KanawatTH/iStock via Getty Images

A Hypothetical Exercise

We are going to start this article off with a little exercise. In this hypothetical example, you have a small amount of money that you are looking to 10x in the next 5 years. You get to pick one company on the public markets. You have to weigh plenty of different factors, but you will likely come to the same conclusions that I did. First, it must be a smaller company. As much as we love Apple (AAPL) or Microsoft (MSFT), neither are going to be $20T companies in 5 years (barring hyperinflation).

Second, there must be a large addressable market for the company. Third, we must see explosive revenue and earnings growth. This will probably lead to a technology related company, where I get to the last factor: founder leadership. This isn’t something that shows up on the balance sheet or income statement, but companies run by founders tend to have a certain “it factor” that is worth paying attention to.

Upstart (UPST) would be my pick for a potential 10x in 5 years. It fits all of my criteria that I would be looking for. Will it happen? It could, but even if it doesn’t, I think shareholders will be richly rewarded if they can hold the stock for the long term. For the short-term investors in Upstart, it has been tough sledding over the last couple months.

I know many of you might already be familiar with Upstart, but if you needed any more proof that Wall Street is the blind leading the blind, take thirty seconds and watch this video. I’m not sure how anyone can go on a national business network to discuss a stock without knowing what the company does, but this aired on CNBC the same day (10/15) that Upstart peaked just over $400.

Investment Thesis

Upstart is a $7.9B company focused on artificial intelligence software for loan approval. Unlike many high-flying software companies, Upstart is currently GAAP profitable. With explosive revenue growth and the potential to have very high margins at scale, Upstart is worth buying at current prices. The stock, like the rest of the market, has seen wild swings in the last month, so it might be wise to dollar cost average into a position.

The company is led by its three cofounders and has added two credit union partnerships (1 & 2) in the last month alone. Investors should be aware that customer concentration is a risk, and short interest is high, but there are more reasons to be bullish than bearish in my opinion. Add in a balance sheet with over $1B in cash, which is plenty to cover the liabilities, and you have an investment in Upstart where the outcome is heavily skewed to the upside.

The Business

Upstart partners with banks and provides their AI lending platform that allows banks to originate personal loans. These contracts with banks typically have 12-month terms and automatically renew. Once the loans are originated, they are either held by the banks, Upstart, or repackaged and sold to institutional investors with loan sale agreements.

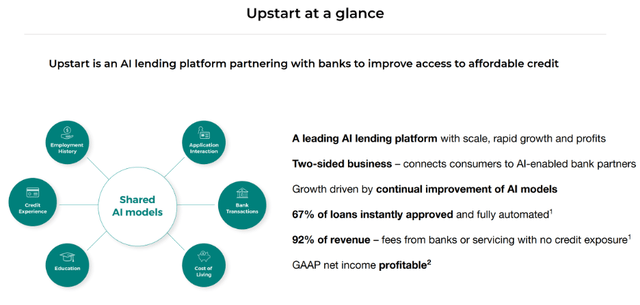

Overview upstart.com

As you can see, most of Upstart’s revenue comes from the software and service fees without the credit exposure. Upstart is still generating triple digit revenue growth and it isn’t sacrificing profitability to do it.

Valuation

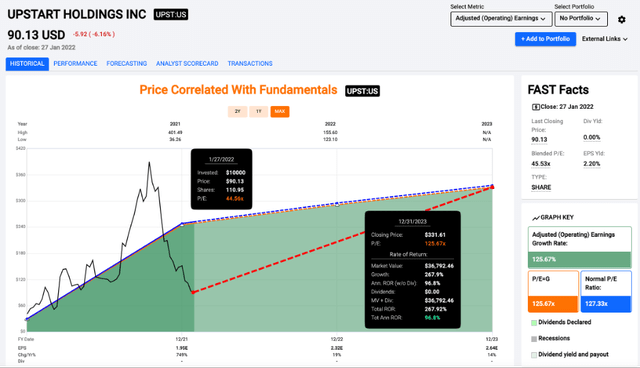

Valuing a company like Upstart isn’t as easy as a mature company. There are more moving pieces and things that can go wrong, but if things go right, the upside for investors buying Upstart at today’s prices could be massive. The price to earnings is at 45x, which at face value could be considered a nosebleed valuation. When you look at revenue and earnings growth of the company, and factor in the potential margin profile of the business, I think Upstart is a strong buy under $100 today.

