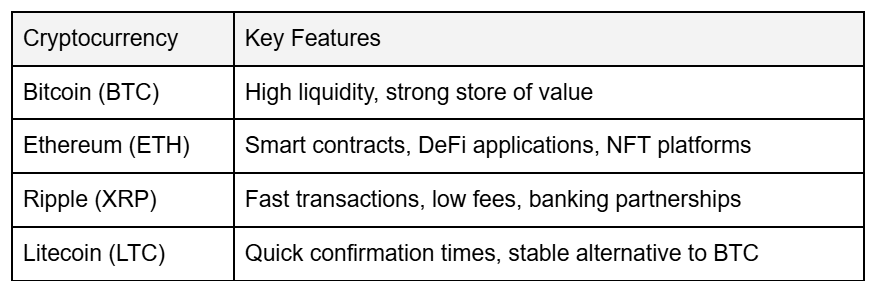

South African traders favor several leading cryptocurrencies:

Growing institutional interest and evolving regulations have boosted trading volumes, making cryptocurrencies an integral part of diversified portfolios.

Managing Risks and Challenges

All trading involves risks. To succeed, traders must approach the market with preparation and caution.

Key Risks in Trading

- Market Volatility: Rapid price fluctuations can lead to significant losses.

- Leverage Risks: Amplified losses can exceed initial investments.

- Emotional Decisions: Poor judgment during stressful market conditions often results in mistakes.

- Technical Failures: Platform issues or internet outages can hinder trade execution.

- Economic Events: Global news and events can cause abrupt market shifts.

Robust risk management practices, such as stop-loss orders, portfolio diversification, and disciplined strategies, are essential for protecting capital.

Importance of Education and Research

Many novice traders fail due to inadequate preparation. Success requires:

- Mastery of technical and fundamental analysis

- Comprehensive understanding of risk management

- Familiarity with market psychology

- Consistent use of educational resources

Dedicated learning, combined with careful research, equips traders to navigate the complexities of forex, stocks, and cryptocurrency markets effectively.

Conclusion

South Africa’s trading landscape offers diverse opportunities across forex, stocks, and cryptocurrencies. Each instrument has unique characteristics, requiring tailored strategies for success. By prioritizing education, disciplined risk management, and informed decision-making, traders can unlock the potential of these markets. Staying adaptable and continuously monitoring market trends will position traders for long-term success in South Africa’s dynamic financial environment.