Price to Earnings fastgraphs.com

Some investors might be reluctant to buy a stock at 45x earnings, especially a volatile one like Upstart. However, I think investors that are able to stomach the volatility and hold on for years instead of months could be richly rewarded as the business continues to grow at a rapid pace. Another valuation metric to consider for a business like Upstart is price to sales.

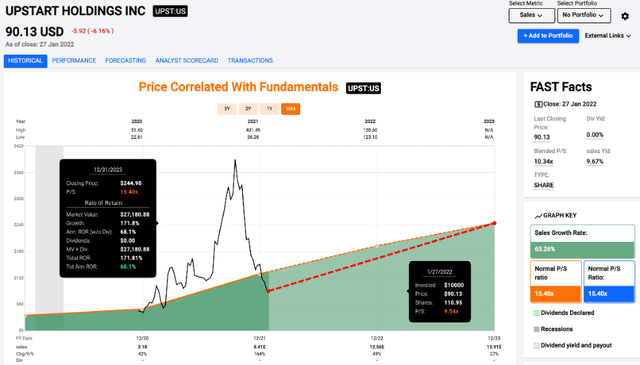

Price to Sales fastgraphs.com

Eventually, the revenue and earnings growth will decelerate, but I think the current price is steal even if the company does slow down. I will continue to follow the business closely, but I think Upstart was overvalued after the huge run up but has been crushed in the last couple months with the wider selloff in growth stocks.

The AI Software & Total Addressable Market

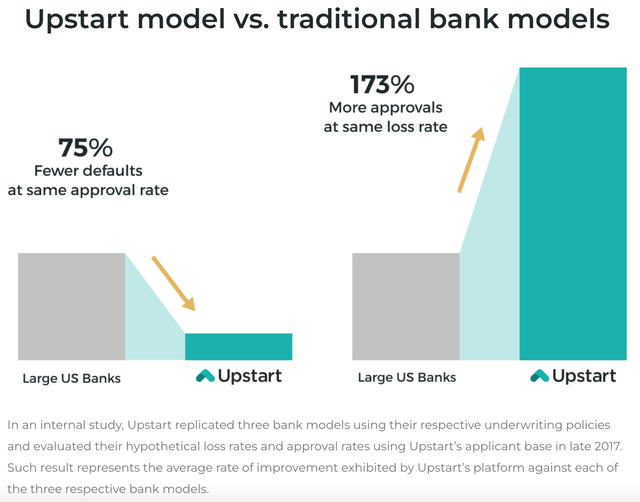

Upstart’s AI software has advantages compared to traditional models currently in use at many banks. It has performed significantly better than credit agency expectations when it comes to loss rates. As long as banks can continue to use Upstart’s model to make better loans and in turn, make more money, I think Upstart will continue to see explosive growth.

Upstart AI upstart.com

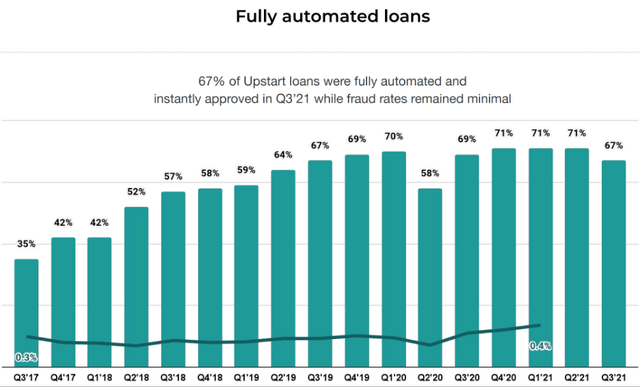

The proportion of Upstart’s loans that were fully automated was 67% in Q3 2021, but based on the chart below, it looks like the automated percentage is going to stabilize somewhere in the high-60s to low-70s. Some of the readers might also be wondering how much fraud slips through Upstart’s algorithm. It has stayed below 0.5% since 2017.

Automated Loans upstart.com

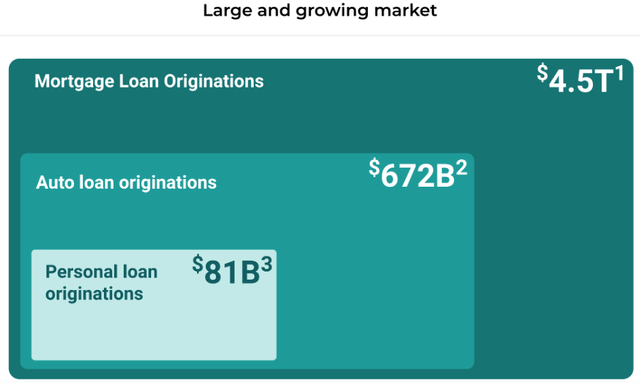

One thing I will be keeping an eye on is Upstart’s move into new markets. In April 2021, the company acquired Prodigy, which is an e-commerce platform designed for car dealerships, for $89M. I expect the company to focus on building out the auto loan piece of the company for a while before eventually setting its sights on mortgage origination. As always, investors should take addressable market projections from company investor presentations with a grain of salt.

Total Addressable Market upstart.com

One potential risk investors should be aware of is customer concentration. Cross River Bank in New Jersey originates a significant majority of the company’s loans. Upstart is working to diversify its customer base, but for the first nine months of 2021, the top two customers made up 84% of the company’s total revenue. As I mentioned earlier, they are working to add new customers, but I would expect customer concentration to remain a risk for at least a couple years. It doesn’t invalidate the bullish thesis, but it’s a potential red flag that investors should be comfortable with before buying shares.

Founders & Insider Ownership

A quick look at Yahoo Finance shows a couple interesting statistics. The first is significant insider ownership at 14.61% of the company. Upstart still has all three cofounders with the company, which is something I like to see for my investments, but especially for smaller tech companies. You can look this up for yourself, but the best long-term investments over the last two decades have been founder led tech companies in segments with large addressable markets and secular tailwinds. Upstart certainly fits the bill and I’m excited as a shareholder to see where the company is five years from now.

Dave Girouard (CEO) and Anna Counselman (People & Operations) both have experience working at Google (NASDAQ:GOOG) (NASDAQ:GOOGL). They founded the company along with Paul Gu (Product & Data Science). Girouard also has experience at Apple, but he was President of Google Enterprise and was responsible for the cloud apps business. Counselman was responsible for the growth of Gmail at Google and helped grow the business line from 150M users to 450M users.

I wasn’t as familiar with Gu before researching the company in more depth recently, but he might be the most impressive of the three in my opinion. He is just 30 years old. By the age of 20, he had created an algorithmic trading system using Interactive Brokers and has experience working at the well-known quant investment firm D.E. Shaw. It might be oversimplifying it to compare Girouard to Steve Jobs and Gu to Steve Wozniak, but each of the cofounders fills an important role that is crucial to the continued growth of the company.

Short Interest

One of the last things I wanted to mention is the short interest. Both the Seeking Alpha Upstart page and Yahoo Finance have short interest over 10%. This is no surprise after the run up we saw from last summer into the blow off top in October. Could shares keep dropping like they have over the last four months? Sure. However, if you are looking for a long-term investment instead of a short-term trade, I think Upstart could be worth a closer look.

Conclusion

I’m expecting a blowout quarter when Upstart reports in the coming weeks. If shares keep dropping, bullish investors that have some familiarity with options might want to consider Jan 2024 LEAPS with a $200 or $250 strike. I will be sticking with shares as the premiums on the LEAPS are pretty steep, but I will be looking to continue to lower my cost basis as long as Upstart is under $100.

I said in recent articles that I wouldn’t pay premium earnings multiples for businesses like Visa (V) or Mastercard (MA), even though they generate some of the best margins I have seen. Part of this is just the law of large numbers. Paying a premium multiple for a large cap is generally not a good idea, but for a smaller company with a long growth runway like Upstart, I have no problem paying up for the future potential of the company. Upstart is the only fintech that I’m buying and I would love to build up a good sized position at current prices.

If you ask me, the current selloff for Upstart is overdone. If you are bullish like I am but nervous about the volatility, dollar cost average into a position with the plan to hold for at least three years. Long term investors could be richly rewarded and a small position of Upstart could go a long way.

If you have your own 10x idea for the next 5 years, I would be curious to hear about it in the comments below.

Credit: Source link